I invested £12,000 in Brewdog - I think I've lost it all

BBC

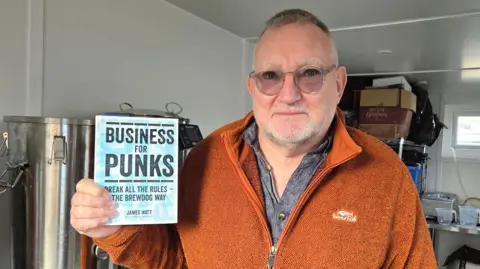

BBCRichard Fisher likes beer. He brews his own ale at home and once considered buying a brewery. But he never expected he might lose £12,000 investing in Brewdog.

For the former small business adviser from Suffolk, taking a small stake in the upstart beer company from north east Scotland seemed an opportunity too good to miss.

"Maverick, independent, to a certain extent rebellious - it was all good stuff," he said.

Richard, 58, is one of more than 200,000 investors who put money into the firm's "Equity for Punks" scheme.

Typically they spent about £500 on shares costing £20-30 each but Richard, seeing the firm's rapid expansion, invested £12,000 in the hope of a good return.

"I genuinely thought Brewdog would go public, be listed on the stock market with the freedom to buy and sell shares and there was potential to make a bit of profit."

Now, with the news that Brewdog is preparing itself to be sold, he's resigned to the risk of losing it all.

Brewdog

BrewdogBrewdog's founders James Watt and Martin Dickie were in their early 20s and "fed up with the stuffy UK beer market" when they started brewing their own craft beer in an industrial unit in Fraserburgh, Aberdeenshire in 2007.

From the outset Brewdog portrayed itself as something radically different, and its Equity for Punks fundraising drive, launched two years later, was no exception.

In essence it was an in-house crowdfunding scheme, promising beer enthusiasts a chance to "own a slice of the brewery and share in its success and growth".

In return Brewdog offered perks such as discounts on beer purchases, free birthday beer and invitations to its "Annual General Mayhem" AGM with live music and beer tastings.

It was a phenomenal success.

Getty Images

Getty ImagesBefore it closed to new investors in 2021, Equity for Punks is said to have raised £75m, powering a rapid expansion that has turned Brewdog into an international brand, boasting four breweries and more than 100 bars.

"Some people invested a lot of money, thinking it was going to be their Google or Tesla," said Richard.

What many of those small investors may not have realised was that Brewdog was also looking for institutional sources of finance - and that affected the value of their own shares.

In 2017 a US equity firm TSG Consumer Partners acquired a 22% stake in Brewdog, but unlike the Equity for Punks' "ordinary" shareholders, TSG was given "preference shares".

That means that if Brewdog is sold, TSG is first in the queue to get back its investment and any interest owed.

The fear of investors like Richard is that the firm's valuation has fallen so much in recent years there will be little or nothing left for them.

He bought his shares about five or six years ago, but says he was unaware of details of the earlier TSG deal until they started to emerge on an online forum.

Brewdog used to offer "trading days" when shareholders could buy or sell shares but the last one was in 2022 and no more appear to be scheduled.

"My shares have effectively been worthless for the last two or three years," said Richard.

Not all Equity for Punks investors were motivated by the chance of a windfall profit.

Some felt they were buying into a worthy cause and have been rewarded with friendships and freebies.

Chris Huish, from South Wales, purchased £500 of shares - and has made use of a 15% discount for beer bought online or in Brewdog bars.

Does he feel he's had his money's worth? "I've had a lot of discount over the years but now not so much really."

As the beer became more widely available, Chris found he could often buy it in his local supermarket for a similar price to his discounted offer.

"I have no idea how much my shares are worth now," he said.

"There's not much transparency on that. I don't think I'm going to get it back."

Getty Images

Getty ImagesThere is no suggestion the firm has done anything illegal.

Application forms for Equity for Punks told investors to check they had read the prospectus which outlined the risk factors, as well as the detailed terms and conditions.

Gareth Fitzgerald, who spent £1,000 on his shares, accepts there is always a risk with this type of investing which would have been explained in the small print.

But he says the deal Brewdog made with TSG and its impact on small investors has left him disillusioned with a firm that presented itself as progressive.

"You know when you invest in shares their value can go up or down.

"But that's probably where I fell foul because you assume there is going to be some proper resale value at some point for your shares.

"We've basically just put money in to buoy up their business and there's no way we can now sell it."

Brewdog has been contacted about the investors' concerns but declined to comment further.

In a statement issued on an online forum for Equity for Punk investors, current chief executive James Taylor confirmed that business consultants Alix Partners were reviewing the firm's "strategic options" and "investment opportunities".

He added: "It remains business as usual across our bars, venues and breweries.

"We remain fully committed to our customers, our crew, our partners - and to you, our Equity Punk community.

"Your continued support is a fundamental part of Brewdog's journey, and we will keep you updated as the process progresses."