Three reasons for the record rise in gold prices, and one why they are falling

Getty Images

Getty ImagesGold prices have reached record highs recently, with investors piling money into the safe haven asset amid rising global political uncertainty.

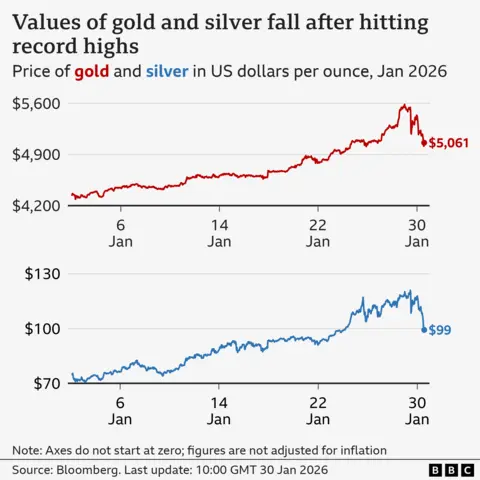

Gold surged past the $5,000 per ounce mark for the first time on Monday and briefly hit $5,500, falling back slightly in recent days.

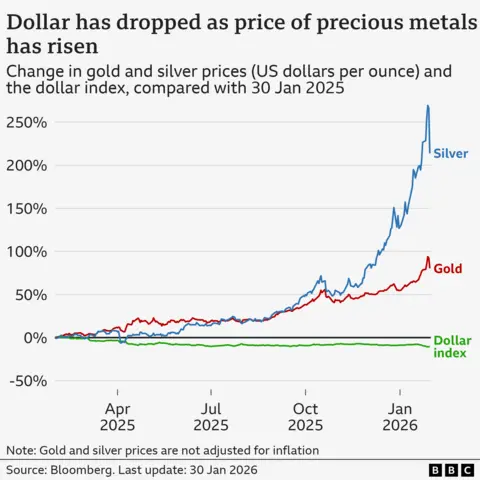

Silver has also rallied and is currently trading at around $98 per ounce, up from $35 per ounce a year ago.

While the price of gold has fallen from recent highs, investors are still finding refuge in the precious metal.

Trump uncertainty shifting investment

Global trade has been upset by tariffs introduced by US President Donald Trump on countries who wish to trade with the US but whom he sees as unfavourable.

His trade policies continue to worry investors, helping to drive the gold rally, says Emma Wall, chief investment strategist at Hargreaves Lansdown.

In January, gold and silver prices hit record highs, but share prices fell as investors reacted to Trump's threat of fresh tariffs on eight European countries opposed to his proposed takeover of Greenland.

Hamad Hussain, an economist at Capital Economics, said the perception gold is a safe investment, in contrast with the risks associated with US foreign and fiscal policies under Trump, has put the precious metal "in the spotlight".

War and Greenland threats add to uncertainty

Wars in Ukraine and Gaza have added to a climate of general political uncertainty. The US seizure of Venezuelan President Nicolás Maduro also pushed the gold price to blockbuster levels.

Trump's Greenland threats heightened global political tensions and saw confidence in the US dollar plummet, with investors turning to precious metals as a safer investment. The biggest hit the dollar has faced during Trump's tenure was in the aftermath of his so-called "Liberation Day" tariffs, announced last spring.

"Gold is doing what it does best when the world feels messy, jumping amid rising trade tensions, geopolitical flare-ups, political uncertainty in the US," Wall says.

"Fresh friction between the US, Canada and China, unease around Europe and the Middle East, and even shutdown risks in Washington have all added to gold's appeal."

Central bank buying

Central banks buying gold has been a key factor pushing up its price.

"Investors and global central banks have... favoured gold as their reserve currency of choice, which they believe insulates them from US policy dependence," says Wall.

"Certain nations will have observed the threat of Russia having its US dollar assets seized by global players supportive of Ukraine, and subsequently considered the metal a more attractive neutral reserve," she added.

But while central banks are still buying more gold than before 2022, Hussain says, estimates suggest that demand actually softened in 2025.

Other buyers of gold include China, which is the biggest buyer of gold, with demand in the country coming from individuals buying jewellery as well as investors.

Investors in the west are also huge buyers of gold, with money flowing into firms on the stock market that own and trade gold.

Hussein also says new buyers in the market have been picking up huge amounts of gold, adding to its dramatic rise recently. One example was Tether, a digital currency specialist which has recently purchased so much gold its reserves reportedly outsize those of some small countries.

Why has the price of gold and silver fallen in recent days?

Gold prices had been soaring to record highs in recent days, partly driven by fears Trump would choose a Fed chairman who would cave into his demands to cut interest rates, leading to a falling dollar and rising inflation. Buying gold is a strategy to protect against those things.

But, as reports emerged the president would nominate Kevin Warsh, who is seen as a relatively safe bet compared with other candidates, the upward pressure on gold prices eased.

The slump even saw gold fall below $5,000 an ounce at one stage on Friday.

However, gold prices are still around 65% higher than this time last year because of ongoing geopolitical tensions, current tariffs and further tariff threats from Trump, and ongoing conflicts around the world. It means the shine of gold and silver feels more attractive than ever for investors seeking "safe haven" assets.

One of gold's biggest appeals is its relative scarcity.

Nicholas Frappell, global head of institutional markets at ABC Refinery, told the BBC: "When you own gold, it's not attached to the debt of somebody else like a bond is or an equity where the performance of a company will drive performance.

"It's a really good diversifier in a very uncertain world."

Friday's gold price volatility shows its value can fall almost as quickly as it rises, like all traded commodities.