Scottish Budget to pass as Labour vows not to oppose it

Getty Images

Getty ImagesThe Scottish government's Budget looks set to pass into law after Scottish Labour leader Anas Sarwar confirmed his party would not oppose it.

Sarwar said the government's tax and spending plans would not "change outcomes for people in Scotland" but confirmed that his MSPs would not vote against them.

He told BBC Scotland News: "We will not stand in the way of the Budget. This Budget's going to pass."

Finance Secretary Shona Robison's £68bn proposals - including changes to income tax thresholds - are scheduled to face a final vote in Holyrood on 25 February.

That will come just three months before Scots head to the polls for the Holyrood election.

Speaking on a visit to Greenock, Sarwar said that only a change in government could deliver real change.

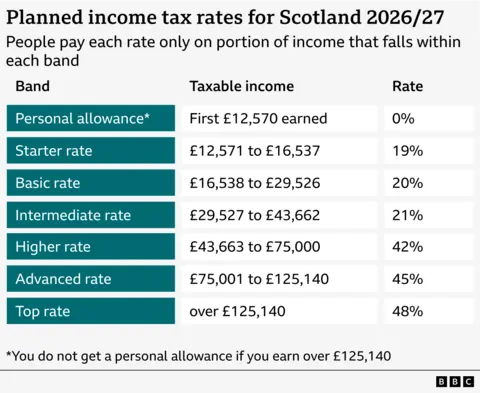

Under the draft Budget, the thresholds for the basic and intermediate levels of income tax are to be raised by double the rate of inflation, while bands for higher earners are to remain frozen.

Scots earning less than £33,500 are expected to pay slightly less income tax than they would elsewhere in the UK, to a maximum of £40 a year.

However, those earning more than £33,500 will pay increasingly more. For example, someone earning £50,000 will pay almost £1,500 more than they would in England.

Robison also announced plans for a so-called "mansion tax" on properties worth more than £1m, and to raise the Scottish Child Payment to £28.20 a week - with a new £40 rate to be introduced for some parents from 2027-28.

The government intends to expand after school and breakfast clubs and provide free swimming lessons for primary pupils. It also plans to increase funding for colleges by £70m.

Robison said the Budget would provide business rates relief and funding to deliver walk-in GP services.

Sarwar told the BBC: "A 19th John Swinney budget is not going to change the outcomes for people in Scotland. Only a change of government in May can."

The Scottish Labour leader said he believed that Scots were paying too much tax.

"The idea that if you earn £33,500 you have the broadest shoulders in this country is for the birds," the MSP said.

"And that is why we need to have a fair tax system... but that requires us to grow the economy."

He added that Labour supported the principle of a tax on properties wroth more than £1m but accused SNP ministers of a "sleight of hand" since the levy is not to be introduced until 2028.

The Scottish Fiscal Commission (SFC) said that it expects 835,000 people - more than a quarter of the country's taxpayers - to pay income tax at "at least" the higher rate in 2026-27.

That compares to 304,000 (12.1%) who paid higher rate taxes in 2016-17, before the Scottish government introduced new bands.

By 2028-29, the number paying the higher rate or above could increase to 948,000 (28.7%) of taxpayers, according to the SFC.

SFC chairman Prof Graeme Roy said that meant public sector workers were increasingly having to pay the higher rates of tax, "whether it be nurses, whether it be teachers".

MSPs will begin debating the Budget bill early next month ahead of a final vote.

The government does not have a majority and relies on the support of other parties or abstentions to pass its plans into law.

Last year, the Budget was passed with the support of Green and Liberal Democrat MSPs, who negotiated concessions with the government, while Labour abstained.

'Vindictive tax'

The Scottish Conservatives, who had called for tax cuts and reduced welfare spending, have criticised the Budget.

The party's finance spokesman, Craig Hoy, said: "Tens of thousands more nurses, teachers and police officers on relatively modest salaries are being dragged into the higher rate, which was never intended for them.

"The SNP's vindictive tax on aspiration is stifling Scotland's economic performance by making it harder and harder for businesses to recruit and retain skilled individuals."

The Scottish Greens said they had secured concessions from the government on a "mansion tax" and a new levy on private jets, earmarked for 2028.

However, co-leader Ross Greer said the government could "go further", calling for measures to cut the cost of transport and childcare.

He said: "Labour may have walked away having achieved nothing, but the Scottish Greens will continue working to secure more changes which save families money and protect our planet."

Liberal Democrat finance spokesman Jamie Greene said he was "pleased to see that many of the Liberal Democrat asks" in the draft Budget.

However, he warned many companies are "facing choppy waters ahead" despite a package of transitional relief for businesses facing rising rates bills after a revaluation.

Deputy First Minister Kate Forbes said the tax changes would allow the government to support public services.

She told BBC Scotland News: "I know that people want to see investment in their NHS, investment in education, investment in transport, and so the decision that we've taken is to ensure that there is as much funding as possible to invest in the services that people rely on."

Many at Holyrood are mystified by Labour's decision to let this Budget pass without seeking something in exchange.

Why wouldn't you want to secure a deal and then, for example, claim credit on the doorsteps for securing additional funding for colleges?

The finance secretary wryly noted that the decision to abstain hadn't cost her a single penny.

But it seems this was a deliberate strategy.

Budget negotiations are often highly pressured, with talk of governments falling and emergency elections being required if the bill falls.

With an election due in May anyway, the party felt there was little jeopardy, and decided to "let some air out of the tyres".

With the Budget's passage through parliament assured, Labour reasoned the political focus would be more on the election, than on the tax and spending plans.

Its ambition would be to win that election and then make the changes it wants to spending priorities.

But the SNP reckons Labour has been irresponsible by failing to set out an alternative budget during this process.