Scottish Budget 2026-27: Key points at a glance

Getty Images

Getty ImagesFinance Secretary Shona Robison has announced the Scottish government's tax and spending plans for the next financial year.

The budget covers measures controlled by the Scottish parliament and comes just four months before the next Holyrood election.

Here is a summary of the main points.

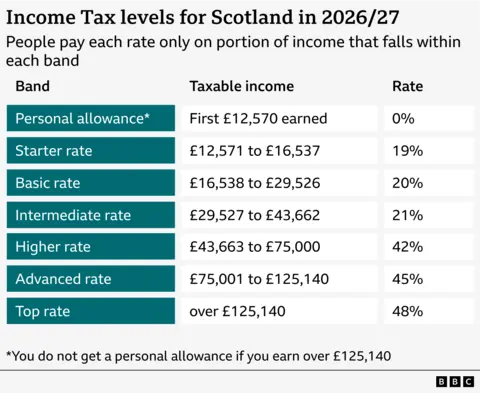

- The thresholds for both the Basic and Intermediate rates of income tax in Scotland have been increased by 7.4%

- The Higher, Advanced and Top rate thresholds will remain at their current levels, a move which will mean it is likely more people will pay these rates over time - contributing an estimated £190m to the Scottish Budget in 2026-27 alone

- A mansion tax, similar to a plan for England, will be introduced by April 2028 and applied to properties worth more than £1m

- A "targeted revaluation" of the most expensive homes in Scotland will result in two extra higher council tax bands being created - one for properties valued between £1m and £2m, and one for homes valued above £2m

- Removal of peak season fares for residents of Orkney and Shetland on Northern Isles ferries

- Investment in railways, the ferry fleet and nearly £200m for the dualling of the A9 and key sections of A96

- A new railway station at the Winchburgh new town in West Lothian

- An air departure tax on all eligible passengers, with the Highlands and Islands to be exempted. A private jet tax is to be levied through this new tax

- The Scottish Child Payment will be increased to £40 a week for families with a baby under the age of one from 2027-28. The additional payment is estimated to benefit the families of about 12,000 children

- An extra £600m will be spent on social security assistance in 2026-27, taking the total bill to £7.2bn

- £70m in extra funding for colleges

- A pledge that by 2027 there will be a breakfast club for every single primary and special school

- An extra £20m for the University of Dundee, which currently faces a £35m deficit

- A "Summer of Sport", including free children's sport and swimming lessons for every primary school pupil

- £22.5bn for health and social care, including funding to begin the national rollout of walk-in GP clinics

- An expansion of the number of Hospital at Home beds by at least 2,000 by December this year.

- Further delays to five planned national treatment centres which are now being reconsidered as part of a wider look at infrastructure across NHS Scotland.

- There will be a 15% non-domestic rates relief in 2026-27, worth £138m over three years for retail, hospitality and leisure premises

- £1.5bn in efficiency savings from a public sector reform programme

- A 2% increase in the local government budget

- Money for the international development fund to increase by 25% to £16m