| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

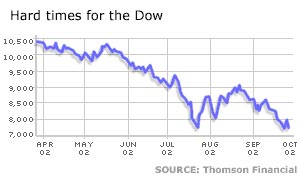

| Monday, 30 September, 2002, 20:39 GMT 21:39 UK Gloomy markets slump again  World stock markets took another tumble on Monday US shares have plunged again, dragging major European markets down with them. The Dow Jones index closed down 109 points or 1.4% at 7,591, its lowest level for four years as weak company figures and falling consumer spending levels added to investor woes. London's FTSE 100 closed down 185.4 points, or 4.7%, at 3,721.8, while in Paris the Cac index ended the day down 5.8% and in Frankfurt the Dax closed 5% lower. The losses, which were widely predicted after last week's market pessimism, make September one of the worst months in recent stock market history. However, the White House economic adviser Glenn Hubbard sounded a note of optimism, predicting an economic recovery in the next three months. Transatlantic troubles Since the end of August, most major share indexes have lost at least 10% of their value, and the Dax is down by one-quarter.

Investor nervousness has been compounded by fresh concerns over the US economy as figures showed consumer spending had fallen sharply in August, growing just 0.3% against 1.0% in July. There was also more bad news from the world's largest retailer, Wal-Mart, which cut its September sales forecasts for the second time. The week sees an unusually heavy barrage of reports from the sluggish US economy, including crucial labour and manufacturing data, car sales and factory orders. Monday was also the end of the US third quarter-year, heralding the start of the next wave of corporate earnings reports. Ian Harnett, European strategist at UBS Warburg said: "There just don't seem to be any buyers out there. And unless we start to see signs of earnings pick up then it will remain subdued." But Mr Hubbard confidently predicted to a speech to the National Association of Business Economics that he expected business investment to pick up in the next quarter. "The economy has a recovery that's underway," said Mr Hubbard.  East is best Only in Asia were the markets more robust on Monday. Tokyo's Nikkei share index, which has only slipped marginally in the past month, eased by 1.54%, with sentiment buoyed by hopes of speedier reform of the banking sector. Asian shares, traditionally less vulnerable to the swings of Wall Street, have performed far more strongly than the world average in the past few weeks. |

See also: 29 Sep 02 | Business 27 Sep 02 | Business 18 Sep 02 | Business 11 Sep 02 | Business 03 Sep 02 | Business 20 Aug 02 | Business 13 Aug 02 | Business Internet links: The BBC is not responsible for the content of external internet sites Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |