Price of flats fell in England last year, says Land Registry

Getty Images

Getty ImagesBuying a flat or maisonette in England is cheaper than a year ago, according to official figures, with the cost of semi-detached homes rising fastest.

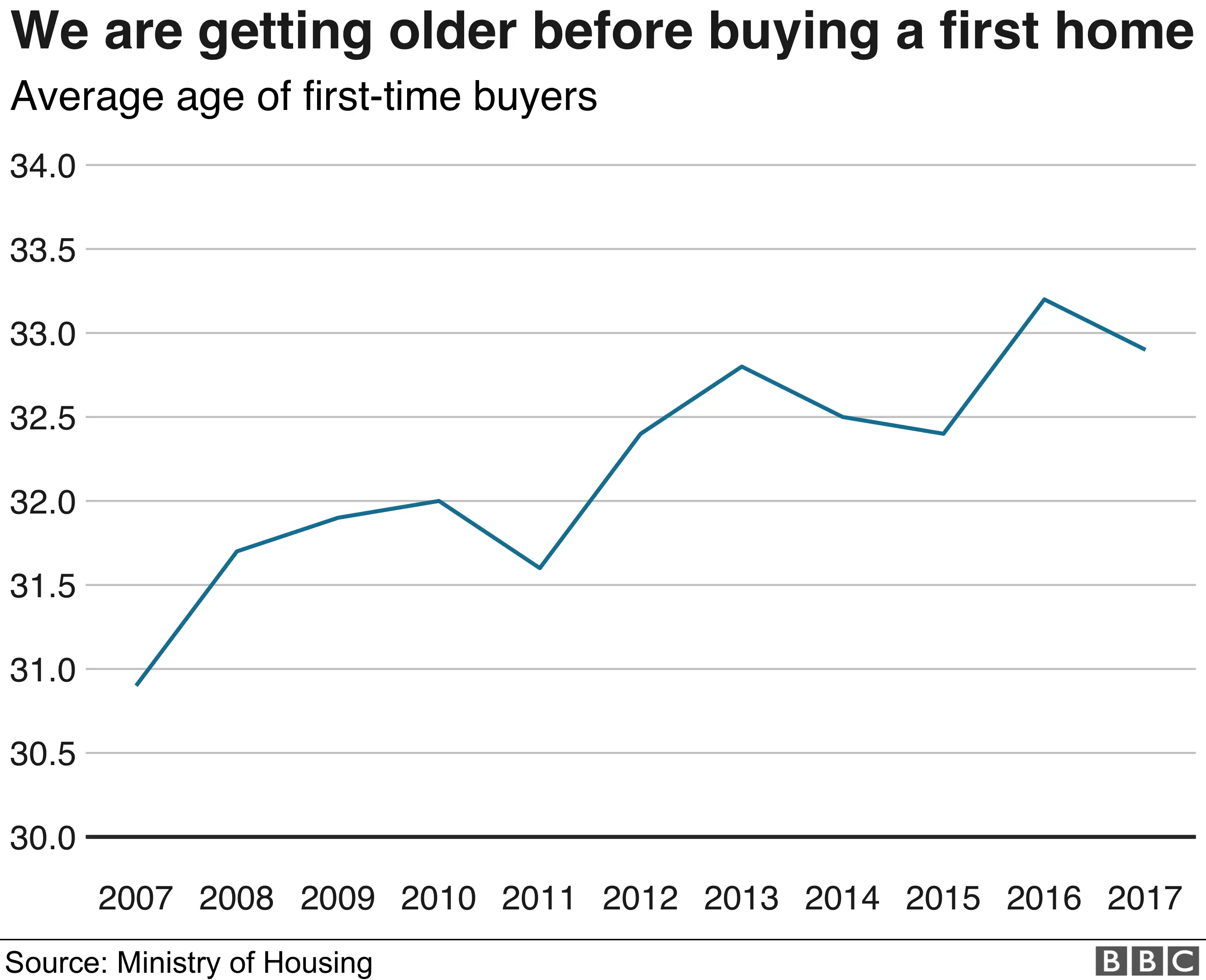

First-time buyers have been buying later in life and a number of buy-to-let investors have pulled out of the market owing to tax changes.

This may partially account for the 0.4% fall in apartment prices in 2018.

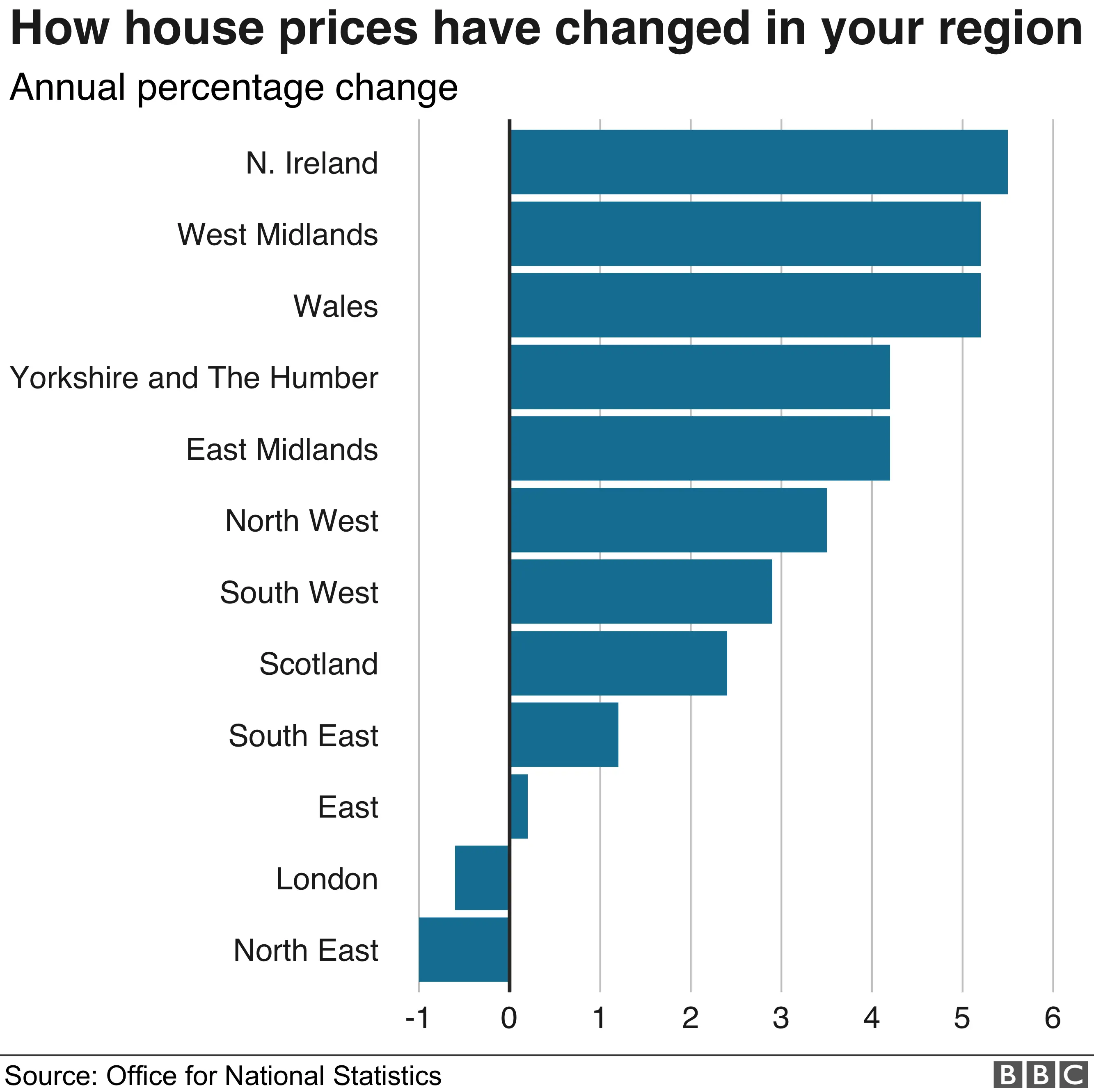

The Office for National Statistics (ONS) said, overall, UK house prices rose by 2.5% in the year to December.

This was the slowest rate of property price growth since July 2013.

The typical cost of a flat or maisonette was £226,247 in December, according to the Land Registry and ONS data.

This was a fall of £883 compared with a year earlier, revealing - in part - the changes in the housing market as a whole.

Some investors have pulled back from buying properties, often flats, to rent, owing to extra stamp duty charges and reduced tax allowances for landlords. This may be a particular issue in London, where apartments are sold at a higher value.

Many new-build schemes aimed at first-time buyers, who are buying later in life, are developments of small houses. This may also reduce demand for flats.

The price of semi-detached homes rose the fastest in England last year (up 3.3%), followed by detached homes (up 3.1%), and terraced houses (up 2.5%).

Overall, house price growth meant the average home in the UK cost £231,000 in December, which was a rise of £6,000 compared with a year earlier.

Mark Harris, chief executive of mortgage broker SPF Private Clients, said: "December's figures confirm a slowdown in house price growth which is not really surprising given the time of year and ongoing Brexit shenanigans."

However, the picture varies in different parts of the country.

Property price growth was fastest in Wales over the year (up 5.2%), taking the average cost to £162,000.

Prices fell in the North East of England (down 1%) and in London (down 0.6%) over the course of 2018.

"With London property prices falling every month for the second half of last year, prices clearly need to correct, which is encouraging both for first-time buyers and second steppers trying to make a move up the housing ladder," Mr Harris said.

"However, let's not get carried away as London remains the most expensive part of the country to purchase property."