The one word description of Wednesday's labour market statistics, external is "good". The two word version is "very good".

Employment is up, wage growth is looking very healthy and there are tentative signs that productivity - the big missing element of the UK's recovery so far - is improving.

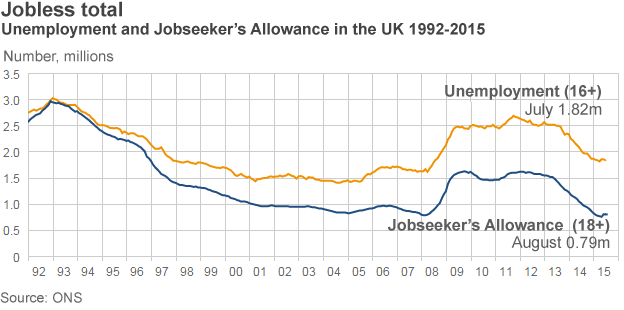

A (comparatively small) rise in unemployment is the only thing blighting an otherwise strong set of numbers.

And if the productivity trend genuinely is starter to turn, then that might start to change the picture on the UK's public finances.

The number of people in work rose by 42,000 in the most recent quarter and the employment rate (the percentage of people in work) is at a record high of 73.5%.

After a few months in which there has been concern that the pace of Britain's jobs recovery has slowed, these firmer numbers will allay some concerns.

But the really significant developments today are what is happening to wages and productivity.

The growth of regular pay (in cash terms) was up 2.9% in the last year. In the private sector regular wages are rising at an annual pace of 3.4% and in the public sector by 1.2%.

In cash terms, this is the fastest wage growth the UK has seen since 2009 and in real terms (accounting for the fact inflation is exceptionally low), this is the strongest wage growth in a decade.

The UK jobs market, after years of behaving abnormally, seems to finally be working in the way that economists expect it to.

A tighter labour market (with more firms starting to face recruitment difficulties and skills shortages) is pushing pay upwards.

Perhaps the most important data in Wednesday's release though are the clues that productivity is recovering.

In the most recent quarter for which we have data (May to July this year) the total number of hors worked in the economy fell by 0.4%.

Falling hours worked coupled with rising output means output per hour - the crucial productivity measure - is on the rise.

Taking it all together, today's numbers give three reasons to be hopeful about the strength of the UK's economic recovery.

What does this say about the economy?

First, despite inflation remaining very low and despite a high chance it will turn negative again the coming months, there is little reason at the moment to fret about a damaging period of "bad deflation".

Pernicious deflation occurs when an economy gets stuck in a negative spiral - when falling prices push down profits and force firms to cut wages, falling wages push down household incomes and suck demand out of the economy.

This kind of negative wage-price spiral leads to much weaker growth and makes it much harder for household's to pay their debts (the real value of which increases).

That is not the kind of spiral the UK is currently facing, low inflation isn't feeding through into weak growth growth.

If anything falling commodity prices are providing a timely boost to household incomes.

Second, the combination of record high employment levels and strong real earnings growth suggests that UK domestic economic demand should remain robust in the months ahead.

A slowing global recovery (and a stronger pound) makes exporting harder but if more people are in work and their pay is rising, the domestic motor of the UK recovery should continue to do well.

The UK isn't immune to global developments and our economy remains unbalanced but it also looks to be a decent place to weather any emerging economy-led international slowdown.

Finally, the numbers suggest the Treasury can look forward to stronger tax receipts in the rest of this financial year.

More people in work and with higher salaries should provided a decent kicker to income tax receipts and national insurance contributions despite the recent raising of the tax free allowance.

When the Office for Budget Responsibility (OBR) updates it's forecasts in November it looks very likely that the overall budget position is set to improve.

Faster tax receipt grow makes the Chancellor's task much easier and gives him interesting political choices to make: does he ease the pace of spending cuts, target a higher surplus or look at targeted tax cuts?

Of course the jobs market is far from healed.

Real wages remain well below their previous peak and (compared to the pre-crisis period) there are more people in lower paying jobs or under-employed.

But the latest numbers show a jobs market heading in the right direction.