7.5% VAT on transfer, Stamp Duty charge - Wetin be dis bank charges wey dey cause tok for Nigeria?

Wia dis foto come from, PIUS UTOMI EKPEI /Getty Images

Di new tax policies wey come into effect for Nigeria from di first day of 2026, still dey cause plenty tok-tok for di kontri as e don sure say di govment no go look bak for di implementation.

And as business begin in full swing for di new year, di pipo don dey feel or see di impact for different areas.

One area na with online bank transactions.

Some financial institutions bin don send message of tins wey go change in online transactions in di new year 2026.

One na a notice of 7.5% VAT charge on top some transfers.

Even our tori pesin also get one of dose message from im bank wey tok say: "From Monday, January 19, 2026, we dey mandated to apply a 7.5 percent VAT on top some transfers, wey we go remit to di Nigeria Revenue Service (NRS), previously known as di Federal Inland Revenue Service".

No be only di 7.5 % VAT dey cause tok-tok, some Nigerians still also dey complain about one Stamp Duty charge for di sender wey start on January 1, 2026 too.

Dis don cause ogbonge outcry for social media as pipo dey complain say di govment wan use different type of tax finish pipo.

Wetin be dis 7.5% VAT?

Wia dis foto come from, Nigeria Revenue Service

Value Added Tax (VAT) na consumption tax wey govment dey put on top goods and services sake of di value wey don dey added to di goods and services.

Na di final consumer dey bear dis tax, but na individual businesses dey gada di moni and remit to govment pocket and di rate dey different from kontri to kontri.

For Nigeria, di VAT rate na 7.5%. Na for 2020 govment raise am from di 5% wia e bin dey. For some African kontris like Ghana, di standard VAT rate na 15%, according to ogbonge tax organisation PWC.

For one exclusive interview wit BBC News Pidgin for December 2025, di Chairman of di Presidential Fiscal Policy and Tax Reforms Committee, Taiwo Oyedele, tok say di new tax laws don comot VAT on top some kind basic items wey Nigerians dey use.

"If you dey do health, pharmaceutical, you dey buy paracetamol or oda stuff like dat, price too go come down, bicos VAT no dey on dem again. Same tin for rent, e no carry VAT anymore, transportation no carry VAT," Oyedele tok.

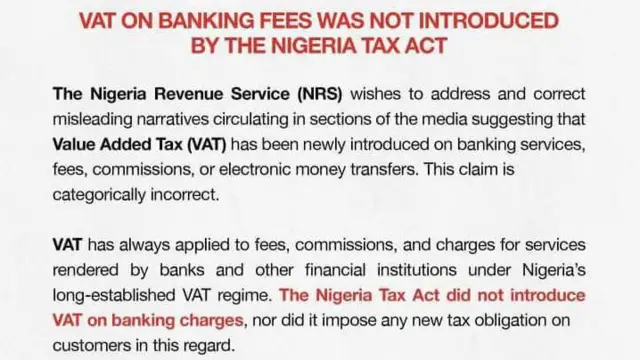

Meanwhile, di NRS release one short statement to explain say charging Value Added Tax on top bank transfer fees na something wey don dey exist since.

"VAT na wetin don dey apply on top fees, commissions and charges for services wey banks and oda financial institutions dey render," di NRS statement explain.

Dem also add say "di Nigerian Tax Act no introduce any VAT on top banking charges, and e no impose any new tax obligation on top customers head".

Also, one of di tok-tok pipo for di NRS explain to BBC News tori pesin say di 7.5% VAT no be on top di amount wey pesin dey transfer, but na on top di charges wey di bank go charge for di transfer.

"For example if you do transaction and di bank charge you 50 naira, di tax na on top dat 50 naira, no be on top your own moni," e explain.

Dis tok-tok pesin wey beg to remain anonymous further explain say e no make sense as many pipo dey paint am as if to say wen pesin transfer 100,000 naira den e go pay 7.5% of dat amount.

E tok say di confusion dey come from di pipo wey dey deliberately spread misinformation about di new tax laws for di kontri.

Wetin be di difference between di 7.5 % VAT, Stamp Duty and Electronic transfer service charge wey bank dey collect?

As e be so, mobile bank transactions dey attract both di Electronic Transfer Service Charge, di 7.5% VAT on dat and den di Stamp Duty.

Electronic transfer service charge na di money wey bank dey collect for any transaction and e dey different from bank to bank. Na from dis electronic charges di banks dey pay VAT to govment.

In di face of di confusion of di different charges, one banker break am down to BBC News Pidgin say dis charges no too dey different from one anoda.

Any time any customer do transaction e get di particular charge wey dey come to di bank, dem go kon divide dat charge into two.

One part na for di bank and dey go into dai Profit and Loss account while di VAT na di Nigeria govment.

"Every charges wey bank dey charge customer no be evritin belong to di bank, dem dey split di money for di back end. For example di bank charges na ₦15, but ₦8 fit go into di Profit and loss income account, while di remaining 7 dey enta for VAT (value added tax)."

Meanwhile di Stamp Duty na ₦50 wey dem dey remove from evri transaction wey dey above ₦10,000 from di pesin wey dey send di money. Before, dem bin dey remove di money from di receiver but now na from di sender dem dey collect am and e dey go govment pocket.

Nigeria new tax laws

Na for 2025, Nigeria President Bola Tinubu setup di Presidential Fiscal Policy and Tax Reforms Committee to bring togeda all di taxes and levies for all levels of govment so e go easy.

Dis committee wey dia chairman na ogbonge tax administrator, Taiwo Oyedele, den come up wit four new laws, namely:

- Di Nigeria Tax Act (NTA)

- Di Nigeria Tax Administration Act (NTAA)

- Di Nigeria Revenue Service Act (NRSA) to replace di former Federal Inland Revenue Service (FIRS),

- Di Joint Revenue Board Act (JRBA)

Oga Oyedele explain say dis new tax laws na to make sure say di rich pipo for Nigeria dey pay tax as dem suppose and di pipo wey no too get go dey pay less or some no go even pay at all, depending on di income.