The Lib Dems and a taxing subject

For a long time, the Liberal Democrats prided themselves on being the one party prepared to say that taxes should go up - do you remember the penny for education? (By the way, it was always called "a penny on tax" because a shockingly high number of voters appeared to think it meant they'd pay 1p more tax, not 1% more.)

Then Nick Clegg announced he'd lead a party of tax cutters who were tough enough not only to cut public spending, but also to hand back some of the dividend to hard-pressed tax payers.

Today, he unveils another approach - or more precisely, a refining of the approach which was shot down in flames at his conference - to promise tax cuts for the many (in the form of a higher personal tax allowance) paid for by tax rises for the few (a "mansion tax" now re-worked so as not to hit voters in Lib Dem marginals; cuts in pension tax relief; increases in capital gains tax and our old friend "closing loopholes".)

Today, he unveils another approach - or more precisely, a refining of the approach which was shot down in flames at his conference - to promise tax cuts for the many (in the form of a higher personal tax allowance) paid for by tax rises for the few (a "mansion tax" now re-worked so as not to hit voters in Lib Dem marginals; cuts in pension tax relief; increases in capital gains tax and our old friend "closing loopholes".)

The proposals raise two questions:

• How "rich" do you have to be before you lose out? Someone on around £50,000 who put 10% of their income into a pension would, I'm told, lose as much in tax relief as they would gain from the higher tax allowance. Of course, the less you put into your pension (and many put less than 10%), the higher income you could earn before you become a loser.

• Clegg has warned of the need for "savage cuts" in public spending. Won't the next government - whoever forms it - have to hike taxes in some of the ways he describes to reduce the deficit or mitigate those savage cuts and not to pay for tax cuts? Already the government is restricting top-rate tax relief on pensions to those earning over £150,000, and it's likely to go further in the future

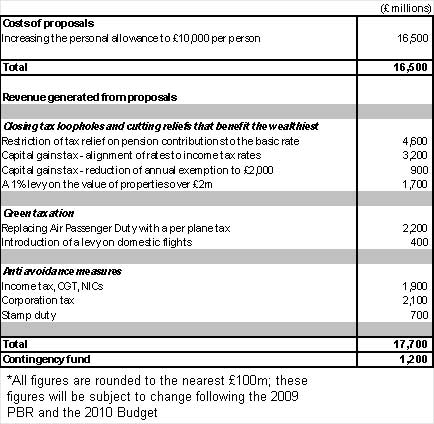

Below is a table showing how the Lib Dems cost their tax-cutting & tax-increasing proposals:

Update 1220: Thanks to those of you who have pointed out that the singular of "pence" is "penny". First paragraph amended.

I'm

I'm

Page 1 of 5

Comment number 1.

At 10:43 30th Nov 2009, desabled wrote:Clegg has wimped out on his tax pledge to try and cozy up to the tories

robbo for once is right the change differs enormously from traditional liberal tax policy,Clegg is the reason I did not renew my membership

he should have joined the tory party he and camoron could be twins

Complain about this comment (Comment number 1)

Comment number 2.

At 10:46 30th Nov 2009, greatHayemaker wrote:Isn't what the Lib Dems "would do" all rather irrelevent?

Nick Clegg can talk until he's blue in the face, his time would be better spent doing something useful.

Complain about this comment (Comment number 2)

Comment number 3.

At 11:05 30th Nov 2009, greatHayemaker wrote:Oh okay, I'll bite.

Certain of these figures seems very much like pipe. How on earth are they coming up with the figures they will save by anti avoidance measures? I'm not saying their is no money to be made here, but this is purest speculation.

As for reducing the AE on CGT, as far as I remember from my tax studies (admittedly a few years ago now), CGT has never made any money, since it always costs more to collect than is raised.

I am strongly against the reduction of pension relief as well. Lets not forget, your annuity is taxable income when it comes time for you to retire, you do not get it tax free. So if you are paying into your pension out of taxable income, by the time you actually get your money back out, it will have been taxed twice.

Since none of us are likely to be getting a state pension when we retire, is this not the time to encourage people to make their own provisions rather than punishing them for it?

Typically punitive tax measures suggested here. I like the £10k personal allowance idea, but it would be more sensible to pay for it with by raising the intermediate and higher tax rates by 1% each.

Complain about this comment (Comment number 3)

Comment number 4.

At 11:13 30th Nov 2009, greatHayemaker wrote:*That should be pipe dream

Complain about this comment (Comment number 4)

Comment number 5.

At 11:15 30th Nov 2009, saga mix wrote:The LibDems are on the right lines. The P/A just HAS to go up to £10,000. At least. I'd go £12,000. It's a scandal that people on breadline wages are hit for tax. But on the other hand, any responsible government has to address the deficit and we all know public spending cuts alone won't do it. So overall, we have to implement tax RISES. As far as possible, they should fall on middle/high income earners under the "ability to pay" principle. That's key. But we shouldn't pretend that Joe Average won't have to pay more too. That would be "head in the sand" stuff which does nobody any good. So a substantial increase in the basic rate, please! First party to recognise that reality gets my vote (unless it's the Clowns). And the Mansion Tax? Yes, good idea. Very good idea. I'm happy to pay that. I WANT to pay it. Just a pity that my Swindon bedsit (although it's gone up a lot since I bought in 1995) is going to get nowhere near whatever threshold Vince and Nick end up setting. All in all then, a B borderline A for the LibDems on this one.

Complain about this comment (Comment number 5)

Comment number 6.

At 11:19 30th Nov 2009, John Bush wrote:Nick..sorry to be pedantic,but PENCE is plural for PENNY.There cannot be one pence..it has to be one penny!!

Complain about this comment (Comment number 6)

Comment number 7.

At 11:20 30th Nov 2009, Ernie wrote:"#2 Nick Clegg can talk until he's blue in the face, his time would be better spent doing something useful."

Yes, that's right, they should all just give up and go home so we can have a proper two-party system like the Americans. That's what we all want!

Well, it seems to be what you want, but frankly I'm sick of the back and forth between labour and the the conservatives. You'd be as well to support a third party (any third party really) if you feel the same way.

Complain about this comment (Comment number 7)

Comment number 8.

At 11:32 30th Nov 2009, Science_PhD wrote:I'd like the details on the Wealth tax - nice idea but difficult to implement. You will need an army of assessors out 'valuing' property and then there will have to be an appeals system - all of which means you won't collect a penny for the first few years.

Also, while tax avoidance crackdown is a great idea, there is a whole army of accountants coming up with new ideas all the time. Government is too slow and cumbersome and these guys will run rings around HMRC. I'm not syaing you shouldn't still do it, I just don't believe the figures quoted. Just like all tax redistributive ideas, great in theory but you need an army of civil servents to implement and then it still doesn't work too well as the rich will always be one step ahead. A simple flat-rate tax though being bad in theory might end up pragmatically delivering the most efficient and fair system in practice.

Complain about this comment (Comment number 8)

Comment number 9.

At 11:38 30th Nov 2009, Ken McArthur wrote:What is actually wrong with a progressive tax system, where those with a paltry £10 000 a year would actually not pay income tax (they will pay a lot of VAT in any case), and those who are better off paying more?

Good for the LibDems to push for this.

Gothnet, yes, a standard response, from Lab/Con cronies, to what the small parties say is always "they are not important". This is of course idiotic for two reasons:

1/ Both Lab and Con have been stupidly wrong, and saying the same rubbish, on the economy, Iraq and even on inheritance tax. They do not appear to want to look that different.

2/ Should a party that got well over 20% at the last general election actually be ignored. In most real democracies (where the result of an election broadly reflects the votes of most of the people, not just a few) a party that got say 23% would have much greater influence to match its support.

Complain about this comment (Comment number 9)

Comment number 10.

At 11:39 30th Nov 2009, rockRobin7 wrote:All taxation is theft.

This is just another way for the government to waste even more more of our money.

There has been quite enough of that already, thank you.

A benefits bill in excess of 120bn pounds a year, the NHS costing tthree times as much as when the tories left power; this is profligacy and waste on a grand scale.

The debate has moved on. We need to discuss how to make savings not how to tax people even more.

Call an election.

Complain about this comment (Comment number 10)

Comment number 11.

At 11:40 30th Nov 2009, romeplebian wrote:better be quick, if the last blog entry by Nick is anything to go by this will get closed soon , any news on climate change Nick ? what are the politicos saying or not saying about what is being described as a scandal, I noted in the Lib Dem announcement you write about, mentioned a green tax , will that have to be re thought ?

Complain about this comment (Comment number 11)

Comment number 12.

At 11:41 30th Nov 2009, giannir wrote:Well spotted Nick. Just spin to save their skins in marginal seats.

Typical of LibDems: they will say anything to please anybody. I just feel sorry for Vince Cable who probably had to go along with such an empty policy just to please handsome Nick (Clegg, I mean :-)).

One cannot be bothered even to look at their figures. I would only ask

(as you rightly did): at a time when even them have convinced us that we will need "savage cuts" and probably heavier taxes (for generations, I add) to come out of the .... mess Superman has thrown us in, how can they possibly talk about playing Robin Hoods? Irresponsible, just hoping to get a few votes here and there. The only consolation is to know that they will never run the Country. Pity because they have half a dozen good people who should seriously consider jumping ship.

Complain about this comment (Comment number 12)

Comment number 13.

At 11:53 30th Nov 2009, KL wrote:Science_PhD - there is a database of property values already in existance, used for the Council Tax. I don't know the full details of the policy but this would at least be a starting point, especially since there is already an appeals process in place (and why, when you're trying to cut expenditure, would you introduce and extra level of bureaucracy?)

Complain about this comment (Comment number 13)

Comment number 14.

At 11:55 30th Nov 2009, calmandhope wrote:Agreed with Gothnet, we need more of a choice between Labour and the Conservatives, or we're just going to end up in a extremely stale political enviroment. I personally am going to be encouraging people who I know won't vote, to vote for a minority or third party as a way of hopefully balancing the house out slightly.

The Lib-Dems though do appear to be on the right lines with what I'd like to see in tax ways at least. Agree with saga surprisingly on that although I think I'd go with extremely low tax at £11,000 with slight increases at £12,000 and £13,000.

Complain about this comment (Comment number 14)

Comment number 15.

At 11:55 30th Nov 2009, Justin150 wrote:Fantasy - pure fantasy.

Raising personal allowance is sensible - takes people out of the tax net totally and has a much bigger impact (relatively speaking) for lower paid than higher paid.

Anti-avoidance measures never produce the figures claimed.

Reducing pension relief to basic rate tax looks sensible until you do the maths. Bearing in mind that Lab has already (in effect) capped pension contributions at £20,000 a year how exactly is someone supposed to save enough to generate a decent pension. Most people will not be able to afford to pay the full £20,000 per year ever and those that can will usually not be able to do so until kids have left home and mortgage paid off (obviously this does not apply to top 1% of income earners) The net result will be to make pension investment at best a marginal use of money. That will reduce the size of pension funds and thereby reduce the amount of money they put into shares which will reduce the wealth of the country (and reduce stamp duty)

Increasing CGT - you might want to cross check that against the newspaper reports from businessmen who say that the worst thing Lab did was increase CGT from 10% (if held long enough) to 18%. It was a disincentive to entrepreneurship. Reducing CGT threshold to £2000 is just plain daft - now no one has any incentive to invest in shares.

As for the 1% levy on mansions - will that apply to MPs collective properties founded by the tax payer? Now lets see how to avoid this - are simple my house will become 2 flats each worth say £1.25m and of course if all else fails simply dispute the valuation.

This counts as primary school level tax plans and a poor primary school at that. As for it being radical - I suggest Nick Clegg looks up the meaning of the word.

Here is a radical plan:

1. Increase the personal allowance to £10,000 but apply to both income and capital

2. Merge NI and Income tax into a single tax

3. Flat rate of say 30% on all income and capital gains subject only to the following exceptions

3.1 The old taper relief brought back for business assets

3.2 Charitable donations

3.3 Pension contributions

3.4 Main home exempt

3.5 some form of business angel investment relief to encourage investment in SME in UK

4. VAT at 20% and on much wider range of goods than currently

5. Stamp Duty on houses increased (first £250,000 free then say at 5-10% which should slow down property speculation)

I have no idea how the numbers add up but at least it counts as radical

Complain about this comment (Comment number 15)

Comment number 16.

At 11:57 30th Nov 2009, Looternite wrote:Once again Lib/Dem spin aimed at winning seats, not realistic and workable which is what the country really needs.

Vote Tory - get a Tory government

Vote Lib/Dem - Get a Tory Government

Complain about this comment (Comment number 16)

Comment number 17.

At 12:00 30th Nov 2009, greatHayemaker wrote:7. At 11:20am on 30 Nov 2009, Gothnet wrote:

"#2 Nick Clegg can talk until he's blue in the face, his time would be better spent doing something useful."

Yes, that's right, they should all just give up and go home so we can have a proper two-party system like the Americans. That's what we all want!

Well, it seems to be what you want, but frankly I'm sick of the back and forth between labour and the the conservatives. You'd be as well to support a third party (any third party really) if you feel the same way.

-----------

Except thats not what I said, is it.

Something must be wrong with me, I can't even be bothered to set you straight properly. Put it down to that monday morning feeling.

Complain about this comment (Comment number 17)

Comment number 18.

At 12:01 30th Nov 2009, Ian Nartowicz wrote:What the conspiracy theorists don't seem to realise, and what Nick (Robinson) probably knows but rarely gets reported, is that Nick (Clegg) is one of the more right wing Lib-Dems and always has been. On the other hand, a considerable chunk of the party range from nanny-state to near-communist and it is these left-wingers that have been more visible in the past. The common theme in the party is "liberal" and "democrat", but economic policies are all over the place. Food for thought for anyone thinking of voting Lib-Dem: are you going to get a less judgemental Mrs Thatcher or a kinder gentler Stalin?

Complain about this comment (Comment number 18)

Comment number 19.

At 12:02 30th Nov 2009, DevilsAdvocate wrote:5. At 11:15am on 30 Nov 2009, sagamix wrote:

The LibDems are on the right lines. The P/A just HAS to go up to £10,000. At least. I'd go £12,000. It's a scandal that people on breadline wages are hit for tax. But on the other hand, any responsible government has to address the deficit and we all know public spending cuts alone won't do it. So overall, we have to implement tax RISES. As far as possible, they should fall on middle/high income earners under the "ability to pay" principle. That's key. But we shouldn't pretend that Joe Average won't have to pay more too. That would be "head in the sand" stuff which does nobody any good. So a substantial increase in the basic rate, please! First party to recognise that reality gets my vote (unless it's the Clowns). And the Mansion Tax? Yes, good idea. Very good idea. I'm happy to pay that. I WANT to pay it. Just a pity that my Swindon bedsit (although it's gone up a lot since I bought in 1995) is going to get nowhere near whatever threshold Vince and Nick end up setting. All in all then, a B borderline A for the LibDems on this one.

-----------

Actually, you can volunteer to pay the Taxman, you don't have to be forced to do so, apparently there are people who do so, but it has gone down under the Labour Government compared to the Tories. Unfortunately I can't find a link to a site that would back up that claim, but I believe I read it in a newspaper some time ago. So you could pay now without waiting for a change of Tax regime or Government.

Complain about this comment (Comment number 19)

Comment number 20.

At 12:12 30th Nov 2009, Mike wrote:A strong 3rd party, and their policy, is always revelvant.

As it stops the Tories and Labour, colluding to do whatever they want on the major issues.

The only way the main parties really differ hugely, are on a few token policies that they devise to please their cores historical support.

The tories will do something for the bankers and businessmen. Labour will do the same to the Unions and jobless.

If you look at core politics - tax, spending, cuts, NHS, Europe, business, Army, policing - I really don't think there are huge chasms between Labour and Tory policy, no matter what they try and claim.

Labour has gone a bit towards the right since Blair, Cameron has gone to the left.

The principle basically being traditional tory and labour politics aren't electable in 2010.

Labour would never have got in in 1997, without the new badge, name, and a move to the right. Ditto the tories. New badge, new leader, new leftist policy.

It's pretty apparent the public just want centralized politics, and the main parties just give them what they want.

As I said though, you need these other parties keeping it honest. Without UKIP or the Lib Dems, the 2 big parties would not offer you much of a choice in what you are voting for

Complain about this comment (Comment number 20)

Comment number 21.

At 12:14 30th Nov 2009, greatHayemaker wrote:15

Not a bad plan. My biggest problem with it is stamp duty.

Never been a fan of stamp duty, someone about to undertake significant expenditure out of taxed income, and whack a load of tax on it.

Most tax is charged at the point of income, not the point of expenditure, which guarantees people being able to afford it. Other tax at point of purchase, ie. VAT, is okay in my book because it is charged on luxuries, and you can choose whether to pay it or not.

Complain about this comment (Comment number 21)

Comment number 22.

At 12:15 30th Nov 2009, yewlodge wrote:Am I missing something? I thought there was a need to raise taxes to pay off the Labour Black Hole? This seems to be essentially tax neutral.

Actually I also wonder if savings via a pension can be taxed twice as this appears to imply. In any other form of savings of tax paid income only the gain/dividend is taxable. Surely all it will encourage is a new form of "pension" saving schemes to avoid the double taxation. It could end pension schemes as we know them and actually reduce the amount raised in tax in the short term.

And finally I am against tax on capital because it doesn't relate to ability to pay( eg the elderly on pensions may be disproportionally hit) and it is somewhat arbitrary, as we have seen house prices go up and down. Surely art collections, wine cellars, yaughts, classic cars etc are more a sign of substantial wealth/disposable income and a damn site more easy to dispose of piecemeal to pay the tax. Lopping the chimney pot off this year and flogging the garage next year aren't realistic options. I know its difficult to identify such items relative to a house but higher VAT on luxuries such as these ( say 25% or more) may raise at least as much and from those with the ability to pay and with relatively little additional bureaucracy.

Complain about this comment (Comment number 22)

Comment number 23.

At 12:18 30th Nov 2009, Poprishchin wrote:This comment was removed because the moderators found it broke the house rules. Explain.

Complain about this comment (Comment number 23)

Comment number 24.

At 12:25 30th Nov 2009, Strictly Pickled wrote:4 sagamix

"It's a scandal that people on breadline wages are hit for tax."

==================================

Interesting that you cannot bring yourself to say which government are currently responsible for this !!!! You mention the Liberals and the "clowns", but very oddly not the party actually responsible, and who could actually make these changes now. Or have you given up on them ever coming up with any sensible proposals - most other people have. Doubling of the 10p hardly helped the people in this salary range - tell me saga, who was the chancellor who introduced this change - which was so carefully thought out - clearly targetting this group of people ???

Complain about this comment (Comment number 24)

Comment number 25.

At 12:26 30th Nov 2009, pdavies65 wrote:10 Robin wrote:

All taxation is theft.

Surely some taxation is necessary. You want to stop every 100 metres on the motorway to put a coin in the streetlamp?

Complain about this comment (Comment number 25)

Comment number 26.

At 12:28 30th Nov 2009, Looternite wrote:In many seats there are likely to be a number of "celebrity Independants", like Esther Rantzen.

Therefore there will be choice at the next election ans so although Nick expects a Tory victory at the next election. The new parliament is likely to be less predictable.

Complain about this comment (Comment number 26)

Comment number 27.

At 12:29 30th Nov 2009, Doctor Bob wrote:I appreciate that it's perfectly fair that those who are the benficiaries of wealth in our system should look after those who produce them that wealth but this won't win my vote.

I'd far sooner have a fairer council tax based on income rather than property. Income tax (based on what the government says I can afford) covers my access to various central services so why not the same re local tax? That policy was once on the books of the Lib Dems and would have leaned me more toward this party.

Nick Clegg really doesn't seem to have that spark that inspires confidence.

Complain about this comment (Comment number 27)

Comment number 28.

At 12:31 30th Nov 2009, grand voyager wrote:2 greathaymaker

#Nick Clegg can talk until he's blue in the face, his time would be better spent doing something useful.

Yes he could be riding with the hounds,or spending a weekends pleasure with you down at the abattoir.

Complain about this comment (Comment number 28)

Comment number 29.

At 12:34 30th Nov 2009, Strictly Pickled wrote:5 sagamix

"And the Mansion Tax? Yes, good idea. Very good idea."

========================================

Can you explain why it is a good idea ? Presumably stamp duty was pain when it was bought, and council tax associated with it is paid at the going rate.

Why should anyone have to pay tax for something they have bought and own. Exactly why is tax payable ? As for the setting of the £2 million thereshold, how is that figure arrived at ? Taxing someone simply because they own something doesn't seem like a great idea to me - and I don't think it would end there

Complain about this comment (Comment number 29)

Comment number 30.

At 12:36 30th Nov 2009, skynine wrote:What's the point of the Lib Dems? They aren't going to form a government so whatever they propose is pie in the sky. If you want to make a protest vote go for the BNP, at least any future government will sit up and take notice, other wise just vote for the parties that actually matter, Labour or Conservative because it is one of them who will form the next Government. Whatever Cleggy proposes is as much use as a snowball in Dubai.

Complain about this comment (Comment number 30)

Comment number 31.

At 12:38 30th Nov 2009, grand voyager wrote:24 strictly pickled

#tell me saga, who was the chancellor who introduced this change

Tell me pickled who was the chancellor that saw the error and corrected it.

Complain about this comment (Comment number 31)

Comment number 32.

At 12:42 30th Nov 2009, Doctor Bob wrote:Still nothing on the hateful and despised inheritance tax, nor stamp duty (which comprises the bulk of the expense of moving home), nor the once heralded local income tax to replace the council tax.

This proposal can be applauded if only because it will help undo the rather ridiculous system where the less wealthy are taxed then receive a rebate through tax credits. Daft.

Complain about this comment (Comment number 32)

Comment number 33.

At 12:42 30th Nov 2009, kaybraes wrote:" The last idea didn't gain any votes,lets try another one, doesn't matter if it's a viable idea or not , as long as it sounds good and gets a few votes". The Lib dems are back in the David Steel mould, clutching at straws and hoping someone will give them a piggy back into power ; " even one obscure cabinet post would do , and we'll support anything for anybody " No doubt Vinc the convince will be trotted out in the fullness of time with his usual calm measured statement to make the nonsense sound credible.

Complain about this comment (Comment number 33)

Comment number 34.

At 12:45 30th Nov 2009, englandcricket fan wrote:This will be another hit on private pensions after Brown's raid earlier. Perhaps, a "fairer" system might be to do away with taxpayer funded pensions schemes such as Nick Clegg and his friends will all receive and instead make them have a private pension plan like the rest of use.

Complain about this comment (Comment number 34)

Comment number 35.

At 12:50 30th Nov 2009, IPGABP1 wrote:No10 Rocking Robin,

In a recent international survey Norway was regarded as the best place in the world to live.They have higher levels of taxation than the UK. Do you think it may be worth considering moving in the direction they have chosen in order to improve political, economic and social life in the UK?

Complain about this comment (Comment number 35)

Comment number 36.

At 12:55 30th Nov 2009, greatHayemaker wrote:31. At 12:38pm on 30 Nov 2009, grandantidote wrote:

24 strictly pickled

#tell me saga, who was the chancellor who introduced this change

Tell me pickled who was the chancellor that saw the error and corrected it.

------------

If you are referring to the 10p tax bracket, no chancerllor did. Those who spotted the error were:

The press

Me

Everyone in my (then) firm, Deloitte

Everyone in every other professional services firm

My Dad

My Brother

My Brother's pet dog

My Nephew

............ I could go on

But you get the picture, right? No credit for retrospectively changing something that was so blatantly wrong it beggars belief, something so wrong that any halfwit with a calculator could have spotted.

By the way, assume from your other post that you conceed losing the argument, so you are instead resorting to fatuous nonsense you believe to be amusing.

Complain about this comment (Comment number 36)

Comment number 37.

At 13:02 30th Nov 2009, Poprishchin wrote:He's got the mindless glassy eyes. He's got the inane management speak. He's got the crazy semaphore hand signals. Suit. Tie. Combed hair, brushed teeth. Yep! It must be yet another career politician!

I thought human cloning was illegal!

Complain about this comment (Comment number 37)

Comment number 38.

At 13:03 30th Nov 2009, IR35_SURVIVOR wrote:we should abandon NI, and car tax and TV licencing (the BBC can get a protrato amount out of general tax for each household in the country.

put car tax on petrol/diesel

Nodody of 66% of the average wage to pay and sort of tax and then have

band up to 60% to raise what is required to balance the budget.

scrap council tax and also tax out a prorata amount out of tax and then give that to the council. Then there is be not need for capping. This is what you are going to get. Then the council have to decide how to spend it wisely. Therefore central HMG cannot use council tax as a means to incease tax levels without increasing the tax rate as is the case at present.

Complain about this comment (Comment number 38)

Comment number 39.

At 13:08 30th Nov 2009, Looternite wrote:Like most people I am rather tired of the Limp/Dums promising the Earth and delivering nothing.

I am old enough to remember when the Liberals tried to get the "Yoof" vote by promising to legalise drugs. Then they wanted to get the middle aged male vote by promising to legalise brothels, both ideas were quietly dropped (too loony).

Every election the BBC gives the Limp/Dums an easy ride. After every election the Limp/Dums come third and they say they are making steady progress.

By now this steady progress should mean they have 100% of the vote!

All they do is carp and criticize anything the other parties do.

These plans of Clegg are just pipe dreams.

Complain about this comment (Comment number 39)

Comment number 40.

At 13:16 30th Nov 2009, jrperry wrote:To all who believe that messing about with personal taxation has anything to do with finding our way out of the debt crisis.

The debt crisis is the result of the government having decided to maintain public expenditure in the face of a collapse in tax revenue. The principal element of this collapse is the catastrophic drop in corporation tax revenue. Any taxation policy that fails to address recovering these corporation tax revenues is therefore merely fiddling at the edges of the problem, and is inherently doomed to failure.

Complain about this comment (Comment number 40)

Comment number 41.

At 13:26 30th Nov 2009, Strictly Pickled wrote:31 grandantidote

"Tell me pickled who was the chancellor that saw the error and corrected it."

=====================

No problem at all GA.

No chancellor actually has ever stated it was an "error" and it took the best part of a year before after it was announced before it was even discussed at all. Frank Field would probably win the prize for the first politician spotting this, but he was certainly not the chancellor. As post 39 also states, the chancellor was well, well down the field for this one.

And certainly the measures taken since have not fully corrected the problem for all of those most affected by it.

You'll be telling us that the handling of this "error" was a great success next.

Complain about this comment (Comment number 41)

Comment number 42.

At 13:29 30th Nov 2009, saga mix wrote:devils @ 19

"Actually, you can volunteer to pay the Taxman"

I'll give that a miss if you don't mind.

Complain about this comment (Comment number 42)

Comment number 43.

At 13:31 30th Nov 2009, calmandhope wrote:Looternite it is kinda hard to deliver on promises if you're not in power you know. And they have campaigned on a number of issues that the two main parties now agree on as well, surely that would be delivering?

Complain about this comment (Comment number 43)

Comment number 44.

At 13:31 30th Nov 2009, AndyC555 wrote:jrp

2008/09 figures for sums collected by HMG - Income tax 151.2 bn, National Insurance 97.7 bn, VAT 82.6 bn - Corporation Tax 44.9 bn. Income tax and NIC bring in 5 times as much as CT. Always has brought in a lot, loe more.

Corporation tax is important but not as important as you say.

Where you are right is that those who think inheritance tax or CGT is some sort of answer. The amounts collected by HMG for those two? Just 3.1 bn and 4.9 bn. to think that you could engineer some sort of change that made those two taxes important is plain daft. Not that being plain daft and clearly not knowing what they are talking about has stopped people posting on here.

Complain about this comment (Comment number 44)

Comment number 45.

At 13:33 30th Nov 2009, fairlyopenmind wrote:#5, sagamix wrote:

"... As far as possible, they should fall on middle/high income earners under the "ability to pay" principle. That's key. But we shouldn't pretend that Joe Average won't have to pay more too.

And the Mansion Tax? Yes, good idea. Very good idea. I'm happy to pay that. I WANT to pay it. Just a pity that my Swindon bedsit (although it's gone up a lot since I bought in 1995) is going to get nowhere near whatever threshold Vince and Nick end up setting..."

Sorry, saga,

But are you know claiming the Swindon bed-sit as your "main home"?

Does that mean that your Hampstead base is in a company structure and somehow protected?

I believe that raising the tax-free allowance should have been done by Brown decade or so ago. Even if it were qualified to be subject to total income levels (i.e. decent allowance for people with low incomes, but withdrawn for those above a certain level).

Complain about this comment (Comment number 45)

Comment number 46.

At 13:35 30th Nov 2009, Roland D wrote:Update 1220: Thanks to those of you who have pointed out that the singular of "pence" is "penny". First paragraph amended.

See. Nick DOES read what we post here.

Complain about this comment (Comment number 46)

Comment number 47.

At 13:37 30th Nov 2009, gavin aylott wrote:Complain about this comment (Comment number 47)

Comment number 48.

At 13:38 30th Nov 2009, saga mix wrote:PD @ 25

Don't underestimate Robin. He has a well developed blueprint for a network of privately funded motorways - state of the art construction, and with each one incorporating a special "superfast" section exclusively for the use of people who need to get to their next important business meeting like NOW! Will be known as the "Entrepreneur Lane".

Complain about this comment (Comment number 48)

Comment number 49.

At 13:41 30th Nov 2009, gavin aylott wrote:What failures to amaze to me during this whole debate is people seem to assume that we can have all the current services and not pay for them. Taxes will have to go up but it should be in fair progressive manner that makes sure the richest pay their fair share. My final point is that the difference between the current administration and the Conservative Party is that the Labour party will try to be less ruthless in what they cut. Where as the Conservative right wing will attack all the social benefits that currently exist. I remember how ruthless they were in the 80s, people need to remember how they destroyed entire communities in the name of the market!!!

Complain about this comment (Comment number 49)

Comment number 50.

At 13:42 30th Nov 2009, greatHayemaker wrote:42. At 1:29pm on 30 Nov 2009, sagamix wrote:

devils @ 19

"Actually, you can volunteer to pay the Taxman"

I'll give that a miss if you don't mind.

----------

Think you've just been found out Saga.

Happy to force others to contribute, just don't want to yourself.

Yes, very socialist.

Complain about this comment (Comment number 50)

Comment number 51.

At 13:43 30th Nov 2009, AndyC555 wrote:I'm interested that the Liberals now feel that paying into a pension is somehow exploiting a 'loophole'. That higher paid people get tax relief at their top rate is not a 'loophole', it's how the system is supposed to work.

If you earn £25,000 and put £1,000 into a pension, you are taxed as if you earned £24,000. If you earn £200,000 and put £1,000 into a pension you are taxed as if you earned £199,000. What is so obnoxious about that?

If you can expand your minds a moment and replace "paying into a pension" with "incurring business travel costs", you'll see how daft it is. No-one would claim that it's a 'loophole' that the person who earns more pays £400 less tax as a result of his business travel but the lower paid person 'only' pays £200 less tax.

If both Labour and the Liberals could be honest and instead of talking about 'closing loopholes' they were to say "we're desperately scrabbling around to find ways to raise more tax and this is one we've come up with" at least we'd know.

Complain about this comment (Comment number 51)

Comment number 52.

At 13:49 30th Nov 2009, greatHayemaker wrote:49. At 1:41pm on 30 Nov 2009, gavin aylott wrote:

What failures to amaze to me during this whole debate is people seem to assume that we can have all the current services and not pay for them. Taxes will have to go up but it should be in fair progressive manner that makes sure the richest pay their fair share. My final point is that the difference between the current administration and the Conservative Party is that the Labour party will try to be less ruthless in what they cut. Where as the Conservative right wing will attack all the social benefits that currently exist. I remember how ruthless they were in the 80s, people need to remember how they destroyed entire communities in the name of the market!!!

-------------

By definition, progressive taxes meaning the wealthy are paying more than their fair share. In fact, a "fair share" would mean the richest pay less, since they make least use of the services. Bit mixed up here.

You last point is absolute rot, pure conjecture and indoctrinated hatred. Try to form your own opinion instead of just trotting out the labour party HQ lines.

Complain about this comment (Comment number 52)

Comment number 53.

At 13:51 30th Nov 2009, AndyC555 wrote:#49

"Taxes will have to go up but it should be in fair progressive manner that makes sure the richest pay their fair share."

Somone on £20,000 a year pays about 21% of his income to HMG.

Someone on £1,000,000 currently pays 40% (near as damn it). I think someone paying twice the proportion is already doing his bit.

There just are not enough rich peopole around to ever make a difference to the tax system. It's just political posturing and jealousy.

Complain about this comment (Comment number 53)

Comment number 54.

At 13:58 30th Nov 2009, saga mix wrote:pickled @ 29

"Exactly why is tax payable?"

A good question.

I'd say for two main reasons ...

(1) To fund public services.

(2) To tackle the deficit.

As to Who Pays, we should go (as far as possible) on the ability to pay principle. But within reason, obviously.

Complain about this comment (Comment number 54)

Comment number 55.

At 14:00 30th Nov 2009, rockRobin7 wrote:sagamix...

one of your better ideas there.

Perhaps the superfast lane on the new motorways could be kept well swept and clear by all those on newlabour handouts to give them something useful to do.

Call an election.

Complain about this comment (Comment number 55)

Comment number 56.

At 14:00 30th Nov 2009, greatHayemaker wrote:25 & 48

The worthiness of the cause does not mean it is any less "theft".

If I were to break into rich people's homes, steal their valuables in order to donate them to charity, I would still be arrested and sent to prison. Doubtless some chinless do gooders would applaud such actions, but the majority would recognise them as being wrong.

The money is extorted from you under threat of force, and distributed in a way that you do not get any say in. Democracy is meant to be our means of having a say, but as we all know, there is so little difference between any of the parties at the moment that democracy is more or less broken.

Complain about this comment (Comment number 56)

Comment number 57.

At 14:05 30th Nov 2009, saga mix wrote:jr perry @ 40

"The debt crisis is the result of the government having decided to maintain public expenditure in the face of a collapse in tax revenue. The principal element of this collapse is the catastrophic drop in corporation tax revenue. Any taxation policy that fails to address recovering these corporation tax revenues is therefore merely fiddling at the edges of the problem, and is inherently doomed to failure"

Yes, but a hike in Corporation Tax rates might really damage business. Could actually backfire and bring in LESS revenue! Sometimes a policy which looks attractive on the surface (and higher rates of Corp Tax is certainly that) has to be passed over for hard headed practical reasons. No, Corp Tax stays the same, JR, I think we have to say. Or maybe a very small rise, but no more than that.

Complain about this comment (Comment number 57)

Comment number 58.

At 14:05 30th Nov 2009, AndyC555 wrote:#50

"Think you've just been found out Saga.

Happy to force others to contribute, just don't want to yourself.

Yes, very socialist."

Oh come on, we found him out ages ago. If "X" is the amount that sagamix earns, then "X" is a fair, reasonable amount to live on but "X" + £1 is a capitalist obscenity that deserves punative taxation. Anyone earning "X" - £1 is someone being exploited (probably by an obscene capitalist) and although Sagamix won't actaully DO anything to change the situation, he will give the exploited worker a concerned look.

Complain about this comment (Comment number 58)

Comment number 59.

At 14:10 30th Nov 2009, rockRobin7 wrote:Another wquestion that puzzles me.. a week ago we have acres of coverage on the apparent recovery of the newlabour corpe inthe opinion polls, this weekend we have another claiming a troy landslide is inevitable after their successful campaigning in key marginals but not a peep out of the BEEB...

Institutional bias, perchance?

Call an election.. I'm hotting it off to campaign via my priority lane built by sagamix.

Complain about this comment (Comment number 59)

Comment number 60.

At 14:11 30th Nov 2009, gac wrote:It is a no brainer:- those who pay taxes are going to have to pay more, those in gainful employment are going to see their pay and rations squeezed, those who unfortunately have to live on benefits are going to have to live on less! at least for a year or three.

Blame whomever you will but the UK is in deep purple. Even so Mr Brown is again promising more of our borrowings to the third world on the basis that Australia and GB are two of the richest countries in the World. (OK the UK is not a country but that is what he said). And Cameron and Clegg think the same when it comes to overseas aid.

In fact we are now so poor that we should be getting aid from the African Nations!

Oh! any tax on people saving for their retirement should be roundly shouted down.

Complain about this comment (Comment number 60)

Comment number 61.

At 14:15 30th Nov 2009, saga mix wrote:haye @ 50

"Happy to force others to contribute, just don't want to yourself. Yes, very socialist"

So, to be a Socialist you have to voluntarily pay more tax than if you're a Clown. Mmm. You like to set the bar quite high for us, don't you? Good job we like soaring skywards.

Complain about this comment (Comment number 61)

Comment number 62.

At 14:18 30th Nov 2009, Khrystalar wrote:@ RockRobin, post #10;

"All taxation is theft."

Really???

Do you enjoy living in a country that employs the Rule of Law? Happy to go down to your local shop without getting mugged? Or at least, safe in the knowledge that if you DO get mugged, you can call a bunch of big burly guys in blue uniforms to go sort out the perpetrator for you?

Perhaps you've made some money as a company owner, or a shareholder. Are you happy with the fact that you have a workforce in order to make you that money who're (comparatively) well-educated, healthy and able to travel freely to get to their workplace, to make you money?

And what are you gonna do if your house suddenly catches fire? Stand there and watch while your home and its contents burn? Or call the Fire Brigade and have other people risk their lives in order to save your family and your livelihood?

No, Taxation isn't theft. Freeloading whiners who expect to live here, in our country, enjoying all the benefits our semi-democracy has to offer and yet don't want to pay what's necessary to keep this place running... they're the thieves.

Not happy to pay your tax? Then get out of my country; your sort aren't welcome here.

Go live in China, as an alternative. See how long you get to spout your "all taxation is theft" nonsense, or spout your criticisms of the ruling government, before you get yourself shot by the authorities.

Odds on bet is; it won't be very long.

Complain about this comment (Comment number 62)

Comment number 63.

At 14:20 30th Nov 2009, puzzling wrote:Financial and business tax need to be simplified and clarified.

UK has more accountant than the rest of Europe put together. If evenly spread out, there is one accountant per square mile. If it because the tax laws are too complicated, too full of holes and very lucrative for those who can find the right accountants or find some lobbyists and friends of politicians to change the laws?

Complain about this comment (Comment number 63)

Comment number 64.

At 14:21 30th Nov 2009, rockRobin7 wrote:And all this when the real story is that the government is in a blind panic about what has happened in Dubai ahead of its own pre budget report...

If a once oil rich state can run out of money and not be financed by its neighbours then what hope is there for the UK if the government stands up in a week's time and dodges the debt question, yet again?

Call an election.

Complain about this comment (Comment number 64)

Comment number 65.

At 14:23 30th Nov 2009, AndyC555 wrote:57 Sagamix - "Yes, but a hike in Corporation Tax rates might really damage business. Could actually backfire and bring in LESS revenue! Sometimes a policy which looks attractive on the surface (and higher rates of Corp Tax is certainly that)"

Unbelieveable in a number of ways.....you accept that putting up taxes can bring in less, yet advocate increasing income tax, CGT and just about every other tax but for some reason stop at CT? Wierd. Why does this self-evident truth only apply to CT?

You accept that putting up taxes can damage business but think that's only for companies? Have you any idea how many self-employed people there are in the country?

Still, a small step from you in the right direction. A bit more diligence from you is all that's needed....OK, in your case a LOT more but every great journey starts with the first step.

Complain about this comment (Comment number 65)

Comment number 66.

At 14:25 30th Nov 2009, Strictly Pickled wrote:sagamix

"Exactly why is tax payable?"

A good question.

I'd say for two main reasons ...

(1) To fund public services.

(2) To tackle the deficit.

===================================

No saga, your answer is what the government do with the money the receive as tax (allegedly). It does not justify or explain why it is that a certain tax is payable or justified eg mansion tax.

Why should anyone have to pay tax for something they have bought and own ?

Complain about this comment (Comment number 66)

Comment number 67.

At 14:27 30th Nov 2009, Culverin wrote:#58 AndyC555

Ok, I see that you're adamantly against tax bands.

What's the working (not ideological) alternative?

In a previous stream you rubbished my view that British public schools reinvested their enormous fees (fees that didn't simply cover costs) in 'infrastructure' (please note the inverted commas). Fine, happy to be rubbished, although how do you explain the ability of several of our fine institutions to expand overseas?

Did they win the money on the horses (Sagamix would have been a good bet several years ago at the Prix de l'Arc de Triumph)?

Complain about this comment (Comment number 67)

Comment number 68.

At 14:28 30th Nov 2009, DevilsAdvocate wrote:25. At 12:26pm on 30 Nov 2009, pdavies65 wrote:

10 Robin wrote:

All taxation is theft.

Surely some taxation is necessary. You want to stop every 100 metres on the motorway to put a coin in the streetlamp?

-------------

A recent report suggests switching off motorway/road lights except at roundabouts/junctions, having said that we already have toll bridges and a toll motorway, we don't stop every 100 metres on those.

Complain about this comment (Comment number 68)

Comment number 69.

At 14:29 30th Nov 2009, greatHayemaker wrote:61

Don't you think its a bit hypocritical that you don't?

By your own admission, you have enough money. You are determined to tax people who have more than they need, so rather than spend your time forcing other people (who work harder and for longer to afford their luxuries) to pay more, why don't you take a second, or harder but better paid job, and contribute more yourself? If all socialists would contribute a little more work and pay the earning straight into the tax pot you could quickly match the contributions of those you consider most put upon and ease their burden.

By another (somewhat suspect) claim, you were once a high earner in a city job. You quit because you didn't like it, and yet you think it is reasonable to force those who do that job you despised so much to pay extra taxes, when you didn't consider your "take home" to be worth the effort. Out of the goodness of your heart, why not go back to the job you hated so much and earn a packet of money doing something you hate. You would at least have the satisfaction of knowing you are making a contribution to the cause you fight so hard for.

But their's the problem isn't it. You are happy to tax the hard work and enterprise of other people, just so long as it does not mean having to work hard yourself. There's a word I want to use here. Actual several, but it starts "You hypocritical ..............""

Complain about this comment (Comment number 69)

Comment number 70.

At 14:29 30th Nov 2009, AndyC555 wrote:61

"So, to be a Socialist you have to voluntarily pay more tax than if you're a Clown. Mmm. You like to set the bar quite high for us, don't you? Good job we like soaring skywards."

No, to be a socialist you have to demand that all that earn more than you should pay more in taxes.

As for soaring, when are you going to soar into Government and put all your Education reforms into place? You know, get up off the sofa, fling open the bedsit door and get out their in the real world to see if any of your gandiose plans actaully work. No? Too much like hard work? Never mind, maybe tomorrow...or maybe in SimWorld.

Complain about this comment (Comment number 70)

Comment number 71.

At 14:30 30th Nov 2009, DevilsAdvocate wrote:42. At 1:29pm on 30 Nov 2009, sagamix wrote:

devils @ 19

"Actually, you can volunteer to pay the Taxman"

I'll give that a miss if you don't mind.

-----------

I don't mind at all, although I am curious as to why you would give it a miss?

Complain about this comment (Comment number 71)

Comment number 72.

At 14:31 30th Nov 2009, AndyC555 wrote:#63 "the tax laws are too complicated, too full of holes and very lucrative for those who can find the right accountants"

Amen.

Lucrative for the accountants too, God bless them.

Complain about this comment (Comment number 72)

Comment number 73.

At 14:31 30th Nov 2009, yellowbelly wrote:5. At 11:15am on 30 Nov 2009, sagamix wrote:

"...So a substantial increase in the basic rate, please! First party to recognise that reality gets my vote (unless it's the Clowns)."

===

So, you would consider voting UKIP or BNP then?

Interesting, and you being a CTP as well!

Complain about this comment (Comment number 73)

Comment number 74.

At 14:32 30th Nov 2009, greatHayemaker wrote:62. At 2:18pm on 30 Nov 2009, Khrystalar wrote:

@ RockRobin, post #10;

"All taxation is theft."

Really???

Do you enjoy living in a country that employs the Rule of Law? Happy to go down to your local shop without getting mugged? Or at least, safe in the knowledge that if you DO get mugged, you can call a bunch of big burly guys in blue uniforms to go sort out the perpetrator for you?

-----------

Myself and a friend intercepted a mugging attempt the other day. At knife point, we disarmed the perpetrator and he ran off.

We called the police. The police said if noone was hurt, it was not worth their while to show up, but we visit the station to file a report the next day if we needed a crime number for insurance.

I have had my belongings stolen on numerous occasions. Never seen any benefit from my taxes in this area.

Look up "theft" in a dictionary, then apply it to tax and try to find a way in which it does not fit.

Complain about this comment (Comment number 74)

Comment number 75.

At 14:33 30th Nov 2009, Culverin wrote:#64 Robin

Yes, once oil rich state but not any more so oil, in the context of it's current debt problems, are irrelevant unless it's the oil that Abu Dhabi give them free of charge.

Are you calling for an election in Dubai now?

Complain about this comment (Comment number 75)

Comment number 76.

At 14:33 30th Nov 2009, yellowbelly wrote:At 11:15am on 30 Nov 2009, sagamix wrote:

"...And the Mansion Tax? Yes, good idea. Very good idea. I'm happy to pay that. I WANT to pay it. Just a pity that my Swindon bedsit (although it's gone up a lot since I bought in 1995) is going to get nowhere near whatever threshold Vince and Nick end up setting. All in all then, a B borderline A for the LibDems on this one."

===

Forgive my scant geographic knowledge of London, is Swindon near Hampstead then?

Complain about this comment (Comment number 76)

Comment number 77.

At 14:34 30th Nov 2009, pdavies65 wrote:To reduce the deficit we need to be bold. The problem with hiking tax rates for the well-off and raising the personal allowance to protect the lower paid is that there are comparatively few high-earners compared to the numbers on low-to-average pay. So taxing the rich is always going to be gesture politics (although gestures can be very satisfying) - raising the basic rate of tax is the best way to generate serious amounts of revenue. (The rich are also better at avoiding tax.)

My suggestions for sizable reductions in the deficit would be:

1) Retrospective 80% tax on all bankers' bonuses paid in the past five years.

2) Flat-rate £3 surcharge on all alcohol purchases in a supermarket. (This also eradicates teenage binge-drinking.)

3) Immediate demobilization of entire UK armed forces and nuclear deterrent, to be replaced by a pro rata contribution to Europe-wide defense force. (Big saving here - plus reduced tendency to launch expensive and ill-advised military campaigns.)

4) Raise pension age to 70 with exemption for manual workers.

5) Supertax on patio heaters.

Complain about this comment (Comment number 77)

Comment number 78.

At 14:35 30th Nov 2009, greatHayemaker wrote:62

You see, the problem with people like you is that it is so ingrained in you that the government has a right to take whatever moneys it needs that you have lost sight of the bigger picture. It is the Gordon Brown behavioural deficit, I have the power, therefore I have a right to help myself to as much wealth as I need.

It is a far more basic human right to retain what we work for. Don't act as though any money we are actually allowed to keep is a favour bestowed upon us, it is insulting, demeaning, and quite dictatorial.

Complain about this comment (Comment number 78)

Comment number 79.

At 14:39 30th Nov 2009, yellowbelly wrote:5. At 11:55am on 30 Nov 2009, Justin150 wrote:

"...Here is a radical plan.

1. Increase the personal allowance to £10,000 but apply to both income and capital

2. Merge NI and Income tax into a single tax

3. Flat rate of say 30% on all income and capital gains subject only to the following exceptions

3.1 The old taper relief brought back for business assets

3.2 Charitable donations

3.3 Pension contributions

3.4 Main home exempt

3.5 some form of business angel investment relief to encourage investment in SME in UK

4. VAT at 20% and on much wider range of goods than currently

5. Stamp Duty on houses increased (first £250,000 free then say at 5-10% which should slow down property speculation)

I have no idea how the numbers add up but at least it counts as radical."

===

I would vote for that.

(Unless introduced by Labour, eh saga?)!

Complain about this comment (Comment number 79)

Comment number 80.

At 14:42 30th Nov 2009, yellowbelly wrote:20. At 12:12pm on 30 Nov 2009, Mike_Naylor

Blimey, Mike, I agree with you on this!

There's a first!

Complain about this comment (Comment number 80)

Comment number 81.

At 14:47 30th Nov 2009, Mark_WE wrote:"Khrystalar wrote:

Do you enjoy living in a country that employs the Rule of Law? Happy to go down to your local shop without getting mugged? Or at least, safe in the knowledge that if you DO get mugged, you can call a bunch of big burly guys in blue uniforms to go sort out the perpetrator for you?"

I would like to live in a country that would sort out the perpetrator of violent crimes like muggings - do you know of any?

I had a friend who got mugged and nothing of the sort happened. The impression he got from the police was that he was an annoyance for even reporting it.

"Perhaps you've made some money as a company owner, or a shareholder. Are you happy with the fact that you have a workforce in order to make you that money who're (comparatively) well-educated, healthy and able to travel freely to get to their workplace, to make you money?"

I very much doubt that everybody who has a problem with tax is a company owner (for a start people like that are usually rich enough to make large chunks of the tax they owe disappear). I have a problem with the amount of tax I pay and really feel that we don't see value for money for what we pay and I don't own my own business.

"And what are you gonna do if your house suddenly catches fire? Stand there and watch while your home and its contents burn? Or call the Fire Brigade and have other people risk their lives in order to save your family and your livelihood?"

In the days before the fire service was paid for out of taxation people used to buy levels of cover from the fire brigade. If public funding for the fire service stopped I would imagine that much the same would start to happen.

"No, Taxation isn't theft."

Taxation isn't theft - it is more like protection money. An organisation that is more powerful than you demands money to provide certain protections (even if you don't want the service) and threatens you if you refuse to pay. The main difference is with protection money you can actually opt out!

"Not happy to pay your tax? Then get out of my country; your sort aren't welcome here."

I must have missed the memo that promoted you to Overlord of the country - you should really fire your minions. And on the whole other posters have as much right to be here as you do.

"Go live in China, as an alternative. See how long you get to spout your "all taxation is theft" nonsense, or spout your criticisms of the ruling government, before you get yourself shot by the authorities."

Considering that you want to get rid of people who you don't agree with you I would suggest that countries run by dictators would be better suited to you :)

Complain about this comment (Comment number 81)

Comment number 82.

At 14:48 30th Nov 2009, David Evershed wrote:It is in principle better to tax those who are wealthy than those who have a good income but little or no wealth. The only issue is the practicality.

In practice a crude but easy way to tax wealth is the mansion tax, using the existing house valuation methods for council tax as a basis.

People who claim that people with wealth but little income can not afford to pay a wealth tax are wrong. They can sell assets or take out home loans to pay their tax. After all younger people with high incomes can not use all the money to buy their house because a large part goes in tax - so they have to take out a bigger mortgage to be able to afford to pay their tax bill.

Complain about this comment (Comment number 82)

Comment number 83.

At 14:50 30th Nov 2009, AndyC555 wrote:67

"In a previous stream you rubbished my view that British public schools reinvested their enormous fees (fees that didn't simply cover costs) in 'infrastructure' (please note the inverted commas). Fine, happy to be rubbished, although how do you explain the ability of several of our fine institutions to expand overseas?"

My comments arose because you said that private schools were somehow abusing charitable status by 'investing in infrastructure' from the profits from fees. It was pointed out by someone else that a lot of private schools were not charities and did indeed pay tax on profits. A school that is a charity cannot make a profit else it loses it's charitable status. Some expenditure is not counted as a deduction in accounts for tax purposes. Capital expenditure is either wholly or partly disallowed. That's a fact. If a private school made a £1m surplus and said @oh crumbs, let's build a new gym' that deduction wouldn't be allowed and the school would still be making a profit. The moment it isn't a charity it is taxed as a normal business. as for expanding overseas, setting up a school overseas can be done in a number of ways, branch, subsidiary, stand alone affiliate, but the essential capital/revenue divide remains. You cannot make 'profits' disappear by just investing in infrasturcture. And if they DO invest in revenue items (maybe they employ another dozen teachers) what is your objection? What would be the difference between that and a bakers taking on another doxen bakers? If the result is zero taxable surplus, what is the difference in the result to the exchequer?

Complain about this comment (Comment number 83)

Comment number 84.

At 14:50 30th Nov 2009, jrperry wrote:sagamix 57

"Yes, but a hike in Corporation Tax rates might really damage business. Could actually backfire and bring in LESS revenue! Sometimes a policy which looks attractive on the surface (and higher rates of Corp Tax is certainly that) has to be passed over for hard headed practical reasons. No, Corp Tax stays the same, JR, I think we have to say. Or maybe a very small rise, but no more than that."

Yes saga, quite so. Nothing in what I wrote implied, or should be taken to imply, that I thought it was a good idea to tax what remains of the life out of our companies. (And I think you knew that too - I wrote "address corporation tax revenues", not "increase the corporation tax rates"!)

There is indeed much to be said for reducing and simplifying corporation tax. Reduction of CT has commonly been seen as a stimulant to growth (and reductions of the CT rate have frequently been correlated with an increase in overall corporation tax revenue - we discussed this before, quite a while ago). Simplification of the tax encourages businesses to grow and adapt more purely to the available market, rather than merely artificially shaping themselves to the tax regime.

Complain about this comment (Comment number 84)

Comment number 85.

At 14:51 30th Nov 2009, stanblogger wrote:For me Nick Clegg has destroyed any sympathy I might have had for his tax proposals by echoing the Tory demand for "savage cuts" in public spending. This is dangerous talk. As economists, apart from those who are badly tainted by their previous support for discredited monetarist theory, have said over and over again, there should not be any cuts until recovery is well under way.

Public deficits, funded by the Bank of England at effectively zero interest rates, are creating the money necessary to replace that previously supplied by bank lending. Until bank lending recovers, which may not be until after the end of the next parliament, savage cuts are not only unnecessary but undesirable.

Complain about this comment (Comment number 85)

Comment number 86.

At 14:55 30th Nov 2009, greatHayemaker wrote:67

You manage to combine a profoundly fundamental and remarkably complete ignorance when it comes to matters financial with a nauseating smugness when attempting to talk about them.

Accountancy day 1.

Profit: The positive gain from an investment or business operation after subtracting for all expenses.

So, you reinvest in a further business operation.

There is still no positive gain for anyone. There is no profit to be distributed.

Just who the hell do you think actually makes money out private schools?

Complain about this comment (Comment number 86)

Comment number 87.

At 14:56 30th Nov 2009, yellowbelly wrote:5. At 1:33pm on 30 Nov 2009, fairlyopenmind wrote:

Sorry, saga,

But are you know claiming the Swindon bed-sit as your "main home"?

Does that mean that your Hampstead base is in a company structure and somehow protected?

===

Perhaps he is a "flipper". He certainly doesn't seem to have a problem when certain politicians (Brown, Darling) do it!

Complain about this comment (Comment number 87)

Comment number 88.

At 14:58 30th Nov 2009, Khrystalar wrote:@ greatHayemaker, post #69

"...other people (who work harder and for longer to afford their luxuries) to pay more..."

Ah, but that's the big fat lie that's at the centre of the taxation debate, is it not? That those at the top of the business chain are always harder-working; more dedicated; work longer hours and have more responsibility, etc.

Sheesh... you've never worked anywhere where the boss/CEO turned up two hours later than you did, left two hours earlier, and did nothing obvious of any note while he was there? Probably about 70% of the places I've ever worked - Public or Private sector - have fitted that description, personally.

Do you keep falling conveniently asleep when reports come out of how somebody supposedly "responsible" for a major company has completely screwed up, lost a bunch of money, etc.; and yet far from being held responsible, gets a "Golden Parachute" and a massive redundancy/retirement payoff, and then walks straight into another MD's job somewhere else?

How about shareholders who don't work per sé and simply live off their portfolio? How much "working harder... and for longer" are they doing then the people in the various companies in which they own shares? What, making a couple of phone calls per day to your broker to catch up on events and perhaps issue an instruction to buy or sell something, is equivalent to 8-hours-per-day hard graft???

My god, man... and I bet you even managed to keep a straight face while typing that rubbish, didn't you?

Complain about this comment (Comment number 88)

Comment number 89.

At 15:04 30th Nov 2009, yellowbelly wrote:2. At 2:18pm on 30 Nov 2009, Khrystalar wrote:

"...Not happy to pay your tax? Then get out of my country; your sort aren't welcome here."

===

Who made YOU king?

Complain about this comment (Comment number 89)

Comment number 90.

At 15:09 30th Nov 2009, greatHayemaker wrote:82. At 2:48pm on 30 Nov 2009, Pensfold wrote:

It is in principle better to tax those who are wealthy than those who have a good income but little or no wealth. The only issue is the practicality.

In practice a crude but easy way to tax wealth is the mansion tax, using the existing house valuation methods for council tax as a basis.

People who claim that people with wealth but little income can not afford to pay a wealth tax are wrong. They can sell assets or take out home loans to pay their tax. After all younger people with high incomes can not use all the money to buy their house because a large part goes in tax - so they have to take out a bigger mortgage to be able to afford to pay their tax bill.

-------------

Good god, are you serious? Go into debt to pay your tax bill? Or sell off your goods?

Aside from the all to obvious (or so I would have thought) sustainability issue here, why would you think it is reasonable to bankrupt someone so you can extract money from them? Ever heard of killing the cow to get the milk?

Complain about this comment (Comment number 90)

Comment number 91.

At 15:12 30th Nov 2009, yellowbelly wrote:7. At 2:34pm on 30 Nov 2009, pdavies65 wrote:

My suggestions for sizable reductions in the deficit would be:

5) Supertax on patio heaters.

===

Gesture politics!

Complain about this comment (Comment number 91)

Comment number 92.

At 15:12 30th Nov 2009, grand voyager wrote:36 greathaymaker

Since you told me that you get pleasure from having animals killed so that you could enjoy a good meal, I would have thought a family day out to the nearest abattoir would have been your thing,.A little fatuous I guess but not quite as fatuous as you comparing killing animals for food as being the same thing as you claiming that killing and injuring animals for some sort of inane pleasure is acceptable, even if you cant eat them, or perhaps you do Eh!.No the argument was not lost you know it and I certainly know it, just that the blog ran out, no point in continuing if you have a cruel streak no matter who you are, all that we can do is try to constrain it.

By the way their is nothing amusing about killing animals whether for eating and definately not for the pleasure of seeing them die.

I am glad that your dog had a opinion on the 10p tax you obviously treat him better that those that train them to fight one and other, I wonder why.

Complain about this comment (Comment number 92)

Comment number 93.

At 15:14 30th Nov 2009, AndyC555 wrote:#82

"People who claim that people with wealth but little income can not afford to pay a wealth tax are wrong. They can sell assets or take out home loans to pay their tax."

People like my mum, perhaps? Her only income is her state pension and the widow's pension from what was my dad's (bus-conductor's) pension. Not a lot of income but mum still lives in the house she has done since 1960 and she does own it. She's also got a reasonable amount of furniture so I suppose she could start selling that, then when that's all gone, she could take out loans she can't afford to repay until all the equity is gone in the house, then there's the workhouse, I suppose.

Mum's lucky and I know my siblings and I will rally round. Shame about those less fortunate. Perhaps you can give them cast-off balnkets to keep warm?

Complain about this comment (Comment number 93)

Comment number 94.

At 15:22 30th Nov 2009, johnharris66 wrote:#77 pdavies66 wrote:

"Raise pension age to 70 with exemption for manual workers"

How would this be defined? And who would define it?

This is actually a genuine question, not an attempt to ridicule your post(I reserve the right to do this later). In this case, though, yes it's interesting idea.

Complain about this comment (Comment number 94)

Comment number 95.

At 15:23 30th Nov 2009, greatHayemaker wrote:88

The only place I have ever worked in which the top bod was a lazy useless layabout was public sector.

I have known several people in my private sector experience to be fired for not reaching the standards expected of them, and since I work alongside the CFO's, CEO's (hopefully me someday) both when I was in practice and now that I have left it, let me assure you that I have never encountered one who did not sacrifice a large portion of his or her personal life to the company.

Your invention of the stereotype of lazy fat cat does not hold true I'm afraid. I'm not saying they don't exist, but they are few and far between, smacks of envy to me.

Your speculators in shares are essentially professional gamblers, but the most important thing for you to know about them is that they pay tax just like anyone else. Andy, step in and stop me if I'm wrong here, but I believe the effective tax rate on dividends would be the 30% CT rate plus 25% levied on the dividend at point of payment (gross of a 10% deemed paid at source), so actually higher than any other higher rate tax payer.

In any case, if you are getting into a discussion about earning money by investing, I happen to dissaprove of the practice as a general rule. But the stock market is a necessary evil, businesses need to raise capital for investment and there are always going to be professional gamblers who will take advantage of that.

Complain about this comment (Comment number 95)

Comment number 96.

At 15:23 30th Nov 2009, pdavies65 wrote:91. At 3:12pm on 30 Nov 2009, yellowbelly1959 wrote:

"pdavies65 wrote:

My suggestions for sizable reductions in the deficit would be:

5) Supertax on patio heaters."

===

Gesture politics!

Do you mean hot air?

Complain about this comment (Comment number 96)

Comment number 97.

At 15:24 30th Nov 2009, AndyC555 wrote:88

Yeah, all those bosses and shareholders who don't do anything and yet make lots of money.

I'm sure there are SOME who find it lucky but for every boss who gets a golden goodbye, there are dozens of businessmen who lose everything when their business goes under and for every person gifted a portfolio of shares there are people who have seen their investments disappear completely

Odd, as it's apparently so easy, that there aren't more people doing it. Lazing about, doing nothing while the money just roles in....

Or maybe it's that for some it's that they worked harder and for others that they risked more. Either way they did something, not nothing.

Complain about this comment (Comment number 97)

Comment number 98.

At 15:26 30th Nov 2009, AndyC555 wrote:#92 I worked in an abattoir once. It was offal.

Complain about this comment (Comment number 98)

Comment number 99.

At 15:29 30th Nov 2009, grand voyager wrote:After reading most of the Tory comments on this blog they have convinced me that no one should pay any taxes.well perhaps the poorer classes being as they use most of the facilities paid for by taxes. As Haye would say that would put the cat amongst the pigeons.

Complain about this comment (Comment number 99)

Comment number 100.

At 15:31 30th Nov 2009, greatHayemaker wrote:92

Grandy, you're well off mark here and I believe you know it. The fact that I take pleasure from eating meat does not mean that I want to watch an animal being killed. But I am still having an animal killed for my own enjoyment, I am going to enjoy eating it. There is nothing necessary about eating meat, humans can survive without, therefore any killing is entirely for pleasure.

As far as I can see, your argument is about "type" of pleasure you take from killing an animal. If it is pleasure from the sense taste, it is acceptable, but from the sense of sight, it is not? Would this be because you are able to experience the one, but not the other, therefore you think the other must be somehow imoral? Could a fox hunter who happens to have no sense of taste and therefore abstains from eating meat apply his or her morality to you; "because I can not take pleasure in eating meat, it is sick and I therefore forbid you to do it?"

The pleasure in hunting thought is not in the kill itself (I am told). That is the consequence at the end of a succesful hunt, just as killing a meat animal is the consequence of us wanting to eat it (we don't enjoy killing the animal, we enjoy eating it". The pleasure is in the chase, the hunter's instinct, which man has posessed since he evolved from apes. It is no more "wrong" to want to hunt an animal that it is to want to eat their flesh. It is natural, human.

And you seem to assume that a fox that is not hunted will die peacefully and painlessly. Animals, I am afraid, do not benefit from the same health care that we do, and an old animal in the wild is very likely to suffer terribly before it dies

Complain about this comment (Comment number 100)

Page 1 of 5