Fans helped pay my mortgage and debts, says busker

Ben Smith Music

Ben Smith MusicA busker who found himself in financial dire straits paid off his debts and part of his mortgage after his fans gifted him thousands of pounds.

Ben Smith, a singer-songwriter from Sudbury, Suffolk, performs originals and covers at gigs, events and in town centres.

After a difficult year, the 32-year-old found himself worryingly overdrawn and facing hefty credit card debt.

But Smith told the BBC his life had turned around after his fans, including a very generous one from New Zealand, sent him more than £3,000 as he livestreamed a gig on social media.

"He has been a fan for several months now, but it wasn't just him - he started it and then everyone just carried on," he said.

Smith, who described the donations as "incredible", said there had been "a wave of support" from people "all over the world and locally".

"It's meant I've been able to pay my mortgage for three months, so it has been an absolute lifeline," he added.

Ben Smith Music

Ben Smith MusicLast April, Smith's wife, Lauren, who he performs with, had to leave her job as an estate agent.

Since then, Smith said he had been working "flat out" to try to cover the bills.

But, for the last six weeks, the musician has not been able to gig or busk because of ongoing chest infections.

'Bad place'

Smith found himself £1,000 overdrawn and had spent about £800 on his credit card.

"We were on the phone to the mortgage company a couple of days before, looking at options and talking about if we could keep paying or not," he said.

"Everything has been on me to keep us going and it has been difficult – we were honestly in such a bad place and life has been such a struggle," he added.

Ben Smith Music

Ben Smith MusicTo show his appreciation to his fans, Smith wrote a new song called Thank You, and performed it on the BBC Suffolk Breakfast Show.

"My fanbase got us out of our credit card debt and overdraft and I am just ever so grateful," he added.

"It has meant we are now back in the black and it has been a real kickstart and given me a renewed energy.

"To have that happen was incredible and it has renewed my faith in myself and my ability, and people."

Laurence Cawley/BBC

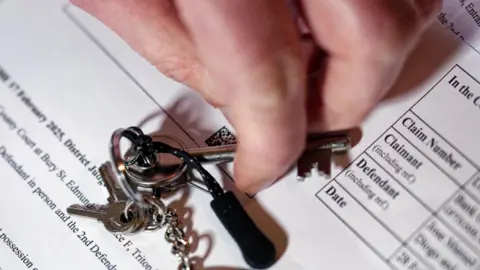

Laurence Cawley/BBCAccording to data published by UK Finance, there were 80,490 homeowner mortgages in arrears of 2.5% or more of the outstanding balance in the fourth quarter of 2025.

This marked a 4% decrease compared with the third quarter of 2025, with the overall proportion of mortgages in arrears remaining at 0.92% of homeowner mortgages.

The number of properties taken into possession also decreased compared with the previous quarter, and overall numbers remain significantly lower than long-term averages.

Toni Pearson, from Pearson Mortgages which operates in the East of England, said homeowners should "never worry" about telling their lenders if they experience financial difficulty.

"The best thing to do is always to be honest and upfront with [your mortgage lender] as soon as possible," she said.

"If you miss payments without telling a lender or having an arrangement you will fall into arrears and that's when they can seek repossession orders.

"But there are options your lender can give you to help lighten the load.

"They might switch you on to an interest-only mortgage for six months or give you a payment holiday but people don't always realise that."

Follow Suffolk news on BBC Sounds, Facebook, Instagram and X.