| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

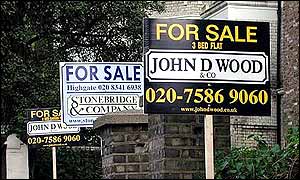

| Thursday, 19 September, 2002, 09:56 GMT 10:56 UK House shortages 'push prices higher'  House prices are set to keep rising A shortage of properties coming on to the market is continuing to fuel house price inflation, according to the Royal Institution of Chartered Surveyors (RICS).

New mortgage lending figures also showed that the housing market remained "buoyant" in August. But the Council of Mortgage Lenders (CML) said that lending was expected to slow next year. Crash fears House price inflation has been running at about 20% this summer and has raised fears that the market could overheat and lead to a house price crash similar to that seen in the early 1990s. RICS said house price rises had eased slightly last month after its members noted a small increase in the number of homes up for sale. But the average number of properties on the books of chartered surveyor estate agents stood at 65 in August, well below the long-term average of 119. And RICS said the situation is unlikely to improve in the coming months as the number of home owners thinking of selling is expected to fall. Economic worries "The shortage of property shows no sign of easing and will continue to impact on prices for many months to come," said RICS' national housing spokesman Ian Perry. "The level of new building is not keeping pace with demand and sellers who would become buyers cannot find a suitable home in their price range, so defer a decision to move. Mr Perry also warned that economic uncertainty was also keeping house prices high. "Many people are also putting off the decision to sell because of a fragile economy, fear of job losses and an uncertain international situation," he said. RICS said the slight slowdown in house price inflation last month was only seen in London, the south-east and south-west of England. The strongest price rises were seen in the West Midlands and the north-west of England. Mortgage lending 'to slow' Mortgage lending hit �19.5bn in August, the third highest figure on record, according to the CML's latest figures. "Low interest rates and unemployment are set to continue throughout 2002 ensuring conditions remain favourable for the housing market," said CML director general Michael Coogan. "This suggests that lending will remain strong for the rest of the year. "However, lending is expected to slow going into 2003 as conditions become less favourable for the housing market." |

See also: 09 Sep 02 | Business 03 Sep 02 | Business 30 Aug 02 | Business 26 Aug 02 | Business 21 Aug 02 | Business 19 Aug 02 | Business 14 Aug 02 | Business 30 Aug 02 | Business 03 Sep 02 | Business Internet links: The BBC is not responsible for the content of external internet sites Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |