Article: published on 7 January 2026

Laura Pomfret's tips for dealing with debt

- Published

According to the UK's largest debt charity, StepChange, around 4 million British adults relied on credit to fund their festive spending.

Thankfully, there are things you can do.

First, you need to track down all of your debts to work out exactly who you owe and how much. An easy way to do this is to request a free credit report, which will detail your financial history. You can get these from companies like Experian, Equifax, or TransUnion at no charge.

The next step is to make a budget; tally up your income and your outgoings every month, and keep any spare money you can find in a separate bank account to make sure it doesn't get spent. Budgeting is not about cutting absolutely everything you can; it's about giving yourself permission to spend, knowing how much money you've got, and feeling in control rather than burying your head in the sand. I'd also recommend building up an emergency fund of £500–£1,000 so that any surprise bills don't put you back into debt. Here is a link to an in-depth budgeting piece I wrote if you'd like more help.

If you can't find any spare money in your budget, it might be a good time to reach out to your creditors. Remember, debt is simply a financial contract, and you are entitled to ask for changes to the terms of that contract. Creditors have whole departments to deal with this and are bound by Consumer Duty laws to help where they can - you can ask for changes to interest rates, frozen payments, or a payment holiday.

Another helpful tool is the government's "Breathing Space, external" scheme. This puts a pause on your debts, meaning enforcement action cannot be taken against you, creditors cannot contact you about the debts, and interest or charges cannot be added. It lasts 60 days, and you can get an additional 30 days if you're receiving mental health crisis treatment.

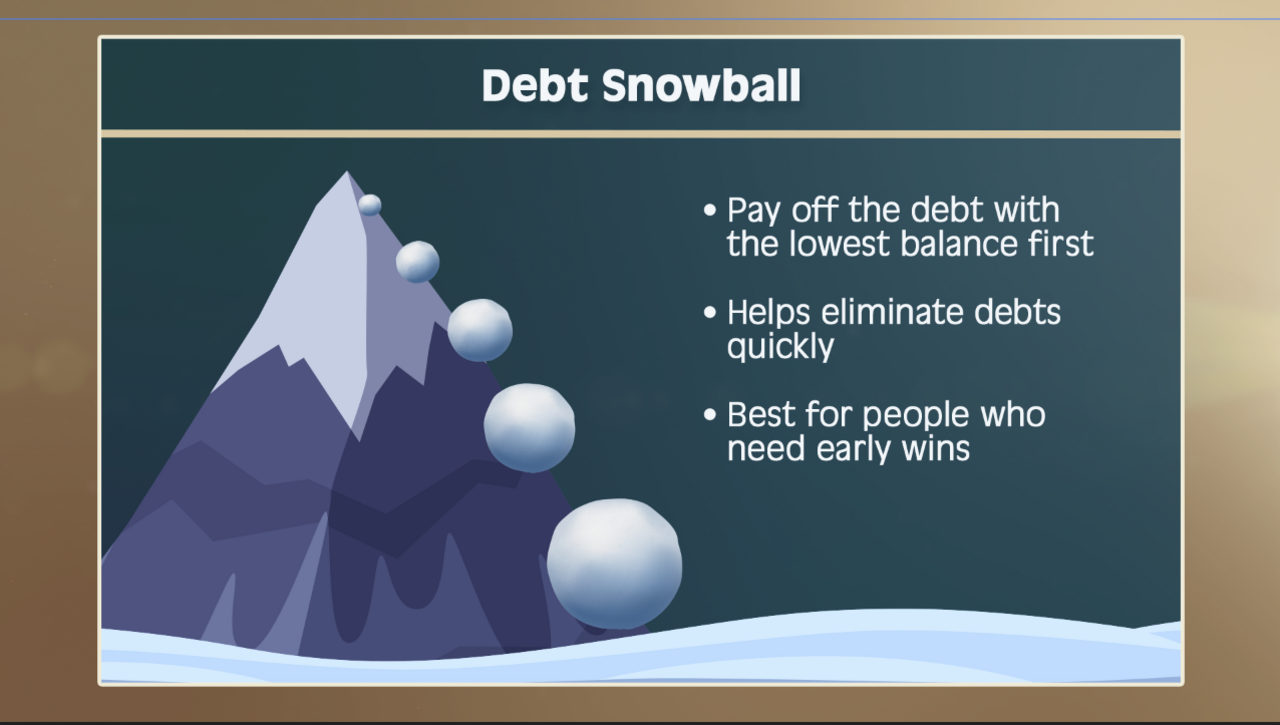

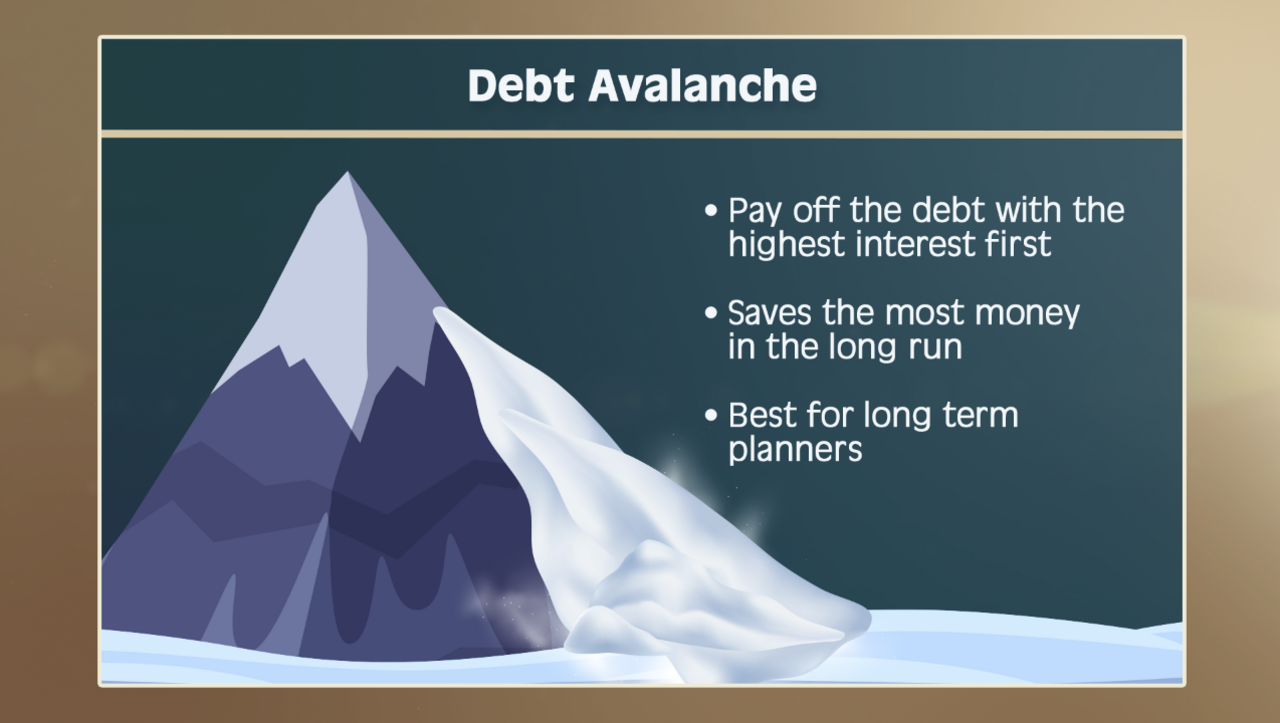

There are two main methods to pay off debt. Instead of paying everything at once, you can list your debts and pay them off one by one. You can order them from smallest to largest - known as the snowball method - which can help you get early wins and build momentum. Alternatively, you can order them by interest rate, from highest to lowest, which will mathematically save you the most money overall and may be better suited to long-term planners.

Debt Snowball

Debt Avalanche

If you are struggling to organise your own debts, then you might want to reach out to a debt charity such as StepChange, National Debtline, PayPlan, or Citizens Advice.

They can help you draw up a budget and decide the best way to start paying off your debts. They might also offer you something called a debt management plan. The providers mentioned here offer that service free of charge, so if a debt adviser is charging you a fee, it might be worth looking elsewhere.

A debt management plan bundles all your debts into one monthly payment, leaving you with less to keep track of and easing your stress.

Remember, you're not alone. People go through debt every day, and there are always people who can help you just a phone call away.