UK economy grew by 'subdued' 0.1% at end of 2025

Bloomberg via Getty Images

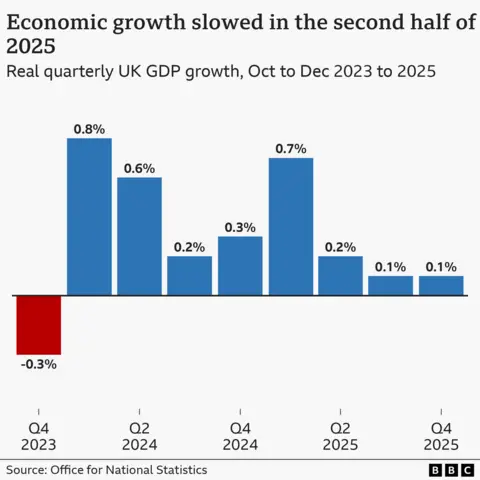

Bloomberg via Getty ImagesThe UK economy saw a lacklustre end to 2025, growing by a slightly lower-than-expected 0.1% in the final quarter of the year.

The Office for National Statistics (ONS) said there was no growth in the crucial services sector for the first time in over two years, with the slight boost driven by an increase in manufacturing.

The construction sector, meanwhile, suffered its worst quarterly performance in four years, the ONS added.

Labour has made growing the economy its number one priority since coming to power, but the ONS said the overall picture for growth at the end of year remained "subdued".

The economy is estimated to have grown by 1.3% for the whole of 2025, a slight uptick from 1.1% growth a year earlier, but lower than the 1.4% forecast by the Bank of England.

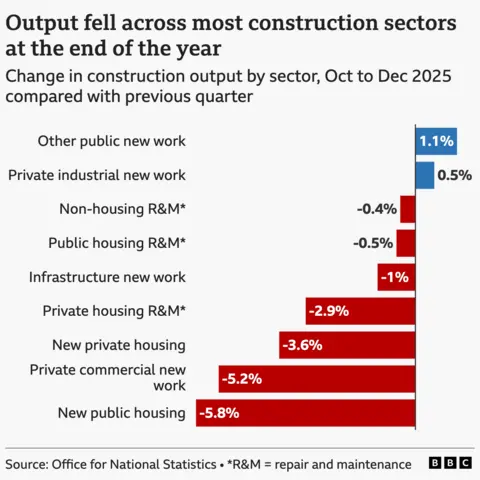

Construction activity fell by 2.1% over the final quarter of 2025, with a fall in repair and maintenance work, as well as a drop-off in the amount of new construction work being started.

New private housing saw the third-largest fall in output of the nine construction sectors in the three months to December.

But the ONS said it was the largest contributor overall to the fall in construction output. This is likely to be because it makes up a large share of overall construction activity.

While the crucial services sector, which accounts for more than 80% of Britain's economic output, failed to grow, there was a strong performance from travel agencies, tour operators and administrative support firms.

Professional, scientific and technical activities, however, declined by 1.1%.

The economy was helped in the quarter by Jaguar Land Rover, with the carmaker bringing production back online after a major cyber-attack. But a period of uncertainty in the run-up to November's Budget, with speculation about tax changes, caused companies to withhold investment.

Liz McKeown, at the ONS, said the overall picture continued to be one of "subdued growth".

Ruth Gregory, chief UK economist at Capital Economics, said the "disappointing" growth figures suggested Britain's economy "still has very little momentum".

Chancellor Rachel Reeves said the government's choices had laid the groundwork for the Bank of England to cut interest rates and left Britain with the fastest-growing European economy in the G7 group of nations.

"The government has the right economic plan to build a stronger and more secure economy," she said.

But shadow chancellor Sir Mel Stride said Labour has "weakened our economy".

"These disappointing statistics show a Downing Street and a Treasury that have taken their eye off the ball," he added.

The Liberal Democrats said Reeves' first two Budgets as chancellor had "killed off the economic recovery our country so desperately needs".

Business group the British Chambers of Commerce (BCC) said 2025 had been "marked by uncertainty and rising costs for firms across the country".

It said surveys of business leaders showed taxes and rising inflation were their top two concerns.

Bosses have consistently complained about the rising tax burden, with particular concerns about how the chancellor's hike in employer National Insurance contributions drove up the cost of hiring for firms.

'We've not been able to employ youngsters'

Nigel Day, who runs a heat pump installation business in Ipswich, said uncertainty around November's Budget had left his customers wary about spending.

He added he had faced difficult choices in order to keep his company in business.

"Increases to the minimum wage have meant that we've not been able to employ the youngsters into the business - they're too expensive to have just as an extra pair of hands," he said. "And we have had to refrain from taking any apprentices."

Last week, the Bank of England kept interest rates on hold in a narrow decision, but cut its forecast for economic growth this year to 0.9%, down from a previous prediction of 1.2%.

At the same time, it raised its expectation for the unemployment rate, from an initial forecast of 5% to 5.3%.

This raised expectations of a rate cut in the next few months, and Rob Wood, chief economist at Pantheon Macroeconomics, said the latest growth figures would do little to stop those in favour from "pushing ahead with a rate cut in March".

However, he added that "economic momentum" would make it the last rate cut of the current cycle.

But Suren Thiru, economics director at the Institute of Chartered Accountants in England and Wales (ICAEW), said an interest rate cut in March was "doubtful".

He said the slight increase in economic output would give policymakers the "comfort" to wait for more evidence inflation is slowing.