Understanding audiences in the Pacific

Our work in Pacific Islands is strengthening public interest media across the region

BBC Media Action has carried out audience research across six Pacific nations - Solomon Islands, Papua New Guinea, Samoa, Tonga, Vanuatu and Fiji. Through structured quantitative surveys and a series of in-depth qualitative discussions, we interviewed over a thousand people in each country to understand how they access, trust, and engage with media, and crucially what they need from the media that serves them. This research uncovers the diverse habits, preferences, and challenges faced by audiences and the briefings offer vital insights to support inclusive, responsive, and effective media and communication strategies across the region.

Read more about the project: Pacific Islands

Read our research briefings

Understanding Media and Audiences in Fiji

BBC Media Action's work in Fiji is informed by a critical need to understand the country's unique and rapidly evolving media landscape and the information needs of its diverse population.

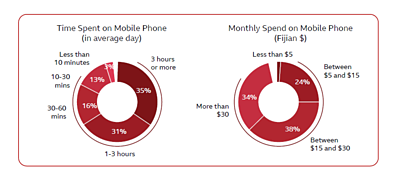

Fiji is a regional hub with a multilingual population of over 930,000. It boasts a highly developed and diverse media sector that is navigating a transition following the repeal of restrictive media laws in 2023. Simultaneously, the country is experiencing a rapid expansion of mobile and online connectivity, with more phone connections than people and widespread smartphone access.

This research briefing, based on a nationwide survey and qualitative discussions, serves to map the current state of media access, consumption, and trust among Fijian adults with mobile phone access.

The research provides crucial insights to shape our programming and strategy by answering questions such as:

What are the key concerns affecting Fijians? At a personal, local, and national level, financial concerns like the cost of living are paramount, alongside issues of crime and security and alcohol and drugs.

How do people in Fiji access and use media? The study confirms that smartphones and social media are integral to daily life, with 68% of respondents using the internet and social media daily. While radio outpaces TV in daily use (45% vs. 26% daily use), most Fijians use a mix of traditional and digital media.

How do Fijians consume and share news? Personal networks (family, friends, and community) are critical sources and means of verification for news. Speed often takes priority over accuracy when sharing information, and 64% of respondents say this is more important.

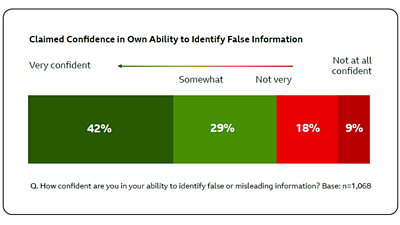

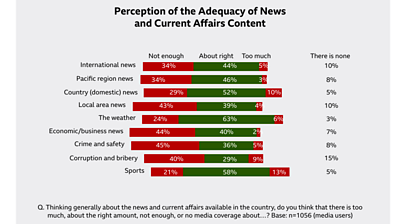

What do Fijians think of the media? Interest in news is high (88% at least somewhat interested). However, half of respondents report exposure to false or misleading information at least weekly, and many communities, particularly those in rural areas, feel their local issues are overlooked by the media. About one-third (30%) do not always receive news in their preferred language.

This understanding directly informs our recommendations for strengthening the media sector in Fiji. Specifically, it highlights the need for targeted training for journalists to strengthen investigative reporting and fact-checking, helping them adjust to new freedoms. It shows the importance of media literacy education to equip audiences to discern fact from misinformation. Fijians have expressed that they want increase on localised content that reflects the experiences of rural and outer island communities who feel overlooked.

By addressing these needs, we aim to support a media sector that is balanced, trustworthy, and able to provide inclusive, relevant coverage that meets the demands of all Fijian communities.

Samoa: Understanding audiences and the role of media and communication

BBC Media Action's research in Samoa is strengthening media by providing in-depth insights into how Samoan adults access, use, and perceive media and information.

"Understanding Audiences and the Role of Media and Communication in Samoa" is a mixed-method research project that showcases the media access, usage, and preferences of Samoans, and the role of key national and local issues in people's lives.

The research found that the information landscape in Samoa is heavily driven by near-universal access to smartphones and the internet among mobile phone users. This has resulted in a high frequency of daily social media use (85%) and internet use (64%). However, cost remains the main constraint to staying informed, primarily due to the expense of data and frequent loss of phone credit.

While social media, especially Facebook, is the primary source of news for many, trust is low. The most trusted non-media sources are family and friends — reflecting the central role of in-person, word-of-mouth communication in Samoan culture. In contrast, traditional media platforms like radio, television, and newspapers provide key access to information, with radio offering the widest reach, and are generally regarded as more trustworthy than social media.

Audiences are highly interested in news (64% are "very interested') and feel well-connected to information. However, there is a pervasive challenge with misinformation: 52% of respondents believe they encounter false or misleading information daily. This is compounded by an apparent limited media literacy, as a majority (64%) agree that it is more important to share information quickly than to check it for accuracy.

This comprehensive study provides fresh insights into how Samoans access, use, and engage with media and communication platforms, and what they need from them. The study includes:

- A nationwide mobile phone survey of 1,068 people aged 18+

- Ten focus group discussions (FGDs) were conducted across Upolu and Savai'i

The findings are intended to inform targeted strategies, including media literacy education and increasing localised news, to support the growth and responsiveness of the media sector in Samoa.

Vanuatu: Understanding audiences and the role of media and communication

BBC Media Action's research in Vanuatu is providing in-depth insights into how Ni-Vanuatu (the population of the Republic of Vanuatu) access, use, and engage with media and communication platforms, and what they need from them.

Our mixed-method research effort "Understanding Audiences and the Role of Media and Communication in Vanuatu" showcases the media access, usage, and preferences of Ni-Vanuatu, and the role of key national and local issues in people’s lives.

The research found that the information landscape in Vanuatu is rapidly transitioning to digital media, but access remains inconsistent and unreliable. Friends and family are the most frequently cited (47%) and most trusted (35%) source of news and information, highlighting a strong reliance on informal, word-of-mouth networks.

Even among those with access to a mobile phone, frequent use of digital media is low: less than half of survey respondents reported using the internet (48%) or visiting social media (49%) daily. This is often due to barriers such as the high cost of phone credit and unstable network connectivity.

While social media is a highly utilised source of news (cited by 44%), trust is significantly lower, with only 24% of respondents considering it trustworthy. Almost all respondents think they are exposed to false or misleading information to some degree, with 34% believing they see it every day.

Audiences have a high demand for news (67% are "very interested") but express widespread dissatisfaction with current content. They voiced a strong demand for more inclusive, timely, and relevant coverage, particularly for issues related to community development, agriculture, climate change, and entrepreneurship. Specifically, 43% felt there was insufficient coverage of local area news.

The study includes:

- A nationwide mobile phone survey of 1,073 people aged 18+

- Eleven focus group discussions (FGDs) were conducted across three provinces

The findings are intended to inform targeted strategies to support the growth and responsiveness of the media sector in Vanuatu.

Resources

Read more about our work in Asia-Pacific

Search by Tag:

- Tagged with Pacific IslandsPacific Islands

- Tagged with InsightInsight