Scottish Budget - the headlinespublished at 18:25 GMT 13 January

As our live coverage comes to a close, here's a quick catch-up on the main things we learned from today's Budget:

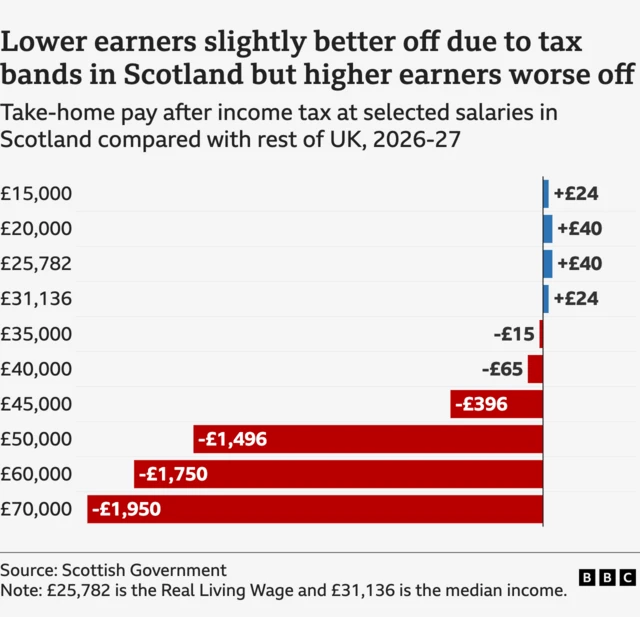

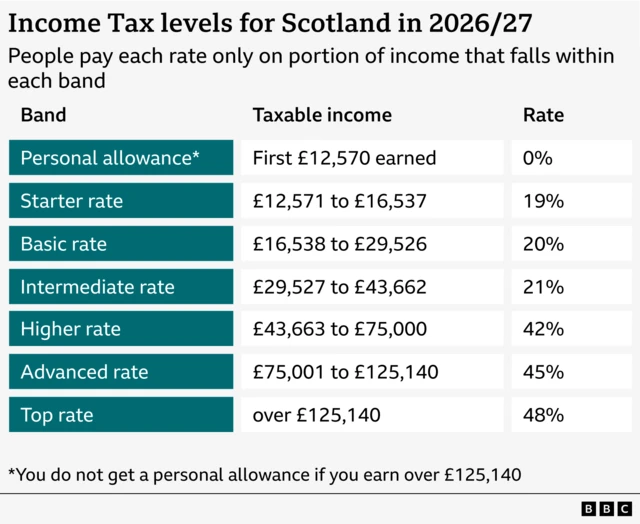

- Scotland's finance secretary promised relief for some income tax payers with a raising of the threshold on the lower rates by 7%.

- Shona Robison said 55% of workers in Scotland would pay less tax than if they were living elsewhere in the UK.

- She said her government was committed to ending the "8am rush" for a GP appointment, with £36m to begin the roll-out of high street walk-in GP clinics

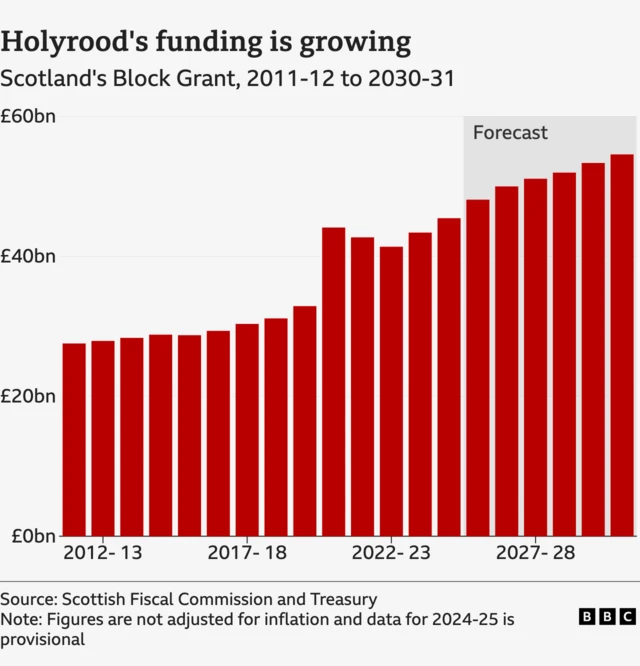

- The cabinet secretary insisted her government provided the "best cost of living support in Britain" as she detailed around £68bn of spending plans

- There's support for some families on benefits, with the weekly Scottish child payment - payable to parents in receipt of certain benefits - being boosted to £40 for those with a baby under the age of one from 2027.

- Breakfast clubs will be available in every primary school from next year - it means children can be dropped off earlier

- There will be a 15% non-domestic rates relief in 2026-27, worth £138m over three years for retail, hospitality and leisure premises

- Investment in railways, the ferry fleet and nearly £200m for the dualling of the A9 and key sections of A96

- A mansion taxis coming in and will be applied to properties worth more than £1m as well as a levy for private jets. These measures have been welcomed by the Greens

- Businesses will benefit with a package of relief to counter a controversial property revaluation - the Liberal Democrats want to see more done for this sector

- Overall, the Conservatives called the proposals predictable and cynical while Labour saidthey don't meet people's aspirations

That's all from us on the live page team, thank you for joining us. Paul McLaren and Calum Watson were today's editors. The writers were Craig Hutchison, Megan Bonar and Katy Scott.