Causes of the Great Depression

An unbalanced boom

The boom of the 1920s came to an end with the Wall Street CrashIn October 1929 share prices on the Wall Street stock market in New York crashed, helping to cause the Great Depression. in October 1929 and the collapse of the stock market A term which can refer to stocks and shares and stock exchange, buying and selling shares, the overall value of shares sold in a stock exchange. Despite the immediate impact of this event on the US economy, many historians have blamed the Great Depression partly on the structural problems of the 1920s. Such problems incuded:

- the huge gap that existed between rich and poor people in America at the time

- the unprofitability of agriculture, which was an important part of the US economy

- The unbalanced economy due to the use of credit, with many people only taking part in the consumer boom through the use of hire purchaseA method used to buy an asset in instalments whereby the asset only belongs to the person or business after the very last repayment. schemes to buy products

Explore the Wall Street Crash and Great Depression through animation and archive footage.

Learn more about the Wall Street Crash and the Great Depression in this podcast.

Listen to the full series on BBC Sounds.

Structural weaknesses in the economy

American businesses had boomed in the early part of the 1920s as consumer demand was rising for a wide range of goods, including radios, vacuum cleaners and refrigerators. However, more than 60 per cent of Americans lived just below the poverty line and so were too poor to afford these goods. This meant that US businesses were producing more than they could sell and so prices and wages began to fall.

One reason for this poverty was the fact that agriculture had been in difficulty throughout the 1920s. overproductionThe production of more of a product than is wanted or needed. had ensured that prices remained low for farmers and farm workers. Overproduction was also an issue in other industries by 1929, partly as a result of the assembly line A series of workers and machines in a factory by which a succession of similar items is progressively assembled. However, despite the abundance of goods, the profits from sales had gone to business owners rather than increasing workers’ wages. In 1929, the poorest 10 per cent of American households received only 1.8 per cent of the total national income. This meant that they couldn’t contribute to the consumer boom. However, they were able to borrow money through the use of credit to purchase consumer goodsGoods that are used as ends in themselves and not for the production of other goods. Examples include vacuum cleaners, fridges and radios. This meant that there was a lot of debt A sum of money owed by an individual or business to another person or business. in the system by the end of the 1920s.

Protectionism

Another weakness was the protectionist policy of the governments. Overproduction would not have been as much of a problem if it had been possible to sell American goods abroad. However, the 1922 Fordney-McCumber Tariff Act had led to European countries imposing tariff A tax or charge placed on imported or exported goods and services. on American goods. This meant American goods were too expensive to buy in Europe. As a result, there was not much trade between America and Europe.

Laissez faire

The laissez faireWhen a government doesn't believe in interfering in the lives of individuals and businesses. For the Republicans, liberty or freedom to live your life and run your business was one of the most important roles of government. policy of the Republican PartyOne of the two major American political parties. Republicans tend to hold a more conservative viewpoint on politics and society. presidents meant that there were not enough safeguards in the economy, especially concerning the banks and the stock market.

With no regulation, there were no checks on buying sharesFinancial stakes in a company or business. Additionally, there were too many small banks without the financial resources to cope with problems.

Speculation and the Wall Street Crash

People had begun to buy more and more shares in US businesses. They were able to afford shares as they could be bought ‘on the marginA process where people borrow money in order to be able to buy shares.’. They believed that these shares would become more valuable as more products were being made to sell. Banks had also loaned out large sums of money, which people had used to buy shares. Everyone thought that they would end up being able to sell their shares for more than they had paid for them. This was known as speculationThe purchasing of shares on credit in the hope that the loans can be repaid from profits when the shares were sold.

By the end of September 1929, people started to realise that the price of shares had become too high compared to the value of companies.

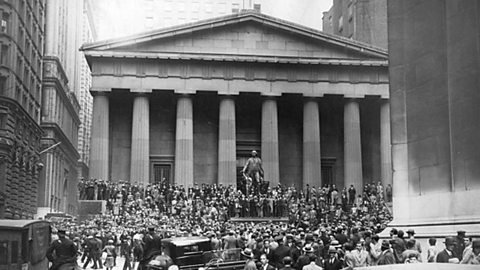

The main American stock exchangeA place where shares are bought and sold. where shares were bought and sold, was on Wall Street in New York. The value of the shares sold on Wall Street had increased by around 120 per cent between 1925 and 1929. Once share prices started to fall in September 1929, more and more people tried to sell their shares before they became worth less than they had paid for them.

On 24 October 1929, now known as Black Thursday, there was panic selling of shares. This led to a sudden fall in share prices. On 29 October, now known as Black Tuesday, 16 million shares were sold on the stock market in Wall Street and the economy collapsed completely. These events became known as the Wall Street Crash.

Banking collapse

The immediate impact on banks was that many of them went bankruptA legal status where a person or organisation is ruled to be unable to pay their debts. as they had run out of money. One of the worst bankruptcies was that of the New York City Bank, which closed in December 1930. As a result, around 400,000 customers lost their savings.

Banks ran out of money because they had:

- lent money to people to buy shares that were now worthless

- bought shares to make a profit and spent all of their customers’ money

- bought shares to keep the prices up during the crash even though prices kept falling

Banks that still had cash found that customers rushed to withdraw their money in cash before the bank collapsed. As a result, some banks went bankrupt that might otherwise have survived.