Bank of England expected to hold interest rates

EPA

EPAInterest rates are expected to remain on hold as the Bank of England's Monetary Policy Committee (MPC) meets for the first time this year.

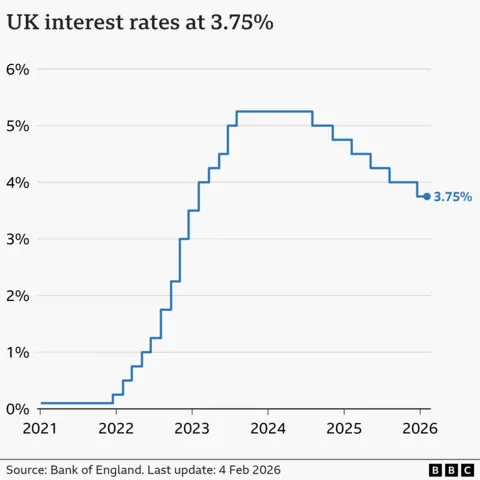

The MPC cut the Bank rate from 4% to 3.75% in December, and suggested rates were "likely to continue on a gradual downward path".

The Bank rate is the primary tool for the committee to try to keep inflation - which charts the annual rate of rising prices - as close to 2% as possible.

It heavily influences the interest charged by lenders for loans and mortgages, and what banks and building societies give in returns to savers.

The majority of analysts are predicting the MPC keeps the Bank rate on hold at 3.75% when it announces its latest decision at 12:00 GMT on Thursday.

Inflation remains above target at 3.4%, according to the latest data for the year to December.

The nine-member committee only narrowly voted for a cut in December and gave a fairly cautious view of the situation.

Analysts say there has been little data so far this year to change the balance between persistent inflation and weak economic growth.

There is also an expectation that the Bank will be vague about when or by how much it will cut the Bank rate during the year as it awaits a clearer picture on inflation.

Some analysts are suggesting one rate cut during 2026, while others believe the MPC could decide on two cuts.

How rates affect your finances

Around a third of households have a mortgage. Of those, about one million have tracker or variable mortgages that tend to change when the Bank rate changes.

The vast majority of mortgage customers have fixed-rate deals. While their monthly payments are not immediately affected by a rate change, future deals can be.

Fixed mortgage rates, for those renewing or signing up to a new deal, fell at the start of the year as lenders competed for customers.

However, broader pressures faced by lenders have shown signs of going up, with commentators saying that could stall any further cuts.

The Bank rate cut in December and conditions thereafter have led to cuts in the interest paid by savings account providers to their customers.

Rachel Springall, from financial information service Moneyfacts, said: "The slaughter of savings rates will sadden hard-pressed savers. Since the start of this year, more than two-thirds (70%) of savings providers have cut their rates.

"As inflation remains well above target, real returns on cash savings are weak and this can lead to a dangerous attitude of apathy."

The MPC has eight meetings a year and, after the latest meeting, it will also publish its quarterly Monetary Policy Report, which sets out its economic analysis and projections on which it bases its decision.