How you fit deposit your old naira notes to CBN

Wia dis foto come from, Getty Images

Di supreme court don adjourn di suit challenging di naira swap policy of di central bank of Nigeria till next Wednesday, 22 February.

Di CBN bin already declare say di old naira notes no longer dey recognized as legal tender, despite di Supreme Court order to hold am till dem hear and make decision on di mata.

Di apex bank on Tuesday however release di guidelines for deposit of old notes at any of im branches across di kontri from February 15 and 17.

As at now Nigerians dey confused on weda dem fit use old currency.

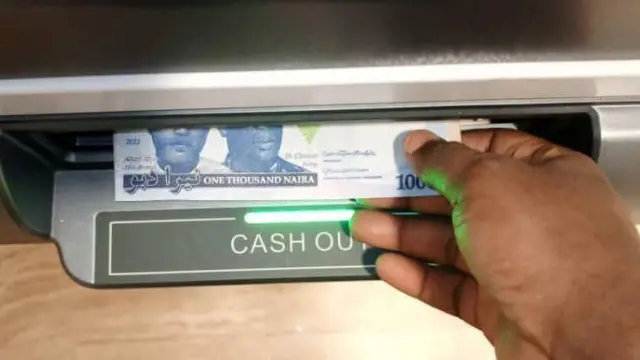

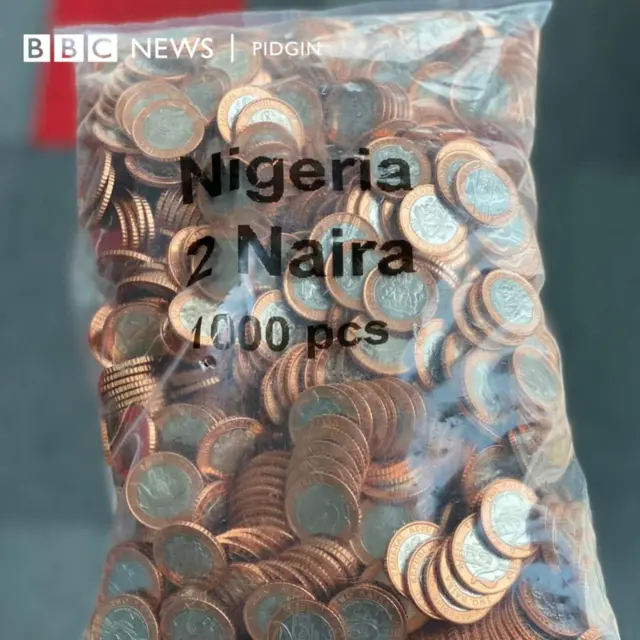

Dis na as di wahala of currency shortage for di kontri, both old and new paper money still dey affect di kontri.

Sotay pipo dey enta banks to collect two naira coin so at least dem go hold money for hand.

But on Thursday, Nigeria President Muhammadu Buhari for national broadcast tell Nigerians say February 17 still remain as date wen old 1000 and 500 naira note go be legal tender.

Im also direct make CBN release old 200 naira notes into di economy for am to remain legal tender until April 10 2023. Dis one mean say both di old and new 200 naira, new 500 and new 1000 na dem go be legal tenders.

End of Di one wey oda users dey read well well

Di president declaration no follow wetin Supreme Court tok but Nigerians dey wait to see wetin di highest court of di land go judge wen dem hear di case between some state govnors and Nigeria Presidency on usage of di old and new notes on Wednesday 22 February.

Di guidlines set by CBN

So now wey regular banks no fit collect old naira notes again, di Central Bank of Nigeria don arrange how to submit your old naira.

Di process suppose end by di 17th of February.

- First enta on online portal to fill application form, afta which you go get reference number wey you go carry along with your money go CBN.

- If you no fill di dia form online, you fit fill am for bank.

- Di bank account go dey verified by law enforcement.

- Di plan na to collect di money and deposit am put back di pesin account

Di process fit take up to four weeks.

Pesin no fit run dis deposit parole for anoda pesin, as na di pesin wey come dey expected to collect di money for im account.

If di bank account no dey valid, di bank go then return di money.

Wetin dey needed na Di reference number from d application form, di active bank account, Bank Verification Number, Federal goment ID card.

Kata-kata wey di new design policy cause

Di policy cause kata-kata for many parts of di kontri as some banks dey hoard di new naira notes and customers no see both new and old naira notes collect for counter and ATMs. Dis one make some angry customers attack banks and stage protests for some parts of di kontri.

For Warri, Delta State, one video show where bank customers dey climb step escape sake of say angry customers wey no see cash collect begin attack di bank staff. Oda videos show some bank customers dey naked diasef to protest sake of say dem no see moni collect for bank.

Oda videos show ATMs wey angry customers destroy for Abeokuta Ogun state sake of dia lack of access to cash. Some banks don shut down to guarantee dia staff safety while some dey close early and also take oda preventive measures against kasala.

To calm dia customers down, viral videos how some banks dey buy soft drinks for dia customers wey dey inside banking hall and di ones wey dey queue to use di ATMs.

Both banks and Nigerians dey cross dia fingers as dem dey expect announcement from di two oga at di top, President Muhammadu Buhari and CBN Oga Godwin Emefiele.

Wetin be di limit for di withdrawal of cash?

Di Central bank of Nigeria say di maximum limit for cash withdrawal across all channels by individual go now be #500,000 (Five hundred thousand Naira) instead of N100,000 and for corporate organisation, e go be #5,000,000 (Five million Naira) instead of N500,000 wey dem set before.

For any situation wia cash withdrawal go pass dat one, e go attract 3% processing fee for individual and corporate organisation go pay 5% percent to process am.

Dem no go fit pay any third party cheque wey dey above #100,000( one hundred thousand Naira) ova di counter. And di extent limit of #10 million on clearing cheque still exist.

Also, CBN say Monthly returns on cash withdrawal transactions wey dey above di specified limits must go unda banking supervision or oda financial institutions wia e dey applicable.

Dem believe say di redesigned notes go reduce di amount of cash wey dey in circulation and therefore restricts di way kidnappers take dey demand ransom plus e no go also make politicians fit rig elections.