I said it before

- 13 Oct 08, 08:47 PM

42-days is dead.

After tonight's vote in the Lords and climbdown in the Commons, I refer you to the answer I gave some days ago.

Accessibility Links

42-days is dead.

After tonight's vote in the Lords and climbdown in the Commons, I refer you to the answer I gave some days ago.

The Masters of the Universe are dead. Long live the Master of the Universe.

The death of the banks (at least as independent institutions) has, it would appear, been accompanied by the rebirth of Gordon Brown. Not only has his bank rescue package been backed by all political parties at home but it has also inspired similar plans in the EU and in the United States (once it was clear their own plan had failed to end the rout)

Indeed, the man who was today awarded the Nobel prize for economics, the American economist Paul Krugman, declared in today's New York Times that the Brown/Darling plan had "defined the character of the worldwide rescue effort, with other wealthy nations playing catch-up" and praised the two men for showing a "combination of clarity and decisiveness" which "hasn't been matched by any other Western government".

Indeed, the man who was today awarded the Nobel prize for economics, the American economist Paul Krugman, declared in today's New York Times that the Brown/Darling plan had "defined the character of the worldwide rescue effort, with other wealthy nations playing catch-up" and praised the two men for showing a "combination of clarity and decisiveness" which "hasn't been matched by any other Western government".

This bounce in the market in Browns and indeed, Darlings too, has prompted the Conservatives to re-open hostilities and to side with the British people who, they claim, have "been handed the bill for boom turning into bust".

The Lib Dems too have warned of governmental hubris. What they both believe - and are surely right too - is that the politics of recession could be much less benign for Gordon Brown than the politics of the immediate crisis.

The political fallout of both events is, of course, no more predictable that the economic fallout. It would be unwise to speculate too much.

That surely is one lesson for all of recent events.

What can be stated with total confidence is that the prime minister himself feels more confident doing the job that at any time since he got it.

Congratulations, you are now the proud, or maybe not, owner of a bank or two. You must now be wondering what you'll get for your share of the £37bn. The chancellor's promising you, or at least your representative, a place on the board and no cash bonuses for those who are not the people's representatives, and what's more, freer flowing loans to small businesses and homeowners. Expect more demands to follow soon.

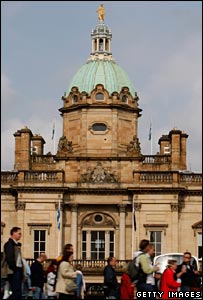

Will, for example, the government guarantee the retention of the Scottish HQs of RBS and Bank of Scotland? And what about the Halifax headquarters of the Halifax? Will they promise to pass on interest rate cuts to mortgage holders? Will they even change that annoying muzak which plays when the bank puts you on hold? You see now that the people own the banks, the people are sure to make demands of the people's representatives who bought them on our behalf.

Will, for example, the government guarantee the retention of the Scottish HQs of RBS and Bank of Scotland? And what about the Halifax headquarters of the Halifax? Will they promise to pass on interest rate cuts to mortgage holders? Will they even change that annoying muzak which plays when the bank puts you on hold? You see now that the people own the banks, the people are sure to make demands of the people's representatives who bought them on our behalf.

And what's more, there'll be demands to nationalise lots more. The new Transport Secretary Geoff Hoon dutifully took the underground home from Wembley after the England game on Saturday. Per chance, he bumped into the head of the RMT union, Bob Crow. "Now you're nationalising the banks", Crow said to him, "how about the railways?" How about it, ministers?

The BBC is not responsible for the content of external internet sites