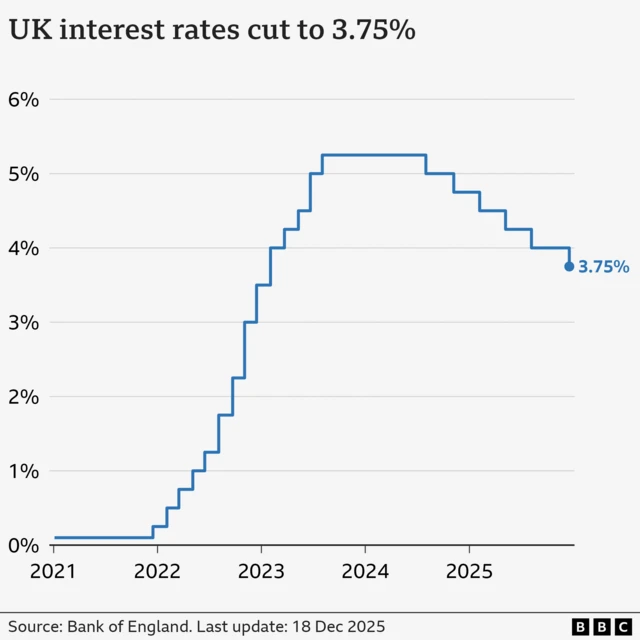

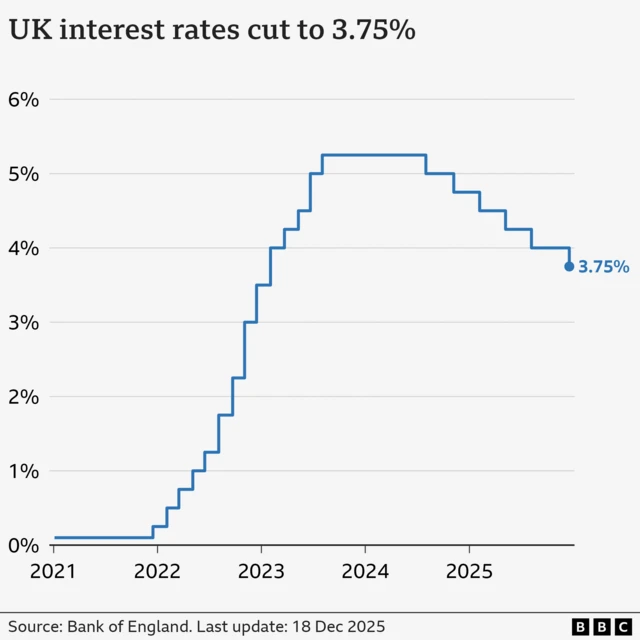

Bank signals caution going forward after cutting interest rates to 3.75%published at 15:15 GMT 18 December 2025

Rachel Clun

Business reporter

The Bank of England has cut interest rates from 4% to 3.75% - the lowest level in nearly three years. Here's the detail:

- The decision was widely expected but it was another knife-edge vote, with policymakers voting 5-4 in favour of a cut

- Concerns about weak economic growth and rising unemployment outweighed worries about inflation, which is falling but remains above the Bank’s 2% target

- The Bank expects inflation to near 2% by the middle of next year, partially due to the government’s tax and spending policies announced in last month’s Budget

- Interest rates are likely to continue on a gradual downward path, Bank governor Andrew Bailey says, but he adds "with every cut we make, how much further we go becomes a closer call"

- The Bank's next meeting to consider interest rates is schedule for 5 February

We're wrapping up our liver coverage now, but you can read more in our news story.