Budget 2025: 'Fair and necessary' choices or a 'truly dismal' future?published at 16:40 GMT 27 November 2025

Nabiha Ahmed

Live reporter

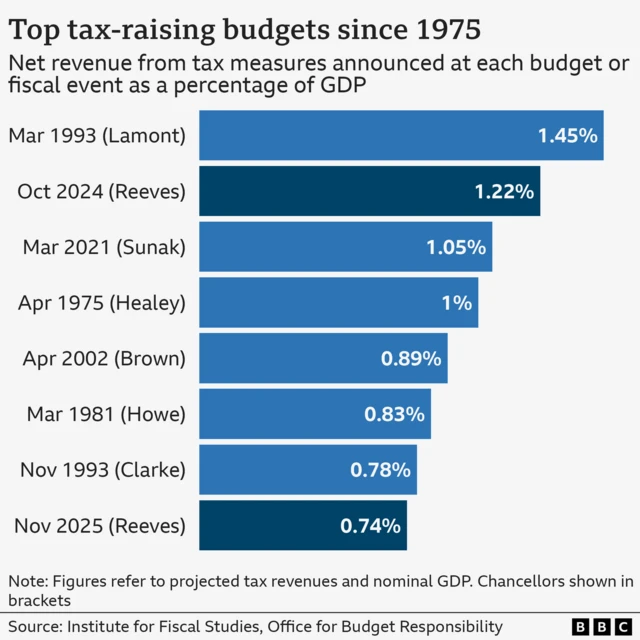

It's been over 24 hours since Chancellor Rachel Reeves delivered her Budget – after being pipped to the post by the Office for Budget Responsibility (OBR), who published their analysis document early in error that has left its boss "personally mortified".

The chancellor extended a freeze on tax thresholds for an extra three years in a move that will drag millions into paying more tax.

But she said the biggest burden would fall on those "with the broadest shoulders" through higher taxes on property and savings, including a new tax on homes worth more than £2m.

Here's what has followed the day after Reeves's announcement:

- Prime Minister Keir Starmer has accepted that everyone is being asked to "make a contribution" which he said was "fair and necessary"

- Independent economics research group the Institute for Fiscal Studies (IFS) says households are in for a "truly dismal" increase in their disposable income, which they say will increase by just 0.5% a year over the next five years

- Other political parties have weighed in. Shadow chancellor Mel Stride says tax hikes are a "clear breach" of Labour's manifesto pledge

- Liberal Democrats leader Ed Davey says Starmer's government is taxing "ordinary people to record levels". Meanwhile, a Green Party spokesperson says the Budget lacks any "transformational changes" and Reform UK leader Nigel Farage called the Budget "an assault on aspiration"

- Scottish First Minister John Swinney has ruled out an increase to income tax rates there - Scotland sets its own rate, called the Scottish rate of income tax

- Reeves has defended her Budget and the "fair and necessary choices" it has made

- From how your energy bills will drop, to if a minimum wage increase can help with the cost of living, we've also been answering your Budget-related questions

- At the heart of this Budget was the chancellor choosing to tax big and spend big, writes our political editor Chris Mason

We're ending our live coverage now. You can read more details from today in our news story.

If you're left wondering how the budget might change things for you, we've got an article unpicking its key takeaways.