| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

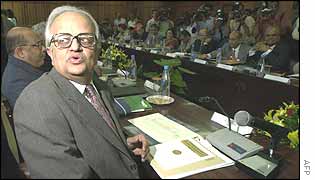

| Tuesday, 29 October, 2002, 07:41 GMT India cuts rates and growth target  Central bank governor Bimal Jalan pleases business India's central bank has cut its key interest rate and lowered its economic growth target for the financial year to March 2003. After its mid-year review, the Reserve Bank of India (RBI) cut its bank rate to 6.25% from 6.5% and said it expected it to remain at that level until the end of the year. Indian Finance Minister Jaswant Singh praised the rate cut. "It is progressive, timely and appropriate. It is easier money in terms of credit to consumers," he said. The forecast for economic growth has been cut by a point to 5-5.5%. The inflation target rate was retained at about 4% for the year. Recent economic data had suggested the world's twelfth largest economy was headed for a rebound after a slowdown in 2001, but a severe drought has put that in question. Business happy The rate cut was less than demanded by leading Indian industry groups, such as the Confederation of India Industry (CII) and the Federation of Indian Chambers of Commerce and Industry (FICCI), who were hoping for one percent. The central bank last cut the bank rate a year ago to a three-decade low. FICCI said low interest rates would encourage banks to lower prime lending rates for business, which have remained unchanged for more than two years. The central bank also cut the cash reserve requirements for banks, the proportion of deposits that banks must keep in cash with the central bank, to 4.75% from 5%, which would allow more lending. |

See also: 28 Oct 02 | Business 24 Oct 02 | Business 30 Sep 02 | Business Internet links: The BBC is not responsible for the content of external internet sites Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |