Which will crack first - wages or prices?

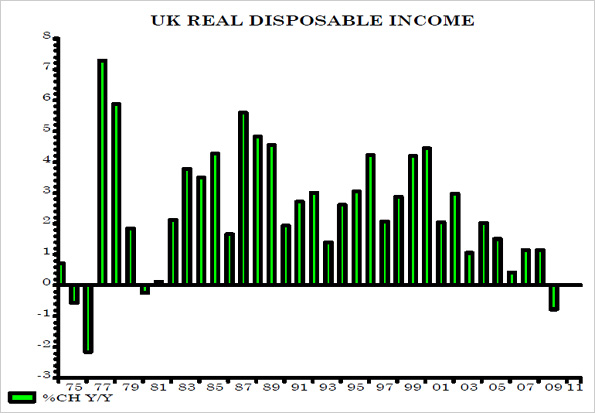

Never mind the 1980s, you have to go back to the Labour government's income policies of 1977 to find a time when household incomes have been as squeezed as they have been in the past year.

Both the government and the Bank of England are implicitly assuming that households will continue to take their medicine, with wages rises falling far short of tax and price rises for at least another two years, and inflation obediently falling back to target in 2012. But you don't have to be an inflation hawk to wonder whether it is likely to happen now. After all, it's not what happened in the late 70s, the early 80s, or the early 1990s.

Believe it or not, many would argue that a prolonged squeeze in household incomes was the "best case" scenario, starting from where we are now, because it spreads the pain of adjusting to a more inhospitable global economy as widely as possible. If wages pick up, interest rates would have to rise further, sooner, to bring inflation under control. Unemployment would be higher, perhaps permanently; growth would be slower, and the costs of this adjustment would fall disproportionately on public sector workers (whose pay is frozen) and all those unemployed workers who find it even harder to find a job.

Those new GDP figures I mentioned yesterday showed real household disposable income falling by 0.8% in 2010. That's the first time this measure has fallen since 1981. As Graham Turner of GFC Economics has pointed out, it's also the largest annual decline since 1977, when phase two of the Labour government's incomes policy was capping incomes growth to combat inflation (see chart below).

At that time, monetarists like Milton Friedman used to publicly lecture Labour ministers that they were making the situation worse: income and price controls only repressed inflation, they didn't get rid of it. And in that case, he was right. The income policy fell apart, collective bargaining resumed, and both nominal and real disposable incomes rose sharply in 1978 and 1979 to make up for lost ground.

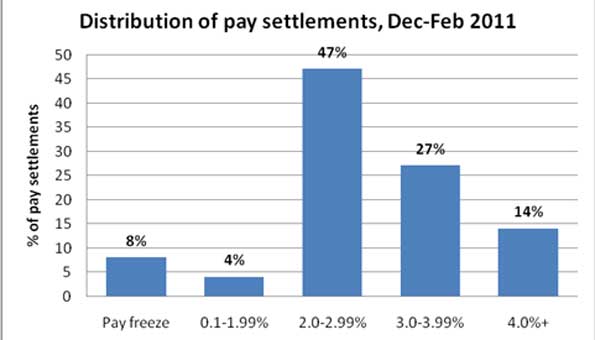

Will we see the same kind of explosion in pay in 2011 or 2012? The monetarists would certainly not expect one, looking at the still weak state of lending and money growth. It's not easy to see in the wage data either. The latest survey from IDS (see chart below) shows wage settlements running well below inflation. The median deal reached between December and February was for a pay rise of 2.5% - very similar to last month.

There are some warning signs in the small print of this month's report. Pay rises in the private sector are running at 2.9%, and the IDS note that most of the April deals it has recorded, not yet included in the three-month rolling average, have been for wage rises of 3% or higher.

The MPC are likely to be poring over those April pay deals as they start to come in, setting the context for the great debate over rates at their meeting in May. The chances are that private sector wages will continue to creep up. But it is also the case that the public sector pay freeze will put downward pressure on average earnings for the whole economy. And as we know, inflation is only one part of the squeeze for households.

In the past I've highlighted the broader TPI measure of the cost of living, which includes not just price rises but tax changes as well. That rose by 5% in 2010, and now the latest figure, for February, shows a year on year increase in costs of 6%. Using that broader measure, even a 3.5% pay rise in 2011 would still represent a sharper fall in real incomes than in 2010.

For some, this squeeze in real incomes poses a bigger risk to confidence and the economic recovery this year than government budget cuts (although, of course, the decision to raise VAT has made its own contribution to the rise in prices). The doves on the MPC are betting that another year of economic hardship will be more than enough to bring down inflation next year.

But only Adam Posen is putting his money where his mouth is: in an interview earlier this week he said he expected inflation to go to 1.5% in the second of half of 2012, and he would not seek another term on the committee if he turned out to be wrong. In theory, we should all hope Posen's right about inflation. But then he might also be right about the grim state of the economy. I'm not sure if I want him to go or stay.

I'm

I'm

Page 1 of 3

Comment number 1.

At 16:26 30th Mar 2011, Kit Green wrote:real household disposable income....

I cannot believe the figures that support the increases that have supposedly benefited households. Thirty or forty years ago many families had only one member working and very little debt.

The current perceptions are a sham.

Official line: You are all better off because you have more things.

Truth: Technology has made you work longer not shorter hours, your partner does too, and you have a load of debt.

Complain about this comment (Comment number 1)

Comment number 2.

At 16:29 30th Mar 2011, John_from_Hendon wrote:The problem with economists is that they ask such silly questions - 'who will crack first'? The Nation is not some game of Russian Roulette!

There are two ways out of the diabolically bad debt problem that we have engineered ourselves through appallingly stupid regulation - inflation or default/bankruptcy. The Everest of private debt is so unmanageable any other solution will take up to half a century. My guess is a bit of both inflation and default - accompanied by a terrible depression and decades of austerity.

This need not happen, but the vested interestes and ignorant politicians haven't the gumption to do anything else.

My recipe remains the same: Stick up interest rates, get back to a proper price for money, deal will the mortgage defaults and repossession, but above all - do it quickly.

Complain about this comment (Comment number 2)

Comment number 3.

At 16:30 30th Mar 2011, Kit Green wrote:But only Adam Posen is putting his money where his mouth is.....

Posen has been wrong for the last eighteen months so why choose to go when this weeks prediction is wrong? Just go now!

Complain about this comment (Comment number 3)

Comment number 4.

At 16:49 30th Mar 2011, foredeckdave wrote:"The income policy fell apart, collective bargaining resumed, and both nominal and real disposable incomes rose sharply in 1978 and 1979 to make up for lost ground."

An interesting observation. This may have happened as a staistical average but I would hazzard a guess that it was not the norm for the majority of workers. You also have to look at what happened to employment between 179-1983!

Now, vitrually the whole of the public sector have had their wages frozen for the next 2 years. Straw polls on the BBC appear to indicate that private sector workers are getting either no pay rises or less than 2%. Therefore, i would suggest that there needs to be some scepticism applied to the IDS figures as they apply to the average private sector worker.

I also note that in 2010 the standard response to the average wage was £26,000 whereas in 2011 the same figure (regularly used in BBC news items) is £21,000.

So, what will crack first? The answer I think will be prices. However, that will mean even less employment as retailers in particular will seek to reduce their workforce even more in an attempt to protect their profit margins.

Complain about this comment (Comment number 4)

Comment number 5.

At 17:30 30th Mar 2011, Marco82 wrote:While the millionaires of the world are claiming they 'don't feel wealthy' according a survey by Fidelity investments.

https://www.mindfulmoney.co.uk/3857/investing-strategy/why-do-the-rich-feel-poor.html

They claim it is in comparison to their peers – I wouldn’t mind being the poorest of a rich bunch tbh!!

Complain about this comment (Comment number 5)

Comment number 6.

At 17:30 30th Mar 2011, Geoff Berry wrote:I remember the Prices and Incomes policies of the 60s and 70s well and the industrial, political and social conditions that prevailed in that period.

With hindsight perhaps time and national resources could have been better utilised, following your arguments as an Economist, and a different economic result may have been produced but that was only a fraction of the governments problems.

Unaffordable wage pressures were placed on uncompetitive manufacturing industries, (that had been starved of investment for years), by uncontrolled militant trade unions whilst consistently rising high street prices and rising taxes were fuelling the wage demands. If my memory is right, inflation was already common at 10% about 1970 and rising and often publicised as 'public Enemy Number One'.

In many regions there was talk of civil unrest, a no-hope attitude to work and as industrial disorder emerged, then along came the governments prices and incomes policies, people kicked up for a while then realised there was a longer term benefit.

Stephanie, prices and incomes controls may not be the Economists or Milton Friedmans dream but the legislation did bring a national recognition that we are all in this together, you know the sort of pulpit policies recently proclaimed by the government ministers of today, pun itended.

Perhaps we could learn from this experience and put the economics 'free markets at any cost' theory books back on the shelf and introduce legislative controls that are identfyable with a common national purpose of getting out of this mess together.

Complain about this comment (Comment number 6)

Comment number 7.

At 17:32 30th Mar 2011, United Dreamer wrote:It would be interesting to see pay settlements in terms of gross income, and also in terms of salary bands (60-80k, 80-100k, 100k+).

Complain about this comment (Comment number 7)

Comment number 8.

At 17:52 30th Mar 2011, IBID wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 8)

Comment number 9.

At 17:54 30th Mar 2011, watriler wrote:It will be astonishing if the increase in wages does not follow the sharp recent rises in prices not forgetting that it is the RPI end of inflation we are dealing with not the smoke and mirrors of CPI. I do not think the public sector will hold a freeze beyond this year and of course the government has adopted an incomes policy for 5 or more million workers without daring to speak its name! The question that needs to be consider is how does this configuration aid recovery because it is difficult to see any green chutes or beckoning light in a tunnel. Exports look good but traditional constraint of skilled workers and now finance is becoming an issue.

As for JfH and his understandable concerns for 'unnatural' interest rates I am intrigued by his suggestion to "deal will the mortgage defaults and repossession, but above all - do it quickly." Dont hold back J.

Complain about this comment (Comment number 9)

Comment number 10.

At 17:55 30th Mar 2011, WolfiePeters wrote:We've had two successive governments who have used currency devaluation, driven by a low BoE interest rate, as a means to tackle a debt crisis. The result is that our incomes and savings are also devalued.

Complain about this comment (Comment number 10)

Comment number 11.

At 17:56 30th Mar 2011, LadyEcon wrote:"But only Adam Posen is putting his money where his mouth is: in an interview earlier this week he said he expected inflation to go to 1.5% in the second of half of 2012, and he would not seek another term on the committee if he turned out to be wrong."

He told us this for this year as well Stephanie is inflation the 1% he said it would be? Oh and he told us this the year before too. He sounds like a gambler hoping for third time lucky!

Complain about this comment (Comment number 11)

Comment number 12.

At 18:16 30th Mar 2011, Mike3 wrote:#3. At 16:30pm on 30th Mar 2011, Kit Green wrote:

"

"But only Adam Posen is putting his money where his mouth is....."

Posen has been wrong for the last eighteen months so why choose to go when this weeks prediction is wrong? Just go now!"

-------------------------------------------------------------------------------

Yep Kit, you are correct Mr Posen does seem to have been wrong and, the BoE/MPC by ignoring their remit has probably reduced growth in the medium term ... so he could end up being right in a self-fullfilling way. (He may need to put an awful lot of "money where his mouth is").

Of course there can always be a risk to having experts, who through their very expertise have a conflict of interest, on a decision committee. Such experts ought to provide advice to decision takers, but not be decision takers themselves. It is not a unique problem.

Still looking on the bright side inflation could be at 1.5% in another year's time, is this the first time since MK took on the role? It does seem somewhat pathetic.

Anyway I think the Chancellor of the Exchequer should change the way the BoE's price stability target is set. I would prefer it to be based on the actual index rather than annual change, that way any over or undershooting has to be rectified in the future and doesn't simply drop out of the calculations.

Complain about this comment (Comment number 12)

Comment number 13.

At 18:16 30th Mar 2011, zygote wrote:How will people react to falling living standards?

Some 250,000 attended the TUC rally in London recently, protesting about government cuts. Unless we believe that our population has become more stoic than back in the 1970's, people will eventually become desperate and demand higher wages. "Stagflation Lite" - as Stephanie recently called the current situation - will become real Stagflation. Little wonder the price of gold and silver is so high.

Complain about this comment (Comment number 13)

Comment number 14.

At 18:34 30th Mar 2011, Lambretta wrote:Who knows. The more pointless imported plastic and tech rubbish we buy - the more we cut our own throats and the less happy we are - although we never make the connection.

Technology and plastic stuff takes huge manufacturing costs. No country can make this stuff without burning fossil fuels; mining in Africa or Madagascar and felling forests for precious metals required for manufacture for more tech stuff. A vicious cycle.

My new laptop was a gift from my son as a birthday gift when he witnessed and decided I was struggling with my 7 year old one. My son also gives me his old mobile phones that are compatible with my SIM and existing good contract.

So, what do you know what forests are felled for mining purposes, globally, by Chinese companies mining for precious metals and gems too, as a by product to make more plastic and tech products you buy without thinking about the damage incurred? Just a few thoughts.

Complain about this comment (Comment number 14)

Comment number 15.

At 18:45 30th Mar 2011, rock_and_roll_economics wrote:Baby you can drive my car...

But NOT if you only look in the rear-view mirror...

Complain about this comment (Comment number 15)

Comment number 16.

At 18:47 30th Mar 2011, Up2snuff wrote:SF: 'Believe it or not, many would argue that a prolonged squeeze in household incomes was the "best case" scenario, starting from where we are now, because it spreads the pain of adjusting to a more inhospitable global economy as widely as possible.'

--------------------------------------------------------------------------------

I would not.

The squeeze is, as far as I can make out, only really hitting the bottom three fifths of wage earners. (Dividing our economy into seven groups - two non-earning, five earning where pension counts as earning.) The top fifth of earners are still having a swimming time even with a 50% rate and NI increases draining their pool slightly. The second fifth are possibly squeezed a bit but I suspect many will, in that grouping, be able to haggle for pay rises.

My thinking now is (with evidence from 2008) that the economy is not driven by the top fifth, or a fraction thereof, but the bottom three fifths of earners - the bulk of the population.

Four likely effects are:

1. People in these three bands will qualify for more more and more benefits now, as they did under Labour,

2. Where they default on debt it will have a more significant effect on the housing market than in the past,

3. Their lack of spending will damage retail sales on which our economy still depends (too much), and

4. The squeeze will affect their savings and their pensions, requiring increasing benefit support in future.

I can only see bigger and bigger bills reaching GO and HM Treasury on this. And further hard times for all. Which is why I argue that 60% and 70% tax bands (plus some other form of wealth tax?) for the high paid may seem unpleasant, may actually be unpleasant, but if suffered now will probably disappear completely in five or so years time. The tax burden needs readjustment upwards after 1979 and the more recent cuts in top taxes in the '80's and '90's. The tax system needs reform, removing our dependence on indirects and stealth taxes and this needs to be started now.

But if these higher IT bands are not imposed now, they may become inevitable and permanent in five years time. As Stephanie questioned in one of her famous Blogs last year, a little pain now for delayed gratification later - what is it to be?

The other alternative is to cut the State spend drastically and has been pointed out elsewhere on these Blogs the Coalition's current projected 'cut' is a real terms increase by 2014/15 compared to 2007/8/9.

Strikes me that the future is blight, the future is cutting. Cut the income of the big middle any more and, unless a miracle occurs overseas and commodities imports fall drastically and stay low for some years, we could be facing some bleak decades while we struggle to re-structure.

Complain about this comment (Comment number 16)

Comment number 17.

At 18:57 30th Mar 2011, Up2snuff wrote:SF: 'The MPC are likely to be poring over those April pay deals as they start to come in, setting the context for the great debate over rates at their meeting in May. The chances are that private sector wages will continue to creep up. But it is also the case that the public sector pay freeze will put downward pressure on average earnings for the whole economy. And as we know, inflation is only one part of the squeeze for households.'

--------------------------------------------------------------------------------

I hope the MPC will be looking at the figures so closely that they are not just looking at average increases within sectors of the economy but will be looking at increases in the different earnings levels to see exactly where the increases are falling.

Complain about this comment (Comment number 17)

Comment number 18.

At 18:58 30th Mar 2011, nautonier wrote:'For some, this squeeze in real incomes poses a bigger risk to confidence and the economic recovery this year than government budget cuts (although, of course, the decision to raise VAT has made its own contribution to the rise in prices). The doves on the MPC are betting that another year of economic hardship will be more than enough to bring down inflation next year.'

....................

UK general price inflation is now embedded and much of it is linked to our own personal choices of buying to much that is grown and made overseas ... and our over reliance on UK imports ... which are are inflated on price as providing super profits for import spivs, monopollies and cartels.

UK general and other inflation is a huge problem and very damaging and urgently needs to be tackled with VAT cuts (even at 5% as the UK domestic economy is very fragile) ... we must argue and fight our corner with the EU on this one ... or suffer the consequences of idiotic interest rate rises for UK price and other inflation management ... which is about as crude and ignorant as it can possibly get.

Complain about this comment (Comment number 18)

Comment number 19.

At 19:09 30th Mar 2011, Up2snuff wrote:What effect will a £1.50 average price for petrol (more for diesel) in three months time have on inflation currently straddling the 5% mark?

Complain about this comment (Comment number 19)

Comment number 20.

At 19:24 30th Mar 2011, CarpCarp wrote:Sorry, but I find it very hard indeed to believe Adam Posen is putting his money where his mouth is with regard to inflation. After all, he's had his foot there for some time now, so heaven only knows where he's going to find the space!

Oh yeah, I forgot, he's an economist, so his mouth will magically expand to fulfil the demand...

Complain about this comment (Comment number 20)

Comment number 21.

At 19:42 30th Mar 2011, KeithRodgers wrote:In the 1970`s the 50 plus generation did well when inflation diminished there mortgage repayments and this age group all did well on the asset appreciation front. In some ways it happened again in the 1980`s, but the truth is it has completely messed it up for the next generation.

The baby boomers(x generation) have done well at the expense of the Y generation and that resentment will start to boil over soon. The next generation have no intention of supporting that X generation in retirement. There too smart for that, hard times are going to be the norm for the next 10 yrs at least.Retail consumption will falter and businesses will start whining that people are not spending.

Complain about this comment (Comment number 21)

Comment number 22.

At 19:45 30th Mar 2011, Oblivion wrote:Unemployment will rise.

Prices will drop, but after adjusting for energy and import cost rises.

Wages will drop.

We keep repeating it, the problem is private debt (personal debt). The only way out is to forcibly have banks write down that debt. If the government wants funding, it will have to auction bonds directly to the public. Problem is, only the really good economists are putting such things on the table. The rest are prisoners of convention and wrapped up in banality.

Complain about this comment (Comment number 22)

Comment number 23.

At 19:51 30th Mar 2011, ciderwithdozy wrote:Don't posters realise that two small paragraphs max keeps the reader interested....more than that is 'scroll down to the next post' material.

Complain about this comment (Comment number 23)

Comment number 24.

At 20:09 30th Mar 2011, Mike3 wrote:Are there any discretionary income rather than disposable income figures to go with these?

The disposable per head may have gone down £200, but with inflation high, but interest rates low it isn't clear to me where discretionary income is. Although union leaders may argue based on disposable income, it is mostly discretionary income that affects how one feels (assuming your income and savings covers the necessities). What is the proportion of people who have a positive discretionary income? (Lorenz curve please). What has happened to discretionary income over this time period?

Complain about this comment (Comment number 24)

Comment number 25.

At 20:21 30th Mar 2011, CASTELLAN wrote:If I asked you for a pay rise, would you hold it against me or look for someone new.

How exactly do I put a ? on a chart and where should it go. Bang goes the theory!

Complain about this comment (Comment number 25)

Comment number 26.

At 20:38 30th Mar 2011, EconomicSlave wrote:Inflation has already occurred. It inflated when the banks created loads of credit money against housing. Money is easily rapidly created, but it cannot be rapidly de-created. It takes special measures to reduce a balance sheet. And it is not reducing.

Inflation, from a consumer perspective, is measured against a basket of goods. It is completely disconnected from true inflation.

Complain about this comment (Comment number 26)

Comment number 27.

At 21:17 30th Mar 2011, Kit Green wrote:26. At 20:38pm on 30th Mar 2011, EconomicSlave wrote:

Inflation, from a consumer perspective, is measured against a basket of goods. It is completely disconnected from true inflation.

--------------------------------------------------------------

The general population don't realise this, or simply don't care or find it a brainache.

It is however very obvious. The clue is in the names of CPI and RPI, specifying price. Therefore there must be other things that can be used to measure inflation, such as wages and manufacturers' materials costs.

I have seen it suggested that "real" inflation is nearer 8% at the moment. It may feel like it but what does it really mean is going on?

Complain about this comment (Comment number 27)

Comment number 28.

At 21:33 30th Mar 2011, richard bunning wrote:Because of our obsession with owning our own homes and treating them as a speculative investment, we have a debt culture where we are prepared to take on large mortgages (and then credit card debt too) because housing policy has made this acceptable - my parents wouldn't have dreamt of owing vast sums in their generation.

This willingness to go deeply into debt to gamble that house prices will go on rising forever and that we will be able to afford the mortgage, then trade down and realise a nice little profit has fueled the vast rise in house proces over recent decades.

Now that real living standards are falling, money is tight and inflation has set in, if the MPC were to raise rates by 1% to 1.5%, that will multiply the cost of borrowing and a large proportion of people who are on the edge will go over it and be unable to afford their mortgage anymore.

The odds of precipitating a meltdown in house prices as people desperately try and sell to trade down seems very likely. I think some people will manage to get higher salaries, but not many - so my money is on a serious fall in house prices and a race to the bottom in retail prices as consumer demand dries up, simply to take turnover off competitors. The trouble is that if - or should I say IMHO when - the UK goes into recession, Sterling will fall even more, which in turn stokes inflation via import prices.

The UK is then but a phone call away from going to the IMF for a bailout followed by the collapse and nationalisation of the major UK banks - as is happening right now in Eire.

This will set UK PLC on a course of stagflation for 10 years, as happened in Japan after their meltdown, but with little prospect of growth lifting the sconomy out of the mire.

Complain about this comment (Comment number 28)

Comment number 29.

At 21:39 30th Mar 2011, stanblogger wrote:What is clear is that a shift in relative pay levels between the public and private sectors is under way, in favour of the private sector. This appears to be the deliberate intention of the coalition government. The important question is whether or not this is a sensible policy.

In the medium and long term this, and reductions in benefits such as pensions, will mean that the public sector will get a smaller proportion of the most able new employees. Those on the right of the political spectrum will say that this will be a good thing. They will say that the public sector does not generate wealth - it is better that more bright young people should go into the private sector.

However, many parts of the private sector, for example the financial services industry, do not generate wealth directly, they merely make a living by helping others do so, just as the public sector does.

Is it really a good idea to reduce the supply of bright youngsters to the teaching profession for example, in order to have more working in banking?

Complain about this comment (Comment number 29)

Comment number 30.

At 22:20 30th Mar 2011, This is a colleague announcement wrote:What is meant by "living standards"?

When I payed off the mortgage on my first house, a modest affair in a textile town, I looked through the bundle of deeds. Its first owner, a hosiery worker, who presumably left school at 13, had bought it for a couple of hundred pounds, and supported his wife and three children at the same time.

When I came to sell it, a young graduate couple, both working, appeared in a newish VW Golf. It was clear that children were out of the question for them, but nonetheless the house on offer was not really affordable to them. That's a couple of decades ago too.

Stuff worth having, that is, somewhere reasonable to live, free time and a happy family life seem to me to be ever more unaffordable for the average person. A life filled with i-prefixed electronic junk does not compensate for this, whatever the BBC might suggest.

Complain about this comment (Comment number 30)

Comment number 31.

At 22:34 30th Mar 2011, foredeckdave wrote:#26 & 27 EconomicsSlave & Kit Green,

Now I may be being completely thick here but why is not consumer related price inflation satisfactory and how is it supposed to differ from 'true' inflation?

I will accept that the means of calculation of CPI and RPI leave a lot to be desired - hence households reporting 'real' inflation at higher levels. However, at some point all goods and services apart from exports are consumed within the economy at a PRICE.

Complain about this comment (Comment number 31)

Comment number 32.

At 22:47 30th Mar 2011, Mike3 wrote:@ 27. At 21:17pm on 30th Mar 2011, Kit Green wrote

"Therefore there must be other things that can be used to measure inflation, such as wages and manufacturers' materials costs."

-------------------------------------------------------------------------------

The GDP deflator.

Complain about this comment (Comment number 32)

Comment number 33.

At 22:54 30th Mar 2011, UnionRep wrote:We still have the housing bubble in place inflating banks balance sheets, that’s why the BOE base rate has not changed – strange when you consider that their only brief is to control inflation and they are supposed to be (now) independent, this is clearly a misnomer!

At 16:29pm on 30th Mar 2011, John_from_Hendon wrote:

“My recipe remains the same: Stick up interest rates, get back to a proper price for money, deal will the mortgage defaults and repossession, but above all - do it quickly.”

I agree entirely and would add that the longer this is left in limbo (in the hope that banks could cover their positions on the devaluation of their assets) the worse the issue becomes.

Interest rates should now be 5 to 6% and climbing, but what’s saved “the game” here is that real wage rises are not keeping pace with inflation thus many economist models are broken.

What baffles me entirely however is how the current western financial model still has in place those individuals that caused the current crisis… how can this be three years down the road to Armageddon?

It’s almost as if the people that hit you over the head with a baseball bat three years ago… you quickly have forgiven, and then (stupidly) allowed them to continue without check or balance!

Surely we can’t all be that stupid, but the logic and evidence say’s otherwise!

Complain about this comment (Comment number 33)

Comment number 34.

At 22:59 30th Mar 2011, Up2snuff wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 34)

Comment number 35.

At 23:01 30th Mar 2011, JohnConstable wrote:Stephanie says that the chances are that private sector wages will continue to creep up.

Well, that is very debatable because office work can and have often been offshored to places like India and many office workers in England understand and worry that they might be next, so zero pressure for pay rises from these folks as they just want to keep the job.

Furthermore, in manufacturing, there is also a tendency to offshore some of that too now, Dyson and Triumph Motorcyles are examples of this pattern so again, these workers are not going to be too keen on pushing for pay rises.

What does seem to be happening, is that shrinking paypackets, due to things like food inflation and taxes, is forcing consumers to try and make whatever income they end up with go a lot further.

That means automatically asking suppliers if they can do a job cheaper if they will accept payment in cash, and often that is the case.

I'm sure economics is a facinating subject but it does seem that sometimes economists {and politicians} may not see the wood for the trees.

Complain about this comment (Comment number 35)

Comment number 36.

At 23:03 30th Mar 2011, Up2snuff wrote:re #30

Too right, mate.

We have GOT to sort it out.

'Tis a TINA moment.

Complain about this comment (Comment number 36)

Comment number 37.

At 23:04 30th Mar 2011, JohnConstable wrote:PS. Even the hairdresser tells me that in recessionary times, like now, men will only have their hair cut once every two months or so rather than once-a-month to save some money.

Mullets again.

Complain about this comment (Comment number 37)

Comment number 38.

At 01:32 31st Mar 2011, Paul wrote:What is worrying me is that I believe that the people in charge ( politicans, central bank governors, etc.) don't really have a clue what to do. The massive explosion in all forms of debt is the elephant in the room that no-one knows how to deal with.

The fact that previous governments encouraged debt to produce growth figures means that the "establishment" are complicit in creating this problem.

The reason given to justify QE was deflation, was this dishonesty or stupidity?

What is really worrying is that at a time when the world's diminishing resources are being chased by an ever expanding population it is not a good time to be skint.

Has anyone in authority really thought things through?

As a country we will no doubt muddle through somehow, but our place in the world and our long term prospects and living standards are now under serious threat.

What we need is honesty, and policy developed so that our country suffers as little as possible in the future.

Unfortunately we are led by political pygmies who would rather point score with each other, and care more about their own political careers than the long term well-being of the likes of us.

Complain about this comment (Comment number 38)

Comment number 39.

At 01:58 31st Mar 2011, richard bunning wrote:For those who advocate taking the pain and raising interest rates, I'd like to give you some idea of what this could mean.

There would be a tidal wave of distressed sellers unable to afford their mortgages anymore, trying to get out or trade down because their living standards have already fallen and the cost of living has risen a lot since rates came right down and they're maxed out as it is.

OECD estimates UK house prices are at least 40% too high - in Eire they more than halved ditto Spain - the consequence would be virtually all the domestic lenders would be insolvent within a few months - it would not be possible to bail them all out, so some or all will go bust - and take a large chunk out of the entire UK economy with them - it would be the US Subprime meltdown all over again, only worse.

People wouldn't get paid, companies wouldn't be able to operate without clearing banks and it wouldn't be too long until food, energy and everything we depend on came to a grinding halt.

The government would then have to nationalise all the banks, ending free market capitalism as we know it in the UK and giving politicians control over the entire banking system - this is happening right now in Eire.

There would be such heavy speculation against Sterling that faced with the real risk of hyperinflation, the UK would have no alternative but to join the Euro - as happened to Iceland when their banking system collapsed, taking their currency out too. Billions would be wiped off the UK stock market and off assets and Sterling deposits, drastically cutting the value of pensions and savings.

The financial systemic failure would be so profound that the only possible way to get the country functioning again would be to run it as a command economy to ensure production continued of food, energy and vital services.

Thousands of businesses would be wiped out - the middle class would see their assets go up in smoke and it would take a whole generation to get back where we were when the collapse started.

If anyone is dumb enough to even consider running the risk of this scenaro, they need their heads examining - the financial system is still very fragile - there is no way in the current climate that we can even think of taking big risks with our economy, although George Osborne seems to be dong precisely that in the face of rising inflation, unemployment, energy costs and food prices.

If you are prepared to add an interest rate hike to the £112 Bn being taken out of the economy, I really wonder which planet you're from...

.... it's quite simply suicidal.

Complain about this comment (Comment number 39)

Comment number 40.

At 07:24 31st Mar 2011, duvinrouge wrote:But why is there pressure on wages?

It's all about restoring profit rates.

The profits go to the rich.

The masses are getting a smaller slice of the cake at the expense of the rich.

Complain about this comment (Comment number 40)

Comment number 41.

At 07:33 31st Mar 2011, duvinrouge wrote:#1 Kit Green

"Official line: You are all better off because you have more things.

Truth: Technology has made you work longer not shorter hours, your partner does too, and you have a load of debt."

Capitalism wants to maximise profits & so economic growth.

Hence technology doesn't shorten the working day, just less of the hours worked in a day go towards the means of consumption to reproduce labour & more goes on luxury goods for the rich.

But if the means of production were socially controlled via direct democracy we could work less hours & produce the same amounts as a result of new technologies.

Complain about this comment (Comment number 41)

Comment number 42.

At 08:01 31st Mar 2011, Oblivion wrote:+10 points for richard bunning above.

+10 points to those commenting earlier on i-prefix junk and lower quality of life.

We need a switch to macroeconomic measures that emphasis quality. Quality all round. The word macroeconomics should be substituted with macrosocioeconomics. There is an abundance of everything for everyone, if things are managed properly, and right now there's no effective system in place.

Complain about this comment (Comment number 42)

Comment number 43.

At 08:05 31st Mar 2011, tFoth wrote:I have learnt a lot from the contributions of John from Hendon and Richard Bunning - and find myself agreeing with both of them while they violently disagree with wach other. If I could crack that one then I think we might actually have an answer.....

As it is, we appear to be up s**t creek and still paddling.

Regarding inflation, I have been saying for some time that price inflation was never going to enable us to inflate away our debt (anymore than it helps someone on fixed income to pay off their mortgage). I'm glad that this obvious truth now dares to speak its name. Wage inflation is therefore an issue in determining who pays for this mess. With wage inflation then it is savers (and businesses) who pay: without it is workers.

Complain about this comment (Comment number 43)

Comment number 44.

At 08:12 31st Mar 2011, Mike3 wrote:@39. At 01:58am on 31st Mar 2011, richard bunning wrote:

"For those who advocate taking the pain and raising interest rates ...."

--------------------------------------------------------------------------------

One reason for advocating the increase now (and indeed 12 months ago) is to avoid the tidal wave and do it gradually. As you say we have overvalued house prices and yet they went up in March. If house prices stay flat and so devalue in real terms with the GDP deflator at say 2% per year to reach 60% of their current value will take 26 years. Having misvalued assets hanging around in the economy for this long, I guess, isn't ideal. I think some of the problems you indicate with a rapid readjustment could also be reduced by a reexamination of the mark to market rules, and a Merlin 2 looking at increasing the number of negative liquidity mortgages on offer. [What I'm groping for is a way to adjust on the banks' balance sheets over 25 years, but more rapidly in the real world, rather than the picture you paint which is one of the real world being too big to fail ensuring we are all caught up in a giant moral hazard situation.]

------------------------------------------------------------------------------

@ 33. At 22:54pm on 30th Mar 2011, UnionRep wrote:

" the BOE base rate has not changed – strange when you consider that their only brief is to control inflation and they are supposed to be (now) independent"

-------------------------------------------------------------------------------

Interesting, I suspect the contrary, that it is because of the independence that rates have not gone up. I wonder if we will ever know.

Complain about this comment (Comment number 44)

Comment number 45.

At 08:18 31st Mar 2011, ishkandar wrote:#6 Inflation, in those days, reached as high as 15% and, at some point, unearned income was taxed at 112.5%, which drove all local and foreign investors out of the country !! It took a decade of Thatcherite confidence building to bring those investors home. A good example was the Hanson Group of Companies !!

The last thing we need now is to lose international confidence. Unrealistic Socialist demands have killed that confidence in Portugal and Greece. Will the same happen in Britain ?? Already we are "on watch" !!

Complain about this comment (Comment number 45)

Comment number 46.

At 08:20 31st Mar 2011, Mike3 wrote:@42. At 08:01am on 31st Mar 2011, Oblivion wrote:

"We need a switch to macroeconomic measures that emphasis quality."

--------------------------------------------------------------------------------

Please don't let the economists loose with any more hedonic adjustment fiddles

Complain about this comment (Comment number 46)

Comment number 47.

At 08:28 31st Mar 2011, ishkandar wrote:#8 I'm sorry to bust such a nice dream but that "object printer" that you laud is simply for form, not function. How do you get "inks" that contain sufficient different kinds of Rare Earth elements to make a simple IPad ?? Without those elements, it's just a non-functional lump !!

How do you produce sufficiently diverse organic compounds to produce an OLED TV ?? Finally, who produces these "printers" and "inks" ?? As a long-time (50+ years) science fiction reader, I have seem many science fiction postulations come true but I think it will be very premature to suppose that this is one of them *IN THE NEAR FUTURE* !!

Complain about this comment (Comment number 47)

Comment number 48.

At 08:30 31st Mar 2011, BJK wrote:To mention the squeeze on living standards was an open invitation for John-from-Hendon to make the point that, to really solve our economic problems, there needs to be an even bigger squeeze to wring out the debt financed, over inflated price of assets - viz. property - that we have accrued over the last few decades...

...Ah yes, that's what we need. White feathered patterns on windows in the winter. Milk kept fresh in a bucket of water. Just one person in your street with the audacity to own a motor vehicle. A healthy weekly shop, on foot, at the local butcher, baker and grocer. Putting some old clothes out for the 'rag and bone man'. A few hours of TV in the evening for a lucky few while for the rest it's 'The Navy Lark', 'Sing Something Simple' and 'The Clitheroe Kid' on the radio . For the young it's read a book, draw some pictures and wait for the once a week treat of 'Andy Pandy' and 'Listen With Mother' -none of these all day cartoon and pop party shows to give them hyperactive goldfish minds...

Yes, there might well be some benefits from a bigger squeeze on living standards but, when you measure living standards in purely economic terms, it's all relative and people, not liking to contemplate less, tend to cling on to what they've got.

As Rober Peston often points out, if property prices now sunk to realistic levels, then our banks, being heavily dependent on high property prices, would find themselves in real trouble...And if the banks and whole financial system collapsed, well, I don't think it's in anyone's interest to have living standards squeezed to the point where one feels blessed with a new flint spearhead to hunt down dinner.

The previous Labour government used to go on and on about 'change' -as if change just for the sake of change was a good thing. Now, all we hear is 'growth' and the need for it to get us out of the current economic problems. Yet it seems likely that any growth, whilst providing work and keeping living standards up, will simply perpetuate the underlying problem of over-inflated, debt financed asset values and lead to yet another economic slump. Maybe a period of stagnant growth and living standards is just what our economy needs at this point in order for, as John-from-Hendon routinely observes, a much needed fall in the inflated value of assets and a realistic price/interest rate for money to take place.

Complain about this comment (Comment number 48)

Comment number 49.

At 08:37 31st Mar 2011, ishkandar wrote:#14>> So, what do you know what forests are felled for mining purposes, globally, by Chinese companies mining for precious metals and gems too, as a by product to make more plastic and tech products you buy without thinking about the damage incurred? Just a few thoughts.

A lot less that those felled by Americans in their never-ending search for oil and beef to feed the hungry demands of McDonalds. Just ask the Brazilians where most of their beef goes and where that beef is produced !! Or any of the South American countries, for that matter !!

Britain cannot produce enough beef for its own consumption, so where does the beef sold her come from ?? Or are you going vegetarian ?? Plenty of beans from Kenya, potatoes from the deserts of Egypt and veggies from greenhouses where veggies never grew before !! what price the energy cost of those ??

Complain about this comment (Comment number 49)

Comment number 50.

At 08:58 31st Mar 2011, John_from_Hendon wrote:#48. BJK ,#33. UnionRep ,#43. tFoth

(#48. BJK) "Maybe a period of stagnant growth and living standards is just what our economy needs at this point in order for, as John-from-Hendon routinely observes, a much needed fall in the inflated value of assets and a realistic price/interest rate for money to take place."

Indisputably when a home suitably located and of a sensible size fro a farmworker on 25K to 30K a year is priced at 600K something has to give as the maximum sensible price is 100K.

However stagnation/stagflation is a bad way to do this. It is the cowards way out! Stagnation (admittedly the most probable 'solution') is condemning the Nation to many decades of grinding poverty just to avoid the banks going bust! Is it worth it - even for the banks! Perhaps in the very short term, but consider this: banks and other business run every day, week, month, year and decade. If the hit was taken today the routine running of the banks and business could recommence rapidly and not be delayed fro decades (and make no mistake the stagnation 'way out) will take decades. I like the analogy of removing a gangrenous limb to save the economic body.

Robert Peston on the R4 Today programme guess that if the Irish situation hit the UK to the same extent then the UK default would be at least 700bn. Big though this sounds it is small when considered against decades of grinding poverty, just to save the imprudent borrower and the banks. The Irish private property bubble is already deflating - ours hasn't really started so we have further to go! The first battle is denial.

Complain about this comment (Comment number 50)

Comment number 51.

At 09:05 31st Mar 2011, foredeckdave wrote:#48 BJK,

"...Ah yes, that's what we need. White feathered patterns on windows in the winter. Milk kept fresh in a bucket of water. Just one person in your street with the audacity to own a motor vehicle. A healthy weekly shop, on foot, at the local butcher, baker and grocer. Putting some old clothes out for the 'rag and bone man'. A few hours of TV in the evening for a lucky few while for the rest it's 'The Navy Lark', 'Sing Something Simple' and 'The Clitheroe Kid' on the radio . For the young it's read a book, draw some pictures and wait for the once a week treat of 'Andy Pandy' and 'Listen With Mother' -none of these all day cartoon and pop party shows to give them hyperactive goldfish minds..."

"Left hand down a bit" What was wrong with the Navy Lark? You seem to have existed in some strange state in the 50's. Listen with Mother was a radio programme - "are you sitting comfortably? Then I'll begin" - whereas Andy Pandy was a tv programme (Picture Book on Monday, Andy Pandy on Tuesday, Flower Pot Men on Wednesday, Rag, Tag and Bobtail on Thursday, Woodentops on Friday.

In those days the majority of us had no reference points with which to compare our standard of living. So what we had we accepted as being the best, or close to the best, that could be achieved. Even then we could see that things could get better. More cars, more tv's, buses replacing trams, electric trains, etc. etc. And don't forget we also had Round The Horn and the Billy Cotton Band Show (Wakey wakey!).

It's not really what we have, it's the perception that we can keep them and that in the longer term things will get better.

Complain about this comment (Comment number 51)

Comment number 52.

At 09:06 31st Mar 2011, John_from_Hendon wrote:ps to #50

Remember that the only part of overly inflated property prices that hits the banks is that on which they have lent. If the owner has no mortgage the inevitable house value fall will have no effect on the banks at all. The banks cause the contagion by having overly inflated prices of assets as security. So, for example an halving in property prices may only hit the banks to the tune of 10 to 15% of the notional fall.

Complain about this comment (Comment number 52)

Comment number 53.

At 09:13 31st Mar 2011, sanity4all wrote:easy one this - which will crack first - Wages, followed by prices.

its inevitable that as wages are constrained, anything for sale, will in time, fall in price.

give the markup on goods with the likes of next, topshop, electronic goods, car dealers - it will be easy for them to absorb the price reduction, although their profit margins will be reduced.

one can't feel sorry for any organisation that's made bumper profits for shareholders, if the workforce take a hit on salaries, then so should the shareholders.

if the forecast is for reduced profit margins, private equities are going to take a hit too.

Complain about this comment (Comment number 53)

Comment number 54.

At 09:21 31st Mar 2011, allan365 wrote:FTSE director's saw their remuneration packages go up either 55% or 23% depending on who you listen to...

https://www.personneltoday.com/articles/2010/11/01/56852/ftse-directors-pay-rise-figures-called-into-doubt.html

Complain about this comment (Comment number 54)

Comment number 55.

At 09:33 31st Mar 2011, Kit Green wrote:32. At 22:47pm on 30th Mar 2011, Mike3 wrote:

The GDP deflator.

--------------------------------------------------------------

All explained here:

https://www.parliament.uk/briefingpapers/commons/lib/research/briefings/snsg-04962.pdf

Complain about this comment (Comment number 55)

Comment number 56.

At 09:38 31st Mar 2011, Up2snuff wrote:45. At 08:18am on 31st Mar 2011, ishkandar wrote:

#6 Inflation, in those days, reached as high as 15% and, at some point, unearned income was taxed at 112.5%, which drove all local and foreign investors out of the country !! It took a decade of Thatcherite confidence building to bring those investors home. A good example was the Hanson Group of Companies !!

The last thing we need now is to lose international confidence. Unrealistic Socialist demands have killed that confidence in Portugal and Greece. Will the same happen in Britain ?? Already we are "on watch" !!

------------------------------------------------------------------------------

50 years of reading sci-fi and your memories have become slightly scrambled, old son!

The top rate of income tax in the 1970's was 83% for someone earning lots of money! There was an additional charge of 15% for unearned income so someone who owned a substantial shareholding in a private or public company and had an extremely high dividend income could end up paying 98% top slice tax if they only had unearned income and no earned income. Inflation actually hit 26% in 1975/76 but the adjusted figures now scheduled as 'official' in the House of Commons Library show it as 24.2% for 1975 but there were four other years when 15% was exceeded. The Thatcher recovery, after UK recession, followed by world recession, reclaiming the Falklands and defeating Scargill, took just seven years.

But your general point is good. We need to attract existing business to the UK as well as start lots of new small businesses ourselves. {But be aware, this is not the panacea that some believe - about two-thirds of new businesses fail in the first year or so.}

High personal tax rates do not drive away business of size - ie medium to large enterprises. It is uncertainty, constant changes of rules and legislation, constant swings in currency values so that money or opportunities are lost (despite hedges), high cost of employees, inflation, red tape and inconsistent/illogical restrictions, high Business Rates and high Corporation Tax in relation to other countries.

Dave was actually coining quite a good phrase for outlining one of our major problems and creating Government and national motivation when he talked about "eliminating the enemies of enterprise".

He and The Coalition have now got to get on and do their bit for us, the stuff we cannot do.

Would we be prepared to give Dave, Cleggie, GO & Co seven years to create the climate for full recovery?

Complain about this comment (Comment number 56)

Comment number 57.

At 10:02 31st Mar 2011, Dempster wrote:In January 2009 The Bank of England reduced interest rates to 1.5%, and finally to 0.5% in March 2009 (the lowest rate since the BOE was founded in 1694).

In addition to the above the B.O.E. started Quantitative Easing in early 2009.

Since these actions were taken, the following has occurred:

(All figures noted below are sourced from the Office for National Statistics website):

Retail price index (all items) RP02:

Jan 2009 210.1

Feb 2011 231.3

Price inflation = + 10%

Average weekly earnings whole economy (not seasonally adjusted):

Jan 2009 Average weekly earnings = £444

Jan 2011 Average weekly earnings = £461 (provisional)

Increase = + 3.8%

Average weekly earnings Private sector (not seasonally adjusted):

Jan 2009 Average weekly earnings = £445

Jan 2011 Average weekly earnings = £459 (provisional)

Increase = + 3.1%

Average weekly earnings Public sector (not seasonally adjusted):

Jan 2009 Average weekly earnings = £441

Jan 2011 Average weekly earnings = £468 (provisional)

Increase = + 6.1

Both private and public sector have taken the pain, but to be fair the private sector have taken nearly twice as much pain as the public sector.

In any event, if you didn’t know the current price of bailing out the banks.

Now you do.

Complain about this comment (Comment number 57)

Comment number 58.

At 10:03 31st Mar 2011, foredeckdave wrote:#56 Up2snuff,

"Would we be prepared to give Dave, Cleggie, GO & Co seven years to create the climate for full recovery?"

Simple answer - NO!

Call me Dave and Gorgeous George have now shown their hand and it is poor. Leaving aside the ideological changes behind their austerity programme they have painted themselves into a one club corner (now which Tory Chancellor did that previously :)). Not only do we lack a strategic programme for trade and industry, we don't even have a plan to research one!

Sorry Snuffy but one sound bite does not a coherent policy make!

As for Cleggie - don't get me started!!!!

Complain about this comment (Comment number 58)

Comment number 59.

At 10:08 31st Mar 2011, inacasino wrote:"eliminating the enemies of enterprise".

Might that include our foolish bankers? I see that Barclays are spitting out their dummy and threatening to move head office to Noo York. Let them go. Nature abhors a vacuum and as we know when 'key' individuals move on, the worst never happens. Talent will emerge to replace them and often do the job better bringing a different perspective and ideas.

Complain about this comment (Comment number 59)

Comment number 60.

At 10:14 31st Mar 2011, ak35 wrote:Seriously Stephanie, do you need to ask that question "which will crack first prices or wages"

If you do then I have to call into question your grasp of the real economic climate being endured by the vast majority of the populous and the real reason behind spiralling prices.

Prices for commodities bear little or no relevance to the actual cost of production, transport and supply but are now completely and perversely controlled and influenced by the vampires who inhabit the investment markets. These people speculate, WITH OTHER PEOPLES MONEY, like a gaggle of Saturday afternoon race punters aiming to maximise their profits by massaging the "cost" of commodities upwards.

So first point prices will not "crack" except for in a very limited way at local level as smaller retailers attemtp to maintain market share and survive.

Next point - wages - Stephanie I would refer to your colleague's conclusions in the Panorama programme screened on Monday night - that in the new dipensation we now find ourselves (rising unemployment, threat of repossession and personal financial ruin) the average employee is in fact at the mercy of their employer, and on balance will accept cuts and freezes to income, as well as an attack on other terms and conditions rather than face losing their jobs.

Case in point HCL based in Northern Ireland - this company employs 1,300 people and has recently issued a dictate to all employees that they will accept new contracts and a reduction in benefits and entitlements or they will lose their jobs -

is this an honest step taken by management to manitain the company or is it just a cynical move to expolit the employees against the backdrop of a region with a spiralling unemployment rate (one of the worst regionally in the UK) and a high level of graduate qualified job seekers. I'll leave you all to make your own minds.

If this is the white charger of the private sector that will save and rebalance the economy, as far as I'm concerned it should put down by a vet.

Lastly I have to echo the sentiments of many other contributers. Where are these current wage rises you refer to actually occuring. My best guess would be that yes indeed it is happening in the upper two fifths of the earning bracket - therefore the vast majority of employees are not experiencing any of this uplift.

Again case in point - and not the labour the point - bank bonuses. Here are people who are inexticably linked to the mess we find ourselves in and yet they experience no hardship or decline in living standards - so they get negative press - Aw diddums.

Finally, in terms of the will of the general populous to do something about declining living standards.

Last case in point - 2000 - cost of fuel 85p a litre - refineries blockaded, city broguht to a halt by hauliers

2011 - cost of fuel 1.40 a litre and rising - public resignation.

The general public have had their indignation and will to protest managed downards by successive governments through careful manipulation base level psychological reactions and processes. Paint yourself as the protector of the public from "the boogeyman" and they will quite happliy let you trample them into the ground - See the excellent documentary "the power of nightmares".

Complain about this comment (Comment number 60)

Comment number 61.

At 10:34 31st Mar 2011, C Turner wrote:IBID @ 8

OBJECT PRINTER. Sounds Wonderful. Our very own Factory!

But wont it need Electricity to run.

We are going to run out of that in a few years time as no Generational capacity

is being replaced in sufficient amounts.

Or will it run off Steam Power?

This nonsense is reminiscent of the Guff I have been told all of my 63 years.

1950s Plastic - new wonder material , so cheap they will be Giving it Away.

1960s Nuclear Generated Electricity , so cheap they will be Giving it Away.

1970s In the future, due to Robotics, we will have so much leisure time we wont no what to do with it.

All humbug.

Burn Britains 200 year supply of Coal now in Coal Fired Stations that can be built and Commissioned within 4 or 5 years. Their is a direct relationship between standard/quality of living and electricity generated per head of Population.

( Contrast say Sweden with Mozambique.)

Send the Greenies , who want to tax and fine us into Slavery,up the chimneys with a set of brushes.

Complain about this comment (Comment number 61)

Comment number 62.

At 10:42 31st Mar 2011, supermk wrote:"costs of this adjustment would fall disproportionately on public sector workers (whose pay is frozen)" - surely one of the reasons for the required adjustment now is that following the 2008 crash public service remuneration continued to rise at a fast rate, I believe of the order of 10% over two years!

So a disproportionate impact on public service workers is desperately required to give some room for the tradeable goods and services section of the economy.

Complain about this comment (Comment number 62)

Comment number 63.

At 10:50 31st Mar 2011, Up2snuff wrote:re #58

Agreed. Another example why I think Cameron is poor on political strategy. What surprises me is that N.Labour haven't picked up on this 'enemies of enterprise' thing. Perhaps they are keeping it up their sleeves or Ed B. isn't sharp enough to use it.

Dave has to deliver. And start delivering pretty much now. I'm not sure the 2011 Budget will do it.

Otherwise he will be seen as the proverbial 'all mouth and no trousers'. And if inflation swings seriously towards 10% even his own Party as well as Tory voters are likely to take against him.

Complain about this comment (Comment number 63)

Comment number 64.

At 11:15 31st Mar 2011, DibbySpot wrote:Unfortunately, government statistical sources have been so corrupted by changes that I would submit this analysis is meaningless since the basis is not defined nor does it take account of the differential pricing/values of products over the period.

The data needs basing back to standard values and indexed to have any real meaning. This sort of scaremongering is counter productive and potentially misleading.

Complain about this comment (Comment number 64)

Comment number 65.

At 11:20 31st Mar 2011, nautonier wrote:But is the real NET disposable income that matters ... the net referring to what we have to spend and what we receive after paying all of the various UK taxes.

If this is somehow calculated ... as, admittedly is very difficult... the position will be that the real net disposable incomes of those currently earning average wages and for those receiving below average wages ... will be very squeezed indeed ... after a decade of squeezing and stealth taxation by The Labour Party.

The position is exacerbated by the better off avoiding most of the VAT and other taxation on their transactions and income and the effect is exacerbated by VAT largely being regressive.

If the post tax position is worked into the equation ... the position is much wosre for some sections of the population that is shown in the baove analysis. The raising of the income tax threshold next months should allevaite this a bit ... but the measurement and full effects of the UK's highest taxes in the world system on UK real NET dispoable incomes ... is not being made.

This sqeezing of the low paid and middle income brackets is not a new phenomemon ... it as been a steady year on year on tax creep for the last 14 years ... but it needs measuring properly, as will give a much different graph line trend and also for for different income levels.

The big problem still is VAT as is a 'tax on existence' for the UK low paid. Those claiming that the 'middle are being squeezed' had better examine the causes and effects.

I have an awful feeling that the effects of VAT are excluded from those lists of countries as to being the highest taxed country in the world ... my 'guesstimate' is thst it is Britain that is the highest taxed country in the world; if VAT and all other indirect taxes are properly evaluated.

Complain about this comment (Comment number 65)

Comment number 66.

At 11:27 31st Mar 2011, Averagejoe wrote:Stehanie,

This is getting boring now. WHY NO REFERENCETO THE FED'S QE2?

($4billion new Dollars every working day).It is pushing up commodity prices which is the source of the inflation. The causes of inflation are set out in Jens O Parsons, The Dying on Money. If you increase the money supply, you debase the currency, and the cost of goods goes up. Itsnot rocket science. The new money is flowing into the markets via the banks, particularly commodites and pushing them up. The only question I have, is will the prices fall back when the fed turns the money taps off in June. Increasing money supply was the cause of inflation in the 70s, but it wasmore convenient to blametheUnions. If the extra money is not soaked up by pay rises, it will just go into goods instead. It has to go somewhere.

Complain about this comment (Comment number 66)

Comment number 67.

At 11:31 31st Mar 2011, Dempster wrote:At the end of December 2010:

*(1) Household debt--- = £1,451,833m

*(2) Government debt-- = £1,023,820m

Total------------------ = £2,475,653m

*(3) M4 (broadest measure of the money supply) was £2,152,254m

*(1) source Bank of England

*(2) source Office for Budgetary Responsibility

*(3) source Bank of England

Where money is created as debt, for every winner there must be a loser, or for every creditor there must be a debtor.

For there to be growth in a debt based monetary system there is an increase in winners and a corresponding increase in losers.

And given that the winners tend to be the financial institutions (large remuneration packages) and the losers the younger generation (student loans and unaffordable house prices); one may consider it debatable as to whether ‘growth’ in a debt based monetary system should indeed be perceived as an end to which a nation should strive.

Perhaps in our present debt based monetary system we are conditioned to believe that ‘growth’ is a worthy end in itself, irrespective of its consequence.

Complain about this comment (Comment number 67)

Comment number 68.

At 11:46 31st Mar 2011, BJK wrote:I rather feel Foredeck Dave, # 51, has somewhat misinterpreted what I said. As a child of the 60s ('50s?-I'm not that old!) I greatly enjoyed 'The Navy lark' and 'Clitheroe Kid'. I wasn't being critical of them. I'm also aware that they were radio programmes whereas 'Andy Pandy' was a TV programme - as someone equally prone to pedantry, I would have hoped a little artistic licence could have been granted here. As for most of the '60s I didn't have a TV I only ever saw it once a week at school-and yes, I remember 'TheWoodentops', too.

I actually have happy memories of those days even though, compared to today's so called period of austerity, they were extremely austere. I suppose what I was trying to point out is that how you define 'living standards' and 'austerity' depends very much on a person's experiences and expectations. It's all relative and what satisfies one person, in a particualr time and place, may not be sufficient for another...I mean, if Harold Macmillan were alive today, he'd probably look around and say, once again: "most of our people have never had it so good" - and would also be astonished at the ensuing backlash.

Complain about this comment (Comment number 68)

Comment number 69.

At 11:47 31st Mar 2011, Lambretta wrote:Response to post 49 @ 08:37am on 31 March 2011 - 'ishkandar'.

Fair points. However, as for your comments on UK beef production, there is plenty. Unfortunately, some UK supermarkets cannot be left out of this concern. They are not prepared to pay for decent husbandry and farmed animals' decent conditions that UK farmers have to adhere to. Some UK supermarkets promote all imported meat as the profit margin is so much higher.

Am not a veggie, love saag aloo and tandori chicken and an occasional fried egg sandwich. Bacon and eggs with toast and butter. mmmm. Roasted Welsh lamb and UK grown vegetables - fresh or frozen.

So the moral is to buy more home produced food? It's often hard to find in supermarkets as they are rarely promoted. The psychological imprint on supermarket shoppers is very powerful and sophisticated. We are too used to seeing so much plenty - yet never see the waste of the supermarket juggernaut.

Complain about this comment (Comment number 69)

Comment number 70.

At 11:50 31st Mar 2011, Kit Green wrote:67. At 11:31am on 31st Mar 2011, Dempster wrote:

Perhaps in our present debt based monetary system we are conditioned to believe that ‘growth’ is a worthy end in itself, irrespective of its consequence.

---------------------------------------------------------------------

Back in the sixties (and perhaps earlier too) there was the God of progress. We were meant to unquestioningly accept all sorts of things justified by the mantra.

It is the same now with growth.

Complain about this comment (Comment number 70)

Comment number 71.

At 11:51 31st Mar 2011, Up2snuff wrote:23. At 19:51pm on 30th Mar 2011, ciderwithdozy wrote:

Don't posters realise that two small paragraphs max keeps the reader interested....more than that is 'scroll down to the next post' material.

------------------------------------------------------------------

Here's a thought: too much cider will leave you sleepy but a pageful of economics will give you something to chew on all day long.

It is not always easy to post complex ideas with brevity and speed and the internet is fast moving, is it not? The major BBC Bloggers sometimes manage two or three blogs in a day.

'Tis often worth working through a screenful of, say, Richard Brunning or the Dempster, as the gems can be tucked away deep inside. While a posting style similar to kevinb might be commendable for its (usual) brevity and one-liners (his limitation was delivery via a Blackberry or similar device) it doesn't always lend itself to debate over weighty economic issues.

Complain about this comment (Comment number 71)

Comment number 72.

At 12:02 31st Mar 2011, foredeckdave wrote:#66 Averagejoe,

It's not just as simple as QE. You have to consider the effect of increased demand for commodities and climatic influences. Oh, OK then, just for Sage, the limit of resources will also have an effect. Top that off with the casino commodity markets and you have a fearful cocktail of elements that would increase commodity price inflation even without QE

Complain about this comment (Comment number 72)

Comment number 73.

At 12:03 31st Mar 2011, This is a colleague announcement wrote:33. At 22:54pm on 30th Mar 2011, UnionRep wrote:

"...We still have the housing bubble in place inflating banks balance sheets, that’s why the BOE base rate has not changed..."

++++++++++++++++++++++++++++++++++++++++++

I'd say the housing bubble has withstood because of the continuing ridiculously low rates, which also support the inflation we're now seeing. In general I agree with much of your post though.

Complain about this comment (Comment number 73)

Comment number 74.

At 12:04 31st Mar 2011, sizzler wrote:Reality check. Low interest rates and high wage inflation shrink stirling denominated consumer, govt and bank debt. It is your patriotic duty to demand wage rises far above inflation and your bosses to pay it.

What is the point in having our own currency if we can't manipulate it's value to our best advantage. The Govt and BoE can't say so, but they want private sector workers to demand and get wage rises approaching 10%.

Complain about this comment (Comment number 74)

Comment number 75.

At 12:06 31st Mar 2011, AnotherEngineer wrote:47. At 08:28am on 31st Mar 2011, ishkandar wrote:

#8 I'm sorry to bust such a nice dream but that "object printer" that you laud is simply for form, not function. How do you get "inks" that contain sufficient different kinds of Rare Earth elements to make a simple IPad ?? Without those elements, it's just a non-functional lump !!

How do you produce sufficiently diverse organic compounds to produce an OLED TV ?? Finally, who produces these "printers" and "inks" ?? As a long-time (50+ years) science fiction reader, I have seem many science fiction postulations come true but I think it will be very premature to suppose that this is one of them *IN THE NEAR FUTURE* !!

=========================

While the post was a bit of an exageration, these printers were the lead story in the Economist a few weeks ago https://www.economist.com/node/18114221?story_id=18114221

Of course it will be some time before they can produce an iPad.

Complain about this comment (Comment number 75)

Comment number 76.

At 12:12 31st Mar 2011, AnotherEngineer wrote:I think you will find that it was 1968 or 69 that the top rate of income tax on investment income was 104 or 105%

Complain about this comment (Comment number 76)

Comment number 77.

At 12:23 31st Mar 2011, muggwhump wrote:We are coming to the end of a 30/40 year period in our history in which real grinding poverty just hasn't been the average persons default life experience. That is about to change. The reason that, so far, there hasn't been the kind of widespread public anger predicted by Mervyn King is simply that most people haven't really started to feel the squeeze yet or appreciate that when it comes its going to last for years. The reason we don't all demand higher wages or go on strike at the drop of a hat these days isn't because we all understand how very tough and hard it must be for the poor old politicians and bankers, its because years of living on credit and having a comprehensive social safety net there to catch us if we fall on hard times have made real poverty nothing more than a fading memory.

History always moves in cycles though.

I think there is a lagging effect not taken into account by the politicians or economists. The militant trade unions of the 80's were at the end of a long road that started with the depression of the 20's and 30's, people lived through years of hardship when, just like today, you could count yourself lucky if you had a job. In the end though fear of losing your job is outweighed by not being able to afford to put food on the table or a roof over your head. The pendulum of public opinion will swing back to some kind of trade union/collective bargaining again, it will just take longer than people expect. Even when it does it will take decades to reach the state it did in the 80's.

Maybe the push for higher wages won't come for 5 years or even longer, but when it does come I don't think Merv or Dave are going to be able to do to much about it. The interesting question is, when the pay demands do start piling up what is the point of raising interest rates if it pushes up the value of the pound and hits the export market? What will the next downturn in the economic cycle look like in say 10 years time with a large proportion of the workforce determined to get higher wages yet higher rates killing off the economy and the ever precious, must be protected at all costs, housing market?

Complain about this comment (Comment number 77)

Comment number 78.

At 12:36 31st Mar 2011, Geoff Berry wrote:Ishkandar@45

I believe there is merit in a prices and incomes policy at present.

It would send a plus signal to potential inward investors and the markets that something more than loose and often conflicting talk by our politicians and economists is in place.

Ordinary working families who deserve better are concerned about their incomes and never ending rising prices and the future effect of rising interest rates and inflation.

Profits and dividends of domestic utilities, supermarkets, oil and gas, some bankers etc, all those with which the ordinary householder financially interfaces, are through the roof. Not exactly a Cameron togetherness there.

A period of sustained higher inflation is on the horizon, at least some stabilising of the economy would be achieved by such legislation.

I am not an economist, that is easily recognised, but it seems rather inappropriate and stupid to leave the prospects of our financial and economic improvement to the free market ideologies that was a major factor in getting us in the mess in the first place.