Weighing the risks

I just asked Danny Alexander what the government would do if Mr Osborne - and the governor of the Bank of England, and all those bond market vigilantes who wanted to see this kind of attack on the deficit - if all those people turned out to be wrong. What would he do if the economy responded as Japan's did to an increase in consumption taxes, years after its financial crisis?

Surprise surprise, I didn't get an answer: Mr Alexander stuck to his conviction that it would be even riskier to the recovery to delay.

Mr Darling used to say that any unexpected improvement in the public finances would be channelled into reducing the deficit. There was no corresponding promise from Mr Osborne today, saying that he would use any good news on borrowing to cut spending less - or take back the rise in VAT.

But speaking to us, the chief secretary did not deny that the new OBR forecasts in the Budget show growth a bit weaker in 2010, and unemployment about 100,000 higher.

As I said in last night's post, it's difficult to draw straight conclusions from the revisions in the forecasts because last week's predictions, in effect, incorporated assumptions about interest rates which might not have panned out if Labour had won the election. We'll never know.

However, very few people would argue that tightening on this scale would NOT affect growth, at least in the short run. That is probably why Mr Alexander didn't quibble with the figures I put to him.

It is also quite clear, from the forecasts in the Budget book, that the economy will now be operating with spare capacity for longer than we thought - in the parlance, there will still be a positive output gap in 2014-15 because the recovery, over this period, is expected to be a bit weaker than we thought.

Interestingly, that means that cyclical borrowing - the borrowing due to slower growth - has actually gone up in this red book, by £9bn a year in 2014-15, even as Mr Osborne has cut spending or raised taxes by £37bn. Expect Labour to make much of that figure - and don't expect them to put in the crucial caveats.

The government view is that all the short-term pain - economic and political - will be worth the long-term gain, in Britain's credibility with the markets and possibly its long-term potential growth. So, presumably, does Mervyn King. But Mr Darling isn't the only one who worries about the economic consequences of tightening policy on this scale. We have all to hope that they are all wrong - and Mr Osborne is right.

Update, 08:30, 23 June: Almost every page of the Budget book [2.73MB PDF] has information on it that on any other day would be a front page story. Heaven knows when any of us will have time to read them all. But if you've only got time for two, here are the two charts I'd pick:

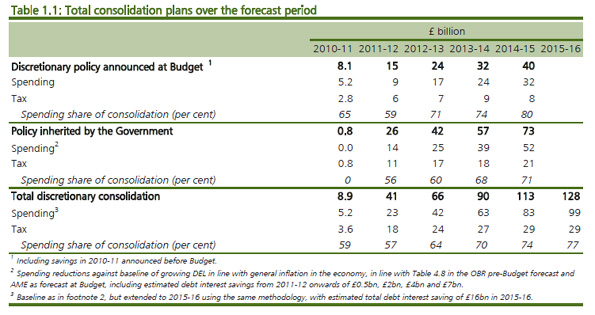

The first is on page 15. It shows how far the chancellor has had to stray from his desired 4:1 ratio of spending cuts to tax rises, especially in the first few years of this Parliament.

True, he has stuck to a nearly 4:1 ratio for the new measures introduced today. But as we know, that is not the half of it, because you have also to include all the measures previously announced by Mr Darling.

When those are taken into account, spending accounts for only 57% of the tightening in 2011-12, and 64% in 2012-13. The number only gets up to 77% in 2015-16, as a result of (presumed) further spending cuts in that year which will not be part of the autumn review.

As Robert Chote has concluded, the government seems to have looked at the implications of sticking to 80% spending cuts in filling the slightly larger structural hole identified by the OBR last week and decided it couldn't be done. Bad though it will be for Whitehall in the next few years, departments can console themselves that it could have been even worse.

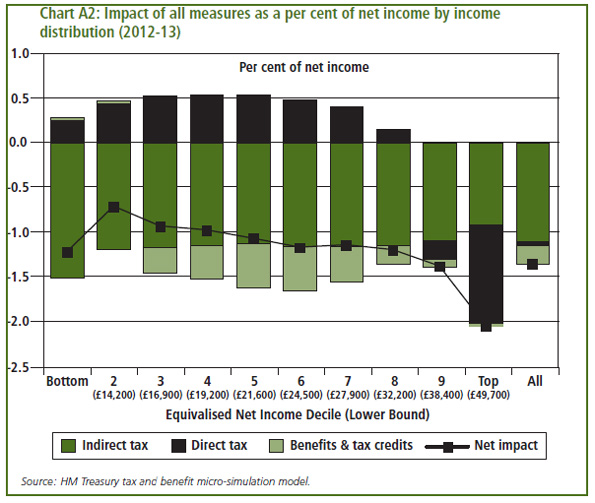

The second chart is on page 67, and shows the impact of the measures announced by Mr Osborne on different parts of the population, as a share of income. This supports the chancellor's claim that the pain is being evenly spread - and the richest are paying most.

However, as many have pointed out, the chart cannot and does not include the impact of spending cuts, which will tend to fall heaviest on poorer households and regions. And there is an even more obvious point to make about this table - which is that the bottom decile may not be suffering the biggest relative hit to income, but they are still taking a larger hit than almost any other group.

As a share of income, the highest earners will pay the most. But because the charts, somewhat conveniently, compare the system today with the system of taxes and benefits that will be in place in 2012-13, they include the impact of Labour's National Insurance rise (though presumably not Labour's other tax rises, like the introduction of the 50p rate, which would greatly increase the hit on top earners.)

Regardless, it's clear that the worst off will be hit worse by these changes than the middle classes, primarily because of the rise in VAT, which is only very slightly offset by the income tax cut. That is probably because relatively few people at this point in the income distribution earn enough to be paying income tax now.

PS An earlier version of this post had different charts on it, these have now been changed.

I'm

I'm

Page 1 of 2

Comment number 1.

At 15:11 22nd Jun 2010, SeanBroseley wrote:Stephanie, are the forecasts about longer spare capacity now factoring in these budget proposals whereas the OBR figures weren't?

Complain about this comment (Comment number 1)

Comment number 2.

At 15:18 22nd Jun 2010, tonyparksrun wrote:The Economic Consequences of Mr Osborne - a double dip recession/depression. As has already been mentioned and warned against we are in a competitive austerity cycle and as Europe's growth fails our growth will fail as they are our main export market. Public sector unions will embark on a series of wrecking strikes as the reality of the 2 year pay freeze coinciding with well over 2% inflation and a built in 2.5% increase in the rate of VAT dawns on the public sector, together with higher unemployment. The 25% cut in department spend is game changing. Efficiency savings and weeding out the unproductive is one thing but this level of cuts will bring down useful and necessary services. That may be what is needed but it looks ideological.

Complain about this comment (Comment number 2)

Comment number 3.

At 15:23 22nd Jun 2010, Bob Baker wrote:3m unemployment - here we come !

Complain about this comment (Comment number 3)

Comment number 4.

At 15:25 22nd Jun 2010, hubert huzzah wrote:Danny Alexander was visibly dissembling. He answered a completely different question which seemed to be more about the future of the Liberal-Democrats as a force in British Politics rather than the specifics of VAT being a regressive tax (which entrenches fuel poverty) or why the sudden enthusiasm for policies he specifically campaigned against.

He was the very model of a politician.

Complain about this comment (Comment number 4)

Comment number 5.

At 15:37 22nd Jun 2010, Richard35 wrote:It is interesting to debate the issue of whether austerity will lead to a better long-term result than pressing for growth now and hoping that it will offset the increased immediate fiscal deficit in the future. It will appear that Mr Trichet and President Obama are on opposite sides of this fence lining up as they do with Mr. Osbourne and Mr. Darling respectively.

I am also interested in the implications of your last post in the change in the uprating of benefits and tax credits as well as public sector pensions from RPI to CPI.I notice that the notayesmanseconomics web blog thinks that this is a considerable downgrade which could spread to private sector defined benefits pensions. This means that the impact could be very far-reaching.

"Let me spell out the implications of it on this years evidence. Currently CPI inflation is at 3.4% and RPI is at 5.1%. However this is not a one month fluke. Let me explain by showing the annual rates of change for the two indices from 2002 to illustrate my point.

CPI: 1.3%;1.4%;1.3%;2.1%;2.3%;2.3%;3.6%;2.2%

RPI:1.7%;2.9%;3.0%;2.8%;3.2%;4.3%4.0%;-0.5%

As you can see in every year RPI inflation exceeded CPI inflation up until 2008.

NB: 2009′s implications are not what you might think."

It seems as someone with such a pension I should be concerned (the full article is on [Unsuitable/Broken URL removed by Moderator]

Complain about this comment (Comment number 5)

Comment number 6.

At 15:45 22nd Jun 2010, Lockers wrote:If you consider the significant proportion of our government income that is going to go towards servicing our massive budget deficit, I would have though that it would be prudent to at least try to pacify the 'bond market vigilantes' given their demand for UK bonds (and our credit rating) will determine the interest rate and therefore the repayments we need to make in future years.

If I go cap in hand to my bank because I am in excess of my overdraft I would expect them to at least demand some measure of fiscal restraint in my future behaviour before bailing me out!

Complain about this comment (Comment number 6)

Comment number 7.

At 15:47 22nd Jun 2010, MarkSOSH wrote:Stephanie,

Your last sentence is enough to chill the blood -

"We have all to hope that they are all wrong - and Mr Osborne is right."

Complain about this comment (Comment number 7)

Comment number 8.

At 16:02 22nd Jun 2010, steve wrote:Looks like we're doomed if we do, and doomed if we don't. Mervyn King's prediction that whoever won the election would be consigned to an age in the wilderness after this parliament might be spot on!

Complain about this comment (Comment number 8)

Comment number 9.

At 16:15 22nd Jun 2010, stanblogger wrote:It is worrying that there does not seem to be any plan B, because it seems very unlikely that the coalitions' plan to reduce the ratio of public to private employment will succeed, because in successful economies, the tide has run, and will continue to run, away from private towards public.

What could all the workers who are to be displaced from the public sector actually do in the private sector?

The sort of manufacturing that can succeed in the modern world, now has to be so efficient in the use of labour that it will never be able to absorb a significantly increased proportion of those wanting work. Even repair and maintenance work is absorbing less labour, because it is cheaper to throw away and replace.

Mrs Thatcher was right to recognise that the tide was running against manufacturing and towards services. She was wrong to believe that those services should be provided by private rather than public enterprise.

The fact is that public enterprise is much better at providing many important services than private enterprise. It is only sensible to provide key services like policing, justice and security publicly. Others like health and education are much more cost effective when delivered by the direct employees of the state. Financial services like pensions and insurance against the misfortunes of life, are more secure and also more cost effective when delivered by the state. We now know that most of the much vaunted success of the private financial sector in recent years, was not only parasitic but funded by unsustainable borrowing.

The dreams that right wing politicians have of reversing the trend of recent years are fantasies.

Complain about this comment (Comment number 9)

Comment number 10.

At 16:16 22nd Jun 2010, Wee-Scamp wrote:Why are you taking any notice at all of Alistair Darling has to say? In fact why are you even bothering to ask him his opinion. The man has completely lost his credibility which reminds me, was Gordon Brown in the commons today or is he still hiding his head in shame?

Complain about this comment (Comment number 10)

Comment number 11.

At 16:18 22nd Jun 2010, stanilic wrote:Everyone will be wrong. Why as a culture do we put so much emphasis upon being right? Are we more righteous as a result or more swollen-headed? I will opt for the second.

The question everyone has to ask before they rush to judgement is what would Labour have done if they had got back in at the election? After deferring any decision they would have been eventually forced by autumn by the so-called markets to do even worse.

You pays your money and takes you choice or is it you pay your taxes and get no choice at all? We are where we are, deep in debt, and I think George deserves an E for Effort. There is no way out of the dilemma in which we find ourselves and I think he managed the least dogmatic proposition.

I have had the whingers in the office already telling me that Osborne cost them a packet. I tell them Gordon Brown and his friend Tony sold them the packet and now they have the bill. It's a bit like having a holiday on the credit card. Now it is time to pay so you discover the sun never shined that much when you were away so why did you even bother in the first place? Put it down as the dropping bit at the end of the learning curve.

This is the question that has to be asked: why did we bother with New Labour? Things can only get better! What a laugh.

The money has gone, the broker's men are at the end of the street. Time to cough. Let's get on with it as the sooner it is done the sooner it is over.

Recovery? Don't make me laugh again! We'll have that once we have sound money and sound finances and we won't have any of that until the debt is paid off.

Complain about this comment (Comment number 11)

Comment number 12.

At 16:27 22nd Jun 2010, Dempster wrote:I’m a self employed working Joe and there are three distinct areas which made me decide not to expand my little business:

1) Costly health and safety legislation

2) The farcical compensation claims industry.

3) The burden of increasing bureaucracy.

Tax changes have thus far made no difference to my attitude to expanding the size of my business.

Complain about this comment (Comment number 12)

Comment number 13.

At 16:27 22nd Jun 2010, SeanBroseley wrote:#3 Bob Baker

Surely it will break 3m quite comfortably? It's not just the UK government doing this but also the governments of our major trading partners.

Complain about this comment (Comment number 13)

Comment number 14.

At 16:41 22nd Jun 2010, Mike2010_81 wrote:Hi Stephanie, on this and a few of the other blogs people have been asking what impact a potential future sale of the nationalised banks will have on the deficit/debt in the future. Do we know what the value of these assets currently stands at, what it is projected to be in the future and roughly when the government is planning to sell our stake?

Neither the Conservatives or Labour (the Lib Dems are an irrelevance) seem to mention it much.

Complain about this comment (Comment number 14)

Comment number 15.

At 16:46 22nd Jun 2010, Charles Jurcich wrote:This is not just a test for the coallition government, but also for the OBR. If the growth predicted by the OBR does not materialise, they might not ever be trusted again. The underlying political (let's face it) assumptions which underly these forecasts, combined with the huge margin for errors, will be exposed at last to the general public.

"This huge structural deficit" which everyone quotes as a factual certainty, will be exposed for its uncertainty.

In future, when anyone talks of structural deficits, no one would take them as seriously.

Complain about this comment (Comment number 15)

Comment number 16.

At 16:47 22nd Jun 2010, DibbySpot wrote:The Budget is simply a joke with the effects for many barely perceptable.

Unless you are in the overpaid under performing public sector this budget is a pussycat dressed up as a tiger.

Complain about this comment (Comment number 16)

Comment number 17.

At 16:54 22nd Jun 2010, daveh wrote:What I find funny is that we all know that we need to make steps to reduce a ridiculous overspend but don't want to do anything that harms them. Working in a sector that is funded via public spending I see the huge wastage. Yes the unions are right that most civil servants are hard working and lowly paid, however they do not want to mention the good holiday entitlements and the pension which is better than most have in the private sector, as well as the highly paid failures that it collects. Many of the highly paid civil servants in government have failed in the private sector but get a cosy job and create their own little empires without looking at the real needs. Tax credits highlight this systems, so does the benefit system. It is so complex that it fails to deliver to those who need, is extremely expensive to run and highly bureaucratic. If these were in the private sector, they would have be designed to be more efficient and would cost considerably less to deliver.

Complain about this comment (Comment number 17)

Comment number 18.

At 17:01 22nd Jun 2010, Sambista wrote:IS the VAT rate on domestic fuel going up? It's currently 5%, not the standard rate of 17.5%. Unless this is changing, the budget shouldn't really affect fuel poverty, should it?

Complain about this comment (Comment number 18)

Comment number 19.

At 17:16 22nd Jun 2010, Tony wrote:Given the current structure of the UK economy (predominantly the financial and public sectors), could it be the case that we have to accept that growth will inevitably be lower in the future?

Now that the financial stables are about to cleaned out, and the financial nags it once housed are shortly for the knackers yard, it is difficult to imagine that even the 'masters of the universe' will be able to conjure up new schemes to replace the lost 'profit' opportunities.

Much of this country's recent historic growth seems to have been based upon speculation and 'fantasy finance'. Those times were great (for some) but believe it or not, the party's over!

The choice really is simple - an economy based upon speculation, unquantifiable risk and a flaccid public sector. Or trade, manageable retail banking and a public sector which appreciates the value of taxpayer money.

I know which I prefer...

Complain about this comment (Comment number 19)

Comment number 20.

At 17:17 22nd Jun 2010, ghostofsichuan wrote:Hocus Pocus, the primary instrument of governmental economic forecasting. It is all about making the banks rich, has little to do with the real economy and the continued lack of understanding at the policy level of the role of the middle class as the primary contributor to economic recovery. In politics, the main goal is to protect the wealthy and when the economy tanks that strategy will not work in the long term. Will be very much like the lost decade of Japan in the 90's. These are decisions made by lobbyist and special interests and do not consider the economy as a whole or national well-being.

Complain about this comment (Comment number 20)

Comment number 21.

At 17:32 22nd Jun 2010, paulo2chop wrote:A budget that contained lots of forecasts and estimations but few, if any crunching tackles to deal with public sector waste. I am none the wiser really on how departments (outside heathcare) are supposed to make cuts of 25% over 4 years.

So more of a plan than a budget and I'm afraid a little disappointing. We'll just have to wait for details of the public sector culling to come.

Complain about this comment (Comment number 21)

Comment number 22.

At 17:35 22nd Jun 2010, funythat wrote:The problem is that the cuts in the departments will most probably not cut waste (which is undoubtedly there) but increase its relative percentage. We have far too many chiefs and underchiefs on unsustainable salaries in the government departments. But it will be the people who actually do the work who will be cut, because the managers make the decisions (and will rake in significant bonuses for having got rid of the workers). It has never been different in the past, why should it be different now.

The consequence will be a figure of 4 M rather than 3 M unemployed (most of them in the private sector actually) in 2012 and as (unfortunately) most European governments are following the same course of action there is no end in sight to this downward spiral. Sweden and Canada were able to cut their deficits against a background of global economic growth and they are fairly small countries by comparison. There is no evidence that collective austerity of the major economies will have any beneficial outcome. In fact, I would predict that the budget deficit will not be significantly lower in 2015 than it is now due to vast increases in social benefit payments and diminished tax revenue.

It is the completely irrational global markets (which got into this mess in the first place) which are dictating this. As long as governments feel they have to be subservient to the markets there is very little hope. New Deal anyone?

Complain about this comment (Comment number 22)

Comment number 23.

At 17:38 22nd Jun 2010, Jon wrote:#14. Mike2010_81 wrote:.....the nationalised banks will have on the deficit/debt in the future. Do we know what the value of these assets currently stands at, what it is projected to be in the future and roughly when the government is planning to sell our stake?

It is known that these banks have tens of billions exposure to the bonds of the troubled countries (Greece, Spain, Portugal), so if it goes even more pair shaped in Europe we are likely to need yet another bail out of the banks. So it makes sense to keep quiet and hope for the best, rather than imply we are about to get our money back and end up with egg on face.

Complain about this comment (Comment number 23)

Comment number 24.

At 17:49 22nd Jun 2010, StartAgain wrote:What is the point of economic growth if it can only be acheived by borrowing for consumption - which then has to be paid back with interest in the future? How mny people would be happy to see their salary increase by 3% only to see their debts grow by 25%?

If Obama is doing it then that is as good a signal as any to do the opposite as his is always behind the curve on the big issues. The US will be destrotyed by it's debt the $ will not be the reserve currency forever - so it will not be able to print it's way out of trouble.

Complain about this comment (Comment number 24)

Comment number 25.

At 17:58 22nd Jun 2010, Dr_Doom wrote:21 Paulo

All in good time, all in good time. GO stated that the full details of cuts in expenditure would come at the time of the spending review announcements in October.

Complain about this comment (Comment number 25)

Comment number 26.

At 17:59 22nd Jun 2010, Ilkeston_Tim wrote:I see elsewhere on the wonderful BBC site that unemployment is expected to peak at 8.1% this year and then fall back each year until in 2015 at 6.1%. 6Million jobs in the public sector less 25% means 4.5Million jobs by 2015. Will the private sector create more than 1.5Million jobs? I think not.

Complain about this comment (Comment number 26)

Comment number 27.

At 17:59 22nd Jun 2010, Dr_Doom wrote:18 Urnungal

No, it isn't. An increase in VAT on fuel would be extremely regressive and I am glad that GO has avoided this.

Complain about this comment (Comment number 27)

Comment number 28.

At 18:00 22nd Jun 2010, Tony Jones wrote:@ #9 stanblogger..

Mrs Thatcher was right to recognise that the tide was running against manufacturing and towards services. She was wrong to believe that those services should be provided by private rather than public enterprise.

Public enterprise? Surely that's an oxymoron.

Financial services like pensions and insurance against the misfortunes of life, are more secure and also more cost effective when delivered by the state.

So you believe that the best way to underwite pensions is to take contributions, spend them and pretend that we can just burden the people of the future, our children, when it's time to pay back? Governments of all colours have been doing that for years and now it's coming home to roost.

You're right in one way, the private sector can't do that, it would be called a Ponzi scheme and would be illegal.

The dreams that right wing politicians have of reversing the trend of recent years are fantasies.

You may be right, but if they don't try we'd all better get used to the idea of living in a banana republic without the climate to grow bananas. The world doesn't owe us a living and sooner or later the borrowing runs out.

Complain about this comment (Comment number 28)

Comment number 29.

At 18:07 22nd Jun 2010, John E wrote:It is not an economist but it must be patently obvious to all that tackling the ludicrous amount of wasted money spent servicing interest payments on our debts must be our highest priority because it is simply money down the drain with nothing to show for it.

Children in school who have money management classes must be baffled by the example set by the government. Although I am broadly approving of the budget measures, it seems to me as if the Chancellor has missed an opportunity for more radical action. I was expecting something even more drastic - and I suspect that most of the public was also.

Complain about this comment (Comment number 29)

Comment number 30.

At 18:07 22nd Jun 2010, sassydog1 wrote:Here come the 1930s, such economic ignorance is staggering, have they read any economic history about the origins of the "Great Depression" and how competitive cutting started a malign downward spiral, only reversed by re-armament and the Second world War.

Still "a little unemployment is a price worth paying" so long as you do not have to do the paying!

Complain about this comment (Comment number 30)

Comment number 31.

At 18:12 22nd Jun 2010, NonLondonView wrote:There is some union guy on the telly winging that the public sector has had "below inflation" pay rises for three years and calling for a day of strikes.

I haven't HAD ANY pay rise for three years.

Time for the public sector to feel the wind of change. Let them strike. Fire them when they do "pour encourage les autres". Give the jobs to people with some grip on reality.

Complain about this comment (Comment number 31)

Comment number 32.

At 18:42 22nd Jun 2010, Wee-Scamp wrote:#18

No - the VAT on domestic fuel stays the same. But - as economic growth returns the oil price will go up.

Complain about this comment (Comment number 32)

Comment number 33.

At 18:49 22nd Jun 2010, Charles Jurcich wrote:Many private sector companies are using the recession as an excuse for not paying their staff more, and not taking anymore staff on, even though many of them are making healthy profits. And all these private sector workers are falling for it. Their bosses are often raking it in, I suspect.

Complain about this comment (Comment number 33)

Comment number 34.

At 18:50 22nd Jun 2010, Neil Wilson wrote:"If I go cap in hand to my bank because I am in excess of my overdraft I would expect them to at least demand some measure of fiscal restraint in my future behaviour before bailing me out!"

Looks like the politicians have you bang to rights. A government doesn't need to go cap in hand to any one because it owns the currency everything is denominated in. The interest payments on bonds can always be settled and sterling bonds can always be paid for.

We have the buffer of a free floating exchange rate. Locking it down given the state of the country is very silly indeed.

Complain about this comment (Comment number 34)

Comment number 35.

At 18:52 22nd Jun 2010, ronnie wrote:there is no such thing as public enterprise,

Complain about this comment (Comment number 35)

Comment number 36.

At 18:54 22nd Jun 2010, CastlesMadeOfSand_ wrote:With VAT at 20% we’re definitely not going to see a consumer led recovery this time, and the chances of export led recovery like Germany would be fine if had their manufacturing base, but due to 30 years of successive unimaginative governments we don’t of course, so I’m mythed how we’re ever going to get the growth back into the economy.

Come back dodgy bankers all is forgiven – sorry just clutching at straws like this government.

Complain about this comment (Comment number 36)

Comment number 37.

At 18:57 22nd Jun 2010, Neil Wilson wrote:"It is not an economist but it must be patently obvious to all that tackling the ludicrous amount of wasted money spent servicing interest payments on our debts must be our highest priority because it is simply money down the drain with nothing to show for it."

Not really. Where do you think the money to pay private pensions comes from? Almost all of it is government bonds of one nature or another. (About 80% of sterling bonds are owned by UK entities). So essentially all private pensions are just government spending - pretty much like the state pension. Makes you wonder why we bother doesn't it.

There is no need for a sovereign government to borrow in its own currency. It can just spend as required and then tax sufficiently to keep inflation under control.

Complain about this comment (Comment number 37)

Comment number 38.

At 18:58 22nd Jun 2010, LudwigVonLloyd wrote:We have 3 choices:

1. Just borrow everything we need and don't worry (for as long as the markets let us)

2. Tax it all from the very richest people so it does not affect lower or middle income folks tax bills or services.

3. Cuts & tax increases that affect us all.

The problem with option 1 is that, assuming there is a finite amount of money (ok humour me, I know it is infinite in theory), then the money from borrowing does not come from a bottomless pit. That means any state borrowing is likely to vacuum capital that could finance the private sector growth that most realise is a necessity. Also the more any person, company or government borrow the higher risk they become and therefore the higher interest rate the creditor will demand. Option 1 is not realistic.

The problem with option 2 is the laffer curve and the fact the richest afford the best advisers and are most mobile, ergo if you increase too much they just leave the jurisdiction. This can be played with but ultimately it is unlikely to provide the whole answer.

That leaves us with option 3, like it or lump, necessity or ideology we have a prolonged period of belt tightening and I guess it could last a generation.

Complain about this comment (Comment number 38)

Comment number 39.

At 18:59 22nd Jun 2010, Neil Wilson wrote:"Children in school who have money management classes must be baffled by the example set by the government."

Depends whether they are taught the 'government = household' myth, or the reality 'government doesn't need funding, it just needs to keep inflation under control'.

If they are taught the latter, they'd be baffled as to why we are using public money so inefficiently.

Complain about this comment (Comment number 39)

Comment number 40.

At 19:03 22nd Jun 2010, truths33k3r wrote:it's a start

Complain about this comment (Comment number 40)

Comment number 41.

At 19:07 22nd Jun 2010, YellowBrickRoad wrote:11 stanilic

The only thing to fear is NextLabour and the Milli-Boy-Band, the Jedwood of politics, and they are a no show at the moment.

Complain about this comment (Comment number 41)

Comment number 42.

At 19:07 22nd Jun 2010, LudwigVonLloyd wrote:If you are hoping to grow your way out of debt history shows this to be unlikely. In 32 prior instances of situations such as ours there is only 1 on record of growing your way out. The majority of cases involved "belt tightening" to eliminate deficits and the other options are defaulting on debt or inflating your way out (some would say this is the same as default).

Complain about this comment (Comment number 42)

Comment number 43.

At 19:20 22nd Jun 2010, commissionaire wrote:Forget this talk of double-dip, the government has taken a grip on all our throats that makes this almost an irrelevance. This government is now engaged in a massive targeted redistribution, under the miraculous and unprecendented set of cirmcumstances it finds itself in. Some contributors seem to perceive this as only an issue of public versus private - and so write according to which employs them. Where does this sudden hatred of nurses and cleaners come from? More relevantly, if the new government could sell off a percentage of the private assets of each of us, then they would certainly be creeping in that direction already. Repeat, this is about a massive redistribution of resources by government reaching for a war-footing, coalition government in the national interest, non-consultative draconian decision-making - and strangely, up to now, the public seem to have relished it. As it is, the government is not yet confident they can get away with it, so they take away our public services without any discussion of our preferences as an electorate - with occasional putterings of 'Turkeys won't vote for christmas!' etc.

I think we would be capable of agreeing not to sack doctors and prefer to cancel IT disasters if given the options. Too slow? Too unwieldy? Too democratic? Excuse to 'share' the punishment wider?

Labour's position as 'guilty man' in all this is redeemed only a little by the fact that they would have hated doing it - would have probably destroyed themselves as a party had they won the election. So now, with the Libdems effectively committing a Japanese public ritual disemmbowelling of themselves, we are left only with the time - not too far away - when they bring down the Tories. It seems already written in their faces. We are all in for an uncomfortable ride until such time as the Libdems judge they can stand no more even in the national interest, but watch them start to drop off, one by one,...and then there were twelve.. God only knows what will happen then to our public finances. The horrible truth of the matter is that only a true coalition of all parties could have done this properly and allowed proper debate internally - if still excluding the wider electorate. Sometimes it looks like we would rather be back in time, still fighting a European war....

Complain about this comment (Comment number 43)

Comment number 44.

At 19:27 22nd Jun 2010, Kevinb wrote:14. At 4:41pm on 22 Jun 2010, Mike2010_81 wrote:

Hi Stephanie, on this and a few of the other blogs people have been asking what impact a potential future sale of the nationalised banks will have on the deficit/debt in the future. Do we know what the value of these assets currently stands at, what it is projected to be in the future and roughly when the government is planning to sell our stake?

Neither the Conservatives or Labour (the Lib Dems are an irrelevance) seem to mention it much.

The share prices need to be up to £1 prior to even considering a sale

Lloyds current 58p...RBS 47p

Selling in tranches is the best idea, so we protect our stake, and benefit from a rise in price over time

Complain about this comment (Comment number 44)

Comment number 45.

At 19:27 22nd Jun 2010, Kevinb wrote:George Osborne delivered an outstanding budget

We had been told that CGT was a hot potato....result 28% for HR tax payers, fair, and they pay more

HR tax relief on pension contributions...Osborne has listened and said, I need £3.5bn a year revenue, happy to consult as long as I raise that

VAT....not increased until the 15% to 17.5% rise is out of the inflation snake...(as I hoped)

Public sector pay freeze...2 years...those below £21K given a rise (as I hoped)

Child benefit frozen....to means test would cost more than it saved..COMMON SENSE and fairness

Capital allowance for business...fairness..

Corporation Tax reforms...Fair, sensible, and gradual

Housing benefit...reform...DLA...reform...

Ending children's tax credits for those earning more than £40K..sensible and fair

Cider tax...CANCELLED

Capital programmes PROTECTED

ALL VERY FAIR AND SENSIBLE

Back into surplus by reducing expenditure over the 5 years of this parliament

Saving huge amounts on debt interest payments

Encouragement for the UK outside of the sensible and prosperous SE and E, to set up businesses

WELL DONE GEORGE

Response from Harwitch?

Pathetic....When will Gordon Brown turn-up? He is currently drawing an MPs salary on false pretences

To say that this budget is regressive is absurd

Labour are a lost party after the lost decade of their government

Complain about this comment (Comment number 45)

Comment number 46.

At 19:33 22nd Jun 2010, Askarr wrote:Seemed like a very fair budget to me - banks levied, higher income earners not adjusted so they pay more, an increase in allowance for the worst off - I don't see the crisis Labour are claiming, nor the war on the public sector that the unions are claiming. Sounds like more of the same rhetoric they believed we'd swallow for the last ten years - to paraphrase a wise politician 'if you repeat the same message often enough, some idiot will start to believe it'.

As for the disgraced Darling; he often said many things - I don't recall seeing many of them actually happening. Yet more Labour rhetoric to cover up the huge debt & deficit they saddled us the taxpayer with. You'd honestly be forgiven for thinking that these people not only believe the stuff they come out with, but that if they keep saying it, it will change our economic reality. Soviet Russia tried that - look how well it worked out. I for one am glad to finally see someone at the helm of our economy who seems to appreciate the reality of our situation.

I grow tired of all this ideology getting in the way - we have real problems that need solving now. To quote a Chinese friend 'I have my little Red Book, but I have never tried to eat it'.

Complain about this comment (Comment number 46)

Comment number 47.

At 19:35 22nd Jun 2010, Charles Jurcich wrote:LudwigVonLloyd

The instances when these countries were unable to grow their way out of recession occurred because they were "belt tightening".

Argentina tried to peg themselves to the USD and used fiscal austerity. The IMF predicted they would start growing after a couple of years, but instead they went back into recession. Eventually Argentina stoppped listening to the IMF, unpegged theselves from the dollar, and spent lots of money on public works and job creation - they grew again.

Complain about this comment (Comment number 47)

Comment number 48.

At 19:35 22nd Jun 2010, teamrafa2 wrote:Stephanie I do believe I have spotted a significant problem with regard to public servants who are due to retire in the next few years. Won't their their final salary be affected by a 2 year freeze as it will still be counted amongst their 3 best years? This coupled with the spending review findings and subsequent outcomes in October surely reveals a sleight of hand?

Complain about this comment (Comment number 48)

Comment number 49.

At 19:44 22nd Jun 2010, Kevinb wrote:14

Sorry, forget to include the fact that there are just under 67bn Lloyds shares, and 58bn RBS shares

Hope that helps you

Complain about this comment (Comment number 49)

Comment number 50.

At 19:52 22nd Jun 2010, Martin George wrote:Since the world seems to be stuck with conventional (pre-mediaeval) economics and fiat currency systems, we are going to be forced in general to live within "our means". The belated day of reckoning (maybe that should be decade?) has arrived today. Well done George and well done the coalition for keeping your nerve. In the longer term, the world needs to work out how to change the economic ond monetary systems (after all it is only a man-made system - there is nothing immutable about it, apart from humans' own inability to think outside the box). Even more in this age of globalisation we can't do it on our own by printing or borrowing more money, which would be the only way to "finance" what was the status quo pre-budget. Britain is never going to compete with China or India or many other developing nations on product manufacturing terms. Equally Britain and the USA cannot be consumers of last resort, to buy much of the unnecessary material produced by certain manufacturing economies who insist on an export led model. We can't all be net exporters either - think about it! So economics is bizarre and flawed: Stephanie - where are the thought leaders to fix this thing? Or maybe we are doomed to repeat the gross bust of previous civilisations that rose on the back of industriousness and crashed on a wave of complacency and corruption, as the infrastructures they built could no longer be sustained and maintained.....

Complain about this comment (Comment number 50)

Comment number 51.

At 19:54 22nd Jun 2010, Askarr wrote:Here's a radical idea - instead of just adjusting thresholds for tax, why don't we actually change the tax system? Here's just one idea:

Right now I have to declare monies I've received. What if I also had to declare monies above a certain threshold that I paid out & to whom? This gives the Inland Revenue a classic double entry system - any large discrepancies between what people claim they paid a person and what a person claims they received get flagged up. Tax evaders would run the risk that the other party would be honest.

It'd create jobs in accountancy & data entry; it'd curtail tax evasion, and coupled with a closing of loopholes in the tax system and general reduction of red tape, it might even make more in tax than it'd cost to run.

Might be completely loony, but just a thought... After all, people want to revolutionise the way we vote; why not the ways we pay tax?

Complain about this comment (Comment number 51)

Comment number 52.

At 19:57 22nd Jun 2010, Rachel Blackburn wrote:"We have all to hope that they are all wrong - and Mr Osborne is right."

That's a bit harshly slanted, don't you think, making it look as if Mr Osborne is a lone voice against a universal chorus of disagreement? Especially given only a couple of lines earlier you'd noted the Governor of the Bank of England agrees with him, as indeed do an awful lot of traders and economists, especially those who understand the Micawber principle as applied to current accounts.

I'll grant there are some who think that the solution to having got the country up to its neck in debt is to work on now getting it up to the eyeballs, but fortunately they're on the opposition benches now. Just a shame they weren't put there 5 years earlier.

Complain about this comment (Comment number 52)

Comment number 53.

At 19:58 22nd Jun 2010, Kevinb wrote:48. At 7:35pm on 22 Jun 2010, teamrafa2 wrote:

Stephanie I do believe I have spotted a significant problem with regard to public servants who are due to retire in the next few years. Won't their their final salary be affected by a 2 year freeze as it will still be counted amongst their 3 best years? This coupled with the spending review findings and subsequent outcomes in October surely reveals a sleight of hand?

It is 3 best years in the last 10, with inflation being applied to the older year's earnings

Complain about this comment (Comment number 53)

Comment number 54.

At 20:00 22nd Jun 2010, Rachel Blackburn wrote:@commissionaire

"so they take away our public services without any discussion of our preferences as an electorate"

So .. how far does this still leave spending on public services *above* where it was, say, 5 years ago? Quite.

Still, you can always cry wolf about Tory cuts, can't you? Some idiots will always believe you.

Complain about this comment (Comment number 54)

Comment number 55.

At 20:15 22nd Jun 2010, NorthSeaHalibut wrote:45. At 7:27pm on 22 Jun 2010, Kevinb wrote:

"Housing benefit...reform...DLA...reform..."

Chose your words very carefully there eh Kev, "reform."

You forgot -

25% slashing of public services budgets...unemployment

Freeze council tax, only support LOW spending authorities - unemployment/loss of services to the vulnerable.

Projected growth in 2011 2.3%...where the hell from?

VAT 20% death knell for many small businesses....do you know how much it costs a business to implement a VAT change?

All the tax hikes will be avoided by the rich who can afford smart accountants, and any corporation tax reduction will go into the pockets of the executives, job creation and investment my a**e. After the times we've just gone through most businesses will be reluctant to take on staff unless they really booming ahead, they'll all be saving for the next rainy day.

As for reducing the deficit, well I tell you what, come back in a two years time and we'll see how much it's reduced, hardly at all I'll wager. We are entering a downward spiral of cut - lose tax revenue - cut again - lose more tax revenue - cut some more and cross fingers - damn!!!!!!

The only fair way to have done this was 2p on income tax but then I wouldn't trust them not to cut with abandon anyway. By the way didn't BOTH the Tories and Lib Dems say they wouldn't increase VAT in their manifesto's - promise no 1 broken.

Well done George Osborne...creator of an underclass.

Complain about this comment (Comment number 55)

Comment number 56.

At 20:23 22nd Jun 2010, NorthSeaHalibut wrote:#52. At 7:57pm on 22 Jun 2010, Rachel Blackburn wrote:

""We have all to hope that they are all wrong - and Mr Osborne is right."

That's a bit harshly slanted, don't you think, making it look as if Mr Osborne is a lone voice against a universal chorus of disagreement? Especially given only a couple of lines earlier you'd noted the Governor of the Bank of England agrees with him, as indeed do an awful lot of traders and economists, especially those who understand the Micawber principle as applied to current accounts.

I'll grant there are some who think that the solution to having got the country up to its neck in debt is to work on now getting it up to the eyeballs, but fortunately they're on the opposition benches now. Just a shame they weren't put there 5 years earlier."

Selective attention to detail, there are many critics on the government side of the benches. Simply that for the moment their thirst for power is affecting their memories.

Only an idiot would produce a Roosevelt budget before the economy was back on its feet. Maybe Osborne wants a recession named after him as well, lets just hope it doesn't need the same stimulus to get us out of it.

Complain about this comment (Comment number 56)

Comment number 57.

At 20:24 22nd Jun 2010, Kevinb wrote:51

Too complicated and costly to run. We need to simplify the system, and combine Tax and NI at some point, with ALL benefits also being handled by HMRC

This would save a fortune and be a better service as well

Complain about this comment (Comment number 57)

Comment number 58.

At 20:28 22nd Jun 2010, Cliff Blaken wrote:Mr Osborne.

I am a pensioner. earnings free of tax £9490. My OAP £6102 which leaves £3388 to be transferred for tax purposes to to my NHS pension which is £4670.40 which, I paid for with 27 yrs service, and contributions to the NHS pension scheme. Now that you have offered me tax free for the first £10.000 I will pay tax at 20p in the pound on the rest. So I have a rise of £510 without tax.

Now add the increase in VAT which is going to be added to my fuel payments. who the hell is bearing the main cost of the rise. Not the rich, but the low paid and OAPs, some with there lives for they will scrimp and cut back on warmth, they will save on fuel so as to eat.

Well here is one who will be warm for if I cannot pay the bills you can take me to prison, where I will get three square meals a day, medical care. No worry about heating.

Don't quote the Pensions being based on the return to the RPI for all of that is being taxed so you give with one hand and take a bigger share with the other. We have to wait till next until it starts, yet even then you have not been open, and stated that we will get the payment in full or will have to wait for percentage rises until it return to it's rightful level. Condems or is it Condoms for you are only protecting yourselves.

Yours disgusted ly

Cliff B

Complain about this comment (Comment number 58)

Comment number 59.

At 20:29 22nd Jun 2010, Kevinb wrote:Only an idiot would leave the country £903bn in debt and with a deficit of £156bn...

Complain about this comment (Comment number 59)

Comment number 60.

At 20:29 22nd Jun 2010, LudwigVonLloyd wrote:47. At 7:35pm on 22 Jun 2010, Charles Jurcich wrote:

The instances when these countries were unable to grow their way out of recession occurred because they were "belt tightening".

__________________________________________________

Without digging out the research I will accept that you may be right in some of the instances. However, in some cases the state did not try this and defaulted (actually or by inflation).

I assume you want to spend our way out of debt and as I state in post 38, I dont believe that is possible.

Complain about this comment (Comment number 60)

Comment number 61.

At 20:37 22nd Jun 2010, NorthSeaHalibut wrote:#9. At 4:15pm on 22 Jun 2010, stanblogger wrote:

"It is worrying that there does not seem to be any plan B, because it seems very unlikely that the coalitions' plan to reduce the ratio of public to private employment will succeed, because in successful economies, the tide has run, and will continue to run, away from private towards public.

What could all the workers who are to be displaced from the public sector actually do in the private sector?........

.........The dreams that right wing politicians have of reversing the trend of recent years are fantasies."

Those fantasies are based on the private sectors ability to create wealth from overseas trade but this is unlikely given the might of the Tiger and Dragon, especially when you keep missing opportunities to lead in a field. Selling to your own populace doesn't create wealth it redistributes it but usually upward. Conversely large public sectors can only be sustained in a closed economy where you have all the resources you need at your disposal within that economy - usually called communism by the ill informed and biased. Unfortunately the UK is torn between the two environments so neither can be sustained in the present world economy. Effectively we've had our day and we must get used to not having the muscle to influence others so we should look after our own and that means as big a public sector as you can afford not the smallest one needed to exist.

Complain about this comment (Comment number 61)

Comment number 62.

At 21:03 22nd Jun 2010, Chas1 wrote:Stephanie - I'm unclear as to whom you mean by 'they are all wrong' in your last sentence - do you mean the last Labour Government.

If so it would seem the last Lab our govt have already been proved to be wrong - over optimistic growth forecasts and under-estimating the structural deficit- leading to further cuts in public expenditure - which Osborne has just implemented today.

There doesn't really appear to be much difference between the old regime and the new ...just posturing as usual.

Complain about this comment (Comment number 62)

Comment number 63.

At 21:15 22nd Jun 2010, Cobbydaler wrote:[ At 8:28pm on 22 Jun 2010, Cliff Blaken wrote:

Mr Osborne.

I am a pensioner. earnings free of tax £9490. My OAP £6102 which leaves £3388 to be transferred for tax purposes to to my NHS pension which is £4670.40 which, I paid for with 27 yrs service, and contributions to the NHS pension scheme. Now that you have offered me tax free for the first £10.000 I will pay tax at 20p in the pound on the rest. So I have a rise of £510 without tax.

Now add the increase in VAT which is going to be added to my fuel payments...]

VAT on fuel is not being increased from the current 5% level.

Complain about this comment (Comment number 63)

Comment number 64.

At 21:37 22nd Jun 2010, dontmakeawave wrote:38. At 6:58pm on 22 Jun 2010, LudwigVonLloyd wrote:

"We have 3 choices:

1. Just borrow everything we need and don't worry ...

2. Tax it all from the very richest people ........

3. Cuts & tax increases that affect us all."

LVL Permit me to summarise the Budget at No. 4!

Your No. 3 and incentives to the Private Sector (to invest and create jobs, particularly outside the SE)!

Somebody has to create the wealth before we can spend it on Public Services.

And guess what will happen in year 4 if the Coalition lasts that long - Yes, a giveaway budget to win the next election!

Complain about this comment (Comment number 64)

Comment number 65.

At 21:37 22nd Jun 2010, YellowBrickRoad wrote:61 NS Halibut

''that means as big a public sector as you can afford''

You do make me laugh. We are having as big a public sector as we can afford. Based roughly on a tax take of 46 percent of GDP. How big are you proposing.

The pound was up at 2USD. Its back where it should be, mid 1 to 2. That will help domestic activity. Browns stupid policies made importing easy. We had the big importing retail groups lobbying hard to keep the pound sky high. The problem is if you have boom and bust (No more boom and bust, did I hear that somewhere), anyway if you have boom and bust you have wild destructive swings which arbitarily hit endeavour and destroy families. Arbitarily being the key word. All that has happened this time is it has reached the public sector as well. This is because sucessive recessions have hit other sectors hard so they cannot be hit again easily. You are just experiencing what many hard working skilled people have experienced before.

''where you have all the resources you need at your disposal within that economy''

Hmm. All resources eh. Where would that be, China.

You have my sympathy because it is never easy to dismantle something effort has gone into and to see comrades suffer. You are nto the first and will not be the last. But thats the way it goes when you have a guy who only looks one way marching people up to the top of the hill and marching them down again which is what has been going on in the Brown Period. Surely you never really thought that particular dream would last.

Complain about this comment (Comment number 65)

Comment number 66.

At 21:46 22nd Jun 2010, NonLondonView wrote:The media is full of stuff about this being the toughest budget for a generation, really hard etc. etc.

I thought it was moderate under the circumstances. Surprised they didnt tax alcohol anf fags more. Easy discretionary tax. Nothing on airport tax. Where were the public sector pay cuts or pension changes.

Can't really describe this as an "emergancy budget", most features delayed. I see a watering down by the LagDems in this...

Can't see any headline features I didn't agree with. Overall 8/10 good start George.

Complain about this comment (Comment number 66)

Comment number 67.

At 21:59 22nd Jun 2010, NorthSeaHalibut wrote:#65 YellowBrickRoad

You deliberately misinterpret my blog but I expect it so I can handle it.

Like I've said before we're poles apart so i'm not having a pointless tit for tat argument with you thanks, I'll stick to my political philosophy and economic principles you stick to yours. The difference is I'm not in the market for dishing out insults and actually hope you do well in your enterprise, the country needs successful businesses. You on the other seem keen for me and many others in both public and private sector to fall on our swords.

Complain about this comment (Comment number 67)

Comment number 68.

At 22:11 22nd Jun 2010, Oblivion wrote:Ahhhhhh it's just the UK trying to maintain the aspiration that Sterling could remain a reserve currency. They'd rather have y'akk licking the pavements for scraps than have Sterling assimilated into either the USD or the EUR. It's national pride in its most sinister form.

Complain about this comment (Comment number 68)

Comment number 69.

At 22:18 22nd Jun 2010, truths33k3r wrote:The elephant in the room is what is going to happen when the banks come round for another bailout? Socialism for the rich has previously been a given, will a change of colour change the response? What about QE - is it now permanently off the table? If so we are in for a serious deflationary depression.

Complain about this comment (Comment number 69)

Comment number 70.

At 22:22 22nd Jun 2010, sunnydays wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 70)

Comment number 71.

At 22:22 22nd Jun 2010, Henry Nutter wrote:Stephanie, when you said "there will still be a positive output gap in 2014-15 because the recovery, over this period, is expected to be a bit weaker than we thought", who was the "we" you referred to?

Complain about this comment (Comment number 71)

Comment number 72.

At 22:23 22nd Jun 2010, joleon1 wrote:so here we are back to the early 1990s ...just wait and see...education in dire trouble not helped by the Gove disaster on our doorstep..school buildings will start to crumble again and Osborn will do nothing about it....Hospital and medical care will start to untangle with waiting lists and care getting very much worse...the poor ill and elderly will all suffer despite a few sops to try and keep them on board and who are the winners....YES..the rich..all the major benefit has gone to business people who will not reinvest it into society but will take the excess profit gained by tax reductions for themselves...as always always the Tories cannot resist the opportunity to help the rich and get the rest of us back into the pen. This budget is a piece of pure Tory malice against the bulk of people in this country and the quicker your correspondent gets the hang of this the better

Complain about this comment (Comment number 72)

Comment number 73.

At 22:26 22nd Jun 2010, Dempster wrote:To the coalition government: And what of the future?

Is the business of fractional reserve banking still left in corporate hands?

The very cause of our disenfranchisement is still there, quietly germinating underground awaiting the its rebirth to visit upon us yet more boom and bust.

The madness of money creation, visited upon the majority by the corporate minority is till left untouched.

I have no politics, no leaning to left or right.

My concern is for future generations being a father of three.

And still, even at this point, with austerity being our watchword, distress and destitution being accepted, we leave the very catalyst of our destruction intact.

And now a short prayer.

‘Dear heavenly father, I ask for your forgiveness for the sins I have committed.

Bless this country with an understanding of the plague brought upon it by it by those intent on bleeding its citizens of their ability to provide for those who come after us. Visit upon them your wrath, let them feel the pain of your retribution for the misery and destitution they have created in pursuit of their wealth ……. Amen’

Complain about this comment (Comment number 73)

Comment number 74.

At 22:33 22nd Jun 2010, paul mawer wrote:In the good old days the only way to increase your wealth was to go to war pillage, burn or destroy items equivalent to yours, so making your valuables more valuable. the idea being having something is far more valuale than having nothing.

But I thought this actually de-valued your items in real terms.

The Bankers are worse than the Government for destroying manufacturing in this country

What ever comes next be it : Nero or Marie-Antoinette, Lenin or Hitler

or Camclegg or Macmillan lets pray for the masses, and peace

Complain about this comment (Comment number 74)

Comment number 75.

At 22:49 22nd Jun 2010, democracythreat wrote:The comment, offered in all seriousness by these so called economic "experts", that we cannot halt borrowing because to do so would hurt spending, defies the fundamental and very simple reality that we can't borrow any more and expect to be better off.

The refusal to face that simple economic fact is exactly the reason we are where we are. Put in its simplest terms, the people who are discussing public spending and borrowing have the intellectual capacity of children. They may know a lot of words, and they may even know what they mean, but these people do not have the maturity or adult common sense to face hard truths. They are children in adult bodies, living in a fantasy world and chattering madly about what the world might be like if it were made of cheese and gingerbread.

It is when I see so many esteemed and apparently intelligent, and hugely paid, people talking such nonsense that I am certain the system of direct democracy is fundamental to long term economic planning.

We need ordinary mum's and dad's to be making our policy and laws, not professional politicians. The party members are a joke. They are immature. They will not face any economic reality except the calculus which will get their party re-elected.

History is the story of common people struggling to overcome the foolishness of the powerful and greedy, and nowhere has that been written larger than modern Europe.

There has to be a political solution to this system of public debt and borrowing in our children's name. There has got to a move towards a different political system. The party system is defunct. I mean, how bad would it need to get before we scrap it and try something that has been proved to get better results?

A third world war? A thousand more years of boom and bust, and degrading government taxes to fund the fantasies of party members?

Complain about this comment (Comment number 75)

Comment number 76.

At 23:26 22nd Jun 2010, IrrationalExuberance wrote:When is the right time to have a balanced budget. Crash Gordon and his puppet chancellor's last one was in 2001.

Maybe the government should go on borrowing forever, but the real problem is private debt, and when interest rates go up, the private debt time bomb will explode with devastating effect. On top of that, the USA is in a worse position than ourselves. The underlying fundamentals of this crisis have not gone away, we are stuffed.

Complain about this comment (Comment number 76)

Comment number 77.

At 23:31 22nd Jun 2010, BobRocket wrote:#74 essiritussantos wrote

'...lets pray for the masses, and peace'

Yes, let's pray for peace and prepare for war

(let me get this straight, I don't want any war)

A quick and massive build up of UK forces would be huge stimulus to the UK economy, if we were quick enough and invested enough in UK Military Hi-Tech then the rest of Europe could be catalysed into investing as well for fear of being left behind, exports would boom and we could kiss the defecit goodbye.

We need an arms race, pure and simple, a stimulus that cannot be absolved.

The time for tinkering around the edges is long gone, it is the time for 'all in' or 'fold; and the only window of opportunity is upon us, no more cards will be dealt.

We appear to be led by Chamberlains.

Complain about this comment (Comment number 77)

Comment number 78.

At 23:33 22nd Jun 2010, Up2snuff wrote:51. At 7:54pm on 22 Jun 2010, ele_engineer wrote:

Here's a radical idea - instead of just adjusting thresholds for tax, why don't we actually change the tax system? Here's just one idea:

Right now I have to declare monies I've received. What if I also had to declare monies above a certain threshold that I paid out & to whom? This gives the Inland Revenue a classic double entry system - any large discrepancies between what people claim they paid a person and what a person claims they received get flagged up. Tax evaders would run the risk that the other party would be honest.

It'd create jobs in accountancy & data entry; it'd curtail tax evasion, and coupled with a closing of loopholes in the tax system and general reduction of red tape, it might even make more in tax than it'd cost to run.

Might be completely loony, but just a thought... After all, people want to revolutionise the way we vote; why not the ways we pay tax?

-----------------------------------------------------------

Interesting idea. Would be worth pursuing if NI was scrapped. All the NI staff could be offered alternative employment at HMRC to process the paper. I would have liked to see, at the very least, some signals from GO that he has the UK tax system in his sights for radical overhaul.

The Tories have a track record of saying high taxes and evaded taxes are bad and should be scrapped but only actually do it to higher taxes on income. A root and branch reform of the system should be a priority for year 6, at the latest, of the Coalition.

Both Tories and Labour, in the past, have been like a worker living beyond his means. Halfway between paydays he goes to the boss and says "Can I have a weeks money in advance, please, I'm a bit short at the moment." The boss helps him out. Six months later, it happens again. Six months later, it happens again, and then again. A further six months down the road, after a customer leaves a bill unpaid, the boss is doling out the wages and our worker looks in his envelope and finds only three days money. "Sorry mate, I'm a bit short this month and you've had twenty-eight days money in advance, anyway. Knew you'd understand.".

The British workforce before they go to work, pay tax in order to sleep under a roof. When they get up in the morning they pay tax to eat breakfast (yes, I know food is VAT exempt) - the water and electricity bear tax - then they put their taxed clothes on and go to work in a (multi) taxed car. As they walk through the doors of the building on which their employer has paid tax, they are greeted by the Acounts Department who are busy paying the NI to employ them. They sit down at their desk and haven't yet produced any work to create income. Hmmmn.

It's gotta change .... and soon. Let's be careful, out there ...

Complain about this comment (Comment number 78)

Comment number 79.

At 23:35 22nd Jun 2010, U14399620 wrote:69. At 10:18pm on 22 Jun 2010, truths33k3r wrote:

The elephant in the room is what is going to happen when the banks come round for another bailout? Socialism for the rich has previously been a given, will a change of colour change the response? What about QE - is it now permanently off the table? If so we are in for a serious deflationary depression.

lllllllllllllllllllllllllllllllllllllllllllllll

If the elephant ever learns to fly by the seat of its pants it'll be the inflationary pressure of the big grey area in the middle that the tax payers have to contend with ,followed by a well deserved pAAAt on the head for being a good boy and accepting the kings shill ing .

DEFLATION IS ONLY A PROBLEM FOR THOSE WITH DEBT PILES AND VIRGIN ASSETS and an aversion to the advances of the redumbos

Complain about this comment (Comment number 79)

Comment number 80.

At 23:40 22nd Jun 2010, hopenotdespair wrote:Once again, the Conservative Party now with their new Liberal Democrat allies have produced a budget which will only end in disaster. A double dip recession is,in my opinion, inevitable. To squeeze demand in this climate is madness. But it does make sense if the Conservative/LibDem coalition continues the New Labour policies designed to support the City. Once again,we are being asked to pay the price of reckless speculation and again it is dressed up as 'fairness'. The political agenda is dominated by who will cut public spending the most. Doesn't George Osborne realise the number of people employed by the state in Britain. These people are employed for a reason - to provide services which are essential in a country which calls itself civilised. To cut employment and services in the public sector is a serious mistake. Ask Asda.

Figures shown and commented on by Danny Alexander indicate an extra 100 000 unemployed. Unemployment is the scourge of this country and never has been a price worth paying.

This is a black day brought about by greed and selfishness which vast numbers of people in Britain had no part but must pay for.

Complain about this comment (Comment number 80)

Comment number 81.

At 23:41 22nd Jun 2010, BobRocket wrote:#75 democracythreat wrote

'how bad would it need to get before we scrap it and try something that has been proved to get better results?'

Very

and

What is this something better ?

Complain about this comment (Comment number 81)

Comment number 82.

At 23:53 22nd Jun 2010, TSArthur wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 82)

Comment number 83.

At 23:55 22nd Jun 2010, U14399620 wrote:Its hard to pick up a heavy load after its been dropped by themasses...even using a shovel and long rubber gloves, anyway its a territorial thing indulged in by doogoders

Complain about this comment (Comment number 83)

Comment number 84.

At 23:56 22nd Jun 2010, Fair Pay wrote:Over the duration of the Labour government, government spending increased at a more or fairly constant rate, and receipts from private sector taxation/expenditure pretty much followed (and so, financed) this trend - until 2008, when the banks crashed (at least according to the ONS data I've looked at).

Labour's mistake was perhaps to continue their spending increase in the face of this calamity - whether this was because they really thought they could pull the private sector back up as they'd done before, or they felt electoral defeat was near-inevitable and so embarked on a populist spending spree, I don't know.

I'm pretty much a neophyte when it comes to understanding economics, but I wonder if the BBC's economics editor would agree with me that the recovery very much depends on consumer confidence: i.e. on the average consumer deciding to spend a little more and save a little less?

Fair Pay website

PS: Thanks, Stephanie! - I've learned much from your blog entries - you should do some 'idiot's guide to...' stuff for people like me who lack a good education in economics.

Complain about this comment (Comment number 84)

Comment number 85.

At 23:57 22nd Jun 2010, SeanBroseley wrote:Following on from # 76.

The Government deficit gives David Cameron and George Osbourne the opportunity to look busy when the four riders of the apocolypse come over the hill.

The extent of money creation through the creation of private debt in the last decade is such that the proportion of aggregate demand attributable to credit is much greater than it was in 1929.

“In the great booms and depressions… [there are] two dominant factors, namely over-indebtedness to start with and deflation soon after”

- Irving Fisher

This is less an explosion, more a car crash in slow motion, and it is already happening. The pace will quicken as governments turn to austerity.

Complain about this comment (Comment number 85)

Comment number 86.

At 00:28 23rd Jun 2010, YellowBrickRoad wrote:67 NorthSeaHalibut:

#65 YellowBrickRoad

'You deliberately misinterpret my blog but I expect it so I can handle it............You on the other seem keen for me and many others in both public and private sector to fall on our swords.'

No NS Halibut I just read what you write - sometime you write well but some of the time you go all thespian and shakesp-hero. I am not keen for anybody to 'fall on their swords'. I am keen 'it' does not happen again, certainly not at this level. Simple as. Perhaps you are begining to understand just what damage this sort of pantomime does, because you sound as though this is all new to you.

Every time a recession comes another sector is hit, and does not recover. A different sector every time. The whole purpose of a government is to mitigate, not to attempt to eliminate cycles. We now have major problems. A deeply indebted generation, a younger genration which is losing motivation and disenfranchised. Another generation which has won overall via house price manipulation but will now have to pay up so what was the point. The private sector I suspect is going to have problems as businesses now realise the uplift is not going to happen quite as Darling kept promising. There are signs that some are planning for further problems.

When uplift does occur the danger is domestically we cannot respond in production terms and imports again occur. Then in due course another recession occurs, imports cut back but another UK sector, if any are left, gets hit. This is gross economic mismanagement. To deliberately bubble the economy dispite warnings hides what is really going on in the economy so we are in a worse position as time has been wasted and focus lost.

This is a very hostile environment and if any activity is not alert then they can self harm, let alone any mischief abroad.

The next time bomb is youth discontent and a reluctance to engage in society.

I do what I do because I did what everybody does, they sit and listen and say okay that sounds okay, I'll work my butt off etc etc etc. I showed upward movement. I advised the people I worked with and for about strategy and was basically told I was a party pooper, worried too much about risk, was looking too longterm. Then I got loaded into the cannon because other poeple screwed up. Just like people you know at all levels are getting loaded into the cannon. I said stuff it I'm not playing, I'm going to make my own game and it will be designed specifically to survive. There are rules to what goes on and they can be written down.

I talk about new ways of doing things simply becasue I believe business is polarising into two forms and the middle ground which most operate in will be difficult (I expect failure there). I operate in a mode and I quite openly talk about it so people can consider it. If they dont like it I'm not bothered.

Incidentally if you want to win in a war it is quite simple, you concentrate on the opposition losing, not on you winning. The problem most people have is they concentrate on winning so they lose. I recommend you consider this. At the moment I have you tagged as losing I'm afraid. As far as public spending levels go the game was lost in about 2005, maybe earlier. It has just taken 5+ years for the wave to hit.

Good luck you will need it.

Complain about this comment (Comment number 86)

Comment number 87.

At 00:47 23rd Jun 2010, U14399620 wrote:81. At 11:41pm on 22 Jun 2010, BobRocket wrote:

#75 democracythreat wrote

'how bad would it need to get before we scrap it and try something that has been proved to get better results?'

oooooooooooooooooooooooooooooooooooooooooooooo

Democracy was scrapped Aons AGO ...what we now have IS the sumthing bet err [the peoples carrot and stickupocracy] so that themasses can win the donkey derby pension trophy whilst under the inkfluenziall leadership of carrot and stick power handicapped only by the turhiptopoliticiants

The future is blight the future is a carrot scrappage scheme resulting in 0 range inflation.

Complain about this comment (Comment number 87)

Comment number 88.

At 00:57 23rd Jun 2010, paul mawer wrote:I hope these actions work but a warning do you think that when times are better that the majority will allow such differentials in equality happen again, this could be the real test

Complain about this comment (Comment number 88)

Comment number 89.

At 01:20 23rd Jun 2010, capncook wrote:"What would he do if the economy responded as Japan's did to an increase in consumption taxes, years after its financial crisis?" - Stephanie Flanders

Japan's 'lost decade' from 1990 was caused by a general loss of liquidity which a banking system paralysed by bad loans could not resolve. During this time, not only were interest rates low, but the Japanese budget went from surplus to 10% deficit, with little or no expansionary effect. So the comparison is not valid, though that's not to say the experience will necessarily be different. It's just that if we have our own 'lost decade', the reasons will probably be different.

You could say that there are two academically respectable views about the likely consequences of deficit reduction at a time of loose money. One is that it will result in economic growth as investment resources 'crowded out' by the public sector are made available to the more efficient private sector (it's a simplification, but you could call this a monetarist view). The other is that the deficit reduction will simply reduce the level of demand in the economy (simply: a Keynesian view).

Unfortunately, the difference of view is just that - academic. Deficit reduction is now necessary for reasons of market credibility, thanks to maladministration by the last government.

Complain about this comment (Comment number 89)

Comment number 90.

At 02:08 23rd Jun 2010, U14399620 wrote:88. At 00:57am on 23 Jun 2010, essiritussantos wrote:

I hope these actions work but a warning do you think that when times are better that the majority will allow such differentials in equality happen again, this could be the real test

kkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkkk

"differentials in equality"