| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

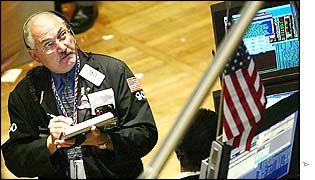

| Friday, 13 September, 2002, 21:14 GMT 22:14 UK Company warnings send shares falling  Share prices prove unhappy viewing once more Profits warnings from icons of both new and old economies have sent shares lower again. On Wall Street, the Dow Jones Industrial Average share index had, within minutes of opening, added a further 135 points to the 201 points lost on Thursday. The index later recovered to close 66 points lower, while the tech-heavy Nasdaq ended in positive territory.

French and German shares also ended lower, while Tokyo's key Nikkei index closed down 1.8%. The falls followed warnings from US-based telecoms equipment firm Lucent and aerospace giant Honeywell that earnings would come in below previous forecasts. 'Cloud of uncertainty' Shares in Honeywell, which cautioned investors over the slow pace of US economic recovery, closed down nearly 17% in New York. Lucent, which forecast a drop of up to one quarter in sales, saw its stock lose 23% to $1.26. The shares began 2002 at $6.30. "Honeywell warned and that's not good," said Paul Cherney, market analyst at S&P Marketscope in New York. "Lucent is less of a surprise, because they have a bad track record. "But it all keeps a cloud of uncertainty in place regarding corporate profits." Jitters over a potential conflict against Iraq also continued to dog sentiment. Rick Meckler, president of investment firm LibertyView, said: "The driving force remains are we going to attack Iraq? "And if so what consequences it would have for the economy." 'Debt threat' In Europe, tech shares in particular suffered from the fallout of Lucent's warning, with Vodafone shares closing down 2.4%. Shares in France Telecom, which also revealed losses of 12.2bn euros, were 14.5% lower at one stage, before recovering some ground to close down 2.6%. Investors also deserted banks, over fears that poorly performing companies would be unable to meet their debts. "Banks have bailed out a lot of companies and default rates are continuing to rise," said Jeremy Batstone, head of research at NatWest Stockbrokers. "On that basis there is still the threat of bad debts." Lloyds TSB shares closed 4.2% lower, HBOS shares down 3.5%, and Abbey National stock 3.6% lower. Adobe factor But US tech shares staged a late recovery, as investors focused on a positive statement from Adobe, a maker of publishing software. "The news on Nasdaq is a little bit more concrete given that Adobe had decent news and the stocks responded well," said Brian Pears, head of equity trading at Victory Capital Management. "It's one thing to be worried about Iraq, or terrorism. It's a totally different thing when one of the leaders of a niche market says things are getting better." Adobe shares closed up nearly 13%. |

See also: 13 Sep 02 | Business 12 Sep 02 | Business 12 Sep 02 | Middle East 12 Sep 02 | Business 11 Sep 02 | Business 08 Sep 02 | Business 22 Jul 02 | Business Internet links: The BBC is not responsible for the content of external internet sites Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |