| You are in: Programmes: Working Lunch | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

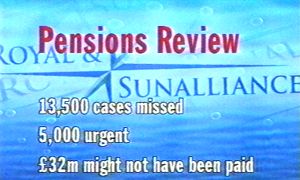

| Pension penalty for Royal and Sun Alliance  Royal and Sun Alliance gets a roasting from the pensions regulator. The giant insurance company, Royal and Sun Alliance, faces a record fine of �1.35m for slip-ups in its review of pension mis-selling. The Financial Services Authority says the company failed to identify 13,500 of cases of people who had lost out in the personal pensions scandal. 5,000 of the cases were urgent and should have been dealt with four years ago.

Mr Robinson told Working Lunch: "The key point to make to firms that still haven't finished is that we will not shy away from taking appropriate enforcement action if a firm is delaying unnecessarily," Pensions providers have been conducting a compulsory review of their customers policies. Around 1.6 million people were wrongly advised to start personal pensions, often because the process involved them withdrawing from company schemes which were much better. Still 50,000 mis-selling cases Across the pensions industry there are still around 50,000 mis-selling cases which still need to be cleared up. The FSA has branded Royal and Sun Alliance's failures as particularly serious because the company had already been fined �225,000 for earlier slip-ups. The hope is that the FSA's monitoring process will pick up on any firms which neglect to compensate for any mis-selling.

The formal Pensions Review is coming to an end, so it is no longer possible to start to seek redress that way. But if you believe that you may have been mis-sold a pension you can still take action on your behalf. Make a complaint Malcolm McLean, chief executive of the Pensions Advisory Service, suggests: "Make a complaint to the firm that provided the advice in the first place. Set out the facts, together with any supporting documentation, and give the firm an opportunity to make the situation right." If, after a couple of months, the firm hasn't given a satisfactory reply, then you can take the matter to the Financial Ombudsman Service. |

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Working Lunch stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |