| You are in: Programmes: Working Lunch | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

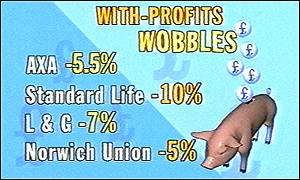

| With-profits wobbles  Falling stocks have hit with-profits investment funds Axa's axing more off the value of its endowment policies. It's the third time this has happened this year and it's adding to the problems of the army of people with endowment mortgages. Many of them are now trying to complain and win compensation. Axa is known for sponsoring the FA Cup, but now, like other insurance companies, it's getting a name for cutting the value of the endowments that people are relying on to pay off their mortgages. Wobble It's all because of the serious wobble in with-profits investment funds that endowments depend on. Axa's latest cut is 5.5% as the stock market has plunged. Standard Life has cut theirs by 10%, Legal and General by 7%, and Norwich Union by 5%. One of the biggest grievances is from homebuyers who were told by an estate agent or broker that an endowment would at least pay off their mortgage loan, and probably provide a healthy sum on top of that. Deceived Wayne Hayward of Sheffield was disappointed that when he was sold a policy, he wasn't warned that it might not make the maturity value. "It was all optimistic figures, and I was told that it was a good investment," he says. "Far from it is the way it's turned out." Surprisingly, complaints to the Financial Ombudsman have actually dropped. After rising from 9,000 two years ago, to 14,500 last year they're down to 3,900 in the first six months of the current year. But perhaps that's because people feel there's not much hope of winning. Burden of proof The problem is that the most common complaint you hear, that people were told the endowment would pay off the mortgage and then found it wouldn't because of the disappointing stockmarket, is the hardest to prove. Essentially, customers should be warned about the risks, and told that the returns aren't guaranteed. If this hasn't been the case, you're basically left trying to prove that you have been misinformed, and then it's one person's word against another's. Hope But some people have managed to get compensation on very specific grounds. Take Chris Newman from Pembrokeshire for example. Back in the early 1990s he was sold an endowment. As it turned out he didn't need it, as it replaced a perfectly adequate existing policy. Furthermore, the new endowment would mature seven years after his mortgage needed to be paid off. In short, it was a clear case, and he was paid �20,000 in compensation, but it was still very difficult to pursue. "I actually retained all the paperwork whereas a lot of people would lose it," he says. "I kept it all in files, it's an old habit that's proved very useful in this instance, but it was a long and uphill struggle." The Consumers' Association is encouraging the six million people with endowments to complain to their providers, and the ombudsman if necessary, if they feel they've been mis-sold. Homeowners may have nothing to lose by having a go, but no one should expect an automatic victory. |

See also: 08 Oct 02 | Business 02 Nov 01 | Working Lunch Internet links: The BBC is not responsible for the content of external internet sites | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Working Lunch stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |