| You are in: Business | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

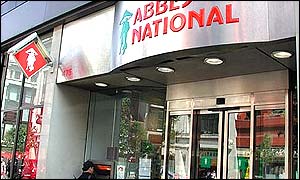

| Friday, 19 July, 2002, 12:04 GMT 13:04 UK Investors claim top Abbey scalp  Abbey National: Farewell to Ian Harley The resignation on Friday of Abbey National chief executive Ian Harley will have taken few City-watchers by surprise.

His departure brings to a close a 25-year career with the UK's fifth-largest bank, which saw him work his way up to the top spot from the post of financial analyst. Mr Harley's four-year stint as Abbey boss hit its first rough patch last year. Risky business A planned merger with Bank of Scotland fell through, and a hostile takeover attempt by Lloyds TSB failed only because the UK government blocked it on competition grounds.

But what told most heavily against Mr Harley was Abbey's shock warning last month that profits for the year would come in "substantially below" forecasts. The origins of Abbey's problems lay in a series of risky investments that it made during a dash for growth in the late 1990s, when a wave of consolidation was putting UK banks under pressure to expand. These included loans to bankrupt energy giant Enron and ailing industrial conglomerate Tyco, as well as purchases of US junk bonds. Investor wrath The news angered investors, with many arguing that such high-risk activities fitted poorly with Abbey's core UK mortgage lending business. Last month's profit warning, which came just six weeks after Abbey had assured shareholders that all was well, wiped about a fifth off the bank's share price. The sell-off left Abbey shares down by about 30% since the beginning of the year, and widened the gap between its stock price and that of other UK banks. Pressure for Mr Harley's resignation has come mainly from institutional shareholders, but they are not the only ones affected by the bank's deteriorating performance. Popular shares Abbey shares are also owned by millions of ordinary account holders who were handed a free stake in the former building society when it converted to a publicly listed company in 1989. According to Abbey's own estimates, its conversion increased the number of British share owners by about 50%, from 6 to 9.5 million. Mr Harley's resignation, which lifted Abbey's share price by about 2.5% to 714p on Friday morning, has gone some way towards restoring their fortunes. They could be in line for another windfall, if, as widely expected, Abbey National is snapped up by another bank later in the year. Abbey man The next step for Mr Harley, who is to receive a year's salary as a pay off, is uncertain. Aged 52, he has worked for Abbey National since the age of 27, after short stints at accountancy firm Touche Ross and engineering firm Morgan Crucible. His first break at the bank came four years into his time there, when he was appointed south-eastern regional manager of Abbey's retail division. He rose up through the ranks to become operations director in 1992, and was made finance director in 1993. Born into a Scottish coalmining family, Mr Harley studied economics at Edinburgh University. | See also: 19 Jul 02 | Business 12 Jun 02 | Business 08 Apr 02 | Business 09 Aug 01 | Business 06 Jun 01 | Business 28 Aug 01 | Business 11 Jul 02 | Business Top Business stories now: Links to more Business stories are at the foot of the page. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |