Bad news for broadcasters as online video powers ahead

Charles Miller

edits this blog. Twitter: @chblm

A previous post from a Royal Television Society event reported on how MCNs – multichannel networks – are thriving as online video grows ever more popular. At the same event, Richard Broughton, research director of Ampere Analysis, presented his research findings about online video, which are reproduced here with his kind permission.

Richard Broughton asked whether multichannel networks – the likes of Rightster, Maker Studios and Copa90 – which create, curate and distribute video online, are “the future of TV”.

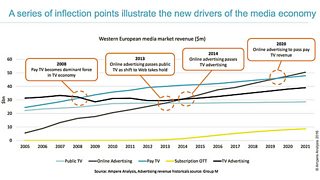

To answer his own question, he outlined trends which have seen traditional TV advertising decline as a percentage of GDP in Western Europe. Around 2008, subscription TV income overtook TV advertising, and there are no signs that commercial TV will catch up again. Meanwhile public television, including the BBC, remains the poor relation with less revenue than either subscription (pay) TV or TV advertising.

So far, so familiar. But Broughton showed that the crossover between pay TV and TV advertising in 2008 was just the first in a series of changes in the media ecosystem – and that the revenue horse to bet on was the grey line below, representing online advertising:

Online advertising overtook public TV in 2013 and commercial TV in 2014. And it’s on track to be the most lucrative sector in this market by 2020 when it will finally overtake subscription TV.

Broughton describes video as a “crucial component of online advertising growth”. Last year, more than half as much again was spent on video advertising than in the previous year.

But the media establishment is not necessarily being shut out. While ‘social video’ typically comes from the big US tech companies, in the UK, both broadcasters (ITV, Channel Four and UKTV) and the press (Daily Mail, the Sun, the Guardian) are also big players in online video.

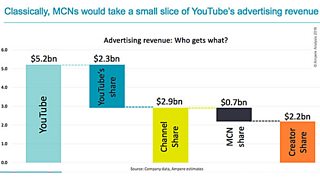

So how does the money move through this new ecosystem? Well, Broughton went back to the basic economics of YouTube – or at least the way YouTube revenue flows in the age of the MCNs. Remember, the MCN takes a slice of the money that YouTube pays to successful content providers in return for helping those providers maximise their revenues using the MCN’s channels.

When an advertiser pays for their ad being shown on YouTube, the money is shared between YouTube, the MCN and the content creator. Here’s how:

By the time YouTube and the content creator have taken their shares, the MCN is left with a relatively small proportion of the ad revenue ($0.7b out of $5.2b or about 13% according to the above figures).

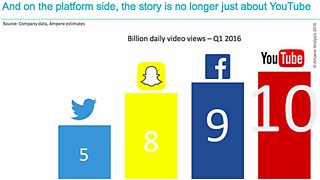

But now the MCNs are extending their businesses to bring in larger slices from more pies. For instance, they are working directly with brands to create and promote branded content, not just for YouTube, but for a range of online outlets. As Broughton showed (below), YouTube may still be the biggest, but it is by no means the only significant player in online video:

All this has made MCNs the focus of growing interest from big financial and media players eager to own a stake in potentially powerful new centres of media revenue and influence.

Valuations in the hundreds of millions of dollars are the norm for successful MCNs , many of which are not yet household names: Awesomeness TV, Fullscreen and Collective 71, for instance.

If you thought that YouTube heralded a new era in which video makers working with newly affordable kit could bring their work directly to the world without the need for any kind of intermediary, dream on.

Giving momentum to online video: The new world of MCNs

Now news videos can be created by software