Pubs and hotels face higher rates bills after revaluation

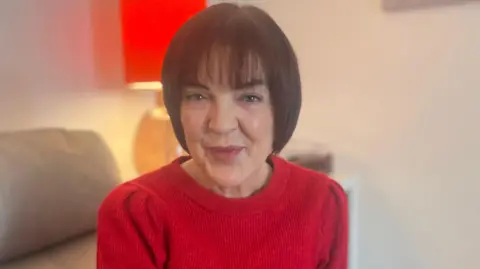

Getty Images

Getty ImagesPubs and hotels in Northern Ireland look set to face higher business rates as a result of a significant increase in their property valuations.

The change reflects improved rental conditions since the Covid-19 pandemic, according to Stormont's Land and Property Services (LPS).

It has revalued more than 75,000 non-domestic properties as part of a new list used in calculating business rates - an annual property tax that helps fund public services.

The revaluation exercise, called "Reval 2026", was last carried out in 2023.

The draft list, which LPS is encouraging businesses to check online, will be used to calculate business rates from 1 April 2026.

It does not change the amount of money generated from rates, but instead is meant to redistribute the rates burden and ensure fairness in the system.

How are business rates calculated?

Business rates apply to most non-domestic premises including shops, offices and warehouses.

The bills are usually issued every April, generating around £720m annually.

Business rates are calculated using a property's Net Annual Value (NAV) alongside the regional rate, set by Stormont, and the district rate, set by councils.

Stormont and councils normally decide their regional and district rates in the final months of each financial year.

Overall the draft revaluations show a 15% increase in the total value of non-domestic properties since the last revaluation.

For a business property with a new NAV of £23,000, it could mean a £182 increase in its rates bill, depending on the regional and district rates.

Hotels have overall had an 84% increase in their total valuations, while pubs have risen by 47%.

LPS said the significant change reflects factors including improved conditions since the Covid-19 pandemic, as well as expansions and improvements to premises.

Industrial and warehousing values have risen by about 16%, which is seen as the result of strong demand from logistics and manufacturing as well as limited supply.

Office values have increased overall by around 9%, driven largely by growth in Grade A offices in Belfast.

Retail property values across Northern Ireland have also increased overall by around 9%.

Approximately 67% of properties have had a revaluation at or below the increase of 15%.

'Expected to see little or no change'

Angela McGrath, the Commissioner of Valuation for Northern Ireland, said Reval 2026 was about ensuring rates were "distributed fairly based on current rental evidence".

"Businesses are currently paying rates based on rental levels that reflect the economic and market conditions during the pandemic in October 2021," she said.

"Reval 2026 updates this position by using more up-to-date rental evidence from April 2024.

"The majority of non‐domestic properties are expected to see little or no change in their rates liability."

She encouraged business ratepayers to view the new valuation online.

"LPS will review any new or relevant information ratepayers wish to bring forward now and make updates where appropriate before the new valuation list takes effect in April 2026," she added.