| You are in: Programmes: Working Lunch | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

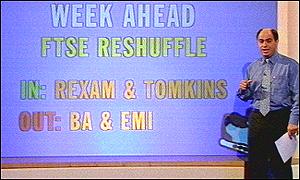

| FTSE ready to shuffle pack  This week's FTSE reshuffle will mean winners and losers

One thing to look out for this week is the FTSE re-shuffle. That's when some companies which have lost a lot of money are chucked out of the indices and those which have made money move into them. Stocks in the FTSE 100 and 250 are reviewed every three months to ensure they give an accurate measure of market activity. A stock is inserted into the FTSE 100 index if it ranks in the top 90 at the close of business on the last day of trading before the review - in this case Tuesday. Similarly, a stock is relegated from the FTSE 100 if it ranks 111th or lower. Winners and losers Tipped to come in are Rexam which is the worlds leading maker of drink cans. Another possible winner is the Engineering and Construction company Tomkins. But the really big news is who might be leaving. British Airways has been in the FTSE 100 for 15 years. But shares are down and it looks like its time is up. Music group EMI and electricity generator International Power are also possible candidates for relegation. BA boss Rod Eddington has told the BBC: "No company that's in the Footsie wants to come out of it". But he remained confident that even if BA did fall out of the index, it would soon return. Prestige and money Like football clubs going in and out of the Premiership, it's about more than just prestige; there's money at stake, too. Most of the FTSE 100 companies are big names - Vodafone, Shell, BT. They're the Manchester Uniteds and Arsenals of the market. But there are one or two lesser-known members as well, like business support company Brambles Industries, or South African Breweries, who are... well, a brewery from South Africa who happen to be listed in London. It's actually making less profit than the average corner shop, so what on earth is it doing in the FTSE 100? Most valuable The companies in the index are the most valuable businesses on the London Stock Exchange. Their value is based on their market capitalisation, the numbers of shares issued multiplied by the share price. So whether a business is making a profit or loss isn't really relevant.

But there's no doubt that being in the FTSE 100 can be good for a company. Advantages "Its shares will be bought by the managers looking after the many funds that track the index," says Henk Potts of Barclays Stockbrokers. "These managers will be forced to sell shares in those companies that fall out of the index and so there will be downward pressure on these stocks." Being in the FTSE 100 also raises a company's profile - many small investors prefer to put their money into what they see as more solid, respectable businesses. Status "Being in the FTSE 100 means more media coverage and generally just a higher profile which in turn attracts investors," says Henk. "Perhaps most importantly, being the chairman of a FTSE 100 company is a very exclusine job; people don't like losing this status and prestige, and hate being kicked out of the index as a matter of principle." "As for BA, it's had a horrifici time since September 11th, and they're very much on a knife-edge at the moment." Clues For observers, the changes in the index give a clue to how different sectors of the market are faring. A couple of years ago, there were lots of high-tech companies in the index. Now it has reverted more to what's known as "old economy" stocks - that's banks, building firms and High Street retailers. Biotech companies have been in and out of the index, reflecting the volatility of that sector. It's clearly an important index - after all, it's the one we quote when assessing movements on the London market. But it does have its faults. The top 10 companies make up 40% of the value of the whole index. In fact at one point Vodafone alone was worth 14%. Liquid "In the past we've also had companies coming in with rather strange shareholdings, where only a small amount of the shares are actually traded," says Justin. "For instance, the Daily Mail is dominated by one family and its shares aren't particularly liquid. "Then there are companies where the majority of shareholders are not in Britain. "It's not an index for British business and it's not a fair representation of the value of businesses either," believes Justin, "but it's the best worst index we have." But there's no doubt that moving into the top division is a big fillip for companies - and likewise being relegated can be a blow to both finances and morale. |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Working Lunch stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |