Is it the 30s - or the 70s?

"Whatever happens, we don't want to repeat the 30s." That has been the mantra of policy-makers since the financial crisis began. The last time the world had seen a banking crisis on this scale, the result had indeed been the Great Depression. But the reference point in thinking about the 1930s is always the horrendous experience of the US. We forget that in the UK, the Depression was not nearly as Great.

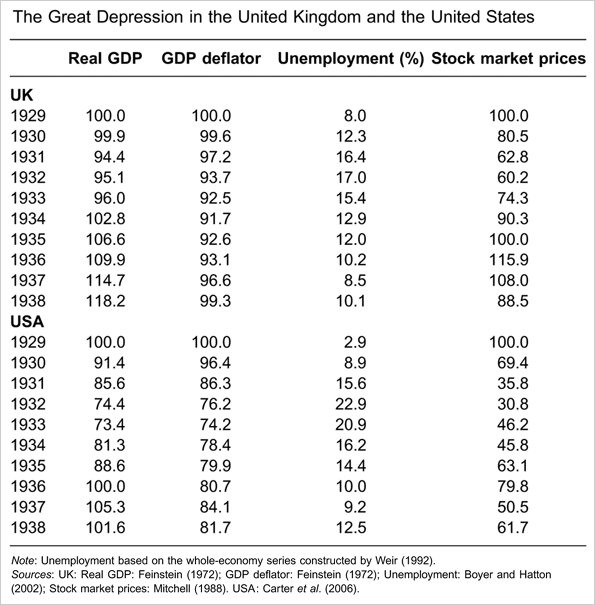

Nicolas Crafts and Peter Fearon remind us in the latest edition of the Oxford Review of Economic Policy that Britain's national output rose by 18% between 1929 and 1938. That's feeble. But in the US, output barely managed to grow at all (and the economy actually shrank, by more than 25%, between 1929 and 1933).

From p287 of the Oxford Review of Economic Policy, v26n3

The 1930s were also a much worse time to hold US stocks: the value of the US stock market fell by nearly 40% over the decade. In the UK, share prices in 1938 were "only" 12% lower than in 1929.

Why this trip down Memory Lane? Because the most important reason the UK avoided a US-style fall in output in the early 1930s was that it avoided lasting deflation. In 1938, the UK price level was almost exactly where it had been in 1929; in the US, prices were more than 25% lower. And the main reason we prevented prices from falling is that we left the gold standard in September 1931, which caused a 25% fall in the value of the pound against the dollar.

In that crucial sense, Britain has indeed repeated the experience of the 1930s - and that is good news. The question now facing the Bank's monetary policy committee is whether they have done too good a job of avoiding America's fate in the 1930s, to the point where we risk a repeat of the 1970s instead.

The minutes of the last Monetary Policy Committee meeting, released yesterday, show that the Bank thinks the target measure of inflation, CPI, could well reach 4% in the next few months, and is likely to remain above 3% for the rest of 2011. If so, the governor would end the year having written a total of 13 letters to the chancellor.

As I've written many times in the past, the Bank has some decent explanations for the consistent overshoot. It's become known as the "Lemony Snicket" defence: a series of unfortunate events, like rising import prices and the switches in VAT.

Interestingly, we tend to talk in similar terms about the stagflation of the 1970s, which we always blame on an "external shock" in the form of the Opec oil price rise. In fact, as Spyros Andreopoulos points out in a recent paper for Morgan Stanley, the downturn in the global economy happened before the big oil price hike, not afterwards. And subsequent oil price rises, in the 1990s and after, didn't produce stagflation at all.

He thinks that stagflation in the 1970s was only partly due to Opec and other "unusual events". More important was a long period of loose US monetary policy, which the rest of the economy was forced to follow, at least until the 1971 collapse of the Bretton Woods system, which indirectly linked other countries to the dollar. On this view, it was loose US and global monetary policy that generated the conditions that allowed Opec to raise prices as high as it did. The Fed then loosened policy even further, in response to the oil price rise, thereby laying the ground for the Great Inflation.

There are important differences between now and then - not least, the fact that, outside of the UK, prices are flat and even falling in many of the largest economies. But you have to say the similarities are interesting. (I will have more to say about today's rise in commodity prices, and what it means for the advanced economies, in a future post.)

In the past two years the UK has applied the lessons it learned in the 1930s, and once again shown its capacity to devalue its way out of deflation. But we should probably also get clear what the lessons of the 1970s are - in case we start to repeat them as well.

I'm

I'm

Page 1 of 2

Comment number 1.

At 13:23 23rd Dec 2010, duvinrouge wrote:In attempting to avoid the necessary devaluation of capital, the ruling classes print money.

This may postpone the devaluation but will eventually lead to a debasement of their currencies.

The law of value will assert itself - or doesn't anyone believe in the market anymore?

Complain about this comment (Comment number 1)

Comment number 2.

At 13:36 23rd Dec 2010, common_man_123 wrote:A positive blog indeed, you must be getting in to the Christmas mood Steph?

Unfortunately I can see the 1970’s being repeated, both politically and economically.

Politically: Heath being afraid to trust the nation and so ended up being indecisive

Economically: High interest and inflation rates

It as felt the same since this crisis began.

Complain about this comment (Comment number 2)

Comment number 3.

At 14:02 23rd Dec 2010, SleepyDormouse wrote:From another blog, I was pointed at this website.

https://pragcap.com/sectoral-balances-and-the-united-states

It is well worth looking at and will only take a couple of minutes to read. It shows the relationship between the government and non government sectors for the US. I wish the UK ONS would publish data in this form [If they do, I have yet to find it].

In the UK, the government policy is to reduce the deficit, [and many would like to see it actually go into surplus]. This graph shows what will happen. The non-government sector will have to reduce its net saving; debt will not be paid of and industry will go into into decline and recession. The only way for us in the non-government sector to reduce our debt is if the government runs a deficit. As exports are unlikely to exceed imports, there is nowhere else for the money to come from.

This is a matter of simple accounting. Its not up for debate.

The policy and direction that the direction in which the various sectors are then driven can be debated. You can go for austerity - effect will be a downturn in the economy and IMHO recession. Or you can try to give the non-government sector a chance to pay off its debts and get a better balanced economy after the debt binge of the last 10-20 years.

Austerity will not, in my view, allow for a better balanced economy to evolve. The latter approach at least has some potential to do it.

Complain about this comment (Comment number 3)

Comment number 4.

At 14:10 23rd Dec 2010, AnotherEngineer wrote:3. At 2:02pm on 23 Dec 2010, SleepyDormouse wrote:

This is a matter of simple accounting. Its not up for debate.

==============

You've been reading Billy's blog.

I think that it is very much up for debate.

Complain about this comment (Comment number 4)

Comment number 5.

At 14:14 23rd Dec 2010, onward-ho wrote:THE BIGGEST LESSONs OF THE 1970S are that Heath under the Tories wrecked the economy and inflation came in with a bang, , Wilson inherited a mess, Callaghan and Healey sorted it out, then Thatcher wrecked it with a whopping VAT rise , public sector cuts and a tripling of unemployment, massive inflation again and divided the nation and made poor people feel like scumbags ......sound familiar?

The Liberals were bonkers then and now too.

Complain about this comment (Comment number 5)

Comment number 6.

At 14:22 23rd Dec 2010, ntp3 wrote:Why was UK unemployment so high at the end of the 1930s, but after World War Two a 'golden age' of American and West European employment and GDP growth commenced? This is the question you should ask yourself.

Here is Paul Krugman blog July 30 2010: "A followup on the question of deflation risks: it’s worth bearing in mind that the last year and a half has been a fairly clean test of alternative views about how the economy works. When the economy slumped, budget deficits skyrocketed, and the Fed began large-scale asset purchases, there were two kinds of people...On one side were people who said that deficits would drive interest rates way up, crowding out private investment, and that all that money printing would lead to high inflation. On the other were those who said that we’d entered a Japan-type liquidity trap, which meant that (a) there was a savings glut, so deficits would not crowd out private investment and interest rates would stay low (b) increases in the monetary base would just sit there, (c) the risk was deflation, not inflation. And so far, the inflationistas have been completely wrong, the deflationistas completely right. This wasn’t a coincidence. For the most part, the inflationistas basically argued that nothing changes when the economy is depressed and short-term interest rates are up against the zero lower bound: the quantity theory of money still rules, and interest rates reflect supply and demand in the loanable funds market. The deflationistas knew — based on study both of Japan and of the 1930s — that everything changes when you’re in the liquidity trap. And recent experience shows just how true that insight is."

Complain about this comment (Comment number 6)

Comment number 7.

At 14:22 23rd Dec 2010, watriler wrote:The truth is that no one really knows where we are going over the next two years but it is unlikely to be the sunny uplands. More than ever our economy is subject to outside events and we do not help ourselves by side sourcing economic management to the MPC and tolerating dependency on the banks for economic stability. The coalition's policies will probably will detract from what little growth the world economy will bring.

Complain about this comment (Comment number 7)

Comment number 8.

At 14:28 23rd Dec 2010, SleepyDormouse wrote:4. At 2:10pm on 23 Dec 2010, AnotherEngineer wrote:

3. At 2:02pm on 23 Dec 2010, SleepyDormouse wrote:

This is a matter of simple accounting. Its not up for debate.

==============

You've been reading Billy's blog.

I think that it is very much up for debate.

-------------------------------------------

True, I do read BillyBlog, but I have been looking for independent evidence in published data that comes from somewhere that cannot be influenced by Prof Mitchell so that I can ask now:

"So if you disbelieve Prof Mitchell [which I don't], please explain this data"

Its an excellent long time series. Please can you explain why you have doubts still.

I really would like to understand the veracity of any alternative view of modern day economics. As far as I can see, MMT probably has the basic structure correct for the way our macroeconomic system works.

Complain about this comment (Comment number 8)

Comment number 9.

At 14:36 23rd Dec 2010, Cassandra wrote:I'm curious that the role of exchange rates in mediating capital flows hasn't been mentioned. Surely one of the main reasons for the disparity in US and Chinese capital flows was the effective pegging of the Renminbi to the dollar? Without this artificial restriction the widening gap in industrial output would have been smaller.

Another reason would seem to be the huge and growing geographical separation between industrial and financial power. Until recently, these always went together and balanced each other out, but in the last dozen years the choice (by US and UK governments in particular) to accept the replacement of industrial engineering by financial engineering as a dominant engine in each country's GDP has helped to create the huge asset bubble that is key to these imbalances.

The key point here is that unlike demographics, it is possible in principle to see a change back over time. Not necessairly for the US and UK to become re-industrialised, but certainly for them to downgrade their financial engineering while the developing countries generate their own financial centres.

As I say, I am surprised that these factrors haven't been stressed. But formal economic methods do seem to miss out critical aspects of the world economy, don't they?

Complain about this comment (Comment number 9)

Comment number 10.

At 14:44 23rd Dec 2010, onward-ho wrote:The Liberals were bonkers then and now too.

I should know,I was one.

Complain about this comment (Comment number 10)

Comment number 11.

At 14:51 23rd Dec 2010, onward-ho wrote:Thankyou for your interesting articles and insights,Stephanie ,and fellow bloggers too.

Might not always agree but it would be boring if we did.

Complain about this comment (Comment number 11)

Comment number 12.

At 15:12 23rd Dec 2010, Mike wrote:The problem with politicians, is they can't help being so damned political!

By that I mean, they look out for the "national interests" of their party, economically, and not neccesarily the futre of the country. That's across the board.

When I look at the countries current fiscal policies, as well as America's they're definite 4 year plans. They'll only start worrying about 2015 onwards, if they do something stupid like get re-elected!

By that I mean, the measures will probably superficially work - cut deficits, increase growth - but I just get the feeling, doing my own sums that the price of that will be very much like what we saw in the 1970s and 1980s.........

It seems to me, Osborne's economic policy is 100% political.

By that, I think he's trying to make sure all pain is only going to be felt by those who wouldn't vote Conservative if you paid them

Complain about this comment (Comment number 12)

Comment number 13.

At 15:17 23rd Dec 2010, ghostofsichuan wrote:Maintaining the wealth of the wealthy has been the policy. Unemployment does not impact those making policy. They have never had a plan and they can fudge the figures on a quarterly basis or just present them in a way that supports their positions. Truth as not been something that the governments find useful.

Nothing has really happened yet. When the cuts and the taxes begin things will get interesting.

Wrong actions bring wrong results.

Not much media interest in the banking bonuses...I am sure the lack of coverage can be rationalized away.

Complain about this comment (Comment number 13)

Comment number 14.

At 15:51 23rd Dec 2010, worcesterjim wrote:Britain was finished as the global financial superpower by the end of the First World War.

The global moneylenders and currency speculators from then on operated out of Wall Street while the City of London became it`s conduit for investment but not the global financial HQ.

The Second World War bankrupted Britain finally and irrevocably and turned us into a wholly owned satellite of the USA...and all our barmy political and economic ideas and problems have come from America since then....including our virtual one-party state and our crazy American-controlled foreign policy and our EU membership and mass immigration and multiculturalism ...and our "need" to prop up a corrupt unstable global financial system that "delivers" us English people very little "going forward"!

WE had the wars and the holocausts and lost our empires and fifty million lives and our economies were destroyed ....while the "poor USA" just got richer and more powerful throughout the last century!

It`s only NOW that communism is dead ...and America`s Frankenstein`s monster creations in China and Russia and Israel and India are beginning to play Wall Street at its own financial games.... that there has really been anything to challenge the USA for ages.

I just wish the BBC would concentrate on Britain`s precarious position a lot more ...and start questioning where our grovelling alleigance to America and America`s "EU" vision of a United States of Europe are taking us ordinary Brits and our grandchildren "going forward"!!

Complain about this comment (Comment number 14)

Comment number 15.

At 16:36 23rd Dec 2010, Chamfort wrote:I don't mind repeating the 1930s. It's the 1940s that worry me.

Complain about this comment (Comment number 15)

Comment number 16.

At 16:43 23rd Dec 2010, blefuscu wrote:" On this view, it was loose US and global monetary policy that generated the conditions that allowed Opec to raise prices as high as it did. The Fed then loosened policy even further, in response to the oil price rise, thereby laying the ground for the Great Inflation."

Yes, Stephanie. The US borrowed and inflated its way through the Vietnam war in order to avoid actually taxing its own citizens to pay the cost. Indirectly, the rest of the world shared in the war costs through inflation.

Nothing has changed, only this time the governments of UK, USA and the EuroPigs were up to the same trick...and if you buck the market it eventually bites back hard.

Complain about this comment (Comment number 16)

Comment number 17.

At 16:57 23rd Dec 2010, enigmajx wrote:Given that we may/may not repeat the 30s, what about the US and the rest of Europe?

Do we then all repeat the 40s?

Happy Xmas!

Complain about this comment (Comment number 17)

Comment number 18.

At 17:11 23rd Dec 2010, Not Buzz Windrip wrote:'The minutes of the last Monetary Policy Committee meeting, released yesterday, show that the Bank thinks the target measure of inflation, CPI, could well reach 4% in the next few months, and is likely to remain above 3% for the rest of 2011. If so, the governor would end the year having written a total of 13 letters to the chancellor.'

Factory gate prices are already +4 percent. As a common value added multiple on imported raw materials is 6x this ties in with 25 percetn currency drop. You can't import at the level that the UK does and not see inflation. As volumes drop prices also will rise. Retailers will change the mix so historical comparision is difficult. How can somebody in the supply chain absorb these increased import costs and why should they. As far as labour costs go they are fixed at the bottom by the minimum wage and anybody working above that level will point out that they are not prepared to drop down too much becasue they expect a differential for capability. They may take a pay packet hit initially but next time around they will say stuff it I have skills.

If you want it you have to pay for it. There are usually alternatives.

Inflation is not a prefered Tory tool so it just shows how bad it is.

Complain about this comment (Comment number 18)

Comment number 19.

At 17:14 23rd Dec 2010, writingsonthewall wrote:"Is it the 30s - or the 70s?"

STOP THE PRESS - BBC ECONOMICS EDITOR FINALLY CATCHES ON!

Cause and effect folks.

Capitalism caused a crisis (as it always does) and it required a response. However a response is not the same thing as 'control'.

The tools used merely blunt the effects - they do not dramatically alter the course (despite what the Economists claim) - this is why the attempts so far have not worked.

At the moment we're looking more like 1970's that 1930's - but that can all change if the cost of borrowing for Governments begins to rise before the growth comes. Not that it matters a great deal because in both scenarios the rich will make sure the poor pay (and for those who call themselves 'middle class' can count themselves as the poor in this instance - don't think you're going to be spared for your previous loyalty)

I think the difference of the 2 scenarios will be dictated by the new Middle Eastern currency due to be floated in a couple of years. If oil is priced in this currency then I expect world deflation, however if it's continued to be priced in Dollars (and the US don't look like letting up on the printing press) the inflation it will be (as the Arab nations demand more and more worthless dollars for their oil)

What is 100% certain is the outcome will not be afffected by the central banks or Governments of the capitalist nations - despite what they tell you.

Complain about this comment (Comment number 19)

Comment number 20.

At 17:28 23rd Dec 2010, Not Buzz Windrip wrote:15 Chamfort:

'I don't mind repeating the 1930s. It's the 1940s that worry me.'

30s. Of course, as long as you are not one of the 13 to 17 percent unemployed. I think you will find most of the people who expect to be in the 83 to 87 percent less affected will think this way also. That is after all the majority expectation. There is a flaw in this apporach however, you can be wrongsided.

Youth unemployment is currently circa 20 percent. The delivery mechanism supplies more youth every year. As the private sector is possibly (if not unlikley) to be unable to fill the public sector cuts it is a fair guess that youth unemployment is likley to rise with time. 25 percent looks a possibility if things do not go well. A reduction in tax revenues and a hostile borrowing environment and current HMG policy suggests public sector cuts will get higher not lower as no impact ahs been made on the deficit, let alone the debt.

Question. What impact will it have on youth who have acheived academically, which is all they are asked to do, who have invested in themselves, to be told as part of DCs Big Society they have to look forward to working for less than the minimum wage litter picking etc etc.

Complain about this comment (Comment number 20)

Comment number 21.

At 17:31 23rd Dec 2010, Not Buzz Windrip wrote:19 WOTW

There has not been any attempt to change course. The objective is containment at present. This is still firefighting.

Complain about this comment (Comment number 21)

Comment number 22.

At 17:41 23rd Dec 2010, common_man_123 wrote:Onward-ho #5

I would be interested in knowing your age because that is not how I remember the mid to late 70’s. Why do you think Thatcher was in for so long?

In 1977 got made redundant started another job for less money! Start of the 4 day week for many manufacturing companies. I was ok because I was salaried but for the average worker it was an extended weekend once a fortnight i.e. signing on for 2 days. Administrators representing the banks became common place on many a board. My first mortgage (just after Thatcher came in) was c9.5% interest! It took 4 or 5 years to bring this country back. (not everything that was done then would suite today, but it needed to be done at the time, just like today) So come on son get your facts and your timelines straight.

Complain about this comment (Comment number 22)

Comment number 23.

At 17:42 23rd Dec 2010, SleepyDormouse wrote:If we understand and know history, we do not have to repeat the mistakes of the past.

Its just a matter of learning the correct lessons from the 30s and 40s.

Policies that do not give people hope and encourage dispair I suggest are wrong now as they were in the 30s. It opens the door to extremism. We already can see the effects of that. Our leaders are following inappropriate and wrong economic ideas and theories, so please draw your own conclusions.

Complain about this comment (Comment number 23)

Comment number 24.

At 17:49 23rd Dec 2010, Dempster wrote:Ms Flanders wrote:

‘There are important differences between now and then - not least, the fact that, outside of the UK, prices are flat and even falling in many of the largest economies’

The conventional equation for inflation is:

Overall price level = Amount of money / Supply of all available items to purchase

So conventional wisdom suggests that for inflation to exist there must be either more money, or less things to purchase.

I post the following information from the Office for National Statistics (with apologies to Chris London):

Retail price index (RP02 all items):

Jan 2009 210.1

Oct 2010 225.8

Price inflation = + 7.5%

Average weekly wages (whole economy not seasonally adjusted):

Jan 2009 Average weekly earnings = £444

Oct 2010 Average weekly earnings = £442

Increase = – 0.005%

And from Credit Action:

Total UK personal debt (loans, mortgages and credit cards) increased by only 0.8% in the last twelve months.

If average earnings aren’t increasing

And

If ‘consumer’ aren't increasing their borrowing by much

And

If prices are generally flat outside the UK.

What’s causing inflation?

Is it because the international confidence in sterling is deteriorating due to quantitative easing?

Complain about this comment (Comment number 24)

Comment number 25.

At 17:50 23rd Dec 2010, foredeckdave wrote:Bloody empiricists! Can we just hang on a minute before we accept this argument.

Economics is a Social Science (despite its over-reliance upon mathematics). It may be a philosophy but it is not a mere outcome of mathematical models. Therefore before we start accepting Stephanie's argument let's look at the effects of the 1930s on the population of the UK.

As with all depressions, they are not uniform in either sector or geographically. Whilst the 'modern' ediffices of Western Avenue were being built and brought 'on stream' the number of soup kitchens in Birmingham, Liverpool, Manchester, Sheffield, Leeds, Newcastle, Glasgow and hundreds of other towns was increasing. If you reaslly want to think abour spare capacity then look at the numbers of unemployed during this period.

Yes, it was not the same as the US but the physical and social damage done was none the less.

Complain about this comment (Comment number 25)

Comment number 26.

At 18:18 23rd Dec 2010, virtualsilverlady wrote:Quite a complicated subject to tax any brain especially as it is neither like the 30's or the 70's.

This time it is a real one-off which is why no-one has yet come up with the right answers.

Or perhaps they have but they are just too unthinkable to contemplate.

Complain about this comment (Comment number 26)

Comment number 27.

At 18:18 23rd Dec 2010, hughesz wrote:Its interesting you choose stock market prices rather than unemployment ??

8% to 17% increase within 4 years is surely the more astonishing figure.

Complain about this comment (Comment number 27)

Comment number 28.

At 18:19 23rd Dec 2010, stanblogger wrote:Personally I think we worry far to much about inflation and deflation. After all the money and credit we use today has no intrinsic value.

The important thing is making sure that demand is such that it can maintain a reasonable level of economic activity. It must be better to keep the level of production up, than to deliberately depress it, merely in pursuit of some monetarist objective.

The Germans suffered hyperinflation in the late 1920s and had to create a new currency. But they recovered from recession in the 1930s relatively rapidly, aided by government expenditure on rearmament and public works and by government controls. In short, policies which today would be regarded as economic folly, actually worked quite well.

Complain about this comment (Comment number 28)

Comment number 29.

At 18:21 23rd Dec 2010, Sage_of_Cromerarrh wrote:You ask is it the 1930's or the 1970's, neither.

There is a mountain of debt public and private which didn't exist in either of the previous downturns.

Above all there is an energy and associated commodity supply and price problem so we won't be able to grow our way out of our downturn.

Complain about this comment (Comment number 29)

Comment number 30.

At 19:06 23rd Dec 2010, BluesBerry wrote:Pardon me for borrowing a little "Christmas Carol" (Dickens):

This girl is deflation; this boy is inflation.

Beware them both, but most of all beware this boy.

I was reading the Bank of England's December meeting minutes. From what I understand MPC is saying that that the risks to inflation in the UK have increased and are increasing.

One of the bank's officials, Mr Paul Fisher: “People must be aware that rates will gradually rise to 'normalised position' of 5% or 6%..."

Officials would like the current 0.5% base rate to rise to a normalised level 10 times as big. But it's the speed of which that requires monitoring.

Also there was an entry saying that banks would put interest rates up and then assess the impact.

Mr Fisher added that he didn't think a change of either 0.25% or 0.5% would make a big differnce, as in "trigger a recession".

It seems more that what banks will do is "trigger the mindset" of people as to their expectations in the future.

Apparently there was some consternation among MPC members that inflation rose again in November to 3.3%, but the majority of MPC members said they still believed that economic conditions “would bring inflation back in the target” (Whatever that means.).

Lastly I noted that the MPC members are talking about mortgage rates climbing to as much as 14% within two years.”

In the next few years:

Pardon me for borrowing a little "Christmas Carol" (Dickens):

This girl is deflation; this boy is inflation.

Beware them both, but most of all beware this boy.

Complain about this comment (Comment number 30)

Comment number 31.

At 19:10 23rd Dec 2010, Duxtungstu wrote:"There are important differences between now and then - not least, the fact that, outside of the UK, prices are flat and even falling in many of the largest economies."

I'm a little confused by this statement. Presumably you are referring to $US values? Or does "many of the largest economies" refer to Japan and USA?

Nevertheless, commodity prices seem to be holding up quite well "outside UK". Particularly items such as food and energy (and labour too):

https://www.bloomberg.com/markets/commodities/futures/

Are we looking at long term $US depreciation? China and Russia seem to think that may be so:

https://au.ibtimes.com/articles/85424/20101124/china-russia-drop-dollar.htm

And, despite delays, the Gulf states have almost certainly decided so too:

https://www.tradearabia.com/news/ECO_172803.html

So, where does that leave the choice between a 30's or a 70's scenario? I don't believe we have the luxury of thinking that we can make a choice between two events from 80 and 40 years ago, when the world was composed of a completely different political and economic environment. Surely, the answer is: it's neither.

Complain about this comment (Comment number 31)

Comment number 32.

At 19:24 23rd Dec 2010, The Itinerant ex-pat wrote:" The question now facing the Bank's monetary policy committee is whether they have done too good a job of avoiding America's fate in the 1930s..."

Is that a question they are required to address, Stephanie?

If the MPC is charged with running the economy as well as keeping CPI on target then they should be elected, not appointed.

Mervyn doesn't even have to write a letter if the economy doesn't grow or unemployment rises or the stock-market falls.

In any case, how many letters does Mervyn have to write before someone (who is elected) says "you're sacked!"

Not only have the MPC failed. They are now forecasting failure.

Perhaps they have proved that inflation has more to do with fiscal policy than they thought.

Complain about this comment (Comment number 32)

Comment number 33.

At 19:51 23rd Dec 2010, The Itinerant ex-pat wrote:" In the past two years the UK has applied the lessons it learned in the 1930s...."

Some people say (and my 91 year-old father-in-law is one of them) that if the men in grey suits had learned anything in the last 80 years then we would not be in this mess now.

Complain about this comment (Comment number 33)

Comment number 34.

At 20:52 23rd Dec 2010, Richard wrote:Comparisons with the crash of 1929 and subsequent depression of the 1930’s inevitably miss a key difference with today, namely that the supply of plentiful cheap low entropy net energy provided by oil that was available in the 1930’s is no longer available today. This fact is a game changer as far as macroeconomic and monetary policy is concerned, so comparisons with the past are unlikely to provide a reliable guide for the future. A good reality check is provided by Chris Martenson in these six short “You Tube” presentations. In particular the third presentation draws attention to the nature of the exponential function, with its true character unambiguously exposed in the example of the "magic eye dropper and Wembley Stadium", also the graphic entitled "The Energy Cliff - OIL" in presentation four illustrates the near term steep fall in net energy availability using newer sources of oil such as tar sands, shale, and deep water oil, that are touted as compensating for any decline in conventional oil production.

https://www.youtube.com/watch?v=msTW7D_rSm4&list=PLAFF8951B6CB05AC2&index=1&playnext=6

A good historic example of the impact of a decline in the availability of net energy (food and slaves in this case) is given in the article entitled "Entropy and Empire". This article is based on examining the role of Thermodynamics in the rise and fall of the Western Roman Empire and how a decline in the availability of low entropy fossil fuel based net energy may impact on today’s Globalised Industrial society.

https://canada.theoildrum.com/node/2381

This final article considers three economic scenarios that may arise with the gradual decline in low entropy net energy availability. Given the impossibility of continuing exponential growth on a planet with finite resources (scenario A), despite it being the most popular mainstream view, the real choice is really between scenarios B & C.

https://www.energybulletin.net/stories/2010-12-02/oil-and-economy-why-it-important-figure-out-approximately-where-we-are-headed

In common with every other species that has evolved into existence on this planet, humans have been engages in a continuous game with Nature, and the key [Thermodynamic] rules of this game can be expressed as:-

1) Humans cannot win

2) Humans cannot draw even

3) Humans can never leave the game

Given that we have been around for ~180,000 years, the currency of the game is clearly not monetary, but low entropy net energy. For all but the last few hundred years we have played the game within our annual energy income provided by low entropy electromagnetic radiation (sunlight). However, over the last 250 years we have become increasing reliant on a source of low entropy energy capital (coal, oil and natural gas) that nature has obligingly provide, unfortunately this ancient sunlight stored in the chemical energy of hydrogen-carbon bonds via equally ancient photosynthesis is finite, and is being rapidly depleted, so in answer to the question “Is it the 30s or the 70s?” the answer is “Neither, it’s the 21st century 10s”

Complain about this comment (Comment number 34)

Comment number 35.

At 21:01 23rd Dec 2010, AnotherEngineer wrote:8. At 2:28pm on 23 Dec 2010, SleepyDormouse wrote:

Its an excellent long time series. Please can you explain why you have doubts still.

I really would like to understand the veracity of any alternative view of modern day economics. As far as I can see, MMT probably has the basic structure correct for the way our macroeconomic system works.

It seems to me that this chap wants governments to print lots of money and spend it to create full employment. That is a perfectly valid viewpoint, but instead of saying that directly he has invented/revived a theory of money that requires him to say some very strange things. For example he explains how the tax receipts are paid into the government’s account at the central bank and then paid out to employees/suppliers etc. No dispute there, but he then says that taxation does not finance government expenditure! And invents all sorts of destroying and creating money operations. I did put quite a long list of this sort of nonsense in a previous post but cannot find it now.

It seems to me typical of these strange ideas like MMT, ‘all money is created as debt’, ‘banks create money by FRB’ that they require more and more outlandish statements like ‘debt can only be repaid by defaulting’ to keep the plates spinning.

Complain about this comment (Comment number 35)

Comment number 36.

At 21:22 23rd Dec 2010, bryhers wrote:Ms Flanders blog:

Ms Flanders blog comparing 30s and 70s lacks a historical context. There was a modest rise in "real GDP" in the UK,but much of this was the result of an improvements in the terms of trade between the UK and the rest of the world.In other words we gave less for more, so standards of living rose in the Uk while they fell in the primary producing countries.

Much of the modest increase in GDP,ie.the value of goods and services produced here,was accounted for by this imbalance.The rise in the actual production of goods and services in the UK was more modest than the increase of 18% of real GDP suggests.The figures for unemployment show this.Most of the 18% rise in real GDP was accounted for by the improvement in the terms of trade.We may have been depressed,but others were more so and sold their goods more cheaply to us than our exports to them.

The USA was more dependent on an internal market and less able to benefit from an improved ratio of exchange of industrial goods for raw materials.On the contrary,most of the raw materials we imported were produced internally in the USA, so lower world prices had a crippling effect on American domestic producers.In the depths of the depression,oil was selling for $5 a barrel in Louisiana and wheat and cotton was being burned to maintain prices.Deflation was the result.

Prices fell slightly in the UK in the thirties,no deflation but no inflation either.The problem with high inflation is it transfers purchasing power from consumers to governments and corporations.

In the 7s this was reflected in so-called staglation,weak growth combined with rapidly rising prices as pay demands fell behind price increases creating an inflationary spiral.What the next decade showed is you can deflate demand without lowering prices as rigidities in corporate pricing produced spikes through the eighties.

Complain about this comment (Comment number 36)

Comment number 37.

At 21:30 23rd Dec 2010, SleepyDormouse wrote:35. At 9:01pm on 23 Dec 2010, AnotherEngineer wrote:

--------------------------------------------------------

Many thanks for your interesting response. I now understand, I think, where you are coming from. I just wonder if my original point and follow-up response to you have ended up with us being at cross purposes.

My initial post concerned a graph sourced from the FT and produced by Gavyn Davies. It seems to me to be a highly relevant demonstration of an accounting identity.

[See

https://pragcap.com/sectoral-balances-and-the-united-states ]

I went on to comment

"It is well worth looking at and will only take a couple of minutes to read. It shows the relationship between the government and non government sectors for the US. I wish the UK ONS would publish data in this form [If they do, I have yet to find it].

In the UK, the government policy is to reduce the deficit, [and many would like to see it actually go into surplus]. This graph shows what will happen. The non-government sector will have to reduce its net saving; debt will not be paid of and industry will go into into decline and recession. The only way for us in the non-government sector to reduce our debt is if the government runs a deficit. As exports are unlikely to exceed imports, there is nowhere else for the money to come from.

This is a matter of simple accounting. Its not up for debate."

This identity is used within MMT ideas and theory, but I suggest it is is outside MMT. It is basic accounting at a macro-economic level.

I now see that your doubts seem to centre on anything to do with MMT, including this accounting identity.

I wonder if we can divorce the identity from MMT and agree that the identity is true?

I then went on to suggest conclusions that can be drawn, in my view, from this graph published by Gavyn Davies. Perhaps foolishly, I have linked this to MMT. As you may see from my response at #8 I am searching for evidence to support or falsify MMT. I appreciate your doubts about MMT and as yet have found insufficient to support a discussion here.

I would point out that Prof Mitchell is not a lone voice; there are other academics who support the views within MMT. They could all be wrong and mis-guided, but I doubt it. As the ideas within mainstream economics are not producing a better life for so many in Greece, Ireland and many other places around the world, I suggest that these ideas fail to meet the criteria of being proven. In fact, I believe they are wrong; far more wrong than the ideas within MMT, which do seem to me to have some practical evidence to back them up.

Complain about this comment (Comment number 37)

Comment number 38.

At 21:32 23rd Dec 2010, Mike3 wrote:So has the BoE/MPC chosen stagflation over stagnation?

Errrr, monetary policy can keep uk above 3% CPI, or could have kept uk below 1% CPI, but for some reason there is no monetary policy route to be between the two?

Complain about this comment (Comment number 38)

Comment number 39.

At 21:35 23rd Dec 2010, EmKay wrote:3. At 2:02pm on 23 Dec 2010, SleepyDormouse wrote:

From another blog, I was pointed at this website.

https://pragcap.com/sectoral-balances-and-the-united-states

It is well worth looking at and will only take a couple of minutes to read. It shows the relationship between the government and non government sectors for the US. I wish the UK ONS would publish data in this form [If they do, I have yet to find it].

In the UK, the government policy is to reduce the deficit, [and many would like to see it actually go into surplus]. This graph shows what will happen. The non-government sector will have to reduce its net saving; debt will not be paid of and industry will go into into decline and recession. The only way for us in the non-government sector to reduce our debt is if the government runs a deficit. As exports are unlikely to exceed imports, there is nowhere else for the money to come from.

+++

Sleepy - what about the level of existing corporate profits?

From the ONS website:-

The overall profitability of UK private non-financial corporations in the second quarter of 2010 was 11.6 per cent, higher than the revised estimate of 11.0 per cent recorded in the previous quarter. Annually, the average net rate of return in 2009 was 11.5 per cent, compared with the 2008 estimate of 14.3 per cent.

The net annual rates of return on investment within the services and manufacturing sectors have settled into a fairly stable picture over the course of this decade. The quarterly rates of return show more variability due to the nature of the data and process used to produce the latest estimates. Services industries are averaging a net annual return of around 16 per cent against the capital employed. Manufacturing industries, which tend to be more capital intensive, have averaged a net annual return of around 10 per cent against the capital employed.

Now I am afraid that I think the Uk private sector need to take a larger share of the burden - remember that many equity holders get dividends and these will tend to be concentrated in pension funds and private wealth so it seems slightly unfair that the public sector debt should have to increase and there are ways of tapping off money (higher tax on dividends for example) that wont actually affect profitability.

Complain about this comment (Comment number 39)

Comment number 40.

At 21:46 23rd Dec 2010, EmKay wrote:39. At 9:35pm on 23 Dec 2010, you wrote:

3. At 2:02pm on 23 Dec 2010, SleepyDormouse wrote:

From another blog, I was pointed at this website.

https://pragcap.com/sectoral-balances-and-the-united-states

++++

Sleepy - another matter. Government debt at the moment is provided by the 'markets' who demand a return. Now some of these debt holders are other governments but others are in the PRIVATE sector. therefore there is a transfer of wealth from the public to the private sector. When the private sector borrows, it also does so from the .. PRIVATE sector so there is no levelling out of the imbalance. Therefore it actually makes more sense for a government to run no deficit on average than the whopping huge one we have.

Now the other view is that of course the government should just print the money as it needs it but my only problem with this is give a politician some means to dole out lots of projects amongst their own constituents and .. they will (look at Labour ramping up the public sector numbers - now this looks like creating a whole new constituency of their own. I am astonished they never actually got a working majority)

Complain about this comment (Comment number 40)

Comment number 41.

At 21:55 23rd Dec 2010, SleepyDormouse wrote:39. At 9:35pm on 23 Dec 2010, EmKay wrote:

The graph that is at the reference I posted, is at a higher macro economic level than the points you are making. I can agree that it would be good to see industry taking a higher proportion of the burden. You make some good and useful points.

The point is that, if as a whole, the non-government sector is not wanting/willing to spend and prefers to net save, then the only other source of money in our economy comes from the government's spending. [paying off debt counts as saving for this]. I am assuming we continue with our net import bill at an approximately constant level. For the economy to recover and allow the debt to be paid-off, the government must spend and run a deficit; [unless we can export a lot more than we import]. If it doesn't, we will face a decline, and possibly a recession. Companies will go bankrupt and banks losses will mount, creating further trouble for the government and require an even higher level of bailout. If this happens, we can expect the confidence globally in the UK economy to decline and the pound to fall, thus importing inflation. We enter the world of stagflation again. It would surely be better to run a deficit for a time , allowing non-government debt to be reduced and our economy to be larger and healthier. This can only be achieved with a budget deficit sufficient to take up the slack in the economy.

I am suggesting this based solely on looking at and interpreting the meaning of the graph. It has nothing to do with my views about the potential value of MMT as suggested by AnotherEngineer, with whom there is an on-going discussion.

Complain about this comment (Comment number 41)

Comment number 42.

At 21:56 23rd Dec 2010, ARHReading wrote:# 5 - That's a very strange analysis of the 1970s. The Heath government attempted the 'dash for growth' approach and was largely undone by trade imbalances and inflation. At the end of this period came the significant hike in oil prices. The Wilson government went as close as any to bankrupting the country until brought into line by the IMF. The Thatcher government applied Friedman economics having recognised that governments cause inflation by increasing the money supply and brought more discipline to economic policy and passed a relatively strong economy to the Blair/Brown brigade.

Complain about this comment (Comment number 42)

Comment number 43.

At 21:56 23rd Dec 2010, EmKay wrote:38. At 9:32pm on 23 Dec 2010, Mike3 wrote:

So has the BoE/MPC chosen stagflation over stagnation?

Errrr, monetary policy can keep uk above 3% CPI, or could have kept uk below 1% CPI, but for some reason there is no monetary policy route to be between the two?

+++

Mike, I personally think that the BOE has implicitly expanded their remit to include trying to keep the economy on as even a keel as possible for the following reasons:-

1. Banks - the banks have massive liabilities to property (particularly the 'nationalised' ones). to incresase interest rates at the moment would mean massive defaults and losses. People like John from Hendon say this would be a good thing. Logically it might but politically it would be devastating.

2. Household budgets- low interest rates are keeping costs of household debts lower than they would be (particularly mortgages) than if interest rates were 5%. Again - massive default and losses or, if it is allowed to run on then those mortgage debts are reducing and so are the liabilities.

3. Debt - high inflation eats away the real value of debt but it also eats away at the real value of savings. This is a way of 'resetting' things. Consequences is that things are going to get more expensive but I think in the long term it might lead to us bringing back more food production and manufacturing into the UK.

4. Political - if the top dogs wanted the BOe to stick to their inflation only policy I have no doubts they would enforce it. Why don't they - because they want the advantages given above but they can say 'its not our remit - its the BOE'. For a politician this is the best of all possible worlds:- advantages with no responsibility.

Just a few thoughts for you.

Complain about this comment (Comment number 43)

Comment number 44.

At 22:07 23rd Dec 2010, EmKay wrote:41. At 9:55pm on 23 Dec 2010, SleepyDormouse wrote:

39. At 9:35pm on 23 Dec 2010, EmKay wrote:

+++++

Following on from your points:

The problem we have is that our total public sector debt has ballooned out of control - even during the times of record tax receipts under labour the deficit continued under the pretext of "we have eliminated boom and bust" - ha ha! when what they were doing was creating an artificial boom using debt. Remember that private sector profits tend to concentrate wealth so a transfer of money from state to private sector will amplify this effect. Note that I am not at all against the private sector - I am actually an ardent supporter - but societally I think that the burden has shifted too far away from the government (think massive bail outs of banks etc).

As for you wishing to disprove MMT the only thing I would say is that when I hear the word 'theory' in an economics context I am immediately worried. Theories are simplified versions of the real world and work well in many situations. When the ASSUMPTIONS of those theories are no longer valid then if fails but past successes can create a lot of inertia in believing it cant be so.

Complain about this comment (Comment number 44)

Comment number 45.

At 22:09 23rd Dec 2010, Suav wrote:34. At 8:52pm on 23 Dec 2010, Richard wrote:

...Given that we have been around for ~180,000 years, the currency of the game is clearly not monetary, but low entropy net energy. For all but the last few hundred years we have played the game within our annual energy income provided by low entropy electromagnetic radiation (sunlight). However, over the last 250 years we have become increasing reliant on a source of low entropy energy capital (coal, oil and natural gas) that nature has obligingly provide, unfortunately this ancient sunlight stored in the chemical energy of hydrogen-carbon bonds via equally ancient photosynthesis is finite, and is being rapidly depleted, so in answer to the question “Is it the 30s or the 70s?” the answer is “Neither, it’s the 21st century 10s”

_________________________________________________________________________

Richard, we are using about 1/7000 of the energy current supplied to us by the sun! There are ideas, there certainly might be technologies. The Gulf countries are favourably placed to use solar as a step by step addition to their energy mix and as soon as they find it economically viable they will. Peak oil is a good pretext to tweak a balance of power but certainly not a reason!. Even if we look at biomass produced yearly on the planet it is around 6 times our energy consumption. We've chosen what probably is the most capital and labour intensive - wind power, which we would be forced to quit when the real need arises. On the other hand inertia of huge social system like our globe might play a bad joke. We all know, that communal transport can be developed to the level of convenience surpassing motoring and at a fraction of motoring long drawn costs. We all know that people can be educated much more effectively and cheaply; that shift from curing to preventing diseases, that... We also know, that many projects can not be resolved because of a short term competitive disadvantage (I call it a middle class curse - they (we?) have to short a time horizon to be persuaded - in this context China is being forcibly equalized to the lowest common denominator - I won't be surprised if they have their (Green?) Tea Party in 5 years time). Some of us here seem to be so indecently smug about our ability to play it all to our advantage. So, yes, in a long run...

Complain about this comment (Comment number 45)

Comment number 46.

At 22:11 23rd Dec 2010, sandy winder wrote:5#

"THE BIGGEST LESSONs OF THE 1970S are that Heath under the Tories wrecked the economy and inflation came in with a bang, , Wilson inherited a mess, Callaghan and Healey sorted it out, then Thatcher wrecked it with a whopping VAT rise , public sector cuts and a tripling of unemployment, massive inflation again and divided the nation and made poor people feel like scumbags ......sound familiar?

The Liberals were bonkers then and now too."

The left are very good at rewriting history. They even try to rewrite the present as well. For example by blaming the recent riots on the police even though the riots were caused by the left wing long before the kettling began.

It is not the Liberals or Tories who are bonkers but the people who support a party that has already wrecked the British economy twice in the last 40 years. Or was the dismal failure of the last 13 years of government also the fault of the Tories? We can be sure no blame will ever be attached by the left to Labour or Gordon Brown, the man who once openly encouraged banks to lend to poor people, while at the same time forcing up house prices so they were bound to struggle.

Complain about this comment (Comment number 46)

Comment number 47.

At 22:27 23rd Dec 2010, EmKay wrote:41. At 9:55pm on 23 Dec 2010, SleepyDormouse wrote:

39. At 9:35pm on 23 Dec 2010, EmKay wrote:

"It would surely be better to run a deficit for a time , allowing non-government debt to be reduced and our economy to be larger and healthier."

Current government plans plan to reduce the deficit to zero only by 2015-2016. Is that long enough? I belive the debt will be approx £1.3 trillion by that point and interest payments will be approx £70bn per year.

P.S its nice to have an intelligent debate with someone who doesn't get all stroppy.

Complain about this comment (Comment number 47)

Comment number 48.

At 22:29 23rd Dec 2010, foredeckdave wrote:#42 ARHReading,

"The Thatcher government applied Friedman economics having recognised that governments cause inflation by increasing the money supply and brought more discipline to economic policy and passed a relatively strong economy to the Blair/Brown brigade."

Only a Thatcherite could make such a statement. It is I'm afraid erroneous. More damage was done to the British economy in the Thatcher years and the following Major maladministration. The fundementals of the economy were ripped apart and replaced by the sham of the financial services bubble. Whilst you were glorying in your M1 - M4 nonesense as economic discipline the essence of our ability tp perform economically was waving us goodbye.

Complain about this comment (Comment number 48)

Comment number 49.

At 22:33 23rd Dec 2010, SleepyDormouse wrote:40. At 9:46pm on 23 Dec 2010, EmKay wrote:

“Sleepy - another matter. Government debt at the moment is provided by the 'markets' who demand a return. Now some of these debt holders are other governments but others are in the PRIVATE sector. therefore there is a transfer of wealth from the public to the private sector. When the private sector borrows, it also does so from the .. PRIVATE sector so there is no levelling out of the imbalance. Therefore it actually makes more sense for a government to run no deficit on average than the whopping huge one we have.

Now the other view is that of course the government should just print the money as it needs it but my only problem with this is give a politician some means to dole out lots of projects amongst their own constituents and .. they will (look at Labour ramping up the public sector numbers - now this looks like creating a whole new constituency of their own. I am astonished they never actually got a working majority) “

= = = =

I think you are opening up the centre of the can of worms in the discussion with AnotherEngineer. I am new to economics and am struggling to understand the subject. Everything I look at seems mired in alternate views/theories etc. I can see little consistency anywhere and much that is written about as research would not stand up to the tests that a physics, chemistry or biology paper would normally be subjected to.

Having said all that, I am attracted to the ideas expressed within the general MMT research area as it does seem at its heart to have some basis in reality. It does have problems, but first, it is important not to equate the economics and rules of the home or non-government sector with the rules that apply to the government sector. You and I have to earn first and we can then spend. We can save to allow for greater spending in the future or we can go into debt to spend more now and less in the future. However, for the government, its different. They can spend what they like each and every day. They spend and this provides the money to the non-government sector. As we spend it, they tax it away. After a number of transactions there is none of any single government inspired spend left in the economy. If the government doesn't keep spending we all get poorer as we still have to pay taxes. The accounting identity shown by that graph is remorseless in its effect. A balanced budget or one in surplus will be for an economy where the non-government sector is flat or going to decline. The non-government sector has to pay back its debt. If the government used debt free money it doesn't have to pay anyone back, but there are problems as you say.

There is a lot written about fractional reserve banking and the power of banks to create money, very large amounts. They have a credit-worthy client who wishes to borrow, so they lend and then worry about reserves and deposits. But the point is this transaction creates an asset and a liability. When the debt is repaid, the asset is extinguished. To show increasing assets [sounds good doesn't it] the banks have to keep lending more and more] Government spending can be different; there is nothing extinguished if they just create the money as they have a perfect right to do.

The problem as I see it is that no-one trusts a government not to overspend and create inflation. I can understand this and share the doubts. The maximum amount the government should spend is set by the productive capacity of our economy. At the moment we have so many un- and under-employed that we are far from working at full capacity. No-one has yet devised a control mechanism as far as I am aware that will be trusted by anyone, least of all the markets.

When the government borrows, a lot of the money comes from pension funds etc. The interest paid then funds private sector pensions etc. Its a huge subsidy and vital to the financial industry. To show this consider in Australia that they were running a surplus for a number of years; they had no need to issue debt, but their finance industry effectively forced them to. Why?, - they needed the risk free interest payouts to support their financial products.

I know I haven't answered you completely, but perhaps there is something here for you to wonder about …....

Complain about this comment (Comment number 49)

Comment number 50.

At 22:49 23rd Dec 2010, SleepyDormouse wrote:44. At 10:07pm on 23 Dec 2010, EmKay wrote:

47. At 10:27pm on 23 Dec 2010, EmKay wrote:

----------------------------------

Points a bit at random...

23% of our debt is now 'owned' by the BoE and the interest payments made to the BoE go straight back to the treasury. This is money spent from QE I assume. Being frivlous, if we bought back all our debt we could have a high debt and income to match at the same time ..... ????

More seriously, it is the size of the non-government sectors debt that needs to be reduced first. It can be no other way. If the government doesn't spend first and continue to spend there will beno work in industry, the debt won't be paid, individuals/companies go bankrupt and then banks get into trouble and they have to be bailed out and the money comes from the government anyway. So why not support the economy and allow it all to unwind. I reckon it might take 20-30 years; given sensible policies, it could be 10 years but these are wet finger estimates.

Theories and economics. an unholy alliance. Mainstream economics huses amny ideas etc associted with the time of convertible currencies, and some date back to the gold standard era. They all need to be swept away and something new developed. MMT has done the sweeping away. I'm just not sure about some of the ideas they are now using.

Have you seen the 'Secret of Oz' https://www.youtube.com/watch?v=U71-KsDArFM

Its nearly 2hrs long but worth it. Its all about debt free money. You'll understand the reference to the Oz after 5-10 minutes. Ignore the adverts and the rubbish singing at the beginning. In my mind it gives credence to the MMT ideas. Take too long to write it all down here.

The Tories fail to understand the vital point of governement spending. No government spending = no economy. They also don't understand that spending=income but I agree, we have a lot to laugh at in the statements made by past politicians.

Complain about this comment (Comment number 50)

Comment number 51.

At 22:57 23rd Dec 2010, EmKay wrote:49. At 10:33pm on 23 Dec 2010, SleepyDormouse wrote:

40. At 9:46pm on 23 Dec 2010, EmKay wrote:

+++

I think you have hit the nail on the head when you talk about "debt free money". Currently our debt is not "free" and when your existing debt has to be repaid the private sector has got more money out than it put in.

In regards to your government money expenditure this is not really the case - the government money does get spent but lots of it flies out of the country via basic mechanisms (multinational companies charging management charges etc). The only way to make this the case IMHO would be to have a centrally planned economy with absolute controls on capital outflows and inflows. I would suggest that this wouldn't work - China has managed it only by becoming the workshop of the world and effectively importing the effects of pollution etc. I don't think I want to live in that type of world and if the world came to a way of balancing imports and exports so we all lived within our means then I would be very happy, even if it meant fewer gadgets and toys.

Complain about this comment (Comment number 51)

Comment number 52.

At 23:08 23rd Dec 2010, AParakh wrote:UK did better than USA in 1930s because, UK had colonies till 1947 including India, USA had no colonies to exploit then. Now UK has no colonies and very little North Sea Oil, I doubt UK can emulate its performance of 1930s. It will have difficult times and is unlikely to match USA.

Complain about this comment (Comment number 52)

Comment number 53.

At 23:08 23rd Dec 2010, Richard Dingle wrote:25. At 5:50pm on 23 Dec 2010, foredeckdave wrote:

Yes, it was not the same as the US but the physical and social damage done was none the less.

Indeed you are not wrong.

But why and has anything changed since.

You might like to look at the class system then and now.

There were probably Tory politicians in the 20s and 30s who had a favourite catch phrase.

It goes like this...'were all init together' (when they meant the opposite, just as now).

Complain about this comment (Comment number 53)

Comment number 54.

At 23:17 23rd Dec 2010, SleepyDormouse wrote:51. At 10:57pm on 23 Dec 2010, EmKay wrote:

---------------------------

I would abhor the type of world you suggest too. So agree absolutely there, but not sure I agree with the conclusion you reach from your statement "In regards to your government money expenditure this is not really the case - the government money does get spent but lots of it flies out of the country via basic mechanisms (multinational companies charging management charges etc). "

The external sector you are concerned about is covered in the graph as exports/imports.

Money goes out of the country - yes. But its just that £s that can only be spent in the UK, in return we get goods and services that we want that add to the quality of our life here in UK. Why spend £50 on a bedpan when I can import one for £5? The exporting country has our pounds in return and they are taking the risk as to whether or not it will hold its value or go down the pan. Quality of life in UK improved, they just have paper ......

If we had debt free money as I believe we could, we'd be far better off.

Complain about this comment (Comment number 54)

Comment number 55.

At 23:21 23rd Dec 2010, Hacky The Hufrex wrote:The article is "begging the question" however if I raise some real questions then I'll be ruled off topic so I'm in "catch 22", which takes me from a logical fallacy to a paradox.

I agree with a lot of the posts who argue that focussing on inflation/deflation does not address many of the key economic issues of the our time, especially energy but also technology, unemployment/capacity/productivity and social justice. The technology question hasn't been addressed. The pace of technological change will continue to grow rapidly for the forseeable future. This can generate benign deflation as technological improvements reduce cost and improve productivity, however, in the past technology has increased energy consumption so there's a risk that technology will collide with the energy crunch. The circumstances of our time are therefore quite unique.

Complain about this comment (Comment number 55)

Comment number 56.

At 23:32 23rd Dec 2010, SleepyDormouse wrote:to EmKay from Sleepy:

I'm not sure if your stll out there, but I'm away to bed now.

Thanks for the discussion, I enjoyed it.

Complain about this comment (Comment number 56)

Comment number 57.

At 23:41 23rd Dec 2010, John_from_Hendon wrote:Stephanie wrote:

"In the past two years the UK has applied the lessons it learned in the 1930s"

No they have not - they have applied a very selective sub-set of the lessons!

There is one very basic lesson of the 1920s/1930s that has been totally ignored and that is the need to first deflate the debt bubble BEFORE trying to get the economy going again. This is critical and what is more because this has been ignored all policy initiatives will fail and we are starting on a long depression.

Further the lessons of the Long Depression of the 1870s have been totally ignored. The once conclusion one can draw from the 1870s Depression that matters and is crucial to today is that property based secured debt bubbles take ages to unwind - but they must be unwound/ deflated before a real recovery can get going no matter what policy initiatives are taken. By the way there were 11 Chancellors of the Exchequer during the Long Depression (1873-1896) with an average time in office just a couple of years. [Lowe, Gladstone, Northcote, Gladstone, Childers, Beach, Harcourt, Churchill, Goschen, Harcourt and Beach.]

The third lesson that is being ignored is of the direct effects of monetary policy of all other policies (fiscal and macroeconomic). When money is too cheap all policy initiatives that are intermediated through money are doomed to failure- until base rate is five to ten times higher all policy initiatives to reflate the economy will fail. ( I have previously argued this in detail and I will not do so again here.)

To say that the lessons are being applied is, I believe I have shown, to substantially misrepresent the situation.

Complain about this comment (Comment number 57)

Comment number 58.

At 23:55 23rd Dec 2010, foredeckdave wrote:#55 Hacky The Hufrex,

All of the strategic indicators suggest that we are on the cusp of a major technological change ( I have set these out before so I won't here - unless asked). Whilst I cannot identify when these developments will take place I feel fairly confident that it will be power oriented as power has historically been the harbinger of further developments.

Complain about this comment (Comment number 58)

Comment number 59.

At 00:15 24th Dec 2010, splendidhashbrowns wrote:Evening Stephanie,

well you do like to write (or draw attention to) controversial blogs don't you?

"Why this trip down Memory Lane? Because the most important reason the UK avoided a US-style fall in output in the early 1930s was that it avoided lasting deflation."

Could you compare and contrast that statement with Japan who have suffered deflation for the last 20 years? The populace of Japan seem quite happy to buy goods and food at cheaper prices than they were yesterday! So what's not to like?

It seems to me as a non-economist that economic theory is bunk put forward by well-meaning charlatans who do not have to suffer any consequences if they are wrong-just like politicians really.

I'll give you a simple conundrum. If we cannot balance our imports and our exports then the only growth in GDP comes from increased consumer spending. If consumers spend more and we do not manufacture the goods, then imports will increase still further and this is current economic policy.

This is fine for the USA who have run a trade deficit for 50 years but is it appropriate for UK? I think not.

Even the great (so-called) economics expert on the great depression Mr (helicopter) Ben Bernanke is making a huge horlicks of American Government monetary policy which is being masked by the feel-good factor of rising stock prices and increasing unemployment. The American experiment to devalue the dollar to pay down their effective debts can only logically result in one outcome-WAR. Now that the Republicans are back in the driving seat, I predict that we will see another major war taking place with an opponent to American post war dominance, maybe as soon as 2011 (god forbid). It is unfortunate that the UK has tied itself to American foreign policy and we will be swept along with their hegemony.

As for your other assertion that "There are important differences between now and then - not least, the fact that, outside of the UK, prices are flat and even falling in many of the largest economies.", I would like to know the basis for that statement. From where I sit there is huge food price inflation in China and India, Russia has banned exports of wheat to control prices, commodities like wheat and corn have doubled in price this year (which will affect everything you buy in 2011), crude oil has reached a state of backwardation which affects all transport and energy suppliers, not to mention cotton or copper.

I'm sorry, Stephanie, I don't see the global picture as you do and I spend many hours trying to make sense of it all and its likely effects.

Perhaps I will comment further when you have had a chance to make a future blog on commodity prices.

I think 2011 will be the beginning of the end for western economies, oh and have a happy Christmas everyone!

Complain about this comment (Comment number 59)

Comment number 60.

At 00:27 24th Dec 2010, common_man_123 wrote:Looking back at yesterday offers solutions TOWARDS tomorrow.

Which is why I believe examining the 30’s and 70’s makes sound judgement. Yes there are differences but there are also similarities. The wise use both and base them around today to formulate plans for tomorrow.

From my readings I concur with many that the crashes of the 30’s and today where ‘banker’ driven (money being more important than people). I can also see connections between the 70’s and today in that there are uncontrollable external factors. There is IMHO something that links all 3 and that is loss of hope!

I broadly agree with what the government is doing, and in their attempt to bring everyone into the game. But as we know the 30’s ended with everyone coming together in War. The 70’s had different coming together’s, live aid, Falklands. At present the ‘we are init together’ is ineffective and god knows we don’t need another war (we are already in one which was ineffective for the last government). The present government need to be seen to have actioned a deed. I thought it was going to be through VC but it seem that the gutter press have different views and are hell bent in looking after their paymasters, if it is not this then they are doing it for their own gratification and although I do not follow a religion I believe they have broken a couple of the ten.

You can talk all about micro and macroeconomics and what make this or that rise or fall but until there is a coming together none of this matters. Just like the 30’s and 70’s (40’s and 80’s)

Complain about this comment (Comment number 60)

Comment number 61.

At 00:29 24th Dec 2010, BobRocket wrote:Stephanie,

you know full well it is the long depression from the 18watsits, ask John from Hendon, he knows.

#3 SleepyDormouse

loved your link, the graph maps my life completely, I'm the dotted blue line, started poor in 61 and got progressivly poorer.

The little spikes in 73 and 75 was when we got lucky in the candle stubb business, then the power workers went back and the boom was over.

79 to 84 wasn't too bad, plenty of income at the edges if you know where to look and then everyone got bored of recession and went back to work and the rot set back in.

Black Monday turned it round and Black Wednesday was sweet tea and shoes all round.

Then some sensible blokes got in and things started the long slide down, 'will it never end' was the fear.

But fear not, those guys messed up big style in 2007, 'you've never had it so good' isn't the half of it, I knew my time would come and this is it.

Let the good times roll

Merry Xmas ? It Is Now.

:)

Complain about this comment (Comment number 61)

Comment number 62.

At 00:39 24th Dec 2010, ishkandar wrote:#9 >>As I say, I am surprised that these factrors haven't been stressed. But formal economic methods do seem to miss out critical aspects of the world economy, don't they?

As was said of the old British Army and its generals, so it will apply to the current crop of economists - They are very well prepared to fight the previous war !! The economists are applying theories that would have been successful against the previous recessions but are, probably, lethal in the current one !!

Complain about this comment (Comment number 62)

Comment number 63.

At 01:07 24th Dec 2010, ishkandar wrote:#20 >>Question. What impact will it have on youth who have acheived academically, which is all they are asked to do, who have invested in themselves, to be told as part of DCs Big Society they have to look forward to working for less than the minimum wage litter picking etc etc.

Wrong question !! The REAL question is - Who will employ the unemployable graduates ?? The current education "system" has been so politicised in the name of political correctness that it is churning out graduates that the employers don't need. Meanwhile, employers are crying out for graduates that they need but cannot get - e.g. engineers, accountants, lawyers, scientists, etc.

Therefore, it is not the NUMBER of graduates that is the problem but the TYPE and QUALITY of graduates that matter !!

India pours out half a million engineers each year and are still crying out for more. Similiarly for China. Where will the next generation of British engineers come from when the education system had failed them ?? Who will manage and operate the much-trumpeted new industries that are supposed to take us out of the recession if there are not enough of the the right kind of graduates ?? Medjia Studies and Surfing graduates are not the most suitable candidates to captain the new industries !!

Complain about this comment (Comment number 63)

Comment number 64.

At 01:42 24th Dec 2010, ishkandar wrote:#46 >>We can be sure no blame will ever be attached by the left to Labour or Gordon Brown, the man who once openly encouraged banks to lend to poor people, while at the same time forcing up house prices so they were bound to struggle.

What ?? Blame Gordon Brown ?? Impossible !! After all, he SAVED the world !!

Complain about this comment (Comment number 64)

Comment number 65.

At 01:55 24th Dec 2010, Justin150 wrote:WOTW wrote "I think the difference of the 2 scenarios will be dictated by the new Middle Eastern currency due to be floated in a couple of years."

I am intrigued what new Middle Eastern currency? I know the IMF proposed about 7 or 8 years ago that the middle east would have an economic union (similar to EU) by 2005 (not happened yet so running a bit late) and a single currency by 2010 (No sign of it so far)

If it were not for some fundamental religious differences there is a reasonable case for saying that a middle eastern single currency might work well - after all most of the countries all speak the same language and have a broadly similar social and legal system which the EU does not

I have seen a few references to this new currency but it does seem to be stuck in limbo

Complain about this comment (Comment number 65)

Comment number 66.

At 01:56 24th Dec 2010, ishkandar wrote:#52 >>UK did better than USA in 1930s because, UK had colonies till 1947 including India, USA had no colonies to exploit then.