Ghana E-Levy: Ghanaians start dey pay 1.5% tax on electronic transactions from May 1

Wia dis foto come from, Ghana E-Levy: Ghanaians start dey pay 1.5% tax on

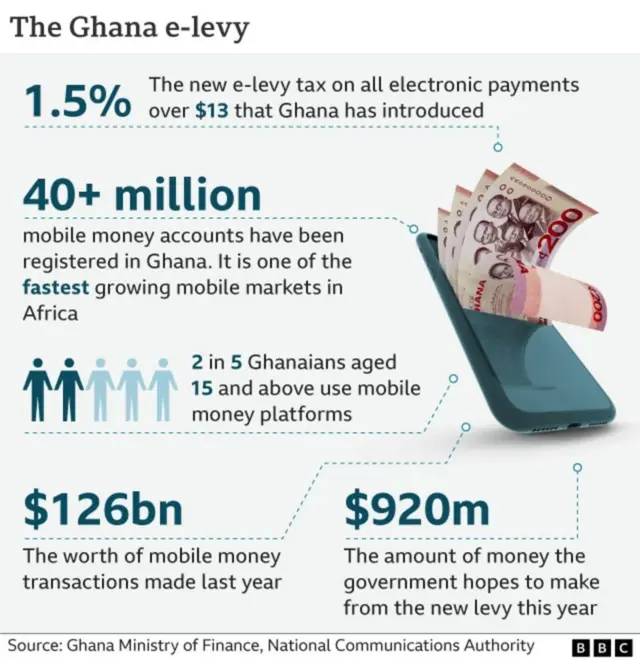

Ghana start dey charge 1.5% levy on mobile electronic transactions which dey exceed Ghc100 daily from May 1, 2022.

Ghana govment say dem go use de e-levy money create jobs for de youth.

Dema also plan to use am build roads den projects for de public good.

Last year alone, mobile money transactions alone for Ghana hit $126 billion.

Assuming govment charge de 1.5% levy on dis amount dem go rake in some $1billion dollars in taxes.

How E-levy charges go apply

De 1.5% levy go affect some five modes of mobile money transactions.

What did dey mean be say if you send total daily volume of Ghc100 across de transactions modes below you go pay de levy.

1. Mobile Money transfers between users on de same network. For instance from one MTN Momo user to another MTN user.

End of Di one wey oda users dey read well well

2. Mobile money transfers between users on different networks.

3. Transfers from bank accounts to mobile money accounts.

4. Transfers from mobile money accounts to bank accounts.

5. Inter-bank transfers which one dey use digital platforms like mobile applications.

Govment justification for E-levy

Ghana govment say de reason for dis levy be sake of dem want generate money internally instead say dem go borrow from outside.

De 1.5% levy go also widen de tax net make more people especially those who dey de informal sector pay taxes, according to govment.

Less than 10% of de Ghanaian population dey pay direct taxes to govment monthly.

Sake of dis, de big informal sector dey operate but govment no dey fit identify and collect taxes from dem for development.

So dis e-levy go help bring in people wey dey inside de informal sector to also contribute to nation building.

Govment believe say dis go widen de tax net, boost government revenue.

Background to Ghana E-levy

Finance Minister, Ken Ofori Atta introduce de levy during de budget reading before parliament in 2021.

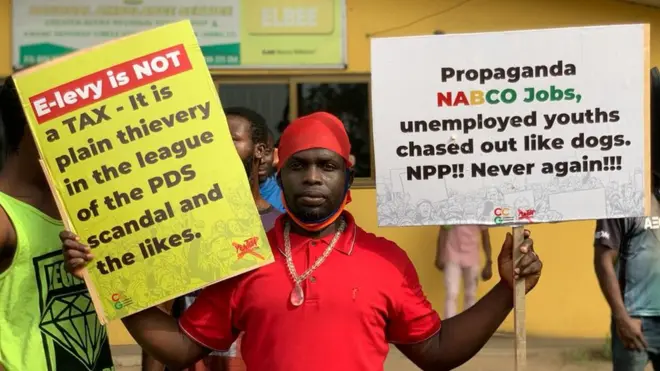

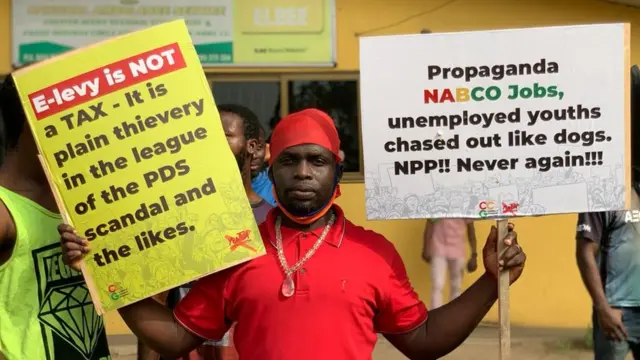

De announcement of de proposed levy face major opposition from some Ghanaians who hit to street to demonstrate for parliament.

Even minority MPs for Ghana parliament boycott sitting proceedings over de introduction of di e-levy.

But on March 29, 2022 parliament pass de Bill in de absence of Minority MPs who stage walk out before dem consider de Bill for second reading.

Dem amend de levy from 1.75% to 1.5% in line with concerns from Ghanaians who say de charge be too high.

President Akufo-Addo sign de e-levy into law on March 31, 2022 wey dem notify Ghanaians say de collection of e-levy go take effect from May 1, 2022.