Wetin dey inside Trump 'Big Beautiful Bill'

Wia dis foto come from, Getty Images

- Author, Brandon Drenon and Nadine Yousif

- Role, BBC News, Washington DC

- Read am in 6 mins

US President Donald Trump budget mega-bill is set to become law after e pass a final vote for di House of Representatives.

Di president now dey ready to sign di bill into law during one ceremony on Friday.

Dis na afta Congress bin debate di package for days, as members of both di House and Senate work overnights for di Capitol.

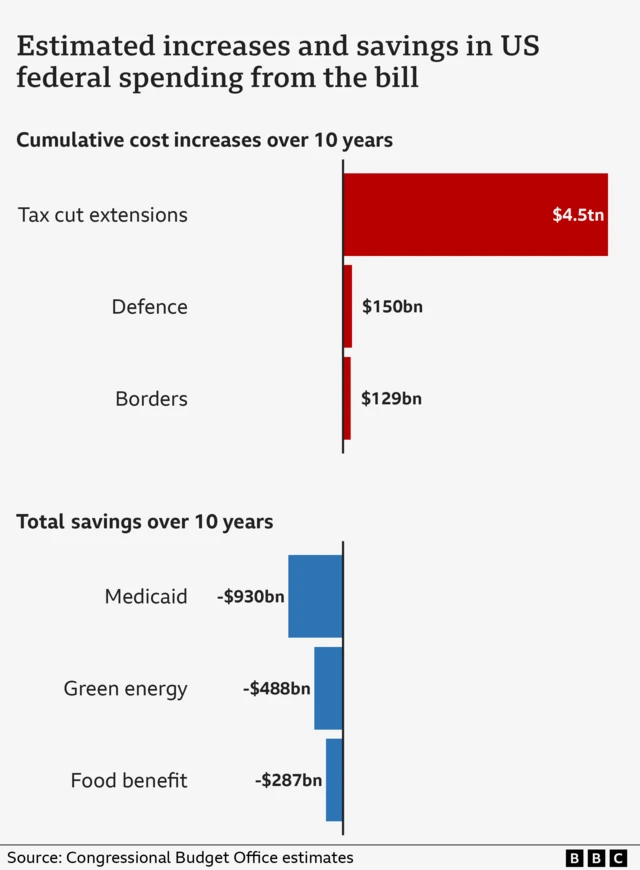

Di Congressional Budget Office dey estimate say di bill fit add $3.3tn to federal deficits ova di next 10 years and leave millions without health coverage - but dis forecast, White House no agree wit am.

Earlier, di final vote bin dey delayed wen Democratic Minority House Leader Hakeem Jeffries break record by speaking for more dan eight hours on di floor.

Di ogbonge bill dey critical to President Trump agenda and bin cause serious debate.

Dis na some of di key items and hotly-debated issues for di bill.

Extension of 2017 Trump tax cuts

During im first term, Trump bin sign di Tax Cuts and Jobs Act, wey lower taxes for corporations and for individuals across most income brackets.

Trump claim say di law go stimulate economic growth, but experts argue say e go benefit wealthy Americans di most.

Key provisions of dat law dey set to expire for December, but di ogbonge budget bill currently wey dey bifor lawmakers aim to make those tax cuts permanent. E go also increase standard deductions by $1,000 (£736) for individuals and $2,000 for married couples until 2028.

Cuts to Medicaid

To help finance tax cuts for oda places, Republicans bin add additional restrictions and requirements for Medicaid, di healthcare programme wey millions of disabled and low-income Americans dey rely on.

Changes to Medicaid - one of di biggest components of federal spending - na major source of political yawa.

One of di changes na new work requirements for childless adults without disabilities. To qualify, di bill say, dem dey required to work at least 80 hours per month from December 2026.

Anoda proposed change to di programme require Medicaid re-enrolment to shift from once a year to every six months. Enrolees go also provide additional income and residency verifications.

Di Senate proposal put even more restrictions on Medicaid, wey dey likely to cause more headaches for Republicans for di House.

Di upper chamber version propose to lower provider taxes - wey states dey use to help fund dia share of Medicaid costs - from 6% to 3.5% by 2032.

Complain from some Republicans for states wey dey draw fund from dis taxes, especially for rural hospitals, lead di Senate to delay di cuts and add a $50bn rural hospital fund.

Di Senate bill also propose to tighten di eligibility requirements so dat di able-bodied adults wit children aged 15 and ova go need to work or volunteer at least 80 hours a month.

Di Senate Medicaid work requirement na di strictest ever proposal by Republicans, wey raise di odds say large numbers of Americans fit lose medical coverage as dem no fit keep up with di new paperwork.

Di Congressional Budget Office estimate say nearly 12 million Americans fit lose dia health coverage by di end of di next decade as a result of di proposed changes.

Social Security taxes

For im campaign trail, Trump bin vow to eliminate taxes on Social Security income - monthly payments to Americans of retirement age and pipo wit disabilities.

Di House bill fall short of delivering on dat promise, but e bin temporarily increase di standard deduction of up to $4,000 for individuals 65 and ova. Dat deduction go dey in place from 2025-28.

Senate Republicans approve di extension of Social Security tax breaks and increase wey go grant a $6,000 tax deduction for older Americans wey dey earn no more dan $75,000 a year.

Increasing state and local tax deduction (Salt)

Di bill go increase di deduction limit for state and local taxes (Salt).

Currently, na $10,000 cap dey on how much taxpayers fit deduct from di amount dem dey owe in federal taxes. Dat go expire dis year.

Di Senate approved bill raise am from $10,000 to $40,000 - but after five years, e go return to $10,000.

Salt taxes na big sticking point for di House, especially Republican holdouts for some Democratic-controlled urban areas. Di House version of di spending bill no include a five-year limit, so di Senate changes fit pose problem for some House Republicans.

Cuts to food benefits

Dem also add reforms to di Supplemental Nutrition Assistance Program (Snap), wey ova 40 million low-income Americans dey use.

Di Senate bill require states to contribute more to di programme, wey currently dey fully funded by di federal goment.

Di goment go continue to fully fund di benefits for states wey get error payment rate below 6%, but states wit higher error rates go dey on di hook for anywhere from 5% to 15% of di programme costs.

Di change go start in 2028.

Di Senate bill also add work requirements for able-bodied Snap enrollees wey no get dependents.

Boost to defence and border spending

US military go receive a budget increase of $150bn under di bill.

Dem go use di money to ginger di armed forces shipbuilding capacity, as well as to fund Trump "Golden Dome" missile defence project.

E go also significantly increase funding for immigration enforcement by allocating $100bn to Immigration and Customs Enforcement (ICE), di agency wey dey central to Trump administration efforts to crack down on illegal immigration for di US.

Di additional funding, wey go run until 2029, go dey used to nearly double migrant detention capacity for di US and hire more enforcement personnel.

Before di bill, di existing annual budget for ICE na about $8bn. Di funding boost now don make ICE di largest federal law enforcement agency, according to di non-profit Brennan Center for Justice.

No tax on overtime or tips and other elements

Di "no tax on tips" provision for di budget bill go mark as win for one of Trump promises during di campaign.

Di Senate bill wey di House dey consider go allow individuals to deduct a certain amount of tip wages and overtime from dia taxes. However, dem dey propose to gradually phase out those benefits based on annual income, starting at $150,000 for individuals and $300,000 for joint filers.

E go expire for 2028.

Di Senate legislation go also permanently increase a child tax credit to $2,200 – wey dey $300 less dan wetin di House lawmakers bin dey eye. Di House version bin require both parents to get a Social Security number, but di Senate OK a requirement of only one parent.

Di upper chamber bill also propose to raise di debt ceiling by $5tn - more dan di $4tn wey di House bin approve last month. Di debt ceiling na di limit on di amount of money wey US government fit borrow to pay dia bills.

To lift di debt limit go allow di govment to pay for programmes wey already, Congress don approve.

Clean energy tax cuts

One of di most notable divisions between House and Senate Republicans na Senate proposal for clean energy tax breaks.

Although both call for an end to Biden-era federal clean energy tax credits, Senate Republicans bin approve for dem to phase am out more slowly.

For example, di Senate bin extend di runway for businesses wey dey build wind and solar farms to still benefit from di tax credits. However, both di House and Senate version seek to deny di credits to company for di supply chains wey fit get ties to a "foreign entity of concern", like China.

Companies wey go begin construction dis year fit qualify for di full tax break. Dat go drop to 60% if dem begin construction for 2026 and 20% if dem begin for 2027. Di credit go disappear for 2028.

Di House version of di bill bin seek to end di tax breaks for those companies almost immediately.