Nigeria tax: Why di goment dey struggle to meet dem target?

Wia dis foto come from, Getty Images

- Author, Reality Check team

- Role, BBC News

- Read am in 3 mins

Nigeria fit enta serious hot soup on top money mata if dem no improve di way dem dey collect tax, na wetin authorities dey warn.

Goment don increase di money dem dey spend by times two and even di gbese wey dem dey service don increase join but dem don dey miss di amount of money dem dey make by at least 45% evri year since 2015.

Even wit dat one, Nigeria presido office, bin praise di work wey di Federal Inland Revenue Service (FIRS) dey do as dem double di number of pipo wey dey pay tax since 2015.

Dis article contain content wey X provide. We ask for una permission before anytin dey loaded, as dem fit dey use cookies and oda technologies. You fit wan read di X cookie policy and privacy policy before accepting. To view dis content choose 'accept and continue'.

End of X post

Social media user sharparly ask am say, if dat one dey true why dem neva see improvement for schools, roads and hospitals dem.

How to get more pipo to pay tax

In 2018, goment data show say 19 million Nigerians bin pay tax for federal and state level.

For dat year, World Bank tok say di amount of Nigerians wey dey work na 65 million, so even with di increase for taxpayers, na less than 30% of pipo dey pay.

Di goment don dey pursue pipo wey dem tink say suppose pay tax but no dey pay.

Wia dis foto come from, Getty Images

Two years ago, di kontri bin give Nigerians 12 months break say make dem pay dia tax gbese to run from di legal punishments but World Bank report tok say e no really suceed as na only 8% of di target na im dem reach by di end of di grace.

End of Di one wey oda users dey read well well

But, Nigerians no fully wan pay dia tax because dem tink say goment pipo go tiff am instead of am to go health, education and oda public services dem.

Drop for Oil Price

Di major wahala wey goment dey face now na on top di reduction of oil prices for world from around $113 a barrel for 2012 to around $54 in 2017 and di recession Nigeria enta for 2016.

Nigeria na Africa biggest oil producer and 57% of di money gomemt make between 2012 and 204 but don reduce to 41% for 2016 to 2018.

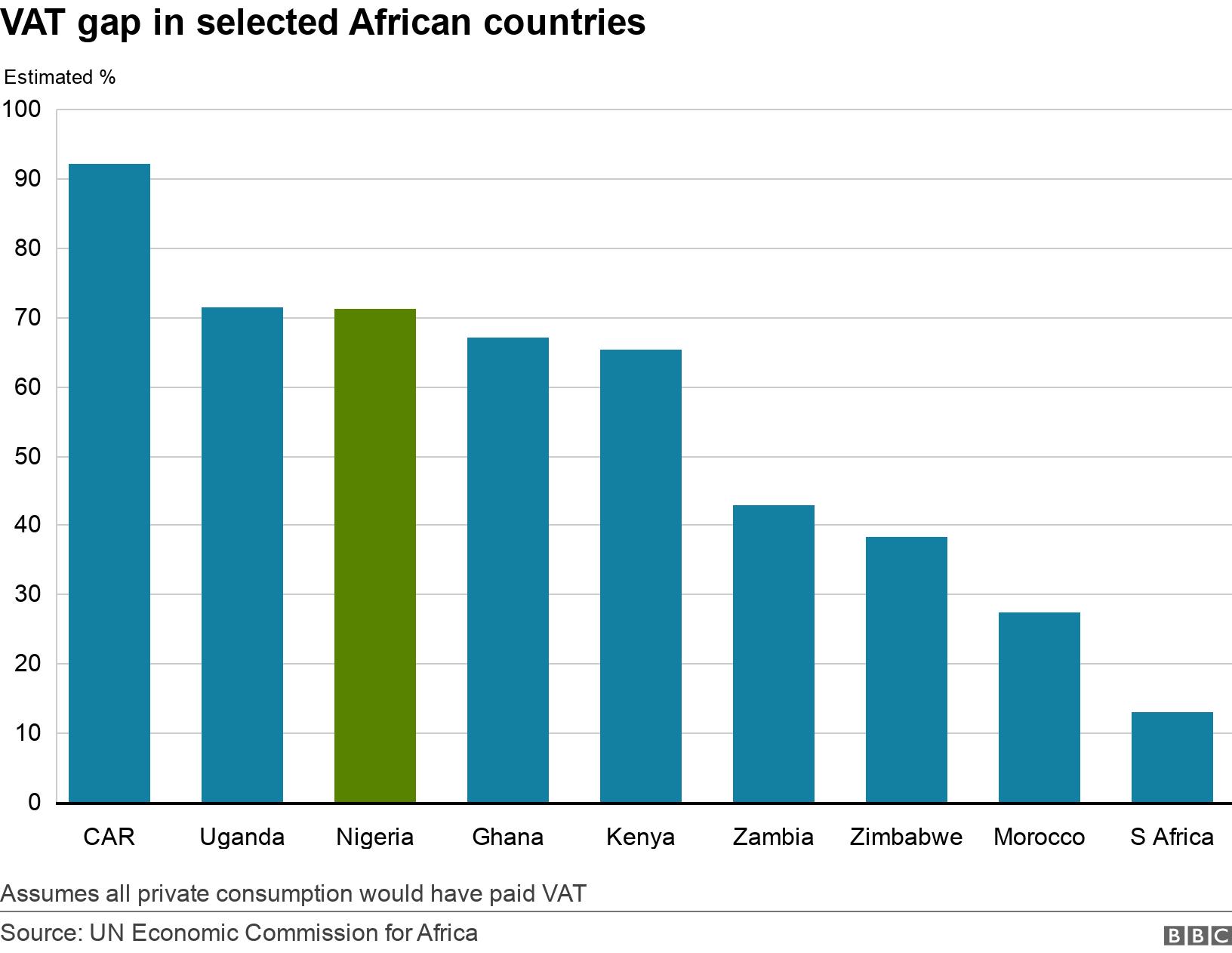

Di goment do report increase for dia value added tax (VAT) and company income tax since 2015 but UN report dis year tok say for 2018, di gap between dia VAR target and wetin dem dey collect na one of di biggest for Africa.

Nigeria also wan increase measures to collect tax from online sales, dem say from January 2020 dem go ask bank to charge 5% tax on top all online trade.

BUt for one side, report from Oxford University's Oxford Martin School show say while non-oil money dey increase inflation and currenc change dey wipe comot di money.

How Nigeria dey for world ranking?

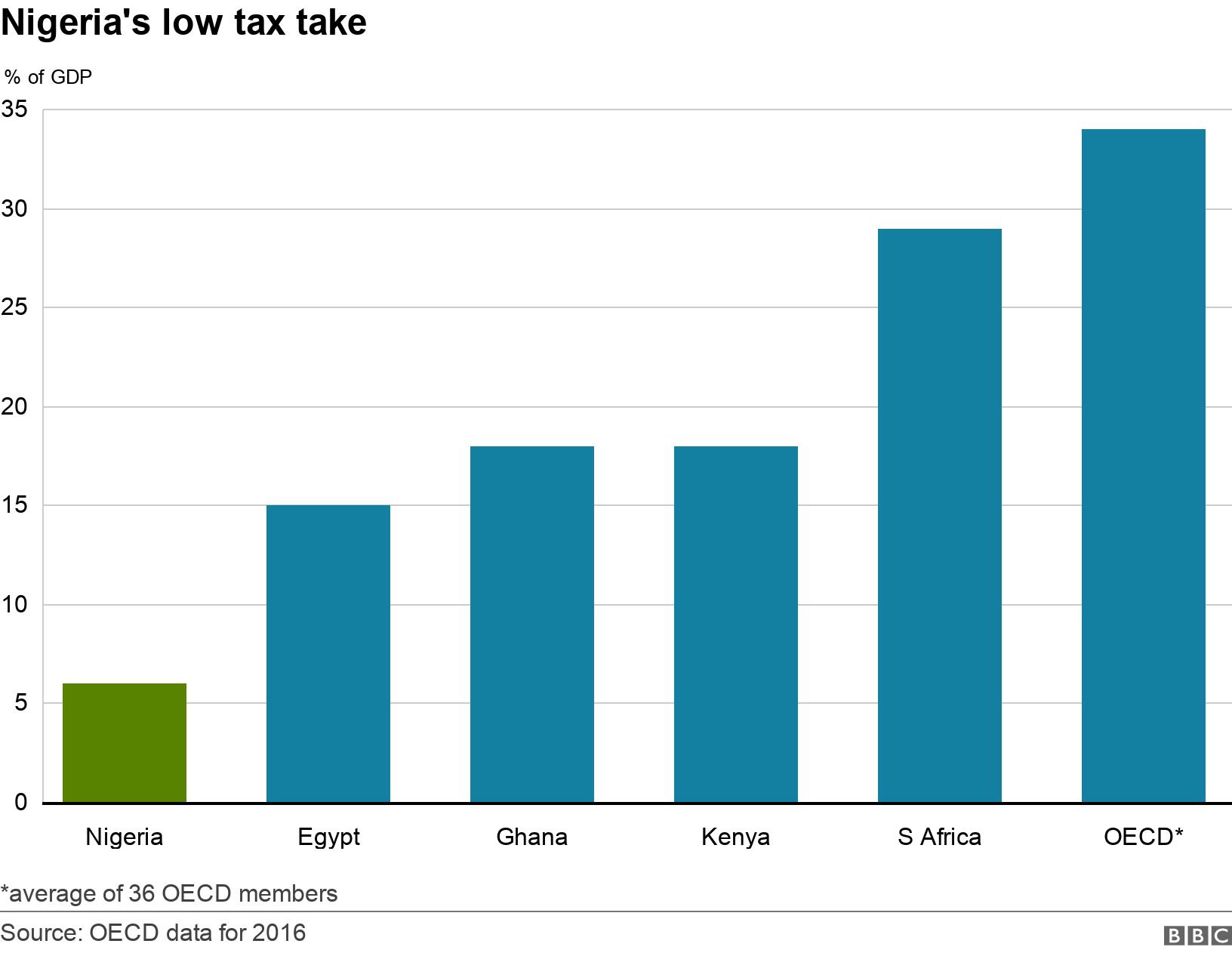

Some estimates show say Nigeria get one of di lowest tax to GDP ratio for world.

Tax to GDP ratio na di amount of tax wey goment collect wen you compare am to di kontri GDP wey be di price of dia goods and services.

Di Organisation for Economic Co-operation and Development (OECD)latest number show say Nigeria dey at 6% for 2016.

For oda kontris make we compare, di tax-to-GDP ratio for South Africa bin dey at 29%, Ghana 18%, Egypt 15% and Kenya 18%, and di average for OECD members dey at 34%.

How we go fit improve our tax take

Plenti oda developing kontris dem get low tax to GDP ratio and recent data show say 60 kontris no reach di 15% mark World Bank give.

Bernardin Akitoby, wey be assistant director for di IMF, tok say advanced kontris dem dey get tax to GDP ratio of around 40%.

Oga Akitoby tok say solutions no dey di same for everi kontri but lessons dey for kontri wey don dey successful before like:

- get clear political goal on how to handle low tax payments

- simple tax system wey get limited number of rates and exemptions

- put taxes for goods and services

- use new technology to increase tax collection

Di IMF tok say beta tax reform for Nigeria go fit help increase di tax to GDP atio by eight percentage points.