800,000 naira annual income earners no go pay tax for Tinubu proposed reforms, odas wey go pay and how much

Wia dis foto come from, Asiwaju Bola Ahmed Tinubu

- Author, Tunde Ososanya

- Role, Senior Journalist

- Reporting from, Lagos

- Read am in 4 mins

Nigeria President Bola Tinubu tax reform bills don dey cause tok-tok for di kontri sake of concern wey some pipo get and di support from odas.

Di president bin send four bills to di National Assembly, wey include Nigeria Tax Bill, Nigeria Tax Administration Bill, Nigeria Revenue Service (Establishment) Bill, and Joint Revenue Board (Establishment) Bill.

You go remember say di bills bin pass second reading for Senate.

Di bills get different aspect including how states go share money wey enter federal goment purse through Value Added Tax, how low and high income earners for Nigeria go dey pay personal income tax, among odas.

However, many Nigerians wan know how di proposed tax reforms go take affect dem if dem pass di bills into law.

Di proposed tax reforms by President Tinubu wan reduce di tax burden for ova 90 percent of Nigerian workers, dis na according to Taiwo Oyedele wey be di Chairman of di Presidential Policy on Fiscal and Tax Reforms.

E say di reforms go ensure fair contribution from high income earners.

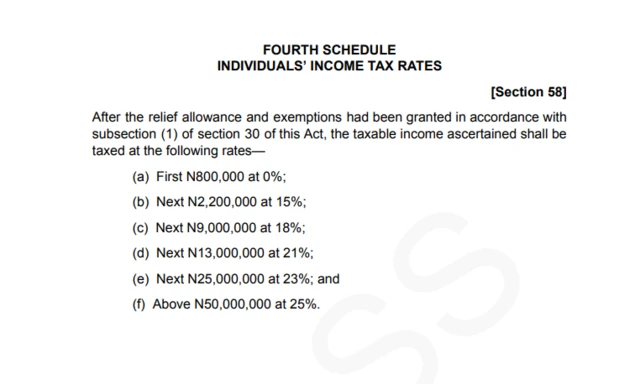

How much tax Nigerians go begin pay?

According to di proposed reforms, pipo wey dey earn 800,000 naira yearly no go pay any tax.

For dose wey dey earn between 800,000 naira and 3 million naira, di first 800,000 naira go remain tax-free, while di next 2.2 million naira go chop tax of 15%, wey go amount to 330,000 naira, dis na according to di Nigeria Tax Bill 2024.

If you dey earn between 12 million naira and 25 million naira, di first 12 million naira go chop tax of 1,950,000 naira, and di next 13 million naira go chop tax of 21%, wey be 2,730,000 naira, and total of 4,680,000 naira.

For dose wey dey earn between 25 million naira and 50 million naira, di first 25 million naira go chop tax of 4,680,000 naira, and di next 25 million naira go chop tax of 23%, wey be 5,750,000 naira and a total of 10,430,000 naira.

Finally, anyone wey dey earn above 50 million naira go pay 10,430,000 naira on di first 50 million naira and 25% on anytin above dat.

Na Pay As You Earn (PAYE) system Nigeria adopt for personal income tax, wey mean say employers go deduct taxes from salaries and remit dem to di relevant tax authority evri month.

Wia dis foto come from, FISCALREFORMS.NG

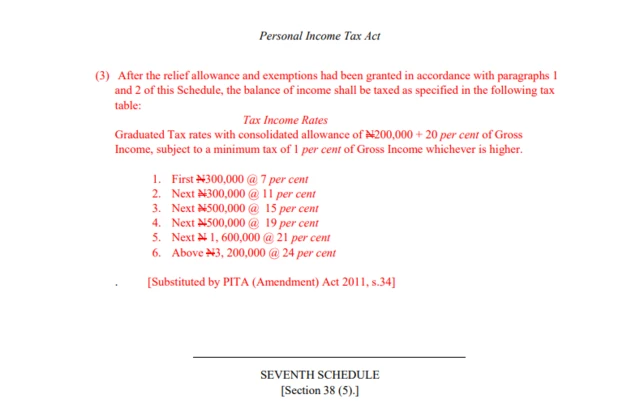

Wetin Nigerians dey currently pay as tax

For di current tax system, pipo wey dey earn less dan 300,000 annually no dey pay any tax.

Dose wey dey earn exactly 300,000 dey pay tax of 7% of dia earnings, wey be be 21,000 naira.

For individuals wey dey earn between 300,000 and 600,000, di first 300,000 go chop tax of 7% (N21,000), while di next 300,000 go chop tax of 11% (N33,000), wey be total of 54,000.

For incomes between 600,000 and 1.1 million, di first 600,000 naira go chop tax of 54,000, and di next 500,000 naira go chop tax of 15%, wey be 75,000 naira and total of 129,000 naira.

Pipo wey dey earn between 1.1 million naira and 2.7 million naira dey pay 129,000 naira on di first 1.1 million naira and 21% (N336,000) on di next 1.6 million naira, wey be total tax of 465,000.

For pipo wey dey earn more dan 3.2 million naira, di first 3.2 million naira go chop tax of 465,000, and anytin above dat go chop tax of 24%.

Wia dis foto come from, OLD.FIRS.GOV.NG

We neva suspend or withdraw deliberations on tax reform bills

Di Senate don tok say dem dey committed to advance di Tax Reform Bills.

Senate President Godswill Akpabio during plenary on Thursday say no aspect of di legislative process dey suspended or withdrawn.

"We neva suspend or withdraw deliberations on di tax reform bills. Any attempt to intimidate di Senate dey undemocratic.

"Dis bills na executive communications, and only di executive arm fit withdraw dem. We remain steadfast for our legislative responsibilities," Senator Akpabio tok.