What is interest?

When you put money into a savings account, the bank will use your money, for example by lending it to other people.

They will pay you a certain amount for allowing this.

The money they pay you is known as ‘interest’.

The rate of interest is calculated on an annual basis or per annumEach year. (% p.a.).

When you borrow money, you will have to pay interest as well as paying back the original amount.

The original amount of money borrowed or loaned is called the ‘principal’.

The ‘interest rate’ is the % of the principal that is added on over the course of one year as interest.

The interest rate charged or earned depends on a lot of factors, including the financial conditions in the country at the time.

The interest rate, including and fees charged over one year, to borrow money is known as Annual Percentage Rate, APR.

The interest rate, including and fees charged over one year, to lend money is known as Annual Equivalent Rate, AER.

APR and AER make it easier to compare savings accounts and loans.

A short video showing how to work out interest.

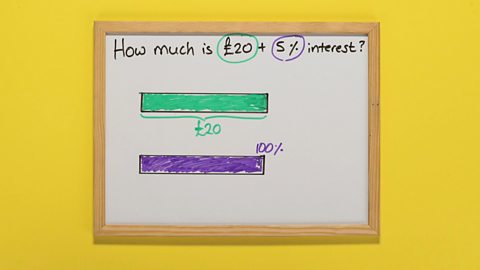

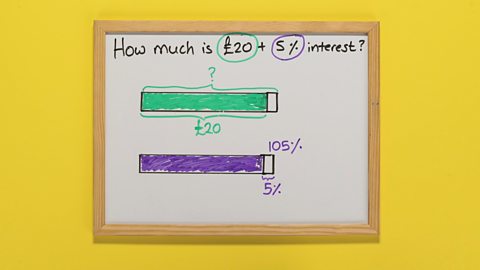

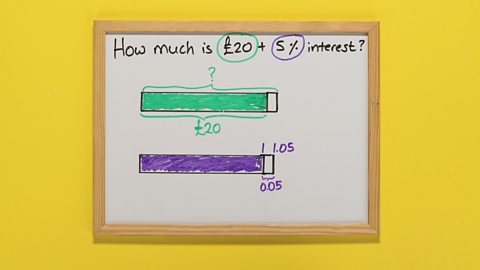

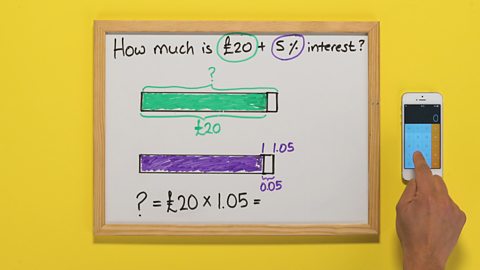

How much is £20 + 5% interest?

£20

100%

5%

105%

1.05

0.05

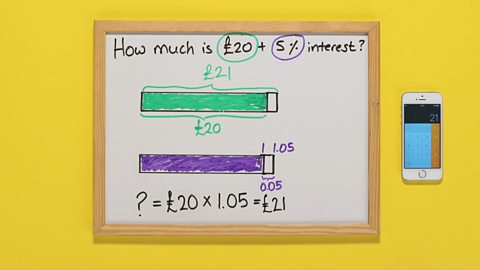

? = £20 x 1.05 = £21.00

How to work out interest

Image caption, Click to see a step-by-step slideshow.

Image caption, WHAT YOU NEED: whiteboard, marker pen, calculator and ruler.

Image caption, STEP 1: Draw two bars. Label the top bar £20 and shade it in. Shade the bottom bar in and label it 100%.

Image caption, STEP 2: Estimate what 5% would look like and add this area to both bars. On the bottom bar, label this area 5%. Label the whole of the top bar with a question mark. Label the whole of the bottom bar 105%.

Image caption, STEP 3: Convert the percentages to decimals by dividing by 100. On the bottom bar, change the 105% label to 1.05 and change the 5% label to 0.05. Label the end of the original bottom bar 1.

Image caption, STEP 4: Multiply the amount of money by the decimal to find the value with added interest. Here it is £20 × 1.05. Before using a calculator can you estimate the answer in your head?

Image caption, Well done! You've now worked out that the total with interest is £21.

1 of 7

Simple interest

Simple interest is calculated as a percentage of the principal and stays the same over time.

Example

Saoirse puts \(£250\) into a savings account which gives simple interest at a rate of \(7.5\%\) per annum (per year).

How much will Saoirse have saved after \(3\) years?

Every year, \(7.5\%\) of \(£250\) will be added as interest to Saoirse’s account.

\({7.5}\% {~of~} {£250} = {£18.75}\)

Each year \(£18.75\) interest will be added.

After \(3\) years interest to be added \(= {3}\times £18.75 = £56.25\).

Saoirse will have saved the principal + interest \(= £250 + £56.25 = £306.25\)

After \(3\) years Saoirse will have saved \(£306.25\).

Question

Rory borrows \(£300\) from his bank.

The bank charges \(9\%\) simple interest per annum.

How much will Rory owe after \(4\) years?

Answer

Each year, \(9\%\) of \(£300\) will be added to the amount that Rory owes.

\(9\%\) of \(£300 = £27\)

Each year \(£27\) interest will be added.

After \(4\) years \({4} \times £27 = £108\) will be added.

Rory will owe the principal + interest

\(= £300 + £108 = £408\)

After \(4\) years Rory will owe \(£408\).

Simple interest formula

It can be helpful to use a formula to calculate simple interest, provided you give the variables the correct values.

The formula is:

Simple Interest = \(\frac{(P ×T×R)}{100}\)

Where

P = Principal (in £s)

T = Time (in years)

R = Interest rate (\(\%\) p.a.)

Example

To show how the formula works, we can recalculate the last example:

Rory borrows \(£300\) from his bank.

The bank charges simple interest at a rate of \(9\%\) p.a. (per annum).

How much will Rory owe after \(4\) years?

P = \(£300\)

T = \(4\) years

R = \(9\%\) p.a.

Put these values into the formula.

Simple Interest = \(\frac{(300 × 4 × 9)}{100}\)

\(= £108\)

Rory owes \(£108\) interest + the principal of \(£300\)

\(= £408\)

If you are using the formula to calculate simple interest, don’t forget to add the principal if you want to know the total amount owed/saved.

Question

Use the simple interest formula to calculate the interest gained on \(£2500\) over \(4\) years at a rate of \(6\%\) per annum.

Answer

Simple Interest = \(\frac{(P × T × R)}{100}\)

P = \(£2500\)

T = \(4\) years

R = \(6\%\) p.a.

Interest = \(\frac{({2500}\times{4}\times{6})}{100}\)

\(= £600\)

Compound Interest

Compound interest is interest that is calculated on the principal plus the amount of interest already earned.

Therefore, the amount of money that earns interest increases every year.

Example

Daniel invests \(£400\) at a compound interest rate of \(6\%\).

How much interest will he have earned after \(3\) years?

Interest earned in first year

\(= 6\% ~of~ £400\)

\(= £24\)

Principal for second year

\(= £400 + £24\)

\(= £424\)

Interest earned in second year

\(= 6\%~ of~ £424\)

\(= £25.44\)

Principal for second year

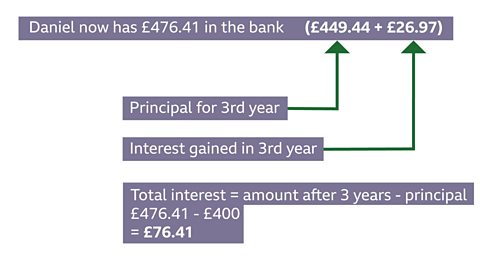

\(= £424 + £25.44 = £449.44\)

Interest earned in third year

\(= 6\%~ of ~£449.44\)

\(= £26.97\)

Total amount of interest earned

\(= £24 + £25.44 + £26.97\)\(= \boldsymbol{£76.41}\)

Question

Amelia borrows \(£1500\) at a compound interest rate of \(8\%\) per annum (p.a.).

How much does she owe after \(2\) years?

Answer

Interest to be added in first year

\(= 8 \percent~of~£1500\)

\(= £120\)

Principal for second year

\(= £1500 + £120\)

\(= £1620\)

Interest to be added in second year

\(= 8 \percent~of~£1620\)

\(= £129.60\)

Amelia now owes \(= £1620 + £129.60\)

\(= \boldsymbol{£1749.60}\)

Compound Interest Formula

If compound interest is to be added over a large number of years, the calculation becomes very long and complex. In this case, it is convenient to use a formula.

Total amount \(= {P}\times{(1 +}\frac{R}{100})^t\)

P = Principal (original amount)

R = compound interest rate (%)

T = time (years)

Example

Daniel invests \(£400\) at a compound interest rate of \(6\%\).

How much interest will he have earned after \(8\) years?

P = \(£400\)

R = \(6\%\) per annum (p.a.).T = \(8\) years

Total amount after \(3\) years \(= {P}\times{(1 +}\frac{R}{100})^t\)\(= 400 (1 + 0.06)^8\)

\(= 400(1.06)^8\)

\(= £637.54\)

Interest earned \(= £637.54 - £400 = £237.54\)

Question

Ryan borrows \(£850\) at a compound interest rate of \(9 \percent\) per annum (p.a.).

Use the compound interest formula to calculate how much will he owe after \(4\) years?

Answer

P = \(£850\)

R = \(9 \percent\) per annum (p.a.).

T = \(4\) years

Total amount after \(4\) years \(= {P}\times{(1 +}\frac{R}{100})^t\)

\(= 850\times(1 + 0.09)^4\)

\(= 850\times(1.09)^4\)

\(= £1199.84\) (nearest penny)

Ryan owes \(£1199.84\) after \(4\) years.

Test section

Question 1

Calculate the simple interest on \(£7000\) borrowed for \(5\) years at an interest rate of \(5.5\%\) per annum (p.a.).

Answer

\(£1925\)

Question 2

Jamie puts \(£450\) into a savings account.

How much will he have in his account after \(4\) years at a simple interest rate of \(12\%\) per annum (p.a.)?

Answer

\(£666\)

Question 3

Emily invests \(£1200\).

After four years, how much will her investment be worth if she is paid \(12\%\) compound interest per annum?

Answer

\(£1888.22\)

Question 4

Mo borrows \(£2400\) at 1\(5\%\) per annum (p.a.) compound interest for \(4\) years.

How much compound interest will he have to pay ?

Answer

\(£1797.62\)

More on Percentages

Find out more by working through a topic

- count4 of 9