Yesterday the Department of Culture, Media and Sport published a weighty assessment of the market impact and distinctiveness of the BBC’s services by Oliver & Ohlbaum (O&O) and Oxera.

We have now had time to digest the report. It suggests that in some areas the BBC has become less distinctive - particularly on BBC One - in recent years.

Having gone through the detail of O&O’s analysis we are not sure that the evidence presented supports such a claim.

In fact, one of O&O’s conclusions is that they don’t have the data to check the long-run distinctiveness of BBC One versus ITV1 across all relevant dimensions and “we are not sure how relevant this is to the current or future dynamics of BBC One and ITV1 and its impact”.

The data, in fact, tells rather a different story – a story of BBC One that is not only distinctive compared to ITV1 but more distinctive than it used to be.

Genre mix

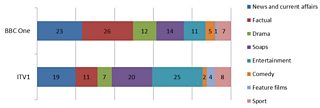

For instance, Ofcom’s industry data shows that despite a similar level of spend, BBC One broadcasts in peak-time a much broader range of programming than that offered by ITV. ITV broadcasts close to double the number of peak-time hours of Entertainment and Soaps (45% to 25%). Almost half of BBC One’s peak-time schedule is allocated to News and Current Affairs and Factual programming, against just 30% on ITV1.

Genre mix on BBC One and ITV (% peak time)

Compared to ITV1, BBC One offers more News in peak-time (295hrs to 242hrs), more Current Affairs in peak-time (48hrs to 37hrs) and more Specialist Factual in peak-time (123hrs to 70hrs). BBC One offers audiences more Comedy and Drama in peak-time schedules but fewer hours of Soaps, Entertainment and Sport.

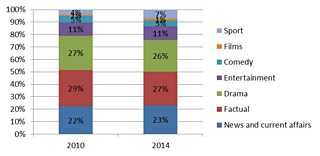

The report asks whether BBC One is reducing its commitment to high public value content. Ofcom’s data and evidence shows that BBC One has maintained a healthy mix of genres. For example, comparing two equivalent years 2010 and 2014 (both major sports years with football World Cups) demonstrates this.

BBC One peak genre mix (2010-2014)

And, of course, BBC One is far more distinctive today than it has ever been. Thirty years ago, a fifth of BBC One’s peak-time schedule consisted of expensively acquired US series such as Starsky and Hutch, Kojak, Dallas and The Rockford Files. Now that figure is zero. BBC One now typically broadcasts 537 minutes of peak-time News each week compared to 272 minutes in 1982, with over 30% more UK-originated peak-time Drama over the same time period.

What the audience thinks

This distinctive mix of output is recognised by audiences. Since 2010 we have asked audiences whether the programme they’ve just watched is ‘fresh and new’ – our lead measure of distinctiveness. BBC One’s ‘fresh and new score’ – calculated by aggregating all the individual responses to individual programmes – has climbed since measurement began from 64.7% in 2010/11 to 71.6% in 2014/15.

This upward trend in BBC One’s score, built bottom-up by aggregating responses to individual transmissions, is also reflected in the top down measures used to track distinctiveness by Ofcom.

Ofcom assesses distinctiveness top-down as part of an annual survey of public perceptions of the delivery of public service broadcasting (PSB). Audiences are asked in the questionnaire for their perceptions of whether each PSB channel that they watch regularly ‘shows programmes with new ideas/different approaches’. Results for BBC One have been rising with 43% of BBC One viewers rating the channel thus in 2006 increasing to 53% in 2010 to 62% in 2014 (the most recently published data). At 62% BBC One ranks first on this metric, and also ranks top when viewers are asked to assess channels in terms of ‘The style of the programmes is different to what I'd expect to see on other channels’. 62% of BBC One viewers rate the channel in this way (compared with 59% of BBC Two viewers, 57% of Channel 4 viewers, 52% of ITV viewers and 41% of Channel 5 viewers)[1].

O&O recommendations

Despite this clear trend, the O&O report concludes that requiring BBC One to commit to a wider range and significant number of new titles in its schedule could reduce BBC One’s audience share of viewing to below 20% (from 22% in 2015); and therefore might increase commercial advertising-funded rival income by £33 to £40m a year.

Let’s be clear what such proposals would mean. On a first analysis, this would mean, for instance, cutting a very long list of long-running shows like Silent Witness, Countryfile, The One Show, Casualty, Holby City, Masterchef, Pointless, The Apprentice, Watchdog, Who Do They Think They Are?, Songs of Praise, Have I Got News For You, The Antiques Roadshow and all their associated shows. Replacing all these shows with new titles, as the report suggests, would be impossible given the £700m savings the BBC has to make over the next few years, and which the report makes no reference to.

So the result would be to reduce what all audiences get from the BBC, for a gain to commercial television of around a quarter of one percent of total TV revenues.

Taken together with O&O’s recommendations for BBC Radio, the net gain would be less than 1% of total TV and radio industry revenues.

We share the ambition of a BBC that should be even more distinctive so that we can build on our strong record, but it's an odd ambition to want fewer people to watch great TV. On the same day as this report was published, the Government published the results of their public consultation into the BBC and its Charter. Over 80% of people responding to the Government’s consultation said the BBC is serving audiences well. Almost three quarters said the BBC’s services are distinctive and about two-thirds think it has a positive wider impact on the market.

So we don’t believe in reconfiguring the BBC to maximise commercial profits rather than asking how can the BBC be improved to best meet audience needs. This report proposes a BBC designed for the convenience of its competitors not the enjoyment of audiences, to the long-term detriment of both.

[1] Regular viewers of the channel rating 7-10 out of 10 for delivery. Available at: http://stakeholders.ofcom.org.uk/binaries/broadcast/reviews-investigations/psb-review/psb2015/PSB__2015_audience_impact.pdf

James Heath is BBC Director of Policy & Charter

- Read also Is BBC One really the same as ITV?