UK inflation rises to 3.4%, driven by tobacco and airfarespublished at 09:03 GMT

Caitlin Doherty

Live reporter

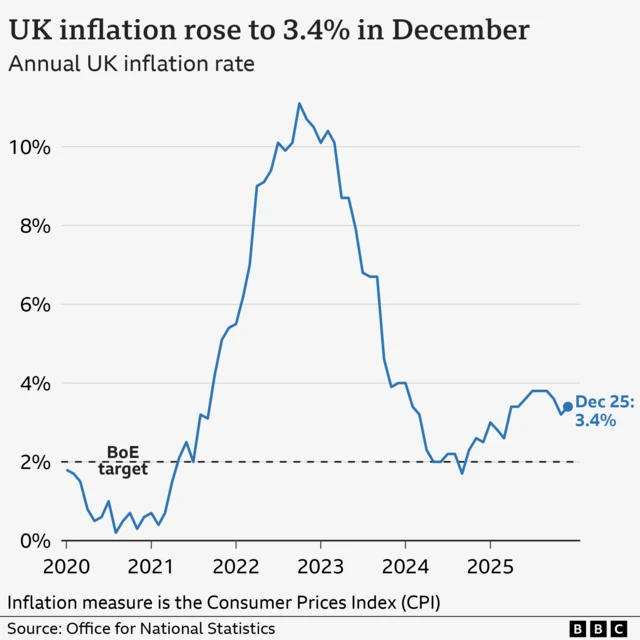

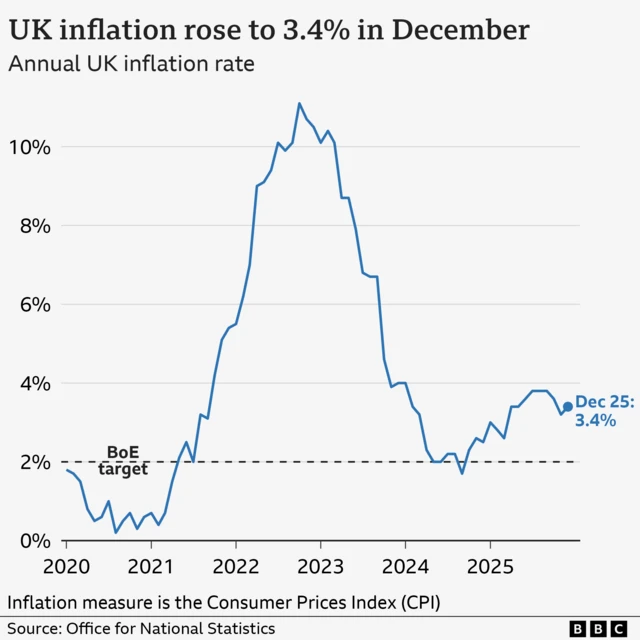

The rate of inflation in the UK rose to 3.4% in the year to December, according to fresh figures from the Office for National Statistics.

Rising prices were driven in part by higher tobacco prices and airfares over the Christmas and New Year break.

Chancellor Rachel Reeves says that her "number one focus is to cut the cost of living," but her Conservative counterpart, Mel Stride, blames the rising rate on what he calls the government's "economic mismanagement".

If you strip out volatile elements - including tobacco, food and energy - then the inflation rate for the year to December was lower, at 3.2%.

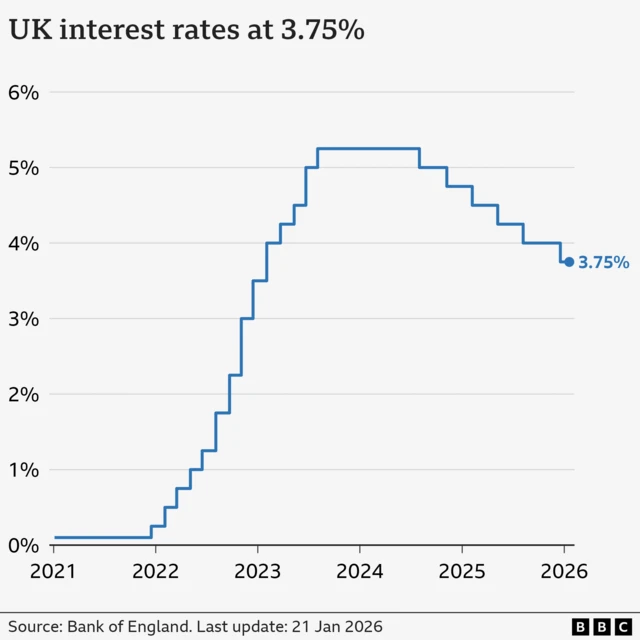

With that in mind, focus now shifts to the Bank of England's next meeting to set interest rates, which will be happening in February.

We are now ending our live coverage, but you can read more of our team's coverage here., external