How much could your council tax bill go up in April?

BBC

BBCCouncil tax payers across Leicester, Leicestershire and Rutland will soon receive letters detailing how bills will be increasing from 1 April.

However, the size of the bill will depend on where people live.

A total of 10 councils covering the city and counties each set their own budgets for 2026/27.

With bills set to increase, while councils make cuts to balance their books, how much are people being asked to pay for the public services they provide?

What does council tax pay for?

Council tax is collected by district and borough councils, but the total bill is split between various authorities.

In Leicestershire, the district authorities typically keep a share of about 10%, which they use to fund services including rubbish collection, council housing and planning.

The largest portion of the bill goes to Leicestershire County Council, which is responsible for areas including adult and children's social care, education, highways and transport, public health, libraries and waste management.

Most of the council tax levied in Leicester goes to the city council, which provides similar services to the county council, but also provides council housing, tackling homelessness, rubbish collection and planning.

Parts of the bill also fund Leicestershire Police and Leicestershire Fire and Rescue Service.

If an area has a town or parish council, a small portion of the bill goes to it to pay for services including providing allotments, parks, events and markets.

The government caps the amount most councils can increase their precepts by, and authorities must hold a referendum if they wish to exceed that.

The cap is 5% for unitary authorities like the city and county council, and 2.99%, or £5 for a Band D property, for districts and boroughs.

Councils and 999 services also receive business rates and funding from the government to pay for services alongside the sums they raise in tax locally.

Leicester City Council

Labour-run Leicester City Council has proposed an increase of just under 5%.

The proposed rise will see the bill for a Band D property in the city increase from £2,020.84 to £2,127.87.

However, the majority of homes in Leicester are smaller and Band A property bills will rise from £1,347.23 to £1,414.58.

Leicester mayor Sir Peter Soulsby said the council still plans cuts and savings to plug a "major black hole" of about £15m in its budget.

Leicestershire County Council

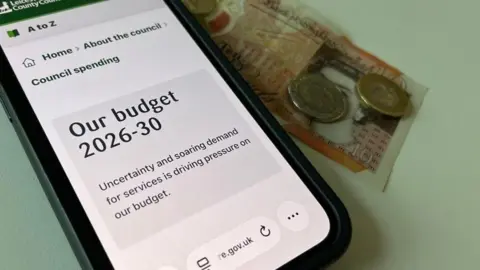

The Reform UK administration at County Hall is setting its first ever budget after taking control of the authority in May's election.

Council leader Dan Harrison said he hoped to keep a council tax increase to 2.99% - an increase of about £50 a year for a Band D property.

However, a maximum 5% increase has not been ruled out and that would be an increase of £84.08 for a Band D home.

Cabinet member for resources Harrison Fowler said: "Escalating costs and soaring demand are creating financial pressure, making managing the budget extremely tough."

Rutland County Council

Rutland council tax payers face a 3.9% council tax increase, which would see a Band D property bill rise by £7.21 a month.

The council, which is under no overall political control, is holding a consultation on the proposals, which runs until 3 February.

Andrew Johnson, cabinet member for governance and resources, said: "I know even this increase won't be what residents want to hear and it's certainly not something we want to do.

"The way Rutland continues to be hamstrung by national government through a serious lack of funding is outrageous and it is getting worse."

Blaby District Council

Current proposals would see the Tory-controlled district's precept increase by a maximum of 2.99% from April, which amounts to £5.82 for a Band D home.

Cheryl Cashmore, portfolio holder for finance, said: "The decision to increase council tax is not taken lightly and all factors will have to be considered to ensure the council remains financially sustainable."

People can have their say on the proposals until 16 February.

Charnwood Borough Council

The Labour-led authority plans to increase its council tax rate by 3.2% - or £5 per year for a Band D home.

Lead member for finance Ian Ashcroft said: "Although local government finance remains challenging, we are committed to making every pound count for the benefit of the borough."

Harborough District Council

Harborough District Council is the only Leicestershire authority considering cutting its share of the council tax bill, with a proposed 5% reduction.

The move would see its precept reduce by £9.16 for a Band D property.

The council, led by a coalition of Liberal Democrats, Labour, Greens and an independent, is currently consulting on its plans.

Hinckley and Bosworth Borough Council

The Liberal Democrat-controlled council has proposed a £5 rise in its precept on a Band D property.

Council leader Stuart Bray said: "It is with reluctance that we increase our council tax charge, but the funding from government is not enough to fund the services our residents rely on.

"We have one of the lowest for council tax charges in England, being about 15th from the bottom."

Melton Borough Council

Melton Borough Council

Melton Borough CouncilThe council, led by a coalition of independent and Labour councillors, has proposed a rise of 2.99%, or £5.69 per year for a Band D property.

Labour council leader Pip Allnatt said: "Our draft budget protects those services that will maximise growth and support the most vulnerable.

"It ensures we are as efficient as we can be and gives us some breathing space to work up scenarios and savings plans should we be forced to implement them."

Oadby and Wigston Borough Council

The Liberal Democrat-run authority proposes to increase its precept by 2.99%.

That equates to £7.82 a year for a Band D property.

Council leader Samia Haq said the authority was committed to setting a balanced and fair budget for 2026/27.

A budget consultation ends on 4 February.

North West Leicestershire District Council

The council plans to increase its precept by 2.75%, which would lead to Band D property bills rising by £4.59 a year.

Keith Merrie, the authority's finance and corporate portfolio holder, said the "small increase" in council tax would keep the council's income healthy.

Leicestershire Police

Leicestershire Police's budget is to be set by Reform UK police and crime commissioner Rupert Matthews.

He is due to unveil his proposals for the coming year before the end of January.

Leicestershire Fire and Rescue Service

The Leicestershire and Rutland Combined Authority intends to increase its precept by £5, which would increase the charge for a Band D property from £86.65 a year to £91.65.

Chief fire officer Callum Faint said the proposed budget would mean personnel reductions would not be needed.

"We are engaging further with our whole workforce as part of a service redesign project on how best to increase our capability and reinvest savings to continue to keep local communities safe," he said.

The government has said more money will be given to council areas with the greatest need this year, as part of a "radical overhaul" of local government funding.

The Ministry of Housing, Communities and Local Government added the first multi-year funding settlement in over a decade would give authorities more financial certainty to help them plan ahead.

All the precepting authorities in Leicestershire are due to finalise their budget plans in February.

Follow BBC Leicester on Facebook, on X, or on Instagram. Send your story ideas to eastmidsnews@bbc.co.uk or via WhatsApp on 0808 100 2210.