Average house prices fall but rents increase

GETTY

GETTYThe average price of a house in York has fallen but rents have risen, according to Office for National Statistics (ONS) data.

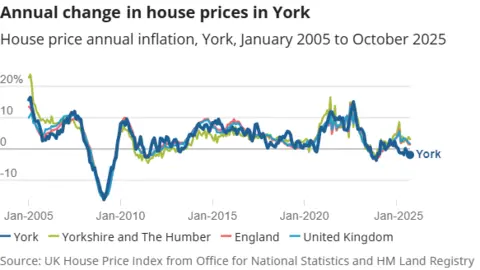

In the city, the average house price is now £304,000, which is a £6,000 or 1.9% dip from the previous year.

Meanwhile, average rents have risen by 3.9%, from £1,103 a month to £1,145.

Matthew Hendry, managing director of York-based Naish Estate Agents, said more properties had come to market last year, with most of them from second home owners and investors looking to sell.

He added an increase in rents pointed to landlords selling properties or hiking fees to cover the cost of new tenancy rules set for later this year.

According to the Local Democracy Reporting Service, York house prices remained the highest in the Yorkshire and Humber region despite the fall.

Office for National Statistics

Office for National StatisticsThe estate agent said buyer numbers held up last year but more homes had been available as tax hikes and law changes drove sales.

He added figures for the rentals pointed to some desperation ahead of changes set to come into force in May under the Renters' Rights Act.

The government has said reforms including ending no-fault evictions, bidding wars and fixed contracts amounted to the biggest increase to tenants' rights in a generation.

However, Hendry said while the reforms were motivated by good intentions, there would be consequences.

The estate agent, whose firm has offices in High Petergate, said: "We noted the properties being sold were typically between the £200,000 to £700,000 price band, indicating the majority of them were second homes and investment properties.

"York has a high number of investment properties compared to other areas in the region.

"With many investment properties being sold, of course there were less available to rent."

Naish Estate Agents

Naish Estate AgentsHendry said he did not feel as though York prices were dropping, as his firm recorded small increases over the year.

"It's more likely that the values of the properties being sold were of a lower value," he explained.

"The sales market is stable and sustainable, buyers are actively viewing properties and buying at similar rates to the past two years.

"The rental market is also stable but there is some desperation there, and it's going to become a lot harder to get an application approved with additional financial qualification and risk assessments.

"Due to the additional competition, this is not the type of market to risk testing prices."

According to the estate agent York was unique and in its "own little bubble", with high demand always there.

"It's not necessarily bullet proof but it will feel the effects a lot less than smaller towns or cities that are not as attractive for people to bring up children," he said.

"I believe with falling interest rates and no upcoming budget, we will see a fairly active sales market."

Listen to highlights from North Yorkshire on BBC Sounds, catch up with the latest episode of Look North.