| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

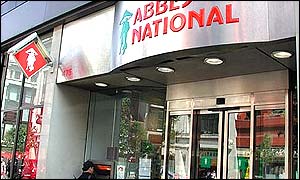

| Monday, 16 September, 2002, 16:04 GMT 17:04 UK Abbey 'plans mass lay-off'  Abbey National is looking for ways to cut costs The Abbey National could shed up to one in 10 workers in an effort to cut costs, a press report said.

The FT said the lay offs would be targeted mainly at Abbey's mortgage administration and processing division, while further savings would be achieved by outsourcing some information technology services. The Abbey, the UK's sixth largest bank, is under pressure to improve its performance after disappointing investors with lower than expected profits earlier this year. Abbey's deteriorating financial position, blamed on risky corporate loans, forced the bank's shares sharply lower and led to the resignation of its former chief executive Ian Harley in July. Speculation Abbey National confirmed that it was looking for ways to trim costs, but said it was too soon to speculate on the likely impact on jobs. "We are undertaking a review of the cost base across the group, but the 3,000 figure has been plucked out of the air," a spokesman told BBC News Online. The bank, which has yet to appoint a permanent successor to Mr Harley, is seen as vulnerable to a takeover bid, with National Australia Bank named as a possible buyer this summer. An attempt to merge with Bank of Scotland fell through last year, while a hostile bid from High Street bank Lloyds TSB was blocked on competition grounds. Abbey shares, which are owned by millions of ordinary savers as well as institutional investors, surged almost 4% to 676p in morning trade on Monday before losing some ground to close up 6.5p at 657p. | See also: 19 Jul 02 | Business 19 Jul 02 | Business 11 Jul 02 | Business 12 Jun 02 | Business 08 Apr 02 | Business 09 Aug 01 | Business 28 Aug 01 | Business Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |