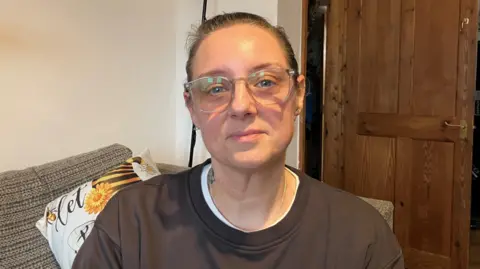

'Check your payslip' warns nurse who overpaid nearly £3k in tax

BBC

BBCA district nurse who found out by accident that she was paying too much income tax is warning everyone to "check your tax code on your payslips".

Gemma Belby, from Barry in the Vale of Glamorgan, only found out she was paying "nearly double" what her colleagues were being taxed when they were chatting about their pay

She said it had taken HM Revenue and Customs (HMRC) three months to sort out her overpayment and refund her nearly £3,000 after she initially raised the query in October, and that the stress had affected her health.

HMRC has been asked to comment.

Legally it is the responsibility of the individual to make sure they are paying the right amount of tax.

The mother-of-four said it was during a chat with her colleagues about how much back pay they had received following the agreement of a new pay deal for nurses that she realised she was paying too much income tax.

"My colleagues had a bigger amount than me and I was like, why haven't I got that much?"

Belby had hoped to get the money returned in time for Christmas but found the process of trying to secure her refund slow and stressful, especially because she said she was given conflicting information and was quoted two vastly different figures of how much she was owed.

"I was tearful all the time," she said.

"I was entitled to that money, I wanted to spend that money on my children at Christmas and I couldn't do that."

She said she was also angry about HMRC's refusal to pay her any interest on the overpaid amount despite her first raising the issue in October last year.

On 19 January HMRC told Gemma that she was owed a refund of £8,194.96 for the tax year 2024-25.

But within days she said an official contacted her to say that figure was incorrect and that the refund would need to be recalculated using the information on her P60 - a document that shows the tax paid on your salary in the financial year.

"When I rang up in October, I gave them my P60 figures and they could have just calculated the refund, and given it to me in October," she said.

After the recalculation HMRC told her she was actually due a refund of £2,863.04, which she received at the end of January.

"My message is make sure you check your tax code," said Gemma, who wants to make sure other people do not end up overpaying thousands of pounds.

"Make sure it's right because if it's happened to me I can guarantee it's happening to more people."

Getty Images

Getty ImagesHow to check your tax code

- A tax code determines how much income tax your employer takes off your salary or pension

- The most common tax code for people with one job or pension is 1257L, which means you can earn £12,570 before you start paying tax

- If you receive company benefits, like health insurance, that number may be reduced

- If you live in Wales or Scotland your tax code will start with a C or an S

- You can check your tax code using the HMRC tax code checker

- You can keep an eye on your details by setting up a personal tax account

It's an issue that financial journalist Martin Lewis recently warned people about on his podcast.

"Millions of them are wrong each year," he said.

"Legally it's the individual's responsibility to ensure their tax code is correct.

"If your tax code is wrong it could mean you're overpaying tax, or paying too little meaning that you could be slapped across the face with a big tax bill and not have the cash to pay for it, which is a nightmare, Lewis added.

Lucy Cohen, co-founder of online accounting firm Mazuma, said tax codes can change for a number of reasons like owing tax from previous years or having other sources of income.

"But sometimes they just go wrong," she said. "Sometimes it's a genuine admin error or a code gets issued incorrectly."

If your tax code is wrong, Cohen recommends speaking your company payroll if they are your only employer, or asking HMRC to rectify the code.