Influencer: 'Why I stopped working with Klarna'

- Published

As it's been announced that buy now, pay later services are to be better regulated by the Financial Conduct Authority, financial and marketing experts are raising concerns about the way they are advertised to young consumers. One influencer explains why she decided to turn her back on working with one of those companies.

Oghosa Ovienrioba, known to her followers as @SincerelyOghosa, was thrilled when she got an email to work with Klarna - the colourful, social media-friendly credit provider that lets you delay online shopping payment for 30 days, or split it into three chunks.

Oghosa's posts were within advertising guidelines, but a lack of clarity about how the service operates - and the potential drawbacks - ultimately left her with regrets about her decision to work with Klarna.

The 29-year-old, who has more than 29,000 followers on Instagram, tells us why she won't work with buy now, pay later services again.

This comes as a new survey commissioned by BBC Three suggests that half of the respondents have seen influencers promoting buy now, pay later (BNPL) products online, and for one in eight of those, this made them more likely to sign up.

'My stomach was in knots. I knew I couldn't work with them again'

By Oghosa Ovienrioba

"I was really excited to be approached by Klarna. They're a big brand and they work with a lot of my favourite companies - and so I started working with them last year.

"I'd used Klarna before and I'd always paid back all my purchases on time. But I wasn't aware of how some people, especially younger people, use Klarna.

"I was asked to create video content for my Instagram Stories about my 'go-to beauty items' that I'd been using more in lockdown. These were products that could be purchased using Klarna on beauty websites.

"The turnaround for the content was quite fast and once it was done, I spoke to a friend about the opportunity that had come along to work with the brand.

"We had a long conversation and she sent me lots of articles about why Klarna can be problematic as a way to shop.

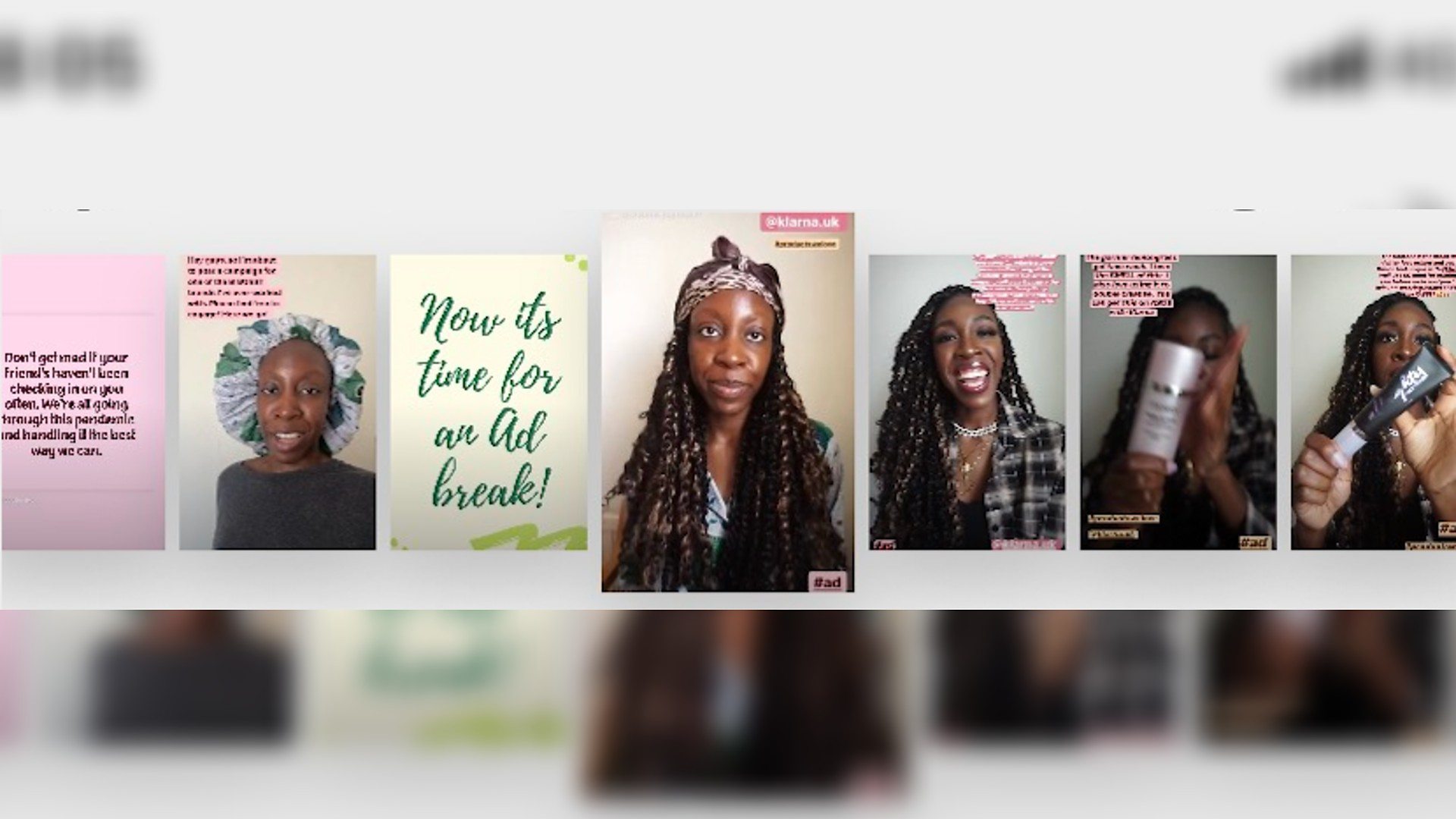

Some of the Klarna-related sponsored posts Oghosa added to her Instagram Stories

"I read about how some young shoppers who bought items with Klarna had gone into debt and were struggling to get their credit score back under control. I was horrified at what I learnt and I felt this incredible pang of guilt at what I'd done, and what I'd supported and promoted.

"I knew I had a lot of younger viewers who looked to me for advice and I couldn't believe my ignorance had meant I'd potentially encouraged them to make bad financial choices.

"Unfortunately by the time I'd found out all the relevant information, it was too late. I'd signed the contract and the content had to be put out.

"My stomach was in knots. I knew, even as I posted, that I couldn't work with them again.

"I was approached by them again but I told them that I couldn't work with them and I listed my reasons why.

"Shortly after that, I was paid by Klarna for the work I'd done, and I knew I couldn't sleep with that money in my possession, it just didn't feel right. So I decided I'd give the funds to my followers by sending grocery vouchers to followers who'd lost their jobs.

"I didn't feel like I was losing money by doing this, I just wanted to do something good with what I felt was a bad situation.

◼ Influencers told not to use 'misleading' beauty filters

◼ Klarna: 'I got a £30 bill - but I didn't buy anything'

"With Klarna, there's no risk wording and that means influencers can promote Klarna without detailing the risks.

"Young and vulnerable people use Klarna because it's been supported by so many large brands and influencers. But many young people use it because they don’t have the funds to pay for these items, especially in a pandemic and in a recession.

"Regulation means more information, more transparency and more protection for buyers."

A spokesperson for Klarna tells the BBC that Oghosa was not "directly promoting any financial products or services and therefore risk wording did not apply" and says she was promoting a competition. The spokesperson adds that she was provided with suggested copy and briefing materials about the business - and that the posts included #ad.

They also point out that Klarna "encourages our consumers to be mindful when they shop. Our biggest marketing investment of 2020 and 2021, is KlarnaSense - an initiative we developed for supporting responsible spending and reducing impulse shopping." The spokesperson adds that for two of their products, Pay in 30 days and Instalments, they perform 'soft credit searches' that do not impact a consumer's credit score.

'It's saying debt is fun'

On 2 February, the Financial Conduct Authority announced the findings of a review into the BNPL sector, which will now be regulated.

Previously, apps like Klarna, Clearpay, Laybuy or Paypal's Pay in 4 were not overseen by the FCA, meaning users couldn't complain to the Financial Ombudsman if they had problems.

While the checks on who's signing up to these services are set to be tightened, regulating the way they're marketed could be more difficult.

"We could be heading for a lot of tension between this sector and the regulator, because this sector is aimed squarely at Gen Z, so how it presents itself online is important to widening its appeal," explains finance blogger Iona Bain, creator of the Young Money Blog.

"Of course the colours, the language, the celebrities it uses in campaigns, will make it seem quite benign and obviously cool."

Swedish bank Klarna is well known for its colourful branding

Our survey, which questioned 2,042 Brits aged 16 to 24, suggests that one in eight 16-17 year olds have used the services despite age restrictions, while three in five 22-to-24 year-olds use BNPL.

Iona explains: "That might be through some of the firms who aren't conducting soft credit checks. You could just enter your parents' details to get around that."

University of Bristol's Professor Agnes Nairn - who researches issues related to marketing, ethics and the wellbeing of children and young people - has concerns about the bright, colourful marketing techniques of these companies.

"It's just saying debt is fun," she argues. "And that's the message: 'It's a great thing to do. Get out there and spend.'"

Influencers and celebrities promoting a BNPL product – Lady Gaga and Queer Eye's Tan France, external have both worked on campaigns with Klarna – are a familiar sight.

Allow Instagram content?

This article contains content provided by Instagram. We ask for your permission before anything is loaded, as they may be using cookies and other technologies. You may want to read Meta’s Instagram cookie policy, external and privacy policy, external before accepting. To view this content choose ‘accept and continue’.

The Advertising Standards Authority (ASA) guidelines make it clear that any sponsored post must be clearly labelled, so there's no doubt that these are adverts, but while they come with an #ad hashtag, they don't usually come with any financial information.

"There isn't enough information that's understandable to young people who may not have financial services education," says Professor Nairn.

The Klarna spokesperson adds: "We understand our obligations and take our role extremely seriously, particularly in the context of supporting responsible spending and financial well-being.

"We abide by a strict set of guidelines to ensure our communications are clear and transparent. If we identify any messaging that we do not think meets our standards, we let merchants know and work with them on new messaging that is more appropriate."

'The adverts do their job'

Many people using buy now, pay later services won't have any issues and will meet their payments.

But for others with existing debt, they can add to the problem. And for Klarna's Pay in 30 days service, for example, if you don't manage to repay debt after several months despite payment reminders, then the account will be passed to a debt collection agency, external.

Among BNPL users, one in six respondents to our survey said they had debt on these services of more than £1,000.

Klarna says that people unable to pay their debts are "restricted from using our service."

And three in five respondents to our survey who used BNPL services like Klarna say they've increased their use during the pandemic; perhaps unsurprisingly, when some influencers posted sponsored content about shopping being an easy way to "lift your mood" in lockdown. Those posts were later banned, external by the ASA.

Anna says she spent more than £3,000 using Klarna

Anna, 22, who says she's spent more than £3,000 using Klarna, says she found the adverts persuasive.

"I saw advertisements for buy now, pay later apps, and also at the checkout [of online shops]," she says. "Even if I'm not looking at shops to buy anything, I might see that and think, 'Oh, I'll have a browse then'.

"So the adverts were doing their job! The posts from influencers I have seen, they do kind of fluff it up and it's like, 'Treat yourself!'"

The Klarna spokesperson said "there was no evidence that the customer has ever expressed difficulties in making payments".

Anna has now cleared all her debts and deleted her shopping apps. She says she didn't think opening a Klarna account was as "serious" a commitment as a credit card, but learned more about how the service works through reading Go Fund Yourself, external, a financial advice blog by Alice Tapper.

Go Fund Yourself campaigned for the buy now, pay later sector to be regulated, and helped the FCA with their research.

A spokesperson for the ASA says there are currently no plans to change how the organisation monitors and regulates influencer posts but says it "remains an ongoing focus." He adds that they recently issued guidance, external that advises advertisers on how to make sure consumers understand that the service being offered comprises a form of credit.

The spokesperson goes on to say "most advertisers, including those who work with influencers, want to promote their products and services in a truthful and responsible way." He adds that various elements of monitoring how these service are advertised could be passed to the FCA under any new regulations.

If you've been affected by issues raised in this story relating to debt, sources of support are available via the BBC Action Line here.