The big borrowers

If you're wondering where the epicentre of the global financial crisis might be in 2009, I suggest you look somewhere east of the Danube.

Today's 24.5bn euro ($31bn; £21.8bn) joint rescue package for Central and Eastern European banks shows that the dire figures coming out of the region are starting to focus minds. But this is just the beginning.

Why are these economies in a particularly painful bind? Well, you knew that big borrower nations like America and the UK were hit first by the credit crunch. As I discussed recently, countries that relied on exporting to the rest of the world are now also being thumped.

The very bad news for the Central and Eastern European economies is that over the past few years they've been big borrowers and big exporters. Now they're suffering the worst of both.

You might think that "horrendous" is a rather emotive term for an economist. But it's the only word that comes to mind when you look at the figures. Until very recently, exports accounted for 80-90% of GDP in the Czech Republic, Hungary and Slovakia.

Meanwhile, US and British borrowing in the lead-up to this crisis was chicken feed compared to what these countries were hoovering up, relative to the size of their economies.

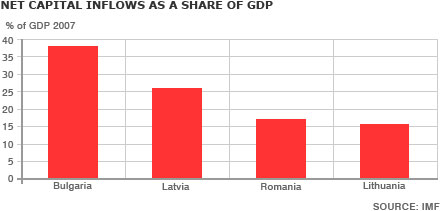

I've brought together the most striking figures in a chart (see below).These are the IMF's figures for net capital inflows in 2007 as a share of GDP.

I must confess that I was astonished to see that Bulgaria sucked in flows worth nearly 40% of GDP in 2007. America wasn't the only place where you had very risky imbalances hiding in plain sight. Trust me, there are plenty more where that came from, and I'm leaving out the likes of Tajikistan and Ukraine - they're a subject for another day.

As Graham Turner of GFC Economics points out, these inflows are far larger than anything seen in the lead-up to the Asian financial crisis of 1997-8. Thailand had net inflows of just under 11% of GDP in 1996, the year before its currency peg collapsed and investors in emerging markets started running for the door.

European governments last week called for a doubling of the IMF's lending resources to £500bn, in the hope that a lot of that money might find its way to the likes of Romania and Bulgaria.

But there's no getting around the fact that many of the economies in trouble are in the European Union. This Sunday's special European summit in Brussels will be an opportunity for the likes of Germany and France to declare their solidarity with the East.

So far, solidarity has been in fairly short supply. Czech officials were understandably outraged earlier this month by the French President Nicolas Sarkozy unveiling support for French car makers which was dependent on keeping French plants open - and appearing to suggest they close their Czech plants down instead. Not a lot of fraternité there.

Though all have been under pressure in the foreign exchange markets, not every country is in the same straits.

Poland and the Czech Republic, while poorly, are in better shape than most of their neighbours. Slovakia and Slovenia also face a hard slog, but at least they are in the euro.

They don't have the problems of Romania or Hungary - where a large chunk of the population, incredibly, now has mortgages denominated in Swiss francs. (I guess it seemed like a good idea at the time, much as 125% mortgages seemed to make sense in Britain in early 2007.)

The situation for the Baltic economies is dire, too (sorry, it's a long list). A few weeks ago Latvia officially became the first country in this crisis to have seen a 10% drop in GDP.

The Baltics are all pegged to the euro. Some say they should go ahead and join - which would at least give them the benefit of lower rates and stop the one-way bet to the speculators who think the pegs will break.

Riding out the storm inside the eurozone is no quick fix. Ask Spain. But if you're on the edge of a full-blown current account crisis from the drying up of capital flows, being outside the euro won't be comfortable either.

Whichever way they go, many of these countries are going to need support from EU and other multilateral institutions but also, probably, individual countries (several of whom, like Austria, have discovered their banks have a lot vested in the East).

Eurozone economies may have to rely on that kind of bilateral help: the Maastricht Treaty explicitly forbids bailouts among euro members.

For EU members that are outside the euro, there are some funds available: the pool of available European Community assistance was doubled to 25bn euro ($31.6bn; £22.3bn) recently when the EU joined an IMF support package for Hungary and Latvia. But that's pretty small change compared to the scale of the problem. Knee-deep in bank bailouts, Western European governments will hardly relish the job of explaining to voters why they should bail out profligate East Europeans as well. But they didn't want to bail out the banks either.

I'm

I'm

Page 1 of 2

Comment number 1.

At 16:56 27th Feb 2009, MrTweedy wrote:Every country around the world seems to be in serious trouble.

Japan now imports more than it exports. The USA's economy shrank by 6% in Q4 08.

China is a no growth area, despite what it pretends to the contrary.

Germany's industrial output is falling fast.

Britain is committing its taxpayers to underwriting toxic debts worth approximately 40% of the UK's total annual economic output.

It's looking very nasty, and seems to be getting worse by the day.

Here's an interesting article regarding the state of the world economy, from Dr Abbas Bakhtiar on the Market Oracle. He says:

"Let me tell you in no uncertain terms that we are facing a synchronised global economic depression and I am not the only one that is saying this."

https://www.marketoracle.co.uk/Article9061.html

Complain about this comment (Comment number 1)

Comment number 2.

At 16:57 27th Feb 2009, thatotherguy2 wrote:What you seem to be flagging up Steph is more external shocks on the way. Perhaps we have only experienced a little light artillery fire to-date and the worst of the credit crunch is still to come. I do hope not but that seems to be what you are warning us to expect. Have a nice week-end as well!

Complain about this comment (Comment number 2)

Comment number 3.

At 16:59 27th Feb 2009, stanilic wrote:There is a distinct smell that the Euro-zone is the next place where the crisis erupts.

How healthy are Ireland and Italy to name but a couple?

Is Germany willing to bail them out for the good of the Euro? Possibly; possibly not?

As for Eastern Europe which is not in the euro-zone, you are quite right about the boom they have been experiencing. In twenty years they have been through the collapse of the Soviet Union, joining the EU and acquiring a banking system like everyone else; namely, based on the never-never. The bust might be quite traumatic as the good times came too fast.

I expect the euro-sterling rate to re-establish to somewhere close to where it was earlier last year before very long. This won't help our exporters one bit.

As for Russia, how is it going there then? Is there any prospect of the oligarchs repaying their debts to western banks or should this be western taxpayers now?

Interesting times; interesting times!

Complain about this comment (Comment number 3)

Comment number 4.

At 17:41 27th Feb 2009, WerringtonSilent wrote:Good piece, this is a very important subject.

Eastern Europe is a strong contender for where the next phase of the crisis originates. The global credit bubble produced some of its greatest distortions there. There are lots of foreign exchange liabilities on government, corporate and household balance sheets, the values of assets which had been pledged at high multiples of their real value are declining, and troubled export industries are incapable of propping up the pyramid. Some, such as in Ukraine, depended on subsidy for viability even at the peak. Demand is collapsing, and prices with it. Weakening currencies close the loop and the feedback is positive. And pegs? How strong is a peg, when faced with this? A rhetorical question.

They are too big for anyone to bail out. These are no Icelands. The banking systems of countries which loaned them the money have something to think about too - and this was a central European play. Look to Switzerland, Austria and Germany for who played the role of irresponsible lender.

I do not expect the EU to help much. It did not have the tools and is improvising what little it can agree. The ECB can cut its rates some more, lend against some collateral maybe, but when it comes to sovereign defaults and currency crises, that is uncharted territory. And once one goes, the rest may have no reason to wait. Where is the line in the sand for liability? At a national border after each election, I suspect. This depression will be a stress test for monetary union, that is for sure.

Complain about this comment (Comment number 4)

Comment number 5.

At 17:52 27th Feb 2009, Oblivion wrote:I live in Prague, am half Czech, and have been here since about 1996.

Most of the country's industry seems to be connected with automotive, though Prague is quite different. It is clear that exports are already hurting the economy. Unemployment is rising, the house market is starting to drop. On the other hand you could still get a 100% mortgage a few weeks ago.

Private and public debt is nothing like as high as the UK, and foreign currency debt is not high either. GDP would have to halve before we get the debt levels of the UK. So the situation in the CZ is much better than that of the UK.

The BBC and other sources made a foolish mistake by responding to the economics analysis about "Eastern Europe". The CZ is not Eastern Europe. The situation in the Czech Republic is considerably better than say Ukraine. The UK is suffering debt deflation. The Czech Republic is suffering disinflation and will suffer deflation as a result of export demand drops.

The Czech currency has been falling largely because of responses to blunt media reports lumping everything into the basket of "Eastern Europe". In all probability then the Czech Koruna will recover slightly when investors realise how underpriced the currency is. If it should fall further then Euro based currencies will just end up with further debt deflation as work gets outsourced to here.

Life here was OK even in the 90's when Westernisation was still in progress. There's still a strong connection with the traditional ways of life. Even if this whole thing goes back to the stone age, it will be pretty comfortable here.

The main risk to the CZ is poor leadership. The government here is unsophisticated to the say the least. Most of them are corrupt. The best thing that could happen to Eastern Europe is if Switzerland and other offshore accounts were forced to disclose their account holders. Then Eastern Europe would finally get out of its communist mode of thinking.

Complain about this comment (Comment number 5)

Comment number 6.

At 18:00 27th Feb 2009, AnonymousCalifornian wrote:Go Bulgaria!

Complain about this comment (Comment number 6)

Comment number 7.

At 18:10 27th Feb 2009, riverside wrote:The last splurge of the ECC in allowing expansion was a mistake. It is a matter of slowly slowly, move fast and you catch King Kong. Whether anybody likes it or not seeking dramatic change of states is welcoming instability. The idea that there is sufficient wealth to solve some of these imbalances in the short term is highly questionable.

Complain about this comment (Comment number 7)

Comment number 8.

At 18:22 27th Feb 2009, nautonier wrote:Hello

The kaleidoscope pattern of borrowing and stats across the EU and beyond is interesting - The question always asked is 'where did all the (UK) money go'?

Presumably, some of it went to Switzerland, Cayman Islands, Monaco, Brunei, Abu Dhabi, Moscow, Beijing?

Can anyone shed any light on this? Is this the same place where UK government now borrows it by the Trillions?

It is a puzzle why G Brown now wants to punish the same tax havens?

Anyone got more on this please?

Complain about this comment (Comment number 8)

Comment number 9.

At 18:24 27th Feb 2009, Straightalk wrote:Stephanie stated:

". . . the dire figures coming out of the region are starting to focus minds. But this is just the beginning."

I couldn't agree more Stephanie.

The PIGS (Portugal, Italy, Greece and Spain) also have more pain to share along with our friends in CEE economies.

Gradually it will dawn on our governments that the Western economic policies of the past decade (based upon excessive debt) were pure fantasy when it comes to sustainability.

Sadly, most of their solutions appear to be grounded in the same magical potions.

Complain about this comment (Comment number 9)

Comment number 10.

At 18:30 27th Feb 2009, newsjock wrote:As ever, Stephanie takes on a subject that other financial commentators couldn't or wouldn't attempt.

This recession brings a real sense of the word "global" home to many of us.

Neither has Steph ever suggested a timescale for this recession, as other so-called financial pundits and politicians have.

If we are on a steady climb out of this financial black hole within 5 years we'll be doing quite well.

Complain about this comment (Comment number 10)

Comment number 11.

At 18:34 27th Feb 2009, Straightalk wrote:I should like to take issue with your comment:

"(I guess it seemed like a good idea at the time, much as 125% mortgages seemed to make sense in Britain in early 2007.)"

I hope and assume this is a joke. Without wishing to sound wise after the event, myself and plenty of my colleagues (and I am sure many visitors to this site) in business were of the opinion that such policies were mad at the time.

The ludicrous thing is that politicians like Vince Cable and whistle blowers like Moore at HBOS were simply ignored or dismissed. But nonetheless, the voices of dissent were present - I assure you.

Complain about this comment (Comment number 11)

Comment number 12.

At 18:48 27th Feb 2009, foredeckdave wrote:It is the 'wind' from the East that will really hurt Eurozone countries.

From what I have read, it is not only the Austrian banks that are frighteningly exposed to 'Eastern' debt. banks in Belgium and Germany are also heavily exposed. I don't know what the situation is for French banks. However, the majority of these loans were made in Euros and therefore the effects will be felt right across the Eurozone.

What we have to remember that all of the Western European countries are already facing major domestic problems within their own economies. Therefore the last thing they need is to face high levels of 'external' weakness that jeapordises their own internal rescue plans.

I will be interesting to see how the ECB tries to deal with this Eastern problem whilst still holding the likes of Ireland, Spain and Greece within the common currency.

Complain about this comment (Comment number 12)

Comment number 13.

At 20:33 27th Feb 2009, dennisjunior1 wrote:Stephanie:

It is surprising that the borrowers (big) ones are in the East and Central Europe and that in the Western Europe and the across the Atlantic...

~Dennis Junior~

Complain about this comment (Comment number 13)

Comment number 14.

At 22:32 27th Feb 2009, John_from_Hendon wrote:Stephanie,

"...where the epicentre of the global financial crisis might be in 2009"?

Whilst your concern for eastern Europe is very commendable - I am still of the opinion the the centre of the crash in 2009 will be in New York.

The US housing market will not stabilise in 09 as the real economy is now just beginning to feel the financial crash of last year. Real jobs will vanish at an alarming rate not only in the USA but also in the rest of the dollar block. The role of the US Dollar as a reserve currency will damage everyone far beyond the shores of the USA.

I am not yet convinced that rescuing collapsed banks is an any more effective a way of stabilizing the economy than letting them go to the wall - it may even be worse! (I can explain this but not in the short from of the blog response.)

The problem has moved very rapidly from a dramatic reduction in liquidity to a collapse in World wide demand. Fiddling with tiny rescue measure in the USA will not fix anything - it will not re-price assets quickly so that a 'normal' economy can continue again.

Asset prices must fall dramatically and interest rates must rise to real positing levels again. Taking 'measure' that prevent this natural process occurring just makes things worse (as we will find out in 2015-2020 or so when the World is still not recovering.)

Finally, your remark on how sensible 125 percent mortgages seemed in 2007 really does demonstrate how pathetically out of touch with economic reality that economists had become! (Joke or no joke - but the joke is on the taxpayer now!!!)

Complain about this comment (Comment number 14)

Comment number 15.

At 22:45 27th Feb 2009, threnodio wrote:"profligate East Europeans"

You have a valid point about Swiss franc denominated mortgages but the above is going too far. The massive exodus of capital from eastern European banks was due in no small measure to the offering of deposit guarantees by western banks which were not needed in the east because there was not the exposure to the level of risk characterised by the sub-prime crisis.

If the eastern European economies are in dire straights, it is due to the profligacy west Europeans. While borrowing may have been excessive in some cases, the idea that you can simply turn on it's head the perceived wisdom that an exporting economy is a healthy economy seems to me absurd. Do you suggest that, because the export market has run out of money, those who have supplied it are at fault?

Complain about this comment (Comment number 15)

Comment number 16.

At 23:04 27th Feb 2009, metric tonne wrote:Just one comment - it would be good if some journalists could explain what has happened to all the cash that is being wiped out at the moment. The commenter at 8 above seems to be one of the many with the misconception that this has gone into the pockets of bankers. In reality, during any crash money just gets wiped out. To give a few examples:

1) Look at the stock markets. Total market capitalisation of companies in the world peaked at about $57.5 trillion dollars just before the crash (May 08). It was just over $40 trillion dollars by Sep 08. In less than 1/2 year over $15 trillion dollars were wiped off the map. People using collateral from shares to borrow suddenly got margin calls and things really hurt.

2) Now look at the housing markets. The UK has seen over 15 percent come off house prices. When prices fall that money disappears. Money that a year ago people could use through equity release and second mortgages, they can't any more. That puts less money in the economy. The same is true for negative equity.

3) Commodity prices fall so companies that produce commodities have less money. They have often borrowed against future earnings, so these debts become bad.

4) General reductions in money flow in the economy have a bad effect back into the economy. Reduced money means companies sell less things. They may have borrowed against future earnings and these debts become bad.

This is just a recession at the moment, with a risk of becoming a depression soon...

Complain about this comment (Comment number 16)

Comment number 17.

At 23:14 27th Feb 2009, foredeckdave wrote:#14

John,

I tend to agree with you that the BIG story in 09 will come from New York. Somehow,I get the feeling that there is almost fear in the government, the administrators and the banks themselves in the US to lift the lid and see just how bad the situation is - though I have no proof of this!

The thing about Eastern Europe's collapse is the effects that it will have on the Euro and the EU itself.

The longer this 'phoney war' goes on the more I am begining to believe that the game is over and we are just playing-out time. Where that leaves us all I have no idea.

Complain about this comment (Comment number 17)

Comment number 18.

At 23:32 27th Feb 2009, riverside wrote:15 threnodio

''Do you suggest that, because the export market has run out of money, those who have supplied it are at fault?''

Yes. They are part of the imbalance and have had no fall back position. In the same way that car makers that looked to endless exports from this country are inevitably part of the problem here. The crunch may have crystalised the problem but the problem was always festering. Supply cannot expand endlessly and if everybody follows the same manufacturing expansion path you end up with oversupply - all around you - take a look. However if you try to suggest there is a flaw in tunnel vision as a strategy when times are good nobody wants to know, it is pump up the volume. As a number of posters have advised of their experiences. You often are cul de sac material because you do not subscribe to the corporate mission, you are not a believer. However it is when times are good that you have to put foundations in place for alternative developments. In this country the procrastination on power staions and green power is a good example.

Complain about this comment (Comment number 18)

Comment number 19.

At 00:02 28th Feb 2009, threnodio wrote:#18 - glanafon

It's a fair point, underlined by what is happening in Germany. Even so, is it not preferable to an excessively service based economy?

Complain about this comment (Comment number 19)

Comment number 20.

At 00:36 28th Feb 2009, foredeckdave wrote:#19 threnodio

The problem occurs when economies loose their 'natural' balance. In the UK our economy has moved dramatically away from manufacturing to a service base. In Germany the over-emphasis has appeared in manufacturing exports. Both have distorted the dynamic tension between sectors for resource allocation.

Complain about this comment (Comment number 20)

Comment number 21.

At 08:28 28th Feb 2009, duvinrouge wrote:Will the EU survive this crisis?

Complain about this comment (Comment number 21)

Comment number 22.

At 08:49 28th Feb 2009, riverside wrote:19 threnodio

I could not disagree.

The problem is shifts in the economy, any economy which are too rapid. Any sector declines too rapidly then the change cannot be absorbed and damage is done to those in the sector. Take manufacturing in the UK as an example. Or too rapid a growth in a sector has the risk of instability, eg UK financial sector. Governments usually appear to have no capability to stop sector collapse, or no will to. Government however never attempt to dampen down too rapid a growth, in fact they egg it on. Businesses usually attempt to become larger, often via the use of debt to take over competitiors. This leads to vulnerbility due to indebtedness, and a lack of flexibility to change direction. It is easier to stop spending money than it is to downsize a producer. The producer will always be damaged more than the consumer or customer. I do not have much sympathy for those countries with a manufacturing and export problem. They are in the main seeing the forces that they have visited on the UK a relatively short time ago. What I find extraordinary is that they have seen the mechanism that benefited them but do not appear to have ever considered that the mechanism can act against them. The other problem some of these manufacturers face is that many of them have hidden behind the low labour cost advantage and are very 19th century is the way they are set up. They just are not very smart or responsive in their operation. I am just glad there is a limit to the amount of money in the world or the do gooders who do not live in the real world would be throwing more money directly in that direction as well as indirectly via multinational bank props.

Complain about this comment (Comment number 22)

Comment number 23.

At 08:57 28th Feb 2009, riverside wrote:21 duvinrouge

The EU is a synthetic. It fragments along national boundaries when under stress. It is not like the US which is a more cohesive self contained economy. The eurozone has to come under enormous stress surely. Wealth transfering from relatively richer to poorer.

Complain about this comment (Comment number 23)

Comment number 24.

At 09:14 28th Feb 2009, angryCB wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 24)

Comment number 25.

At 09:44 28th Feb 2009, clearargument wrote:In response to #8:

The profits must have gone somewhere, a lot of it is probably hidden away.

A wikipedia article on offshore explains: "Offshore banking is an important part of the international financial system. Experts believe that as much as half the world's capital flows through offshore centers. Tax havens have 1.2% of the world's population and hold 26% of the world's wealth, including 31% of the net profits of United States multinationals."

Now here is a challenge which should be worth the attention of Gordon Brown's global thinking and the many earnest commentators on this board: how do we get this capital back into credit crunched societies, for the benefit of the people from whom much of this capital was taken in the first place? Furthermore, the same article informs us that according to the 'World Wealth Report' for 2000, one third of the wealth of the world's 'high net-worth individuals' - nearly $6 trillion out of $17.5 trillion- may now be held offshore. Some $3 trillion is in deposits in tax haven banks and the rest is in securities held by international business companies (IBCs) and trusts.

This article provides more interesting facts: the IMF has estimated that between $600 billion and $1.5 trillion of illicit money is laundered annually, equal to 2% to 5% of global economic output. Today, offshore is where most of the world's drug money is allegedly laundered, estimated at up to $500 billion a year, more than the total income of the world's poorest 20%. Add the proceeds of tax evasion and the figure skyrockets to $1 trillion. Another few hundred billion come from fraud and corruption. "These offshore centers awash in money are the hub of a colossal, underground network of crime, fraud, and corruption" commented Lucy Komisar quoting these statistics.

Her web site can be found here:

https://thekomisarscoop.com/

There is more than enough capital available globally, it just is currently hidden away and often unlawfully in the wrong hands. Without cleaning up the world of tax havens and offshore banking, as well a tighter controls on hedge funds and those financial businesses who serve anyone with money, no questions asked, it is difficult to see how a lawful banking system can be sustained. The moral hazard of fast and easy money will corrupt most bankers, unless banking is firmly regulated and bankers are subjected to law and order, just like other 'normal citizens'.

Complain about this comment (Comment number 25)

Comment number 26.

At 10:32 28th Feb 2009, JadedJean wrote:Continuous growth (what I think is best called idealistic, bubble-economics) is not viable for populations which are demonstrably a) headed towards negative population growth because of below replacement level TFRs b) nurturing differential/dysgenic fertility through counter productive human rights/equality laws c) importing low-skilled/low-educable/high fertility workers in a counter-productive attempt to compensate for a and b.

We need to behave more realistically/viably. More reality, less spin. I've spelled this out elsewhere. Most economists have false core assumptions.

Stephanie, please listen.

Complain about this comment (Comment number 26)

Comment number 27.

At 13:40 28th Feb 2009, Oblivion wrote:The problem with economics is that is not scientific. It hardly includes empirical evidence. Economics must be based on the observation of human beings, and then with the gathered knowledge in order to be able to *predict* models of human behaviour must be made. These models will have to emulate human decision making. Therefore the only viable future for economics is the convergence with the field of artificial intelligence.

Complain about this comment (Comment number 27)

Comment number 28.

At 14:04 28th Feb 2009, LibertarianKurt wrote:FrankSz # 27

Are you advocating a psychological approach to economics; that is the formulation of a hypothesis, which can then be subjected to experimental verification or refutation?

Complain about this comment (Comment number 28)

Comment number 29.

At 14:10 28th Feb 2009, Adam_C_UK wrote:The Head of the Audit Commission is now warning that "very substantial cuts in public expenditure" will soon be needed on top of the tax rises already promised by Mr Brown. He even raised the spectre of an unlikely (but possible) scenario where the UK can't find enough lenders to fund its deficit.

We need those cuts right now before it's too late, and we need higher interest rates to keep the lenders coming. At the moment, the private sector is bearing the full brunt of the credit crunch. The government is hoovering up all the available credit. How much longer can the government's fantasy economics go on?

Complain about this comment (Comment number 29)

Comment number 30.

At 15:27 28th Feb 2009, JadedJean wrote:FranSz (#27) "Therefore the only viable future for economics is the convergence with the field of artificial intelligence."

Yes, but as I've said elsewhere, not the GOFAI model (which was based on a misguided cognitivism). The ANN (Artificial Neural Network) approach isn't much better, as it's really just regression/discriminant analysis renamed. Behavioural Economics is the Experimental Analysis of Behaviour - but sadly, that's exactly how this recent mess came about in my view, i.e through abuse of that empirical work as it was egregiously translated into Prospect Theory by others. The important work lies in The Matching Law, Melioration Theory, and the Hyperbolic Discounting Function (it's how ARMs with sub-primes etc worked). This all came about through titrating parameters of reinforcement which began in the late 50s as Herrnstein took over from Skinner. Reinforcement is another term for value, except, it's lawfully measurable in its relationship to operant behaviour ('choice'). One still has to consider diversity though - consider rather than exploit.

Complain about this comment (Comment number 30)

Comment number 31.

At 15:37 28th Feb 2009, KRITGuy wrote:It's time for each country to look towards self-sufficiency and to close one's doors to most imported goods and services.

There needs to be a complete denial of all "Far-Eastern" imports altogether.

That which may appear at face value, to be a low-cost bargain, actually disables local manufacturing and thus affects jobs.

Whilst we all comprehend a need for international trade, the times in which we now live preclude the good-economy necessity of free world trade.

And it is also time to reduce local government waste by the greedy leeches who draw large salaries and pensions in local government as well as the shopped-out services to businesses who make indecent profits for services provided to both the state as well as local councils.

Irrespective of the actual party who will control the state purse-strings going forwards, the issues remain.

This is honestly a non-partisan thing.

It is neither a Labour nor Tory issue.

It is about self survival.

Complain about this comment (Comment number 31)

Comment number 32.

At 16:02 28th Feb 2009, foredeckdave wrote:FranSz (#27) "Therefore the only viable future for economics is the convergence with the field of artificial intelligence."

Your big problem here is that there is no artificial intelligence that even comes close to matching an understanding of consumer behaviour.

The study of consumer behaviour itself suffers from being stuck with an aggregate of former behaviour in order to predict future decsions - let alone try and rationalise that behaviour.

People are not systems. They are complex individuals. Part of the problem that we now face is that organisations have tried to straightjacket people into systems that they can control.

Go back a few days when we were discussing deflation. part of the discussion was based upon people's unwillingness to purchase. The reason for thir reluctance was totally up for debate!

Complain about this comment (Comment number 32)

Comment number 33.

At 17:30 28th Feb 2009, JadedJean wrote:"People are not systems. They are complex individuals. Part of the problem that we now face is that organisations have tried to straightjacket people into systems that they can control."

Just as well the medical profession doesn't believe that eh?

What you say there rather makes the case does it not? For if one doesn't know what one is talking about/dealing with/managing, one can get away with just about anything - especially in a Neo-Liberal deregulated sytsem. This is what conventional economists have done along with Liberal-Democratic politicians. Those who know no better nod or shake their heads as a function of how good or bad these experts' nefarious rhetoric appears to be - the more ostentatious/flamboyant/charismatic opaque spin - the more admiration/respect.

Pure Holywood celebritism/populism/narcissism.

Complain about this comment (Comment number 33)

Comment number 34.

At 18:04 28th Feb 2009, LibertarianKurt wrote:"People are not systems. They are complex individuals. Part of the problem that we now face is that organisations have tried to straightjacket people into systems that they can control."

Doesn't really equate to a "Neo-Liberal" derugulated system, does it?

Sounds more like a centrally-planned, heavily regulated (full of laws, codes and rules), socialistic system that has been forced upon people.

Complain about this comment (Comment number 34)

Comment number 35.

At 19:05 28th Feb 2009, JadedJean wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 35)

Comment number 36.

At 19:15 28th Feb 2009, nautonier wrote:16. At 11:04pm on 27 Feb 2009, dave_h wrote:

'Just one comment - it would be good if some journalists could explain what has happened to all the cash that is being wiped out at the moment. The commenter at 8 above seems to be one of the many with the misconception that this has gone into the pockets of bankers.'

No - That is not what I wrote (we know that a lot of the 'lost money' was false value anyway) - my point being that its not just a tax haven sleaze issue but a serious global money supply issue.

So to put it another way - How is it that some 'banks' are cash rich with billions of extra notes to lend to UK and European governments and some banks need propping with Government borrowed money as in e.g. case of the UK?

This raises some worrying issues I think which have not been discussed like e.g.

Massive cash build ups in tax havens sound suspicious in many ways? Is this all wholesale money that has gone home for safety?

Are some governments over-printing money to loan to the UK?

There is something extremely worrying about the way various EEC and other countries manage their national debt situations and as to where and how these huge borrowing facilities are and have been made and ammassed?

When most banks are struggling to straighten their balance sheets if e.g the UK , USA and others are borrowing trillions in newly printed money - surely the whole global financial system stands a significantly higher risk of imploding?

If the global financial crisis means that many countries are now printing money by the billions for overseas bail-outs - this can only exacerbate the problem?

Also, is Gordon Brown/HM Treasury trading/buying selling other UK assets for preferred currency - e.g. gold - behind the scenes for 'over-printed' foreign currency monies?

Many unanswered questions here - it's all a big mystery at the moment - the global cash flows for govt bail outs are measured in multi trillions - so where is the global balance of the surplus money? Must be spare cash from the tax havens?

So, presumably, Gordon Brown will discuss this with Pres Obama when they meet as they both have issues with 'tax havens'? But will these include Switzerland, Beijing, Moscow and on-shore treasure chests besides IoM, Bermuda, Jersey etc?

These are not, I think, trivial questions - I think that the world money supply is seriously out of equilibrium and no single country can measure the full effects - this is all very worrying indeed - Does anyone have anything on the economics/finances here - the US dollar must be completely off the rails for the US Fed to be unable to deal with it?

Complain about this comment (Comment number 36)

Comment number 37.

At 19:41 28th Feb 2009, WerringtonSilent wrote:#29 Adam_C_UK wrote:

"The Head of the Audit Commission is now warning that "very substantial cuts in public expenditure" will soon be needed on top of the tax rises already promised by Mr Brown. He even raised the spectre of an unlikely (but possible) scenario where the UK can't find enough lenders to fund its deficit."

As I wrote in the comments to Stephanie's 6 Feb post "Just follow the money":

"There is only so much demand in the credit markets for the sovereign debt of over-extended countries. Push supply too far, and the buyers disappear, forcing prices down and yields up, and interest rates with them, destroying all borrowers, credit-worthy or not. Social spending is not a business plan. It does not repay the debt. So there can be no emphasis on it, if one wishes to borrow. In fact, buyers of government debt will want to see promises of spending cuts to feel confident their loans will be repaid. And monetary union creates so many more losers when these compromises have to be made."

It is just common sense; if someone lends a government money, they want to see it spent on maintenance of taxable economic activity, the taxation of which repays the loan with interest. Spending on consumption (eg welfare, pork barrel projects) does not serve the lender's interests. Nor does it help the borrower for long: with the money spent and not recoverable, he must continually seek out a new lender to pay off the last one or raise taxes to force the bill onto the real economy. The longer it is allowed to accumulate, the more painful it is.

Complain about this comment (Comment number 37)

Comment number 38.

At 20:02 28th Feb 2009, foredeckdave wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 38)

Comment number 39.

At 20:08 28th Feb 2009, StrongholdBarricades wrote:Stephanie,

I would wonder how long it has taken you to notice this incoming tsunami, but you hit the right point when you say that it is protectionism within the rest of the EU that is hurting these countries

In a world of falling demand, no one is buying what people are able to make.

I do note, however, that you believe this is only the beginning, so hopefully you will entertain us with follow up reports.

Can you tell us the exposure of our own hobbled banking system to this issue?

Can you tell us at what level we are connected? Is our lending to European Banks at risk?

Can you tell us if, during this period of expansion, the rate of pay for the worker there has risen significantly?

Complain about this comment (Comment number 39)

Comment number 40.

At 20:32 28th Feb 2009, JadedJean wrote:38. At 8:02pm on 28 Feb 2009, foredeckdave (#38)

"JadedJean I presume that you mean that you are best qualified to undertake such management. Arrogance personnified!"

It's not arrogance, just empiricism. It's evidently you who's making assumptions, and they're clearly not justified by anything in my posts, are they?

Complain about this comment (Comment number 40)

Comment number 41.

At 21:12 28th Feb 2009, scotbot wrote:Hey, Stephanie, as much as it pains me to say it, isn't it time journalists / pro-bloggers like yourself acknowledge that we're heading to world war (probably the end of Western civilisation), and start reporting the consequences of the Depression, especially since the US has just given China over US assets.

Complain about this comment (Comment number 41)

Comment number 42.

At 21:16 28th Feb 2009, Oblivion wrote:"People are not systems. They are complex individuals."

Everything is a system.

The comments above are besides the point.

As much as the financial system has broken down, mainstream economics has failed too. It failed to predict this, it shunned those who did, it refuses to learn and applies the same failed policies to fix its own failures.

Economics is not a science at the moment. It is a cult. It does not test its hypotheses empirically, it indoctrinates students into fallacious modes of thinking, and rewards those who tow the party line.

The fact is, if economics is to have a future, it must follow the scientific method. It must study human behaviour to test hypotheses. If it wants to predict then it must make models based on these empirically tested hypotheses.

The models we currently have do not do this. They are dogmas, drawn up from assumptions about how the markets ought to work, not how they actually do.

The only viable future for economics is to simulate human behaviour, and this is the domain of AI.

Some complaints above about controlling authorities seem irrelevant to this. This is about economics as a science.

Models may be used to predict and describe, models may be used to dictate and prescribe. It just depends on what's most effective for those who make up the models.

Complain about this comment (Comment number 42)

Comment number 43.

At 21:23 28th Feb 2009, Oblivion wrote:Another thing that some critics above of JadedJean's comments above neglect is that most people *want* leadership. They actively seek it. They *want* to wear badges, to belong to some group, to identify with some community.

If you took away leadership, you would just end up with a repeat of history. An intelligent and forceful elite would form that would herd the less intelligent and weaker masses. The relationship is symbiotic. Without the elite the weaker and less intelligent would be worse off, and without the proletariat, the elite would be worse off.

It is only technology that has brought the general awareness and knowledge up. Before the printing press, people were scrabbling around for bread, listening to latin sermons they didn't understand, in elaborate churches that only existed to give people a sense of purpose and communities some orchestrative ability. The price for this was taxes to the religious institution. What brought the church down was the printing press.

Complain about this comment (Comment number 43)

Comment number 44.

At 21:27 28th Feb 2009, Oblivion wrote:Scotbot

The next World War does not have to be military. There have been alternatives, like going to the moon. War is about social mobilisation, a giant fiscal stimulus. It's what got the US out of the Depression to a large extent. This time we have ecological and systemic imperatives that are in the front of people's minds.

What we are more likely (I think) to see instead of a military war that for example Putin already warned against at Davos this year, is a war on systemic problems in the form of huge public spending on new types of infrastructure.

I am particularly excited by Ultracapacitors at the moment. I think these could actually completely change everything.

Complain about this comment (Comment number 44)

Comment number 45.

At 21:49 28th Feb 2009, scotbot wrote:FrankS; nice sentiments; but deluded all the same.

The next War WILL be military. There are too many prophecies all saying the same thing: world war proceeding from a middle eastern war. The global economic collapse just helps mobilise the masses, as each power-bloc strives to recover / maintain what they've lost / defrauded.

Why do think there's been such a hurray in the West to appropriate Middle Eastern oil? Our leaders knew our economies were unsustainable and took it upon themselves to acquire the Grand Prize (as Cheney called it) for themselves. Only problem: our leaders couldn't run the proverbial booze up in a brewery, and so things are not working out as intended.

Wait for the US to attack Iran (foolishly thinking they'll be a pushover) and their allies (Russia and China) will come to their rescue (for fear of losing even more business). Why the ever increasing belligerence from Netanyahu and the US if there's no real plan (as opposed to just bluster) to attack the Iranians.

Anyway, part of the key to the forthcoming world war was in my last post -- the keywords

eminent domain. China has dibs on US property, war being the only method to stop the circumvention of the US Constitution.

Complain about this comment (Comment number 45)

Comment number 46.

At 22:14 28th Feb 2009, foredeckdave wrote:JadedJean

If you must make value judgements about people then you should use far better measures of intelligence and intellectual capacity than IQ. With a little research you will find them.

If economics is really the study of the management of scarce resources then, in their environment, they are far better economists than you will ever be. They survive, you probably would not.

Complain about this comment (Comment number 46)

Comment number 47.

At 22:34 28th Feb 2009, Oblivion wrote:#46

But they are not surviving at all are they? Comparison of individuals here is avoiding the argument. No negative sentiment intended. What we are doing is comparing societies. Sub-saharan Africans are dying of AIDS and Malaria, their children are starving, there are shanty-cities, wars, displacement and unspeakable horrors we cannot even imagine.

What they need is a better type of leadership.

I read an interesting piece about some study that compared types of government based on local cultures, from a socioeconomic perspective. What happens when you have a bunch of nomads and primitive villagers in an environment where things are not in abundance, is that you get gangs of bandits. These bandits go around and loot. Eventually the gang realises it needs a base. It cannot just camp out in the desert, so it chooses to base near some villages, where it has access to resources. It cannot kill all the villagers, or there would be a resource shortage. This evolves into a situation where the thugs keep the surrounding villages operating, but taking as much as they can from them but leaving just enough for them to get by,

This is how governments form in Africa.

This is the wrong type of leadership, but it is emergent from those conditions. It is an inevitable emergent system, a stable configuration. Nature is cruel. Something like Libertarianism simply could not operate there.

Complain about this comment (Comment number 47)

Comment number 48.

At 23:08 28th Feb 2009, JadedJean wrote:foredeckdave (#46) "If you must make value judgements about people then you should use far better measures of intelligence and intellectual capacity than IQ. With a little research you will find them."

Please enlighten us all.

What do you know which ETS (USA), the NAA/QCA (UK), PISA (OECD) and the rest of the world's education testing services don't know?

For the record, what I've provided are not value judgments - but well established empirical relations. You should look into the USA NCLB and UK ECM initiatives/legislation. It might also help if you listened just a little instead of asserting that you know better. The is a show of arrogance (unjustified confidence and argument from ignorance).

Complain about this comment (Comment number 48)

Comment number 49.

At 23:56 28th Feb 2009, foredeckdave wrote:That IQ testing has been proven to be a poor sytem for the measurement of intelligence and intellectual capacity. YOU quote ETS and PISA. Both of these organisations use a range of testing instruments and NEITHER of them would evaluate their results purely on IQ testing.

So don't try and lecture me when you do not understand the basis of your assertions. GOODNIGHT!

Complain about this comment (Comment number 49)

Comment number 50.

At 00:23 1st Mar 2009, LibertarianKurt wrote:JadedJean # 35

Therefore, what you are recommending is that the more a given nation's population "dysgenically deteriorates", the more a centralised, command-type economy is required to regulate the behaviour of these infantile subjects?

Complain about this comment (Comment number 50)

Comment number 51.

At 08:39 1st Mar 2009, clearargument wrote:in response to #8:

If the UK government wants to clean up a morally corrupt banking system for the benefit of the majority of the working people and wants to stop a few profiteers of 'creative accounting' from exploiting the UK population, then government has to clamp down and better regulate offshore banking and tax havens.

For more information on tax havens and offshore banking you can seek for those words in Wikipedia or use a search engine to find some articles of Lucy Komisar.

Complain about this comment (Comment number 51)

Comment number 52.

At 08:39 1st Mar 2009, sidevalve wrote:Just the kind of conditions in place to bring about World War 3. After all, the 1930s Depression was only finally laid to rest by WW2, and there are plenty of reasons for discontent, extremism and instability in today's world.

Complain about this comment (Comment number 52)

Comment number 53.

At 09:21 1st Mar 2009, BrianCR wrote:A 'hard slog' seems to be understood here in Slovenia. Spring is coming but activity in most patches of land is much greater than I have seen for the last few years. More land has been ploughed, more tree pruned, more bamboo burnt, more chickens kept than last year.

Wages are low, prices are high, property values are well down, banks have very little money to lend. You can buy a secondhand Audi or BMW for next to nothing!

The arrival of a whale in the Adriatic in Slovenian or maybe Croatian waters (there is a marine border dispute here!) maybe a protent of changes to come.

Disapproval of current national politician is being expressed pointedly here by the display of the 2009 "Marshal Tito" calender which comes complete with an image of the Jugoslav flag. Are feelings changing about the benefits of capitalism and its manifestation in the EU?

BCR

Koper

Complain about this comment (Comment number 53)

Comment number 54.

At 10:00 1st Mar 2009, JadedJean wrote:FINER DISCRIMINATION

LibertarianKurt (#50) "Therefore, what you are recommending is that the more a given nation's population "dysgenically deteriorates", the more a centralised, command-type economy is required to regulate the behaviour of these infantile subjects?"

It's more of an attempted description than a recomendation perhaps. See Zimbabwe and the admiration which many African countries have for Mugabe's efforts (despite his efforts being doomed by Western sanctions no doubt). Note the support from the Democratic Centralist (Stalinist) PRC, the failure of Liberal-Democracy in Kenya (and elsewhere), the ongoing crisis in Palestine and blow-back to the West.

You should take seriously the equivalence/titration of low IQ and child-like behaviour. It gets dangerous when coupled with high testosterone levels post puberty (see the violent crime rates by groups here and in the USA) - and then look at the ETS material for the USA and the 2006 Leitch Review for the UK. Think of our changing dmographics.

You may then better appreciate what I have been drawing attention to. I suspect it calls for finer discrimination than you have been prepared to give it to date as that finer discrimination will seriously challenge some of your tacit core assumptions.

Complain about this comment (Comment number 54)

Comment number 55.

At 10:32 1st Mar 2009, JadedJean wrote:foredeckdave (#49) "That IQ testing has been proven to be a poor sytem for the measurement of intelligence and intellectual capacity.

This is completely false. Our KS SATs are effectively Verbal, Quantitative and Non Verbal IQ proxies (reliably predicted with an r =~0.7 by the UK CogAT, the CAT3 in thousands of schools across the UK). They are normatively constructed and normally distributed in just the same way that standard IQ tests are.

You are in fact wrong, and I suggest that you follow some of the many links that I have provided in other threads so you can learn just how wrong you actually are. Here is another. You appear to be yet another victim/protagonist of Lysenkoist propaganda.

That's why I am happily lecturing you - although it looks unlikely that you'll thank me for this corrective education.

Prove me wrong.

Complain about this comment (Comment number 55)

Comment number 56.

At 11:10 1st Mar 2009, stanilic wrote:Message 31 KRITguy

You have presented the best arguments for protectionism.

My concern is that I cannot find myself disagreeing with you even though I work in the global economy.

The basic instinct in times like these are to hunker down, stay close to home, fertilise one's own soil and make friends with the neighbours.

Yet we are being told by the great and good who have brought us to this pass that we should not be protectionist.

I think there is an emotional dichotomy at work here.

Complain about this comment (Comment number 56)

Comment number 57.

At 13:02 1st Mar 2009, sanatogen wrote:"Therefore the only viable future for economics is the convergence with the field of artificial intelligence.

"

On a related note, this has already happened in the Stock Market. (AI)

Complain about this comment (Comment number 57)

Comment number 58.

At 13:35 1st Mar 2009, Colin Smith wrote:"48. At 11:08pm on 28 Feb 2009, JadedJean wrote:

For the record, what I've provided are not value judgments - but well established empirical relations. "

Oh dear, a very elementary mistake. Assuming that correlation implies causation.

Complain about this comment (Comment number 58)

Comment number 59.

At 14:03 1st Mar 2009, JadedJean wrote:true-liberal (#58) "Oh dear, a very elementary mistake. Assuming that correlation implies causation."

Where exactly is the assumption? The assumption has been eslewhere, namely that SES determines IQ/attainment. This is even factored into this Socialist Internationalist (look at the model's regression weightings and try to get them to grasp mulitcolinearity when looking at ethnicity, and deprivation weights like FSM).

The empirical fact is that we have no 'robust' evidence that injecting cash into enrichment programs like HeadStart etc makes any difference at all, which is prima facie evidence in support of all the the other Nothing Works evidence that IQ has a heritability of about 80% (the remainder being physical damage post conception) and that it's what people are physicaly made of which drives behaviour, not some etheral psychology or value.

You try providing robust evidence to the contrary. Generations of researchers have tried and they have failed - dismally.

This is why I say that many of the tacit assumptions of conventional economists (who are social 'scientists') are false. Even Adam Smith didn't subscribe to the Lysenkoist nonsense which has been peddled in his name today by so-called 'Libertarians'.

When more people realise just how wrong those asumptions are they're going to be very surprised at the scope of the fall-out. They are seeing some of it happening already, they just don't/won't see why.

Complain about this comment (Comment number 59)

Comment number 60.

At 14:20 1st Mar 2009, JadedJean wrote:true-liberal (#58) For the record, in spite of popular opinion reinforced by our chronically dumbed down Higher Education system since the 60s (when there were only 30,000 not 300,000 graduates a year), the notion of causation does not play a role in science. Conjunctions of observations (Observation Categorcals) or contingencies of high order, i.e prediction and control over variables, is what matters.

Complain about this comment (Comment number 60)

Comment number 61.

At 14:21 1st Mar 2009, foredeckdave wrote:#55 JadedJean

Having worked with and for a large number of multinational organisations and agencies around the world (some with very sophisticated HR practices) I know of none that would use an IQ test as the basis of their recruitment or progression systems.

Complain about this comment (Comment number 61)

Comment number 62.

At 15:03 1st Mar 2009, JadedJean wrote:Erratum (#59) "This is even factored into this Socialist Internationalist [Government's] (look at the model's regression weightings and try to get them to grasp mulitcolinearity when looking at ethnicity, and deprivation weights like FSM).

foredeckdave (#55) "Having worked with and for a large number of multinational organisations and agencies around the world (some with very sophisticated HR practices) I know of none that would use an IQ test as the basis of their recruitment or progression systems."

As sophisticated as the FSA or HBOS, AIG etc etc? You are writing irritating nonsense. Read the ETS report and think.

Read Gottfredson's article on how this has been politicised, (or Murray and Herrnstein's chapter in 'The Bell Curve' back in 1994 on how US Civil Rights driven legislation worked to effect daft quotas at the expense of the economy), or this.

Similar Political Correctness/Equalities Neo-Liberal driven subversive nonsense has blighted our Public Sector here, where recruitment quotas have been based on local ethnic population base rates regarless of the marked group differences which show up in academic attainment by the same groups (see annual data published by the Government). The same thing was done with CODIS in forensic genetic profiling in teh USA, i.e. the microsatellites which distinguish between ethnic groups were purposely excluded. People then said that there is no genetic basis for race!

You need to wake up and look at what is happening, and listen to why it is happening. You are currently just telling me what you don't know, and there are an awful lot of you about. Try to grasp this.

Complain about this comment (Comment number 62)

Comment number 63.

At 15:25 1st Mar 2009, scotbot wrote:Can we stop the futile bickering, please, and keep to the point -- namely, that a few supposedly high IQ white men have ruined the economies of the Western world in their quest to make themselves richer at the expense of the impoverished many, even perhaps bringing us to the brink of a thermo-nuclear settlement.

Complain about this comment (Comment number 63)

Comment number 64.

At 15:54 1st Mar 2009, JadedJean wrote:scotbot (#63) "keep to the point -- namely, that a few supposedly high IQ white men have ruined the economies of the Western world..."

This is not bickering, it's an attempt to educate. Is that futile? You show that you have not grasped the point at all.

Read the ETS report, or at least, watch the videos in the Newsroom tab off the main link. This was Feb 2007 and ETS is the largest Educational Testing service in the world.

This is about demographic changes and people ignoring the consequences, i.e massively missing the point. ETS remarked on this in their press conference back in 2007, other intelligence researchers (e.g Lynn, like Cattell, Herrrnstein and Murray, and others...) have been warning about this for a lot longer.

Reading and thinking about the material in these links demands a few days of hard work. It is not obvious.

Complain about this comment (Comment number 64)

Comment number 65.

At 17:32 1st Mar 2009, Oblivion wrote:Another example on the same theme. When HIV AIDS in the UK was first being addressed, the policies were largely focussed on sex education, adverts for condoms, and targetted heterosexual audiences. However at the time the evidence clearly showed that AIDS in the UK was largely due to African immigration, homosexuality in males and drug abuse.

Unfortunately the policies they would have had to put in place to actually curb the spread of AIDS was too politically incorrect and politically damaging.

The result is an immeasurable social and financial cost and people who you probably know are dying.

The policies were not based on the empirical evidence and didn't deal with the demographic data.

Complain about this comment (Comment number 65)

Comment number 66.

At 17:52 1st Mar 2009, somali_pirate_SP500 wrote:ignoring the irrelevant IQ thread here.......

Stephanie

I think that you are correct to draw our attention to the dangers in what one might call the weaker or transitional free-market economies. These are some but not all of the Eastern European countries, some East Asian economies, and let's not forget Latin and South America; and I would include Russia in this category

I believe that the ratings agencies have demoted Ukraine to CCC status, which is junk; the danger that accompanies all this is that extremist political groups can gain influence quickly as well

Anyway I have nothing to dispute with you, and was simply going to question your writing of such a gloomy article without including any use of the word 'mullered' a la Peston

Oh and here's a thought for a Sunday afternoon:

As we learn more about these huge cash/credit flows around the world in 2005-7 it seems that there was virtually no sensible evaluation of risk; it suggests that the entire system of global finance was in fact no more than a PONZI SCHEME

if that's the case then presumably the only answer - the only way to stop the whole thing collapsing - must be to attract new investment from another planet

perhaps MARS?

were Sir Fred and some of the other bankers who appeared before the Treasury Select Committee on to something before they came unstuck? does Sir Fred need his vast pension to fund interplanetary travel?

and Alistair Darling looks distinctly alien

Complain about this comment (Comment number 66)

Comment number 67.

At 17:55 1st Mar 2009, JadedJean wrote:Oh dear, still missing the key sentence:

The assumption has been elsewhere, namely that SES determines IQ/attainment. This is even factored into this Government's CVA (Contextual Value Added) regression model used to predict expected Key Stage 3 attainment from variables such as KS2 levels, ethnicity, FSM etc - but think about multicolinearity when looking at weightings for ethnicty and FSM. Most people will not look closely at these models.

What has to be thought about is why we still fail to raise attainment in groups like British Muslims even after the English as an Additional Language problem has been addressed (British Muslims come from two very disadvantaged areas, NE Bangladesh and Mirpur in Pakistan - so is it not genetic?). To make this clearer, why, for instance, do British Chinese come top in all SATs (including English), but English speaking Black Caribbeans come bottom in SATs?

Complain about this comment (Comment number 67)

Comment number 68.

At 18:23 1st Mar 2009, somali_pirate_SP500 wrote:just happened to see this little story on the Globe and Mail, which claims that the EU, led by Merckel, have told the East-European countries that they will not be getting and co-ordinated help

barriers going up?

https://www.theglobeandmail.com/servlet/story/RTGAM.20090301.weuironcurtain0301/BNStory/International/home

if they do, we might not be getting any gas next winter, so hope it turns out to be a mild one!

Complain about this comment (Comment number 68)

Comment number 69.

At 19:17 1st Mar 2009, JadedJean wrote:somali_pirate_SP500 (#66) "ignoring the irrelevant IQ thread here......."

The irrelevant IQ thread to whom? That's exactly what the ETS FOCUS group worryngly revealed when they sampled the US population before the early 2007 ETS report 'America's Perfect Storm'.

I take it you have looked at the ETS report and Leitch Review? Look at the details of the changing demography - focus on predatory lending to the sub-prime market.

Complain about this comment (Comment number 69)

Comment number 70.

At 20:05 1st Mar 2009, Oblivion wrote:#68

Eastern Europe is not getting help, according to some EU rep from the recent summit, because there is no such thing as "Eastern Europe". They will be tackling things on a country by country basis, as each country has a different situation.

I think developments are as expected and ultimately good for the EU. The EU will be considerably stronger as time goes by. It was to be expected that coordinated supranational financial regulation would be introduced (I wish they would hurry up), that off shore tax havens will be sanctioned, and that protectionism would be reduced. This all points towards consolidation of state power into the EU itself and away from the nations. Another good thing.

Complain about this comment (Comment number 70)

Comment number 71.

At 22:01 1st Mar 2009, dazedandconfused123 wrote:Not really related to this thread but I read either on this blog or Robert Peston's a comment that said 'the private sector needs to be healthy as it pays for the public sector' (paraphrased). At face level I kind of understood it but then wondered what that actually meant. If Health provision was totally in the private sector and Lawyers were totally public sector, would health professionals effectively be paying for the lawyers? Surely they are both performing a constructive service. If there was no such thing as a private sector this couldn't be true so how does this become true in a mixed economy. There is money in both types of economy. Sorry if this seems a stupid question but it made me curious and the answer is above my intelligence to work out (and since this is an economics blog...)

Complain about this comment (Comment number 71)

Comment number 72.

At 22:43 1st Mar 2009, mrsbloggs13c2 wrote:Stephanie could you clarify - are net inflows of capital the same thing as borrowings. For example, if I wanted to set up a call centre in Sofia and had the cash and converted it into Bulgarian currency, would this be a capital inflow. Or say, if i set up a factory to make widgets under the same circumstances. Perhaps ths type of thing has been happening. Or if I sent back some of my earnings from the UK or France or Germany, would these also contribute to the net inflows of capital?

I ask because I know of companies that set up operations in some of these countries and I'm not sure they borrowed to do so but they'd have had to have deposited capital to operate. I know and have met people from all over that sent cash back.

Or if I bought a nice holiday home on the black sea - what happens then?

I know you sometimes answer, so if you manage to find this question amongst the squabbling and can elaborate, that would be very nice.

I am asking because so far, I have found that I seem to have to clean layers of teh picture before I get to the 'masterpiece' below. Over the last year we have gone from government statements that its a US problem to annual reports showing dodgy domestic loan books. This time, I am half expecting to find that its the domestic governments that have spent willy nilly.

Anyway.....

A bit of rooting about in dark corners indicates to me that in 2007 net inflows were

Bulgaria - about $7bn

Latvia - $3.25bn

Lithuania - $5.5bn

Romania - $8.5bn

Compared to the amounts going into single banks as bail outs, these feel rather small. In fact you could even look at it like this...

the net inflow to Latvia in 2007 is only about 10 times one premiership football club's debt borrowed from RBS and that other financial 'giant' Wachovia.

Interestingly, at least one of these nations does still seem to expect some growth in GDP for 2009

Rather like Mr Hendon @no 14 I think the US is still the main act. According to this week's Economist, about 50% of all US corporate bonds in circulation are of junk status or thereabouts. That's a lot of potential of failure.

Complain about this comment (Comment number 72)

Comment number 73.

At 22:49 1st Mar 2009, Colin Smith wrote:"60. At 2:20pm on 01 Mar 2009, JadedJean wrote:

the notion of causation does not play a role in science."

Of course it does. Causation is the essence of science. Anyone with a rigorous scientific education would be well aware of that.

Without causality it is simply is not science, but some pseudoscientific mumbo jumbo. All you have are a set of meaningless correlations.

Complain about this comment (Comment number 73)

Comment number 74.

At 00:27 2nd Mar 2009, foredeckdave wrote:JadedJean

I have to agree with true-liberal in that you are peddling "some pseadoscientific mumbo jumbo". Further, when you relate this to ethnic groupings it becomes very dangerous mumbo jumbo.

I have disagreed vehemently with others on these blogs as LiberteranianKurt, John_from_Hendon and glanafon will testify. I may not agree with them but I have learnt from their postings and respect the honesty with which their views are held. Sadly I cannot do so with your postings. Therefore I will not comment further on this issue.

Complain about this comment (Comment number 74)

Comment number 75.

At 00:27 2nd Mar 2009, majusko wrote:Today news update: Eastern European leaders pleaded with richer western European countries to boost financial aid and keep trade flowing, warning that the recession risks splitting the European Union.

Complain about this comment (Comment number 75)

Comment number 76.

At 07:59 2nd Mar 2009, JadedJean wrote:foredeckdave "I may not agree with them but I have learnt from their postings and respect the honesty with which their views are held. Sadly I cannot do so with your postings. Therefore I will not comment further on this issue."

It's sad, indeed, to observe anyone assert that they can not learn when propositions, based on sound empirical evidence, disturb them.

You appear to post in order to verbally fence rather than to learn.

Complain about this comment (Comment number 76)

Comment number 77.

At 08:18 2nd Mar 2009, JadedJean wrote:true-liberal (#60) "Causation is the essence of science. Anyone with a rigorous scientific education would be well aware of that.

Without causality it is simply is not science, but some pseudoscientific mumbo jumbo. All you have are a set of meaningless correlations."

Are you sure about that?

I suggest you look into this further. Look in the language of logic first. Try counterfactual conditional, intensional conditional, the Duhem–Quine thesis for a start.

There is no place for causality in science, just in folk science, i.e in folk psychology, and science busies itself exorcising psychology because that's intensional not extensional.

Unsurprisingly, Libertarians appear to be metaphysicians/kabbalists.

Complain about this comment (Comment number 77)

Comment number 78.

At 08:39 2nd Mar 2009, Oblivion wrote:#68 #75

This is completely wrong. The opposite is happening. Just watch the EU and ECB start taking control of the banks.

Complain about this comment (Comment number 78)

Comment number 79.

At 09:48 2nd Mar 2009, shireblogger wrote:Stephanie

It would be important to know which banks carry the sub prime lending on all of this. Do you have any stats on this?

Complain about this comment (Comment number 79)

Comment number 80.

At 09:53 2nd Mar 2009, notsosmug wrote:I'm glad to see you focusing on this area, not least because I have a nagging fear that we could see democratic governments fall on (at least) the Eastern fringes of Europe.

I was interested to read about the possible impact of all this on the Austrian economy - but am I right to be worrying about the implications of all this for the Irish? I understand that a lot of the money invested in property in the newer members of the EU came from Ireland and, given the frailty of their economy already, I can't help thinking that a wave of defaults on loans related to the crash in the East will hit already vulnerable Irish banks very hard.

Complain about this comment (Comment number 80)

Comment number 81.

At 09:59 2nd Mar 2009, JadedJean wrote:mrsbloggs13c2 (#72) 1) Look at the TFRs for Eastern European countries. 2) Stop treating Stephanie Flanders as a guru, she's a reporter.

Complain about this comment (Comment number 81)

Comment number 82.

At 10:57 2nd Mar 2009, doctor-gloom wrote:It just seems to me that the whole world has been on a debt binge. From the towering heights of wall street and the dusty corridors of ailing nation states, right down to Joe and Jane Bloggs in their semi in some far flung region of poor old terminally ill UK plc.

Complain about this comment (Comment number 82)

Comment number 83.

At 12:25 2nd Mar 2009, Oblivion wrote:#80

Here in the CZ the Irish (eg: Quinlan Private) were very active, but bear in mind that this is not a debt-deflation type situation here. Mortgages are still being paid and the total debt levels are nothing like the %s of GDP like in Western Europe.

The projects that were under construction or recently completed will probably get sold but at lower than expected prices, at least here.

They have stopped new builds because of poor debt/equity ratios because of bank credit shortage. They hope this will generate an artificial scarcity in the higher end of the market (new builds).

What is possible however is that GDP falls dramatically,resulting in debt to GDP ratios that are comparable to the Western situation now. CZ total debt is just under 100% GDP if I calculate correctly, whereas say US total debt is over 300% and Japan prior to lost decade was at 160% or something like that. If CZ were to suffer a 50% fall in GDP this would push debt levels up to 200% GDP, which would spark off debt deflation and bank failures. By then however, the Irish will have recouped their investments I would have thought.

Complain about this comment (Comment number 83)

Comment number 84.

At 12:26 2nd Mar 2009, Oblivion wrote:#82

Yes and it was all caused by Nixon in 1971. People don't generally get this.

Complain about this comment (Comment number 84)

Comment number 85.

At 13:56 2nd Mar 2009, JadedJean wrote:BREEDIN' CONSUMERS

FrankSz (#84) It wasn't just abandoning the Gold Standard that brought him down though.

On another matter, given the very low TFRs especially over in E Europe, I take it there isn't a great demand for SUVs or MUVs?

Complain about this comment (Comment number 85)

Comment number 86.

At 15:51 2nd Mar 2009, MrTweedy wrote:Here's and interesting article by George Soros, originally published in the FT, regarding the eurozone needing a government bond market.

https://ecfr.eu/content/entry/commentary_george_soros_ecfr_financial_times_financial_crisis/

Complain about this comment (Comment number 86)

Comment number 87.

At 17:24 2nd Mar 2009, Oblivion wrote:#85

Funny you should say that. Fertility is a problem here. Though you can imagine for me it's sometimes a blessing and a lucky escape.

Actually a lot of people drive estate cars. Not because they have families but people are very much outdoorsy. Skiing, hiking, camping out with friends. Most of them are diesels, turbodiesels. SUVs are driven by mafiosi types who like to show off their illegal earnings and tax evasions in the form of Hummers.

Come to think of it this is why there couldn't possible a general eastern European flow of funds from the EU. Most of it would disappear into the pockets of corrupt politicians. They would have to get the offshore/Luxembourg/Switzerland thing sorted out first. Expect quite a bit of gold to get sold off in the next few years!

Complain about this comment (Comment number 87)

Comment number 88.

At 18:41 2nd Mar 2009, Oblivion wrote:#86

I like that guy Soros. As far as dudes go he has to be the uberdude. Perhaps we should have a new role in the EU. Die Uberdude. Le Uberdude. Why on Earth we don't employ Soros to run things I don't know. Can we stage a revolution and have him as a mascot at least?

Complain about this comment (Comment number 88)

Comment number 89.

At 09:19 3rd Mar 2009, MrTweedy wrote:No. 88. FrankSz

Politicians run the country, but most of them know nothing about economics or markets. As someone once said on here "Gordon Brown has a degree in the history of the Labour Party; so what does he know about running an economy?"

The free market is a blessing to those who don't know any better.

(Free markets need safety limits. We need government intervention to try to prevent externalities (as you mentioned before), and to provide the long term stability of necessities such as energy and housing, etc).

Complain about this comment (Comment number 89)

Comment number 90.

At 14:49 3rd Mar 2009, JadedJean wrote:MrTweedy (#89) "The free market is a blessing to those who don't know any better."

Yes!