Wedding venue owner jailed for two years for fraud

HMRC

HMRCThe former owner of a bar, hotel and wedding venue has been jailed for nearly two years after he failed to pay more than £700,000 in tax to HMRC.

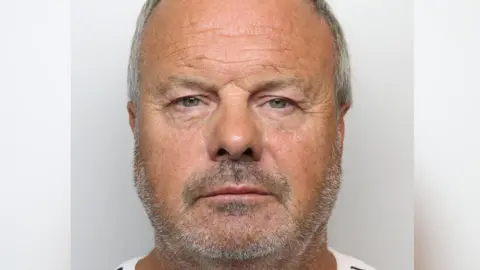

Jack McDaid, 68, previous owner of Casa Brighouse in West Yorkshire, was sentenced at Leeds Crown Court having admitted conspiracy to avoid VAT and cheating the public revenue between 26 October 2011 and 16 May 2019.

Accountant Robert Brook, 47, was jailed for 19 months having been found guilty of the same charges after a trial.

During sentencing on Tuesday, Judge Simon Phillips KC told McDaid he had "placed your own interests above those of everyone else".

He said: "You were entirely aware of your obligation to pay VAT, PAYE and NI. You deliberately failed to account clearly for your financial benefit.

"Customers were charged VAT and employees were given to believe it was a legitimate business, which was paying their PAYE and NI contributions."

'Sophisticated conspiracy'

The business's turnover had been almost £10m during the period when the offences took place.

Judge Phillips said McDaid had played a "leading role" in the "sophisticated" conspiracy and "made a series of bad decisions that returned to haunt you".

He was given concurrent sentences for avoiding VAT and cheating the public revenue of 56 months and 40 months.

He will serve 40% of the sentence in prison – 22 months - and the rest on licence.

Brook was sentenced to concurrent sentences of 48 months for avoiding VAT and 40 months for cheating the public revenue.

He will also serve 40% of the sentence in prison – 19 months - and the rest on licence.

Judge Phillips said Brook, who ran Yorkshire Account Services in Huddersfield, had denied being responsible for payroll but was "well aware" of the fraud.

"You complied when requested and provided false payslips, P60s and P45s," he said.

"You provided PAYE and NI documents to employees and these were deducted from staff wages but not paid.

"Unlike McDaid you did not have a leading role or were a controlling mind but it was not a lesser role. You were working dishonestly and were an integral part of the conspiracy to evade VAT."

Both McDaid and Brook were banned from being directors of a company - McDaid for eight years and Brook for six.

A Proceeds of Crime court date was set for Brook for 1 September 2026.

Listen to highlights from West Yorkshire on BBC Sounds, catch up with the latest episode of Look North.