Hospitality sector could shed 100,000 more jobs, trade body warns

BBC

BBCIt's "entirely plausible" the hospitality sector could lose a further 100,000 workers as a result of the Autumn Budget, according to its trade body.

UKHospitality claims the risk stems from minimum wage rises, the introduction of a tourist tax and an overhaul of business rates.

Its chief executive Allen Simpson says he is particularly worried about the impact on youth employment, as the sector has already shed an estimated 100,000 jobs since the Budget of October 2024, "including many early career opportunities".

The government said: "We're protecting pubs, restaurants and cafés with the Budget's £4.3bn support package", adding that the changes it had made meant most "typical independent pubs" were saving £4,800 a year.

'Very demeaning'

Workers aged 16 to 24 make up 10% of the country's total workforce, but account for about half of the workers in some hospitality roles.

"Employing people at the start of their career is increasingly expensive," Mr Simpson says.

From April, the hourly rate for over-21s will rise by 50p to £12.71, with workers aged 18-20 seeing an 85p rise to £10.85, and under-18s and apprentices getting 45p more, at £8 an hour.

Mr Simpson adds that because "it is increasingly harder for employers to hire people", it will make it difficult for young people to learn skills including "how to work with colleagues".

The latest ONS figures show there are 702,000 people aged 16 to 24 who are unemployed, 60,000 more than the previous year.

Among them is Saif Miah, 23, from west London, who says he has applied for hospitality jobs every day since summer with no luck.

"If you're lucky you'll get a response saying you've not got the job. Other times you don't even get a response. It feels very demeaning because you're in a cycle and it really demotivates you perpetually.

"You're so used to rejection that you feel you're not good enough and get imposter syndrome."

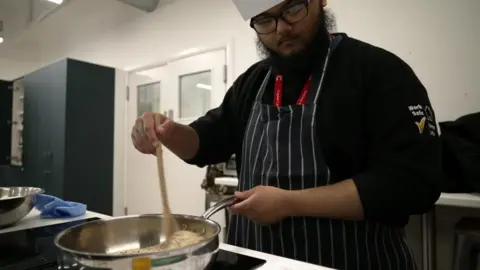

He's now taking part in a government-backed programme at the Hospitality Skills Academy at Capital City College in central London for jobseekers aged 16 and over.

Mr Miah is hoping for a job at the end of the course, which offers a three-day work placement.

Vince Kelly, manager at the academy, says the courses help to plug "large skills gaps" in hospitality.

"There are lots of different sections to the industry. High end, five-star hotels, corporate catering. Hospitals, schools, care homes looking to recruit catering assistants. We're working on confidence and role play."

There has been a 13.6% decrease in the number of hospitality premises with alcohol licences since the pandemic, from 3,470 in March 2020 to 2,995 in September 2025, according to analysis by UKHospitality and research consultancy CGA.

Analysis of ONS data by Trust for London shows that in the past three years, the number of online job vacancies for entry-level roles in food preparation and hospitality is down 26%.

"We are still in a real cost-of-living crisis with high levels of inflation and that's difficult for businesses to stay afloat," says chief executive Manny Hothi.

"If you're a restaurant or a hotel owner you've seen the cost of delivering your service rise and at the same time the people using that service have less money... so these are really difficult circumstances that are pushing down vacancies."

Hospitality business owners say the industry is already under significant pressure following Chancellor Rachel Reeves's first Budget in October last year, which pushed up hiring costs with a hike in employer National Insurance contributions and the minimum wage.

'Monumental increases'

Reeves has vowed to introduce the lowest taxes since 1991 for pubs, restaurants and small shops by increasing the levy on higher-value properties such as warehouses used by Amazon and other online giants.

The government said that as well as its £4.3bn support package that would save many independent pubs £4,800 a year, it was cutting licensing costs to help more venues offer pavement drinks and al-fresco dining and maintaining its cut to alcohol duty on draught pints, along with capping corporation tax.

But according to UKHospitality, "monumental increases in rateable values" will see an average pub pay £12,900 more in business rates over three years, as rates climb 76% for pubs and 115% for hotels.

A firm's rateable value is based on how much it would cost to rent a firm's property for a year, and is used to calculate a business's rates bill.

Despite the gloomy outlook from hospitality leaders, young people training in the sector hope their skills will still be put to use, with jobs to greet them upon graduating.

Listen to the best of BBC Radio London on Sounds and follow BBC London on Facebook, X and Instagram. Send your story ideas to hello.bbclondon@bbc.co.uk