Whether it’s the weekly food shop, clothes or childcare, there are lots of things to plan for financially when parenting. But there are also ways to keep costs down and still have fun.

In the eighth episode of CBeebies Parenting Helpline, Lynn Beattie, aka Mrs Mummypenny, tells Holly Hagan-Blyth and Charlie Hedges that, when it comes to money chat, she has a policy: “absolutely open and honest, no shame around it, let’s just talk about it all”.

Here are Lynn’s top tips for budgeting in family life.

1. Keep a spending diary

On the podcast, Charlies said she was surprised by the “extra costs that come with parenting”.

Lynn Beattie says the first thing you can do to keep track of it all is to keep a spending diary.

“Get to know what you’re spending on a daily and weekly basis… Just to recognise where you’re spending on things that maybe you can cut back on.”

2. Think about the quick wins

Caller Nicola asked how parents can deal with the cost of nursery fees.

Lynn suggests thinking of short-term ‘wins’ by going through your bills (and she encourages everyone to do this on a three-monthly basis!) and look for what you’re spending on things you don’t necessarily need.

“Maybe you’ve signed up to three different TV streaming packages that you don’t need. Cancel those things you don’t need immediately, and that can be a £50 saving.”

“Saving money is really hard… So, can you make little changes to all the different spending, to build up to a big saving?”

Lynn says once you’ve cut out the ‘nice-to-haves’ and you're left with bills for the essentials, “make sure you’ve got the best deal on those things”.

Can you switch your energy company to a lower cost? Can you switch your broadband? “That can be another £50-100 a month.”

3. Plan your food shop

“Start with writing a meal plan, writing a list of all the things you need, checking your freezer, checking the grocery cupboard…”

As well as avoiding too many ‘top up’ shops, Lynn says: “An online shop is going to be the most time-efficient way of doing your shopping.

“But start with writing a meal plan, writing a list of all the things you need, checking your freezer, checking the grocery cupboard, to see if you’ve actually got stuff that’s on your list, and then just buy those specific things online.”

She also has a hack: “There are vouchers to save money on each of your first online shops, so you could do a first online shop with one supermarket, then switch to another one, then switch to another one… Just keep ‘switcherooing’ and save £10-£20 each time.”

If you don’t have a freezer, Lynn says opt for canned goods, and “food you can add water to from kettles” if you don’t have hobs for cooking.

4. Buddy up for birthday parties

Lynn suggests joining forces with your child’s other friends’ parents for birthday parties. You can bake your own food and share the cost of the party between you!

Lynn says she also asks parents for cash presents (rather than toys, etc.) as this can contribute towards the cost. You’ll have to decide yourself if that’s cheeky or not! Alternatively, you can put the money into savings for your child to use at a future date.

For budget-friendly gift-buying hacks, Lynn says: “Supermarkets are your friends… But also remember you don’t necessarily have to give things, it can just be your time or maybe a voucher for ‘we’re going to go and do this for a day’, not a [physical] ‘thing’.”

5. Make a list of fun, free things for the summer holidays

We all know that taking a holiday during the school holidays can be extremely expensive. As Holly says, “It seems that everything is bumped up in price around that time, which is very unfair.”

Lynn says: “I’ve got lots and lots of things that I’ve done for free with my kids, and it’s something that I write about time and time again.

“It’s getting out into nature, doing treasure hunts with your kids, or… I like to write a list of ten things: ‘Can you find a butterfly, can you find a golden retriever, can you find a dandelion?’ It’s educating them as well.”

Lynn also goes geocaching with her kids, which they love. If you’re thinking of going abroad, she advises checking whether all-inclusive is actually the best deal.

“That’s potentially going to cost you more…. We always do things on holiday like finding the supermarket nearby and having a full stock of things in your room.”

6. Talk to your child about money

“The basic message is: saving for something before you spend.”

Holly also asked Lynn how you can explain to your kids “that we can’t go on holiday right now”, especially when there’s so much comparison with peers and on social media.

Lynn comments: “That opens up an even bigger debate about talking to your children about money.” She believes it’s important for us as parents to help our children understand.

“If you’re struggling for money… it’s having that conversation on a lighter level with your children: ‘I’m sorry but we’re not going to be able to have that holiday this year’."

She says it’s not about “scaring them” but that kids are very perceptive: “They hear hushed conversations that you might be having with your partner or your family or your friends… It’s almost protecting them by giving them a bit of a basis of information.”

That might include explaining you need to save up for a while to afford a holiday. “And then they can get their mind around ‘right, this is what saving is – putting some money aside’.”

She also cautions that when it comes to kids’ peers going on holiday, or seeing pictures on social media: “Quite often what you see isn’t the reality of somebody’s life, is it?

“The basic message is: saving for something before you spend. If you can get that kind of core financial advice into your children – and also into us as adults – it’s going to mean you won’t get into lots of debt as soon as you’re able to at 18.”

7. Try to keep an ‘emergency fund’

Lynn says an emergency fund doesn’t have to be a lot of money: “Maybe it’s a few hundred pounds, maybe it’s £1000. But if the washing machine breaks, you’ve got that covered, you don’t have to go into debt to sort that out.”

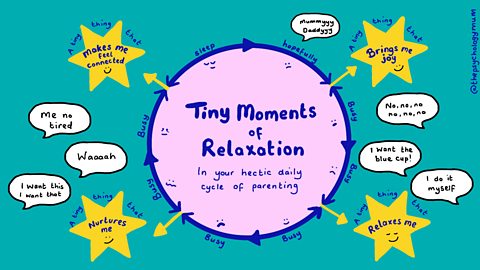

8. Treat yourself once in a while

Self-care is important too, and for Lynn that means keeping a small amount of money to get her nails done:

“I always like to have a little pot set aside for fun money. Again, it doesn’t have to be a lot of money but maybe it’s £10, £20 a week.

“It’s the thing that brings you joy, that makes you happy, that maybe costs you a little bit of money, but setting that money aside for yourself so you don’t feel restricted in everything you do.”

Mrs Mummypenny's advice for talking to your children about money!