| You are in: Business | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

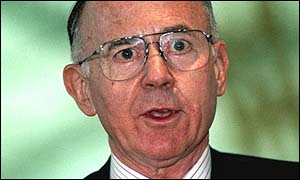

| Monday, 14 October, 2002, 11:26 GMT 12:26 UK Dome saviour warns of 'company crises'  David James: "There are significant aspects of recession starting to bite" Brrrr. Noticed the change in the outlook? That feeling that winter is on its way? So has corporate troubleshooter David James. "Quite perceptibly."

"I felt the wind change in the City last week. I really did," Mr James says in an exclusive interview with BBC News Online. "The temperature dropped, the wind got sharper, and you could feel people saying 'whoops, we are beginning to get a few problems'." Key mileposts In the previous four days he had, as one of Britain's foremost manager of corporate crisis, been contacted by three companies - all listed - for whom the outlook had suddenly deteriorated. "The whole mood has changed since September. It is almost as if everyone has been saying, 'let's get the holidays in, because we are going to have a hell of winter'." The reason? The passing of one of two annual accounting checkpoints - in March and September - when firms' actual records are compared with the targets needed to satisfy bank commitments. The times when firms check to see that data such as cover for interest rate payments, comparisons of debt and asset values, are in line with those laid down in "restrictive covenants", which must be met to guarantee access to bank loans. "Covenants have been assessed and sometimes found wanting." 'Rude awakenings' While the March test of the corporate pulse had proved "fairly quiet", since then "nobody has had an exciting trading period".

"There are significant aspects of recession starting to bite." The September check-up promises to have identified all manner of ills in Britain's body corporate. "A vast number of medium sized firms have got themselves into a situation where they have breached their restrictive covenants. "And the banks have only woken up to the fact at the present time that they have the option of withholding facilities. "We could have quite a few major crises in the next few months. "There is much more trouble in medium-sized companies than is really perceived. There are going to be some rude awakenings." Danger list By medium-sized, Mr James means firm with turnover of about �750m, and bank debts of "�50-100m up". By sector? "There are heavy manufacturing companies. There are food processing companies. "Of those I am actively talking of at the moment there is also a retailer. There is another service company." And by "rude awakenings", Mr James means a sudden appreciation by executives of the terms of bank support. 'Significant misstatement' It was through such a scenario that crisis seized British Energy, just weeks after chairman Robin Jeffrey had assured analysts of the firm's future.

"What nobody had taken account of was that there was a breach of the restrictive covenant of the lending agreement, so therefore the banks had the absolute right to curtail the lending on any given day. "And this is a pattern I am seeing. "At least two of the three cases at the moment are in exactly the same situation." And in at least two, the faltering in financial vital signs could mean that published figures have to be revised. "There has been a very significant misstatement of the accounts for the last year or two. And all of them [by] listed companies." 'Smartarse solution' So at last the accounting scandals which have stunned America, which have exposed a smear of white collar crime around corporate USA, are to rock UK plc. For Enron, Worldcom, Andersen read... "I have not talked about fraud," Mr James says.

"In every one of the companies I have been talking about, it has been a matter of straightforward incompetence. "What they have done is that they have thought they have got a solution, probably a smartarse accounting solution, which has now turned out not to be a practical solution at all." In one case, the finance director realised a solution to an accounting problem would not work, yet failed to declare it to fellow directors for two years. "By which time the board sits there with a certain amount of egg on its face." Pensions provision, hit by the collapse of the stock market, is also a severe test for corporate UK, Mr James says. Rose tinted What are not problematic are UK audit standards, which are in "no way comparable" with those in the US. "Under no circumstances have I seen any comparable accounting malfunction here to those which have beset the American balance sheet." US accounts have for years attempted to give a rosy view of trading "to the exclusion of reality". The US accounting scandals had been "waiting to happen for a long time". "But nobody wanted to look." Targets beaten Mr James speaks as someone with experience on both side of the Atlantic of tackling corporate crises, and salvaging business gems left amid the rubble of corporate collapse. While reconstructing transportation group Lep a decade ago, he oversaw the sale of US security division National Guardian.

And what he counts as one of his most successful missions was for US store giant Sears, for which Mr James executed the break-up and sale of its British Shoe Corporation chain, avoiding closure and saving 6,600 jobs. "I beat every target everybody and ever looked at, and beat it by megabucks," he says. A glance round his London office reveals corporate mementos from around the globe - a National Guardian baseball; a Lego plane in the livery of Dan-Air, the airline he restructured for sale to British Airways. And of course, a die-cast model of the Millennium Dome, which he saved from closure and decommissioned, with �25m of unused lottery grant left unspent. Future shocks So is he set to win work at one the manufacturing, food processing or retail firms he says face a troubled autumn? "Certainly I am busy - busier than I ever expected to be. But much of my time is spent on doctor's visits, one day trips, rather than giving surgical attention." Indeed, many of the troubles of which he has been called to investigate he expects to be quietly resolved. "But some of them you most certainly will hear about. You most certainly will." |

See also: 14 Oct 02 | Business 09 Oct 02 | Business 26 Sep 02 | Business Top Business stories now: Links to more Business stories are at the foot of the page. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Links to more Business stories |

| ||

| ---------------------------------------------------------------------------------- To BBC Sport>> | To BBC Weather>> | To BBC World Service>> ---------------------------------------------------------------------------------- © MMIII | News Sources | Privacy |