| You are in: Business | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

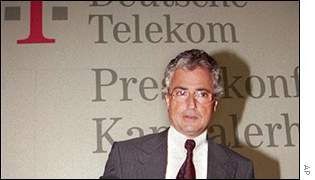

| Friday, 12 July, 2002, 19:36 GMT 20:36 UK German public loses faith in shares  Ron Sommer may have only days left in his job

Deutsche Telekom's internet business, T-Online, was floated two years ago at the peak of the stock market boom. It was one of a series of massively over-subscribed offerings in Germany's former telecoms monopoly.

But instead of rising, Deutsche Telekom's shares have lost approximately 90% of their value. Millions of naturally-cautious Germans have discovered that share fever can lead to a painful hangover. 'Pure insolence' Members of one share club in Berlin say they have lost their enthusiasm. "The Telekom case has diminished the trust and readiness in, and for, shareholding immensely - especially since the shareholder culture in Germany was never a great one," one investor said. "It will decline even further, the more betrayals and manipulations occur and that is the biggest problem of all," he added. Another investor agreed: "What annoys me most is the fact that people like Ron Sommer still fill their own pockets even though the share price is falling so heavily, that's an insolence, it's a pure insolence." Losing faith Scarcely less dramatic than Deutsche Telekom's demise has been the collapse of Germany's Neuer Markt stock exchange.

Once hailed as Europe's answer to the Nasdaq, for the past year it has been the continents worst performing market, dogged by bankruptcies and a series of insider trading and accounting scandals. With almost daily news reports about the stock market crisis it is no surprise that the German public has lost faith in shares. After a twofold increase in share ownership in the late Nineties, the number of private German investors has actually fallen from a peak of 9% to approximately 7% of the population. Growing confidence crisis The shareholder collapse threatens economic and political consequences. It is already making life harder for German entrepreneurs looking for investment capital, but it also risks undermining the government's efforts to reform the country's over-stretched state pension system. Tax incentives to persuade Germans to buy share-based retirement plans have so far attracted little interest. The managing director of the German Share Institute, Dr Rudiger Von Rosen, says that is hardly surprising. "There is a growing confidence crisis overall in this country against share ownership, and since mid 2001 the figures of direct and indirect share holdership is coming down," he said. "The mood is quite understandable... if you are seeing everyday that the value of your portfolio is not moving up, but down, the disappointment is understandable." Mr Sommer believes he is being made a scapegoat for the irrational behaviour of many investors. But the government, which owns 43% of Telekom, clearly thinks a new boss would have a better chance of reviving the so-called "people's share". A rally in Deutsche Telekom stocks would do a lot to staunch Germany's shareholder exodus. | See also: 12 Jul 02 | Business 10 Jul 02 | Business 28 May 02 | Business 22 May 02 | Business 08 May 02 | Business 23 Apr 02 | Business 19 Mar 02 | Business 11 Jul 01 | Business Internet links: The BBC is not responsible for the content of external internet sites Top Business stories now: Links to more Business stories are at the foot of the page. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |